Two-Wheeler Market Insights, 2032

The global two-wheeler market size was esteemed at USD 143.3 billion in 2022 and is estimated to reach USD 206.60 billion by 2032, exhibiting a CAGR of 6.4% from 2023 to 2032. The two-wheeler market is driven by rising demand for affordable, efficient, and eco-friendly mobility solutions, especially in densely populated urban and semi-urban regions. Increasing adoption of e-scooters, integration of smart technologies, and heavy investments by private companies in innovative, high-performance models further accelerate market growth.

Key Market Trends

- Sports utility vehicles (SUVs) are expected to witness significant growth in the near future.

- Electric and hybrid vehicles are projected to show notable growth in the coming years.

- Ultra-luxury vehicle class is anticipated to record strong growth during the forecast period.

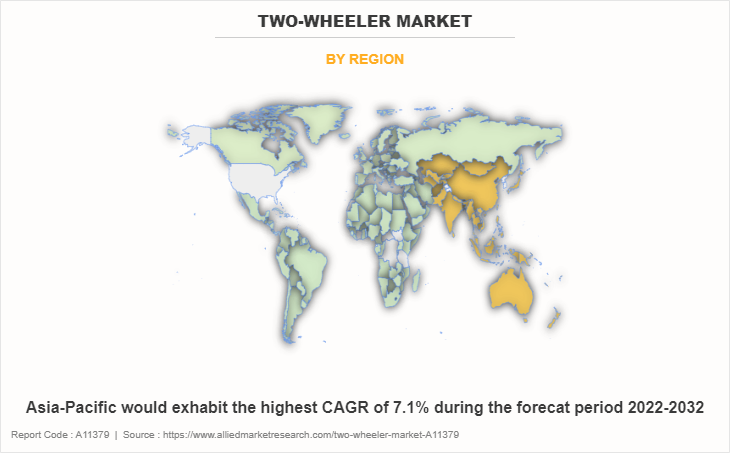

- Asia-Pacific region is forecasted to register the highest CAGR throughout the period.

Market Size & Forecast

- 2032 Projected Market Size: USD 206.60 billion

- 2022 Market Size: USD 143.3 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 6.4%

Report Key Highlighters:

- The two-wheeler market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The two-wheeler market share is highly fragmented, into several players including Honda Motor Co., Ltd., Bajaj Auto Ltd., BMW AG, Hero Moto Corp., Kawasaki Motors Corp., USA, Piaggio & C. SpA, Suzuki Motor Corporation, Triumph Motorcycles, TVS Motor Company, and Yamaha Motors Co. The companies have adopted strategies such as product launch, contract, expansion, agreement, and others to improve their market positioning.

Introduction

A two- wheeler is a term used to describe a class of vehicles that are designed to be operated on roads and are equipped with two bus. This order includes colorful types of vehicles, with motorcycles and scooters being the most common exemplifications. Two- wheelers are generally powered by internal combustion machines or electric motors and are known for their dexterity, ease of project, and energy effectiveness. They're extensively used for particular transportation, exchanging, and recreational purposes, offering a practical and frequently more affordable volition to four- wheeled vehicles, especially in densely peopled civic areas.

Market Dynamics

The increased need for two- wheelers due to business logjams, manufacturers investing more in the two- wheelers assiduity to ameliorate performance and comfort, and the growing acceptance of electric two- wheelers are all factors contributing to the expansion of the global two- wheelers request. still, enterprises like the heightened threat of accidents and the high cost of sports bikes limit request growth. On the other hand, incorporating advanced technology into two- wheelers and the rising fashionability and elaboration of two- wheelers events in developing husbandry are anticipated to give economic openings for request growth.

The Indian government announced that it would reduce the Goods and Services Tax (GST) on EVs from 12% to 5% in June 2019. Also, infrastructure provided by governments, like public charging stations, greatly increases user adoption of electric motorcycles, driving market expansion. Similarly, China has strengthened its industry leadership by profiting across all areas of the electric two-wheelers supply side including current and projected production of electric two-wheelers and their components, like electric motors and lithium-ion batteries. For instance, China launched various initiatives for green transportation and implemented emissions regulations, which drive the market toward positive growth.

With a growing interest in entertaining activities and adventure sports, the demand for performance-oriented motorbikes and off-road bikes has increased in recent year. This shift in consumer behavior provides new opportunities for producers to expand their product offers and reach a larger client base. Also, technological innovations also play an important role in influencing the global two-wheeler market sales growth. For instance, smart features like GPS navigation, connectivity, and improved safety systems improve the whole riding experience, attracting tech-savvy customers. The implementation of these technologies in two-wheelers gives an important opportunity for industry participants to differentiate themselves in a competitive market.

Furthermore, Governments throughout the globe are enacting incentives and subsidies to encourage the manufacturing and purchase of electric two-wheelers, creating a favourable climate for manufacturers to expand and innovate. Legislative actions increasing the use of electric vehicles and lowering carbon emissions are influencing market dynamics. In India, the government launched the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) plan to enhance the manufacturing and purchase of EVs, including electric two-wheelers. In addition, the FAME program provided financial incentives to both manufacturers and consumers, making electric vehicles more available and appealing. Similarly, in Europe, various countries were offering subsidies and incentives for electric vehicles, and some cities provided additional perks such as access to restricted zones or parking benefits for electric two-wheelers. Norway has been a leader in promoting electric vehicles and providing substantial incentives to buyers.

Market Segmentation

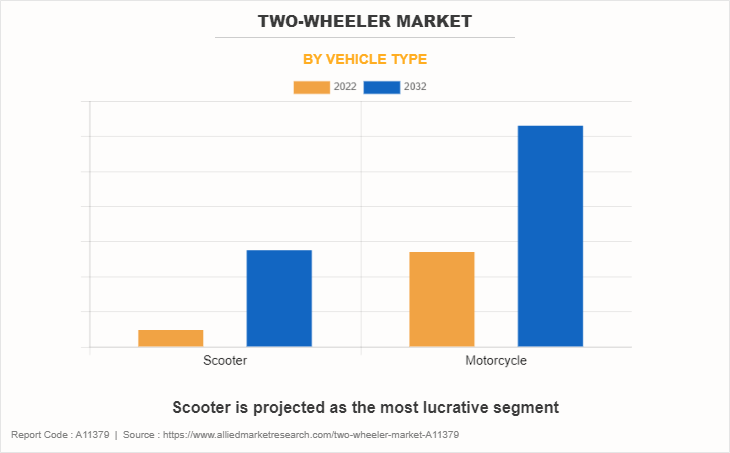

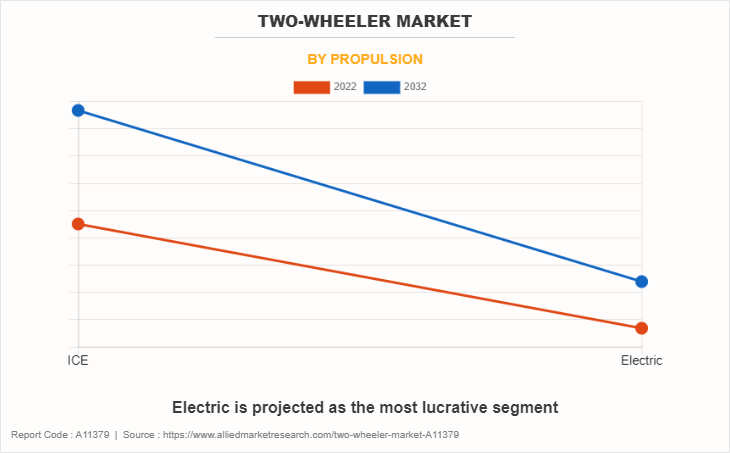

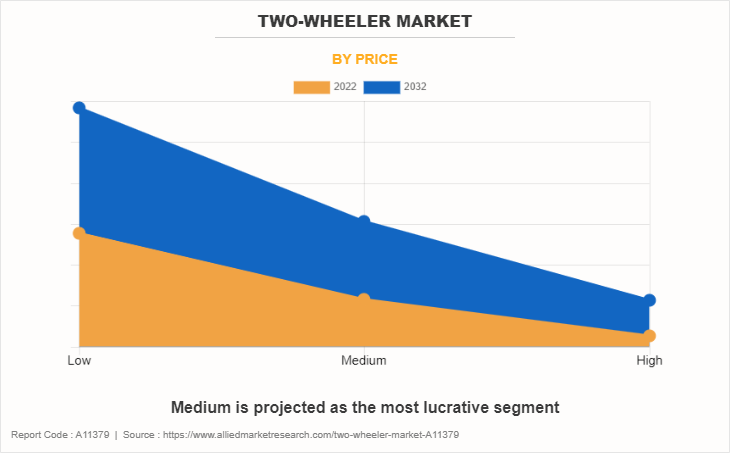

The global two-wheeler market is segmented into body type, technology, price, and region. Depending on the body type, the market is segregated into scooter and motorcycle. By technology, it is categorized into Internal Combustion Engine (ICE) and Electric. As per price, it is fragmented into low, medium, and high. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Asia-Pacific two-wheeler industry is the rapid urbanization observed in many countries. As urban areas increase, there is a growing need for compact and agile transportation options, making motorcycles and scooters a smart choice for commuters navigating congested city streets. Additionally, the affordability of two-wheelers compared to four-wheelers makes them a suitable mode of transportation for a large segment of the population.

Additionally, rising disposable incomes in some Asian countries have increased consumer expenditure on leisure and personal transportation. As a result, demand for premium and high-performance motorbikes has increased, giving manufacturers with profitable chances to cater to a varied variety of customer tastes. Government initiatives and legislation encouraging the adoption of eco-friendly and electric cars also play an important part in creating the Asia-Pacific two-wheeler market landscape. With a growing emphasis on sustainable mobility, there is a notable shift towards electric scooters and motorcycles. This transition opens up new avenues for innovation and investment in the region, fostering a competitive market environment.

Which are the TopTwo-Wheeler companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the Two-Wheele industry.

- Suzuki Motor Corporation

- Honda Motor Co., Ltd.

- Triumph Motorcycles

- Bajaj Auto Ltd.

- Kawasaki Heavy Industries, Ltd.

- Piaggio & C. SpA

- TVS Motor Company

- BMW AG

- Hero MotoCorp Limited

- Yamaha Motor Co., Ltd.

What are the Recent Developments in the Two Wheeler Market

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, product launches and other to strengthen their market position.

In October 2023, Honda Motor Co., Ltd. developed Honda E-Clutch for motorcycles. E-Clutch is an automatic clutch control system for a multi-gear manual motorcycle transmission, enabling smooth starting, shifting gears and stopping without the need for the rider to operate the clutch lever.

In November 2022, Kawasaki Heavy Industries, Ltd. through its subsidiary Kawasaki Motors, Ltd. developed battery electric vehicles and a hybrid motorcycle in prototype form. Kawasaki set out a policy toward achieving carbon neutrality.

In April 2021, Suzuki Motor Corporation launched GSX-S1000. The GSX-S1000 is a street fighter model with exciting acceleration and agile maneuverability, the essence that originated from the street-tuned engine and chassis of the supersport model GSX-R1000.

In April 2020, TVS Motor Company acquired Norton, UK based sport motorcycle manufacturing company. Norton Motorcycles known for classic models & eclectic range of luxury motorcycles ranging from authentic retro classic reboots of the famous Commando to their contemporary 200 bhp, 1200cc V4 super-bikes.

What are the Top Impacting Factors

Key Market Driver

Increase in demand for two-wheelers due to traffic blocking

s are the most convenient mode of transportation to get from one place to another through confined spaces and provide a comfortable experience when riding on various surfaces. Thus, several types of motorcycles and scooters, such as sports bikes, cruiser bikes, and touring bikes among others have been launched over the years to meet the needs of different customers. For instance, in September 2023, TVS India launched its all-new TVS Apache RTR 310 liquid-cooled single-cylinder engine. Similarly, in March 2022, Honda U.S. launched its stunning 30th Anniversary version of the CBR1000RR-R Fireblade SP at a price of $28,900. The motorcycle has an inline four-cylinder engine. The intake ports, airbox, airbox funnels and exhaust mid-section are all revised to deliver extra midrange power. Also, demand for motorcycles and scooters has increased significantly in rural areas owing to the lack of well-established public transportation. Consumers in rural regions turned to buying motorcycles to avoid the high selling prices and tax rates of four-wheelers. Thus, increased employment, improvements in disposable income, and a rise in traffic congestion are fueling demand for motorcycles in developing regions such as South Asia, thereby fostering the global two-wheeler market.

Growth in investment by manufacturers in two-wheelers industry for superior performance and comfort

The trend of motorcycle riding is increasing among youth globally owing to the movies in Hollywood and Bollywood related to car and bike racing. Also, youth consumers are very selective about the performance and comfort of motorcycles, which leads to attractive marketing strategies by manufacturers with the launch of various designs of motorcycles. For instance, in June 2021, Torrot Electric Europa S.A. announced the launch of the new generation of motorcycles in the Motocross, Trial, Enduro and Supermotard models. The motorcycles featured a simple and intuitive battery exchange system, without connectors or cables, which allowed the motorcycle to be ready to run again in less than 15 seconds.

Also, in 2020, BMW AG launched the new ACC system. The new BMW Motorrad Active Cruise Control (ACC) is projected to give the utmost comfort as well as safety to the rider while riding. Therefore, growth in investment by manufacturers for high performance with enhanced safety & comfort drives the market growth during the forecast period.

Restraints

High risk of accidents

The two-wheeler market is frequently constrained by the rising risk of road accidents for riders, despite the fact that motorized two-wheelers have advanced quickly due to their many benefits and improvements. Data from the European Commission show that head injuries were present in around 80% of motorcycle fatalities. In Europe, more than 6,500 two-wheeler riders lose their lives each year, and the risk of mortality for riders is 20 times more than that of passengers, according to the report, which cites two-wheelers as the most hazardous mode of transportation on roadways.

However, to encourage the use of helmets and to take preventative measures, a number of programs and campaigns are being proposed. This will aid manufacturers in getting around this restriction. Similar to cars, motorcycles are anticipated to lower these dangers thanks to better safety features.

Opportunity

Incorporation of cutting-edge technology in two-wheelers

With the growing popularity of motorcycles, new technologies on motorcycles have been appearing every day. They are getting more and more advanced every year. For example, the development of the latest technology including Bluetooth speaker framework, navigation associates, and different horns has increased the interest of customers in the global two-wheeler market all over the world during the forecast period.

Furthermore, motorcycle manufacturers are also focusing on new inventions related to frame metals, riding styles, and shapes to make them more advanced. For instance, in October 2022, BMW AG upgraded its S 1000 R with the advancement in the aerodynamics area. In particular, a newly designed fairing made of exposed visible carbon fiber with a higher windscreen increases the top speed significantly in conjunction with optimized airflow around the rider. Also, female consumers are getting inclined towards bike riding.

Therefore, the rise in technological innovation in the automobile industry increases the demand for motorcycles, which helps to create lucrative opportunities for the growth of the global two-wheeler market during the forecast period. For instance, in March 2022, Spark Minda announced the launch of a rider assistance system for two wheelers by 2024 under a partnership with Israel-based Ride Vision company. The system is being developed jointly with the core platform from Ride Vision and applications by Minda.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the two-wheeler market analysis from 2022 to 2032 to identify the prevailing two-wheeler market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the two-wheeler market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global two-wheeler market trends, key players, market segments, application areas, and market growth strategies.

Two-Wheeler Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 260.6 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Vehicle Type |

|

| By Propulsion |

|

| By Price |

|

| By Region |

|

| Key Market Players | Hero MotoCorp Limited, Yamaha Motor Co., Ltd., TVS Motor Company, Triumph Motorcycles, Kawasaki Heavy Industries, Ltd., Piaggio & C. SpA, Suzuki Motor Corporation, BMW AG, Bajaj Auto Ltd., Honda Motor Co., Ltd. |

The global two-wheeler market was valued at $143.3 billion in 2022, and is projected to reach $260.6 billion by 2032, registering a CAGR of 6.4% from 2023 to 2032.

Increase in demand for two-wheelers due to traffic congestion, growth in investment by manufacturers in the two-wheelers industry for superior performance and comfort, rising adoption of electric two-wheelers.

ICE propulsion is the leading application of Two-Wheeler Market

Asia-Pacific is the largest regional market for Two-Wheeler

Honda Motor Co., Ltd., Bajaj Auto Ltd., BMW AG, Hero Moto Corp., Kawasaki Motors Corp., USA, Piaggio & C. SpA, Suzuki Motor Corporation, Triumph Motorcycles, TVS Motor Company and Yamaha Motors Co.

Loading Table Of Content...

Loading Research Methodology...