U.S. Third-Party Logistics Market Insights, 2032

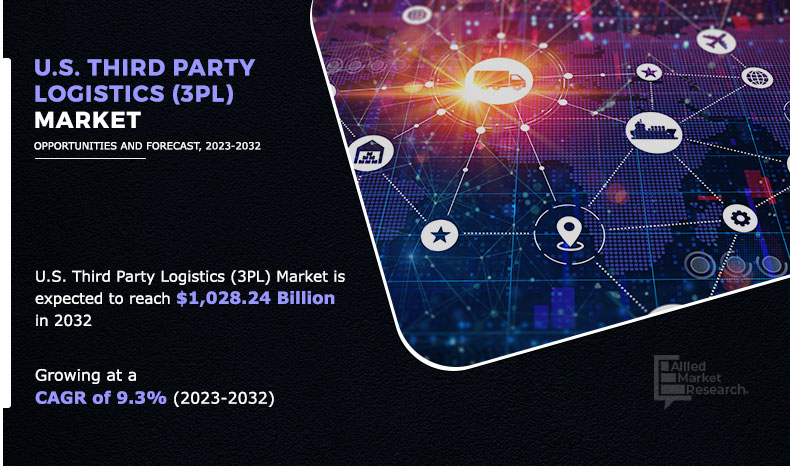

The U.S. third-party logistics market size was valued at USD 435.43 billion in 2022, and is projected to reach USD 1,028.24 billion by 2032, registering a CAGR of 9.3% from 2023 to 2032. The development of logistics infrastructure, the rapid growth of the e-commerce sector, and the development of new technologies are expected to significantly contribute to the U.S. 3PL market growth. Shippers focus on outsourcing the logistics activity to enhance their operations and cost-effectiveness. Furthermore, the shift toward dynamic logistics, especially in consumer goods, food and beverage, and medical equipment, presents a large-scale opportunity for the third-party logistics market.

Key Market Trends

- Airways segment is expected to witness significant growth in the U.S. 3PL market.

- Warehousing and transportation services are projected to grow notably in the U.S. 3PL market.

- Technology industry segment is anticipated to experience strong growth in the U.S. 3PL market.

Market Size & Forecast

- 2032 Projected Market Size: USD 1,028.24 billion

- 2022 Market Size: USD 435.43 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 9.3%

Report Key Highlighters:

- The U.S. third-party logistics market study covers one country. The research includes segment level analysis in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the U.S markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Introduction

Third-party logistics (3PL) is a partner or service that assists manufacturers, especially ecommerce merchants, to outsource activities related to logistics and distribution. A third-party logistics company provides specialized services such as inventory management, cross-docking, door-to-door delivery, and packaging of products. This, in turn, aids enterprises in providing a better customer experience, ensuring scalability, mitigating the risks of product damage, promoting business growth & market expansion, and enabling the completion of core business operations. Furthermore, the third-party logistics model delivers greater asset utilization and asset sharing alliances, which increases its demand, and contributes toward the growth of the market.

Market Dynamics

At present, third-party logistics is commercially available in varying transportation modes and service types, including dedicated contract carriage (DCC), domestic and international transportation management.

The growth of the U.S. third-party logistics market is driven by increase in global trading activity, development of the e-commerce industry, and growth in the manufacturing industry. However, lack of control of manufacturers on logistics service, and security concerns hampers the market growth. On the contrary, surge in use of IT solutions and software and rise in demand for consumer electronics are expected to provide lucrative growth opportunities for market growth.

The 3PL industry is one of the crucial aspects for the country’s imports and exports. Majority of medium and large sized enterprises in the U.S. consider using 3PL services in their operation, this allows them to focus more on their core competencies such as innovation, marketing, product development, sales, and support. U.S. conglomerates are known for their global presence, outsourcing their delivery and logistics operation to third party service providers enable them to expand globally and reduce cost and manpower utilized in logistics operations. Similarly, the U.S. has presence of some of the leading global 3PL companies such as C.H. Robinson Worldwide, Inc., XPO Logistics, Inc, United Parcel Service of America, Inc., FedEx, and others. Similarly, companies in the region are collaboratively working to enhance their efficiency and provide fast and efficient logistics solutions to their end customer.

For instance, in September 2021, United Parcel Service, Inc. (UPS) announced an agreement to acquire Roadie, an on-the-way delivery service provider within the U.S., which reduced the transit times for same-day deliveries as well as last-mile delivery services across the U.S. The constant technological advancement and increase in merger/acquisition between companies are positively impacting the market.

In addition, an increase in adoption of IT solutions and software is anticipated to increase efficiency and smoothen the flow of the supply chain, providing a remarkable growth opportunity for the key players operating in the U.S. 3PL market. For instance, in January 2021, DB Schenker collaborated with Microsoft to develop solutions for enhanced supply chain performance on the Azure platform. This made the supply chain solution offerings more efficient & data driven, which consequently resulted in a better experience for its customers, thus helping to drive the growth of the market.

The U.S. third-party logistics market is segmented into mode of transport, service type, and industry. On the basis of mode of transport, the market is classified into railway, roadway, waterways, and airways. On the basis of service type, the market is categorized into dedicated contract carriage (DCC), domestic transportation management, international transportation management, warehousing & transportation, and others. By industry, the market is divided into technological, automotive, retailing, elements, food & beverage, and healthcare.

What are the Recent Developments in the United States 3PL Industry:

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

On March 2023 A.P. Moller-Maersk launched Captain Peter Integrated package that enables data integration with Application Programming Interface (API) for customers. It gets the raw data log with temperature readings into their own system of choice. It is used to check the condition of perishable goods & tracks the conditions inside the reefers.

On January 2023, A.P. Moller-Maersk acquired Martin Bencher group, that specialist within project logistics services with a high degree of reliability, a proven track-record, and a strong focus on Health, Safety, Security and Environment (HSSE). Martin Bencher is a professional Project specialist with a global footprint, focusing on innovative, technical solutions to move oversized freight to destinations all over the world.

On November 2023, DHL Group planned to open four more automated warehouses in a move to further digitize its global warehousing operations. Currently, it operates nine automated warehouses around the world, including four U.S. sites in Memphis, Tennessee; Fort Worth, Texas; Indianapolis and Atlanta. The warehouses use automated storage and retrieval systems from AutoStore, a warehouse technology company.

On June 2022, DB Schenker acquired truckload carrier USA Truck in an all-stock transaction as it seeks to accelerate its penetration of the U.S. domestic market. The combination is expected to enable DB Schenker to sell USA Truck customers air and ocean shipping and supply chain management services, while offering existing clients direct trucking service in the U.S. and Mexico.

What are the Top Impacting Factors

Key Market Driver

Increase in Global Trading Activity

Dynamic market conditions and improvement in the global economy are the key factors that drive globalization. Furthermore, various activities related to trade have been witnessed to increase, owing to the rise in globalization. Hence, manufacturers or retailers find it difficult to keep track of these activities in an efficient manner, third-party logistics companies help these manufacturers to keep track of and control these activities. This factor is expected to drive the growth of the United States third-party logistics industry.

After the COVID-19 pandemic, the U.S. economy recovered faster as compared European Union countries. The faster recovery in U.S. was due to significant measures taken by the government such as loans, grants, and other stimulus packages for the economic recovery. The pandemic resulted in increased inclination of businesses toward digital transformation such as online retailing, thus creating growth opportunity for the market.

By Type

Airways is projected as the most lucrative segments

Restraints

Lack of Control of Manufacturers on Logistics Service

Manufacturing or end-distribution centers or companies must rely on reliability, competency, and honesty of logistics service provider while using third-party logistics services. In this scenario, the end-distribution centers must rely on contract logistics service providers, which results in a lack of direct control. In addition, the distribution centers cannot monitor the warehouse operations, which seriously threatens the quality of products. Moreover, outsourcing to a third-party logistics (3PL) could potentially lead to a breach of confidentiality, resulting in the exposure of personal data or the sharing of commercially sensitive information of the customer. Thus, the lack of control of manufacturers on logistics services is anticipated to hinder the growth of the third-party logistics (3PL) market in United States.

By Industry

Technological is projected as the most lucrative segments

Russia-Ukraine War Impact Analysis on 3PL Industry in United States

The ongoing war between Russia and Ukraine has had a negative impact on global trade. The conflict has generated uncertainty, which has severely impacted the global economy. The war not only has hampered trade flows, but has also disrupted supply chains, and harmed the confidence of investors.

One example of the impact on trade is the disruption of exports of rare earth elements. Russia and Ukraine account for a huge share of metal and rare earth elements and are being exported to the U.S. These metals and rare earth elements are extensively used in modern automobiles and electronics and U.S. companies rely on export of these metals. Furthermore, the war has also resulted in trade containment policies. Countries have implemented sanctions and trade restrictions on Russia, affecting global trade dynamics. These measures have disrupted established trade relationships and supply chains, leading to a decline in trade volumes thus resulting in a minor decline in demand for third-party logistics.

By Service Type

Warehousing and Transportation is projected as the most lucrative segments

Opportunity

Surge in Use of IT Solutions and Software

Adoption of IT solutions in logistics service is extremely essential for smooth and efficient flow of the entire supply chain. IT solutions add economic value to the supply chain. IT solutions play a vital role for timely delivery and tracing goods in the supply chain. Various software, such as warehouse management system, Electronic Data Interchange (EDI), and cloud computing, help contract logistics service providers to enhance their real-time monitoring and tracking capabilities, the increasing use of these type of solution is anticipated to provide lucrative growth opportunity during the review period.

Which are the Top U.S. Third-Party Logistics companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the U.S. Third-Party Logistics industry.

- A.P. Moller-Maersk

- C.H. Robinson Worldwide, Inc.

- DB Schenker

- DHL Group

- DSV

- GEODIS

- Kuehne+Nagel

- FedEx

- XPO Inc.

- United Parcel Service of America, Inc.

U.S. Third-Party Logistics Market Report Highlights

| Aspects | Details |

| By Mode of Transport |

|

| By Service Type |

|

| By Industry |

|

Analyst Review

The U.S third-party logistics market is anticipated to show high growth rate during the forecast period. The market growth is majorly driven by increase in global trade activity, development of the e-commerce industry, and growth in manufacturing industry. Likewise, surge in use of IT solutions and software and rise in demand for consumer electronics are further helping in the growth of the market.

The automation in third party logistics sector helps in increasing efficiency, reduces human error, enable better tracking of shipments, and increase efficiency in the entire supply chain. Retailers are prioritizing in scaling up their capability, enhancing flexibility in the supply chain, heightened efficiency, and reduced supply chain costs.

For instance, in April 2022, Amazon launched the $1 billion Amazon Industrial Innovation Fund (AIIF), which focused on automating its entire supply chain and logistics with a focus on automation and workplace robotics. The investment is expected to help the company to responds to changing customer preferences for online shopping, emphasizing faster delivery and enhanced experiences.

Moreover, third-party logistics companies are leveraging AI and other cloud-based technologies. By embracing the new 'Big Data' age, 3PL companies operating in the market are anticipated to serve their customers faster. Moreover, the technology is expected to also help in maintaining transparent operations, addressing to changing market conditions and meeting flexible operational demands. This real time exchange of information is expected to aid in item tracking throughout the entire supply chain.

In addition, the U.S. companies are investing on technological development. The software allows stakeholders to manage their shipments, anticipate delays, and optimize on delivery time. Customers are also able to monitor the delivery process of their goods. Thus, the surge in the use of information technologies (IT) solutions & software is expected to create lucrative opportunities in the U.S. 3PL market during the forecast period.

The U.S. third-party logistics market size was valued at $435.43 billion in 2022, and is projected to reach $1,028.24 billion by 2032.

The global U.S. third-party logistics market is projected to grow at a compound annual growth rate of 9.3% from 2023 to 2032 to reach $1,028.24 billion by 2032.

The key players that operate in the U.S. third-party logistics market such as A.P. Moller-Maersk, C.H. Robinson Worldwide, Inc., DB Schenker, DHL Group, DSV, GEODIS, Kuehne+Nagel, FedEx, XPO Inc., and United Parcel Service of America, Inc.

Increase in Global Trading Activity and Lack of Control of Manufacturers on Logistics Service.

Loading Table Of Content...