U.S. Mortar and Admixtures Market Research - 2032

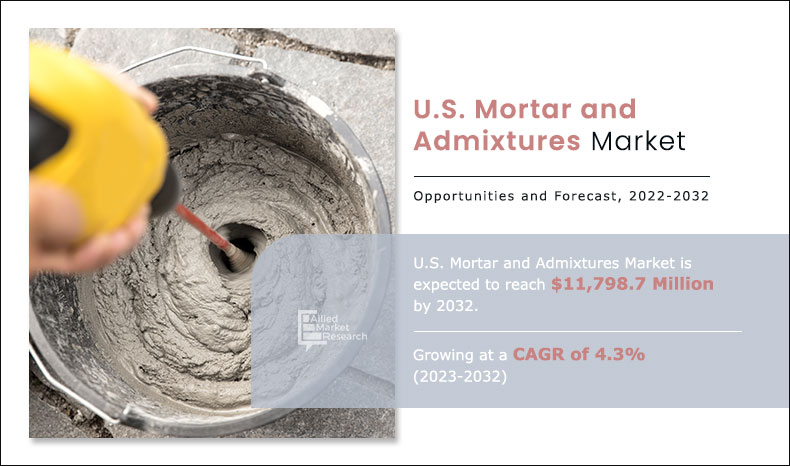

The U.S. Mortar and Admixtures Market Size was valued at $5,683.9 million in 2020 and is projected to reach $11,798.7 million by 2032, registering a CAGR of 4.3% from 2023 to 2032. Mortar and admixtures, both are construction materials widely used for construction as well as the repair or rehabilitation of masonry, concrete, natural stone, and wood structure. Mortar is made by mixing binding agents such as cement or lime, and fine aggregates such as sand, sawdust, fibers, and others.

This bonding agent is used for bonding bricks, blocks, stones, and wood, and also for plastering & rendering walls, grouting, and other such applications. Furthermore, epoxy mortar, resin, thixotropic mortar, flowable mortar, 3D mortars, dehumidifying mortar, and strengthening mortars, are also a few types of mortars used in the construction and repair of the structure. Moreover, admixtures are chemicals mixed in mortar or cement to alter their properties as per the need, which includes adhesion improvers, waterproofing admixtures, quick set admixtures, and others.

The U.S. mortar and admixtures market is anticipated to witness growth at a considerable CAGR in the coming decade, however, the market is negatively impacted by the inflation triggered by the war in Ukraine and the impact of the coronavirus pandemic. The high prices of raw materials and the continued rise in the cost of energy have severe impacts on the U.S. construction sector; thereby, limiting the U.S. mortar and admixtures market growth.”

Market Dynamics

The U.S. mortar and admixtures market is primarily driven by various factors such as an increase in the construction of new residential and commercial buildings such as apartment buildings, hospitals, schools, office buildings, and many others. In addition, an increase in investments in the repair and maintenance of old buildings and infrastructure and rise in spending on home renovation activities are also positively affecting the U.S. mortar and admixtures market. For instance, various old structures are susceptible to various wear and tear over time.

Maintenance is crucial to address issues such as plaster flaking, water seepage, and structural cracks caused by wear and tear. Furthermore, the population in the country increased from 331,721,294 in 2021, to 334,375,357 in 2023, a rise of 0.8% in two years. The rapid population growth in the U.S. further strains the existing infrastructure, necessitating renovations and expansions to accommodate the increasing population. For instance, according to the ASCE’s (American Society of Civil Engineers) 2021 Infrastructure Report Card published by the American Society of Civil Engineers, as much as 42% of nearly 617,000 bridges in the U.S. are more than 50 years old, and about 7.5% of the total bridges are considered structurally weak. Additionally, according to the Conditions and Performance Report from the Federal Highway Administration, around $14.4 billion annually are spent on bridge rehabilitation, which is expected to increase to $22.7 billion annually so that efficient rehabilitation work can be done in a justifiable timeframe.

Furthermore, the expansion of the U.S. mortar and admixtures market is also highly dependent on the construction of roads, airports, bridges, tunnels, and other infrastructure driven by the rising population and urbanization in the U.S. Additionally, in November 2021, the federal government of the U.S. approved the $1 trillion Bipartisan Infrastructure Law, also known as Infrastructure Investment and Jobs Act (IIJA). This act has allocated funds of more than $1 trillion for the construction of new infrastructures, and repair & rehabilitation of the old infrastructure including roads, bridges, tunnels, railroads, electric grid, communication infrastructure including antenna towers, and many more. These large-scale construction and repair & rehabilitation activities are anticipated to drive demand for various types of mortars and admixtures for construction and repair.

However, the fluctuating cost of raw materials used for manufacturing mortar and admixtures is expected to restrain the market growth. Even if the manufacturer does not increase the price, it is expected to affect the profitability of the company involved in making mortar and admixtures and their components. In addition, various other costs associated with the construction have also increased such as increased interest rates, expensive labor, and high energy prices, which are also having a negative impact on the U.S. mortar and admixtures market growth.

Moreover, the rising demand for sustainability in the construction sector is expected to provide lucrative growth opportunities for the key market players that are involved in the manufacturing of sustainable construction materials. Sika USA, along with many other companies operating in the U.S., offer a wide range of sustainable mortar and admixtures in the country.

The U.S. mortar and admixtures market witnesses various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced construction activities, eventually leading to reduced demand for mortar and admixtures. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing mortar and admixtures. In addition, inflation is expected to worsen in the coming years, as the possibility of ending of the war between Ukraine and Russia is less. Moreover, the cost of construction has risen substantially, discouraging builders from initiating new projects, which is also expected to negatively affect the U.S. mortar and admixtures market growth. In addition to that the federal reserve bank (Fed) is also continuously increasing the interest rate to curb inflation. For example, the federal reserve bank announced its ninth-straight interest rate hike of 25 basis points in March 2023.

By Type

The road engineering segment is projected to grow at a significant CAGR during the forecast period.

Segmental Overview

The U.S. mortar and admixtures market is segmented on the basis of type, grade, and end user. By type, the market is divided into skim coating mortar, concrete repair, anchoring and grouting, masonry structure product, admixtures for mortar, other products for construction, road engineering, and strengthening. Moreover, depending on the grade, the market is categorized into structural and non-structural. On the basis of end-user, it is divided into residential, commercial, industrial, infrastructural, and others.

By Material:

The U.S. mortar and admixtures market is divided into skim coating mortar, concrete repair, anchoring and grouting, masonry structure product, admixtures for mortar, other products for construction, road engineering, and strengthening. In 2022, the masonry structures product segment dominated the U.S. mortar and admixtures market, in terms of revenue, and the road engineering segment is expected to grow with a higher CAGR during the forecast period. The growing construction sector in the U.S. is driving the mortar and admixtures market in the U.S.

In addition, the repair and rehabilitation of old buildings and structures is also a major driver of the market. Moreover, demand for various concrete repair products such as general and fast setting thixotropic repair mortars HP (high performance or high power) structural repair mortars, shotcrete mortars, and various others are witnessing high demand. Moreover, strengthening products are also expected to witness an increased demand which includes epoxy SAA adhesives, epoxy adhesives, epoxy resins for injection, carbon fibre laminates for strengthening, carbon fibre fabric for strengthening, glass fibre fabric for strengthening, epoxy adhesive for FRP systems, EQ system, mortars for masonry strengthening, mortars for concrete strengthening, basalt greed and fabric for strengthening, steel fibre fabric for strengthening, and others.

By Grade,

The U.S. mortar and admixtures market is divided into structural and non-structural. In 2022, the non-structural segment dominated the U.S. mortar and admixtures market, in terms of revenue, and the structural segment is expected to witness growth at a higher CAGR during the forecast period. The rising trend of home and building renovation which primarily includes activities pertaining to interior and exterior appearance designing is driving the non-structural segment.

On the other hand, the increased investments in the construction of infrastructures such as bridges, tunnels, roads, airports, and others are playing a high demand for structural-grade mortar and admixture. For example, the construction rate of residential and non-residential buildings has been rising. In January 2023, the Dodge Construction Network, reported that the value of new commercial and multifamily construction starts in 2022, in the top 10 metropolitan areas of the U.S. increased 37% from 2021.

By End-User,

The U.S. mortar and admixtures market is divided into residential, commercial, industrial, infrastructural, and others. The infrastructural segment accounted for the highest market share in 2022, owing to the growing population and urbanization, which drives the demand for infrastructure such as roads, tunnels and bridges. Such large scale undertaking is anticipated to drive tremendous demand for grouts, epoxy resin, road overlay, structure strengthening materials, shotcrete, and various other mortar and related admixtures.

However, the residential segment is anticipated to register a higher growth rate during the forecast period. The residential construction in the U.S. is witnessing a steady growth owing to a gradual population rise. This is expected to drive the demand for tile grouts, wood repair mortar, board sealants, epoxy resins, strengthening materials, and other mortars and admixtures. Moreover, the house improvement sector is also experiencing growth, which is also expected to drive the demand.

Competition Analysis

Competitive analysis and profiles of the major players in the U.S. mortar and admixtures market are provided in the report. Major companies in the report include BASF, Fritz-Pak Corporation, LATICRETE International, Inc., Mapei S.P.A., Pidilite Industries Limited, Saint-Gobain Group, Sika AG, RPM International (The Euclid Chemical Company), W.R. Meadows, Inc., Master Builders Solutions, and Xypex Chemical Corporation.

Major players to remain competitive adopt development strategies such as product launches.

For example, Sika USA launched its new ready-to-use grout at Coverings 2022 in Las Vegas. In addition, in February 2021, MAPEI launched Planibond SBA two-component, epoxy bonding adhesives made for application in segmental bridges. Similarly, in December 2021, LafargeHolcim launched TerCem™, an ultra-low carbon footprint cement offering up to 65% CO2 reduction.

By End User

The residnetial segment is expected to hold a majority share of the market throughout the study period

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging U.S. mortar and admixtures market trends, and historic data.

- In-depth U.S. mortar and admixtures market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the U.S. mortar and admixtures market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The U.S. mortar and admixtures market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the U.S. mortar and admixtures market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the U.S. mortar and admixtures industry.

Analyst Review

According to the insights of the top-level CXOs, the U.S. mortar and admixtures market has witnessed significant growth in the past few years, owing to an increase in construction activities. Moreover, the rise in repair and renovation activities of old buildings and infrastructure is also driving market growth.

The demand for strengthening materials such as epoxy resins, glass- and fiber-reinforced fabric, and strengthening mortar is anticipated to be higher in systemically active regions owing to the high strength, and high flexural capabilities of these materials. Moreover, in coastal construction where humidity is high, silicon renders are favored owing to their additional water resistance which can last up to 25 years. Moreover, gypsum plaster is suitable for hot climate regions, as it has high resistance to heat, as well as is fireproof and soundproof. In addition, the rise in the industrial sector in the country is anticipated to drive demand for grouts for machine installations, waterproof admixtures, fireproof mortars, and other materials.

The CXOs further added that the demand for sustainable construction materials which require the least amount of energy to be produced and have a smaller carbon footprint is rising. However, for the application of specialized materials, skilled expensive labor is required, which is expected to have a negative impact on the market growth.

The U.S. Mortar and Admixtures Market was valued at $ 5,683.9 million in 2020 and is projected to reach $11,798.67 million by 2032, registering a CAGR of 4.3% from 2023 to 2032.

The base year considered in the U.S. Mortar and Admixtures Market is 2022.

The report for U.S. Mortar and Admixtures Market doesn’t provides Value Chain Analysis, but if there is a requirement for the same, it could be added as an additional customization.

On the basis of type, masonry structures product segment is expected to be the most influencing segment in the U.S. Mortar and Admixtures.

Based on the end user industry, in 2022, the infrastructure segment generated the highest revenue, and is projected to grow at a CAGR of 4.4% from 2023 to 2032.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, and market dominance (in terms of revenue).

The market value of U.S. Mortar and Admixtures Market is $ 7,562.8 million in 2022.

Latest version of global U.S. Mortar and Admixtures Market report can be obtained on demand from the website.

Loading Table Of Content...