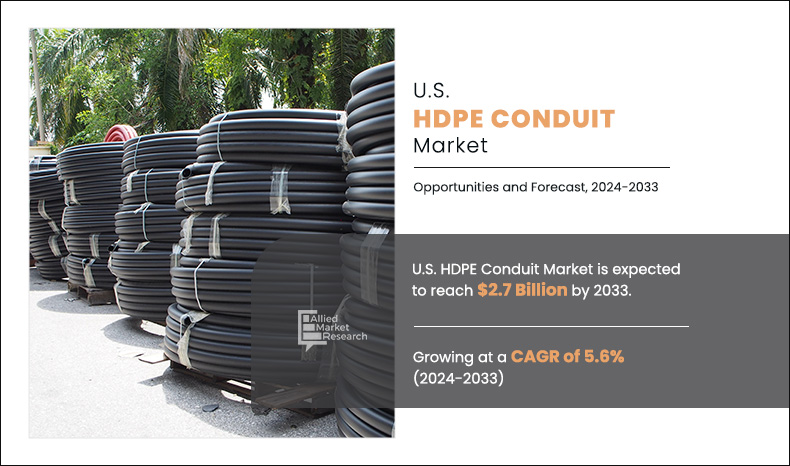

The U.S. HDPE conduit market attained $1.6 billion in 2023 and is projected to reach $2.7 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033. The growth of broadband and 5G networks requires extensive use of conduits for protecting fiber optic cables. HDPE conduits are favored for their flexibility, strength, and resistance to harsh environmental conditions.

Introduction

High-density polyethylene (HDPE) conduit is a versatile, thermoplastic pipe used primarily for protecting and routing electrical wiring in various applications. Its defining characteristics include high strength, durability, and flexibility, making it suitable for a wide range of industries and environments.

In the infrastructure and utilities sector, HDPE conduit plays a crucial role in the protection and management of electrical cables. It is commonly used in underground installations, where its resistance to moisture, corrosion, and abrasion ensures reliable long-term performance. Municipalities and utility companies utilize HDPE conduit to safeguard power and communication cables from environmental factors and mechanical damage, thereby ensuring uninterrupted service delivery to residential, commercial, and industrial areas.

The telecommunications industry relies heavily on HDPE conduit for the deployment of fiber optic cables. These cables require protection from external elements to maintain signal integrity and longevity. HDPE's smooth interior surface reduces friction during cable installation and allows for the efficient deployment of high-density fiber networks.

Key Takeaways

- Quantitative information mentioned in the U.S. HDPE conduit market includes the market numbers in terms of value ($Billion) and volume (Pounds) concerning different segments, annual growth rate, CAGR (2024-33), and growth analysis.

- The analysis in the report is provided based on end-use. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including ATKORE, Blue Diamond Industries, BULLDOG PIPE, Dura-Line, Endot Industries, LLC, Flying W Plastics, Inc, Opti-Com Manufacturing Network, LLC, WL Plastics, Southwire Company, LLC., Advanced Drainage Systems, and Chevron Philips Chemicals LLC hold a large proportion of the U.S. HDPE conduit market.

- This report makes it easier for existing market players and new entrants to the U.S. HDPE conduit industry to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Market Dynamics

Surge in renewable energy projects is expected to set to drive significant growth in the U.S. HDPE conduit market. The expansion of renewable energy sources, particularly solar and wind farms, is driving significant demand for durable conduit systems in the U.S. These projects require robust infrastructure to safely house and protect electrical cables that transmit power generated from renewable sources to distribution networks. HDPE conduit has emerged as a preferred choice for these applications due to its inherent properties that address the unique challenges posed by renewable energy installations. In January 2023, BP PLC initiated construction on the Arche solar project in Fulton County, Ohio. This solar facility is expected to have a capacity of 134 megawatts DC (107 MW AC). It has secured a Power Purchase Agreement with Meta. The project, once fully operational, aims to prevent over 155,900 metric tons of carbon emissions annually through its renewable energy generation.

HDPE conduits provide reliable protection against physical damage and maintain the integrity of electrical pathways over long distances, crucial for ensuring the efficiency and longevity of solar installations. According to the Solar Energy Industries Association (SEIA), Utility-scale solar installations increased 66% from the first quarter of 2022. The sector is still experiencing supply constraints, but things are improving as module shipments arrive at ports. In the first quarter of 2022, photovoltaic solar (PV) accounted for 54% of all new electricity-generating capacity additions. Thus, the growing popularity of solar installations is expected to drive the growth of the U.S. HDPE conduit.

However, the temperature sensitivity of HDPE conduit is expected to hamper the U.S. HDPE conduit market. Temperature sensitivity is a notable consideration in the installation and handling of high-density polyethylene (HDPE) conduits, particularly concerning their susceptibility to deformation and structural changes under high temperatures. During the installation of HDPE conduits, exposure to high temperatures can lead to softening and deformation of the material. This thermal sensitivity is primarily due to HDPE's relatively low melting point as compared to metals. At elevated temperatures, typically above 60-70 degrees Celsius (140-158 degrees Fahrenheit), HDPE begins to soften, potentially losing its shape and mechanical integrity. This sensitivity requires installers to adhere to strict temperature guidelines and employ techniques such as shade tents, cooling techniques, or scheduling installations during cooler times of the day to mitigate the risk of thermal deformation.

Segment Overview

The U.S. HDPE conduit market is segmented on the basis of end-use and states. by end-use, the market is divided into telecommunications, electric cable, utility, renewables, and others. On the basis of the states, the market is categorized into Alabama, Arkansas, Colorado, Florida, Georgia, Indian, lowa, Kansas, Louisiana, Maryland, Missouri, Mississippi, Nebraska, New Jersey, New Mexico, New York, Ohio, Oklahoma, Pennsylvania, Tennessee, Texas, West Virginia, Wyoming, and Rest of U.S.

U.S. HDPE Conduit Market, By End-Use

The telecommunications segment dominated the U.S. HDPE conduit market, and accounts for one-third of the market share. HDPE conduits are available in various sizes to accommodate different cable configurations, from small diameter fiber optic cables to larger coaxial or copper cables used in broadband and traditional telephone networks. The smooth interior of HDPE conduits reduces friction during cable installation, which helps to preserve the integrity of delicate fiber optic cables and minimize the risk of damage. HDPE conduits are preferred for underground cable networks, where they protect cables from environmental factors such as moisture, soil movement, and chemical exposure. Their durability and resistance to corrosion ensure long-term protection and reliability of buried cables, reducing the need for maintenance and repair.

By End-use

Telecommunications is projected as the most lucrative segment.

U.S. HDPE Conduit Market, By States

The Florida state is the fastest-growing state representing the CAGR of 6.3% from 2024 to 2033. In Florida, where the climate ranges from humid subtropical to tropical, HDPE's ability to withstand moisture and extreme temperatures makes it an ideal choice for protecting cables and wires. This resilience is crucial in areas prone to hurricanes and tropical storms, where underground utilities must endure both regular and sudden environmental stresses. HDPE conduit is favored for its ease of installation and maintenance. Its flexibility allows for fewer joints and fittings compared to traditional materials such as PVC or metal conduits, reducing the likelihood of leaks and failures over time.

Competitive Analysis

The major players operating in the U.S. HDPE conduit market are ATKORE, Blue Diamond Industries, BULLDOG PIPE, Dura-Line, Endot Industries, LLC, Flying W Plastics, Inc, Opti-Com Manufacturing Network, LLC, WL Plastics, Southwire Company, LLC., Advanced Drainage Systems, and Chevron Philips Chemicals LLC. In October 2022, Atkore Inc recently acquired two Oregon-based companies, Cascade Poly Pipe & Conduit and Northwest Polymers. Cascade Poly Pipe & Conduit specializes in manufacturing smooth wall HDPE conduit from recycled materials, focusing on telecommunications, utility, and datacom markets.

This acquisition enhances Atkore's product offerings and establishes a manufacturing hub for HDPE conduit in the Pacific Northwest. This move aims to better serve customers and meet the increasing demand driven by the expansion of 5G networks and U.S. infrastructure funding supporting broadband access in rural and underserved areas.

KEY BENEFITS FOR STAKEHOLDERS

- The report includes in-depth analysis of different segments and provides market estimations between 2023 and 2033.

- A comprehensive analysis of the factors that drive and restrict the growth of the U.S. HDPE conduit market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and forecast are based on factors impacting the U.S. HDPE conduit market growth, in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current U.S. HDPE conduit market trends and future estimations from 2024 to 2033, which help identify the prevailing market opportunities.

U.S. HDPE Conduit Market Report Highlights

| Aspects | Details |

| By End-use |

|

| By States |

|

| Key Market Players | BULLDOG PIPE, Southwire Company, LLC., ATKORE, WL Plastics, Opti-Com Manufacturing Network, LLC, Endot Industries, LLC, Blue Diamond Industries, Flying W Plastics, Inc, Chevron Philips Chemicals LLC, Advanced Drainage Systems, Dura-Line |

Analyst Review

According to the opinions of various CXOs of leading companies, rise in urbanization and infrastructure development projects in the U.S. is expected to drive the growth of the U.S. HDPE conduit market during the forecast period. HDPE conduits offer several advantages that align well with the requirements of urban infrastructure projects. Their durability and resistance to corrosion make them suitable for underground installations, where they can protect cables from environmental hazards such as moisture, soil chemicals, and physical damage. This protection is essential in densely populated urban areas where underground utilities face risks from construction activities and urban traffic.

As the U.S. government invests in smart city initiatives, sustainable development goals, and resilient infrastructure, HDPE conduits emerge as a sustainable choice due to their recyclable properties and minimal environmental footprint compared to traditional materials like concrete or metal. This aligns with the growing emphasis on environmental stewardship and sustainable urban planning practices.

In heavy-duty applications such as industrial applications or infrastructure projects involving large-scale utilities, HDPE conduits may not always provide the necessary load-bearing capacity compared to materials like steel or concrete. These materials are preferred in situations where the conduit must withstand heavy loads, intense pressure, or external impacts without compromising the integrity of the cable protection system.

Expansion of broadband and fiber optic network is the key factor boosting the U.S. HDPE conduit market growth

The U.S. HDPE conduit market attained $1.6 billion in 2023 and is projected to reach $2.7 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033.

Key players in the U.S. HDPE conduit market include ATKORE, Blue Diamond Industries, BULLDOG PIPE, Dura-Line, Endot Industries, LLC, Flying W Plastics, Inc, Opti-Com Manufacturing Network, LLC, WL Plastics, Southwire Company, LLC., Advanced Drainage Systems, and Chevron Philips Chemicals LLC

Surge in renewable energy projects is the main driver of U.S. HDPE conduit market.

The U.S. HDPE conduit market is segmented into end-use. On the basis of end-use, the market is classified into telecommunications, electric cable, utility, renewables, and others.

Temperature sensitivity of HDPE conduit is the restraint factor of U.S. HDPE conduit market.

Telcommunication is the dominating segment based on end-use

Loading Table Of Content...