U.S. Carrier Screening Market Insight 2022-2031

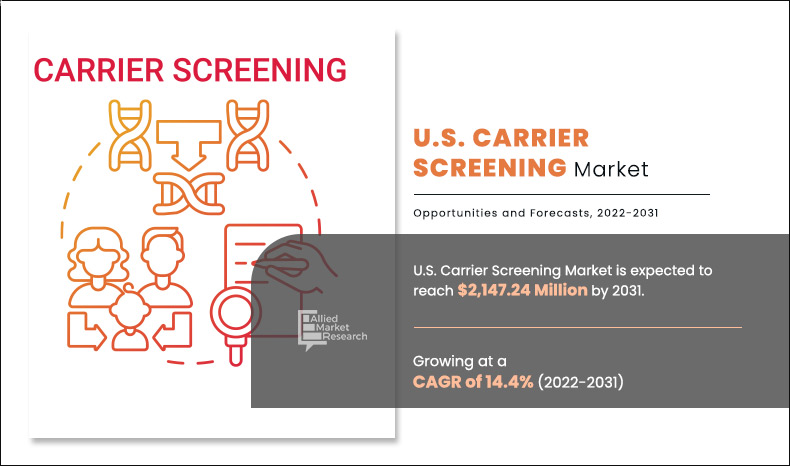

The U.S. carrier screening market size was valued at $585.46 Million in 2021 and is projected to reach $2,147.24 Million by 2031, registering a CAGR of 14.4% from 2022 to 2031. There are a number of inherited conditions which can be screened for in the general population. Genetic screening tests can detect carriers for an inherited condition even though a woman and her partner do not have a family history of the condition.

Carrier screening is typically performed for genetic diseases in which both parents must be carriers in order to have an affected child. Carrier screening determines whether or not an individual carries a change in one of their genes and if they are at increased risk of having a child affected with a genetic disease. Everyone carries abnormal genes, and in general, carriers have no symptoms or signs of the disease they carry. Carrier screening typically involves a blood test from one or both parents and can be performed when planning a pregnancy or after a woman has become pregnant.

Historical Overview

The market was analyzed qualitatively and quantitatively from 2018-2020. Most of the growth during this period was derived owing to the rise in the prevalence of genetic diseases and the increase in the adoption of carrier screening kits in the early diagnosis of genetic disease, improving health awareness, rising disposable incomes, as well as the well-established presence of domestic companies in the region.

Market Dynamics

The rise in the prevalence of genetic and chromosomal diseases such as fragile x syndrome, spinal muscular atrophy, alpha thalassemia, cystic fibrosis, and various others and the rise in technological advancement for the development of the latest carrier screening kits and devices boost the growth of the U.S. carrier screening market. For instance, according to the report published by the Centers for Disease Control and Prevention, in November 2022, it has been reported that down syndrome remains the most common chromosomal condition diagnosed in the U.S. each year, as about 6,000 babies born in the U.S. have down syndrome. This means that down syndrome occurs in about 1 in every 700 babies.

The surge in the growing demand for the early detection of genetic disorders among the population and wide access to advanced screening techniques propels the growth of the market. The growth of the U.S. carrier screening market is expected to be driven by the rise in awareness about the importance of early detection of genetic disorders, and an increase in the demand for tele consultancy services. Moreover, the increase in the number of R&D activities in the field of carrier screening kits or medical devices enhanced healthcare services, and significant investments by the government to improve healthcare infrastructure has become vital tool for small and large businesses that propel the growth of the market.

On February 2019, Invitae Corporation launched the addition of non-invasive prenatal screening (NIPS) to the company's comprehensive women's health genetic testing services, providing patients with easier access to affordable genetic testing in early pregnancy. In combination with the expanded carrier screening (ECS), Invitae also offers integrated testing using the two most common prenatal genetic tests, with in-depth follow-up testing.

Impact Of COVID-19 on U.S. Carrier Screening Market (Pre and Post Analysis)

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced several industries to shut their doors temporarily, including several sub-domains of health care. The U.S. carrier screening market experienced a decrease in 2020 owing to the disrupted healthcare services including genetic counseling, which resulted in a reduction in the patient influx to genetic counselors and workforce shortages to perform the essential functions required of newborn screening (NBS) programs.

The market is anticipated to witness steady growth in 2021 and is anticipated to grow at a significant CAGR during the forecast period for the U.S. carrier screening market. This is attributed to the increasing shift towards the telehealth consultancy program. Moreover, prior to the COVID‐19 pandemic, samples were collected by clinic staff and/or phlebotomy technicians immediately following the genetic counseling appointment. But, with the implementation of direct-to-patient (D2P) telehealth visits due to COVID‐19, now patients had the option to either go to an independent phlebotomy clinic or elect mobile phlebotomy services through the genetic testing laboratory.

Segmental Overview

The U.S. carrier screening market is segmented on the basis of type, technology, and end user. By type, the market is segmented into expanded carrier screening and targeted disease carrier screening. The expanded carrier screening segment is further divided into customized panel testing and predesigned panel testing. As per technology, it is bifurcated into DNA sequencing, polymerase chain reaction, microarrays, and others. According to the end user, the market is segmented into hospitals & clinics, reference laboratories, physician offices, and others.

By Type

Expanded Carrier Screening segment holds a dominant position in 2021 and would continue to maintain the lead over the forecast period. Owing to rise in awareness about the importance of carrier screening test by pregnant women for determining the chances or risk of a child inheriting the genetic disorders from the parents, increasing the demand for expanded carrier screening.

By type: based on type, the market is segmented into expanded carrier screening and targeted disease carrier screening. In 2021, the expanded carrier screening segment accounted for the largest share of the market. The dominance of this segment can be attributed to rising awareness about the importance of carrier screening tests by pregnant women for determining the chances or risk of a child inheriting genetic disorders from the parents, increasing the demand for expanded carrier screening.

By Technology

DNA Sequencing segment is projected as one of the most lucrative segment. Owing to the benefits offered by this technique including its precise accuracy is one of the main factors that define the utility of a genetic carrier testing workflow in a clinical laboratory which boosts the growth of the market.

By technology: by technology U.S. carrier screening market is segregated into DNA sequencing, polymerase chain reaction, microarrays, and others. In 2021, the DNA sequencing segment accounted for the largest share of the market. The dominance of this segment can be attributed to the benefits offered by this technique including its precise accuracy is one of the main factors that define the utility of a genetic carrier testing workflow in a clinical laboratory boosts the growth of the market.

By End User Pharmaceuticals Industry

Physician Office is expected to experience growth at the highest rate, registering a CAGR of 15.7% during the forecast period. owing to the rise in the number of physician’s clinics and rising demand of geneticists for the detection of genetic disorders which propels the growth of the market.

By end user: by end user, the U.S. carrier screening market is segregated into hospitals & clinics, reference laboratories, physician offices, and others. The hospitals & clinics segment exhibited the highest growth in 2021 and is anticipated to lead during the forecast period, owing to improving healthcare facilities, facilities for medical and surgical treatment as well as nursing care to patients, physical rehabilitation post surgeries, and the availability of advanced equipment are the key factors that drive the growth of the market in upcoming years.

Competition Analysis

Competitive analysis and profiles of the major players in the U.S. carrier screening market, such as Fulgent Genetics Inc., Invitae Corporation, Illumina Inc., PerkinElmer Inc., Myriad Genetics, Inc., Natera Inc., LabCorp, Quest Diagnostics Incorporated, Thermo Fisher Scientific, Inc., and Sema4 are provided in this report. Major players have adopted product launch, product expansion, and acquisition as key developmental strategies to improve the product portfolio of the U.S. carrier screening pregnancy market.

Some examples of product launches in the market

Product launch in the market

In September 2022, Illumina, Inc. launched NovaSeq 6000 Dx as the first FDA-registered and CE-marked in vitro diagnostic (IVD) high-throughput sequencer and NovaSeq X Series (NovaSeq X and NovaSeq X Plus), with revolutionary new production-scale sequencers.

In August 2020, Quest Diagnostics launched automated Next Generation Sequencing (NGS) engine to power AncestryHealth. A new innovation in advanced genetic sequencing automation from Quest Diagnostics enables individuals to access highly accurate genetic testing providing insights into inherited diseases including cancers of the breast, colon, and other conditions through AncestryHealth.

In July 2020 Illumina, Inc. launched TruSight software bringing turn-key data analysis solutions to accelerate and facilitate the adoption of whole-genome sequencing with the launch of the new software suite. TruSight Software delivers ready-made infrastructure to realize the full potential of whole-genome sequencing for rare genetic diseases.

U.S. Carrier Screening Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By End User |

|

| Key Market Players | Fulgent Genetics Inc., Quest Diagnostics Incorporated, Sema4, Illumina Inc., LabCorp, PerkinElmer Inc., Myriad Genetics Inc., Natera Inc., Invitae Corporation, Thermo Fisher Scientific Inc. |

Analyst Review

This section provides various opinions of top-level CXOs in the U.S. carrier screening market. According to several interviews conducted, the U.S. carrier screening market is expected to witness significant growth in the future, owing to the rise in the prevalence of genetic disorders and the increase in applications of carrier screening in clinical diagnostic and drug discovery.

According to the perspectives of CXOs, the U.S. carrier screening market is expected to witness steady growth in the future. The increase in pregnancy rate and growth in the prevalence of chronic diseases has also led to the increase in demand for better and more advanced technologies for the diagnosis of diseases which is anticipated to fuel the market growth. The surge in investments in R&D by pharmaceutical & biotechnology companies, the growth in healthcare expenditure, and the rise in technological advancements are the key factors driving the growth of the market. However, the lack of skilled professionals hampers the growth of the market to some extent during the forecast period.

Advancements in DNA & next-generation sequencing and the surge in the expansion of carrier screening drive the market growth. Increase in the initiatives and funding from government & private bodies for large-scale sequencing projects are the key factors that contribute toward the growth of the market.

The total market value of the U.S. Carrier Screening market is $585.46 million in 2021.

The forecast period for U.S. Carrier Screening market is 2022 to 2031

The market value of U.S. Carrier Screening market in 2022 is $640.14 million.

The base year is 2021 in U.S. Carrier Screening market

Top companies such as Fulgent Genetics Inc., Invitae Corporation, Illumina Inc., PerkinElmer Inc., Myriad Genetics, Inc., Natera Inc., LabCorp, Quest Diagnostics Incorporated, Thermo Fisher Scientific, Inc., and Sema4 held a high market position in 2021.

Expanded Carrier Screening segment dominated the global market in 2021, and expected to continue this trend throughout the forecast period, rise in awareness about the importance of carrier screening test by pregnant women for determining the chances or risk of a child inheriting the genetic disorders from the parents, increasing the demand for expanded carrier screening.

An increase in the prevalence of the genetic disorder, a rise in technological advancement, and a rise in awareness for early disease diagnosis is anticipated to drive the market in the forecast period.

No, there is no value chain analysis provided in the U.S. carrier screening market report

Carrier screening is a genetic test used to determine if a healthy person is a carrier of a recessive genetic disease. It provides life-lasting information about an individual's reproductive risk and their chances of having a child with a genetic disease. The carrier screening panel helps to find out a large list of inherited conditions, including fragile x syndrome, spinal muscular atrophy, alpha thalassemia, cystic fibrosis, and other genetic disorders.

The overall impact of COVID-19 remains negative on the U.S. carrier screening market. Owing to the disrupted healthcare services including genetic counseling, which resulted in a reduction in the patient influx to genetic counselors and workforce shortages to perform the essential functions required of newborn screening (NBS) programs.

Loading Table Of Content...