UAV Parachute Recovery Systems Market Research, 2033

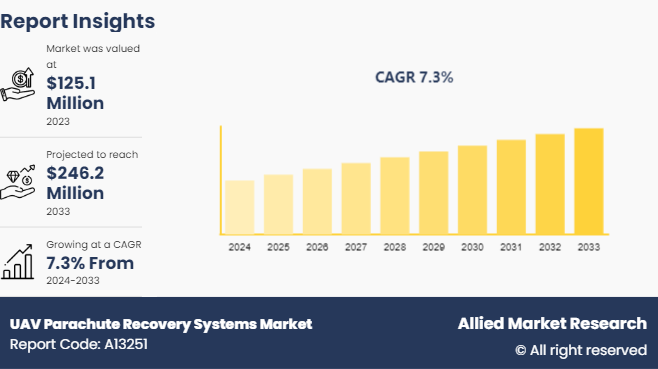

The global uav parachute recovery systems market size was valued at $125.1 million in 2023, and is projected to reach $246.2 million by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

Market Introduction and Definition

UAV parachute recovery systems industry are specialized mechanisms designed to safely return unmanned aerial vehicles (UAVs) to the ground in case of a malfunction or mission completion. These systems typically include a parachute, deployment device, and a control mechanism to initiate the recovery sequence. When a UAV encounters an issue, such as loss of power, system failure, or adverse weather conditions, the parachute is deployed to slow the descent and ensure a controlled landing. The deployment is automatic, triggered by onboard sensors detecting critical conditions, or manual, activated by the operator. These recovery systems are crucial for preserving expensive UAV equipment, protecting payloads, and enhancing safety in populated areas.

Furthermore, they minimize the risk of damage upon impact and reduce potential harm to people and property below. Parachute recovery systems are especially valuable for UAVs used in commercial, military, and research applications, where operational reliability and safety are paramount. Advanced systems may include GPS-guided parachutes to steer the UAV to a specific landing zone, further increasing recovery precision. Overall, UAV Parachute Recovery Systems play a vital role in the sustainable and safe use of unmanned aircraft technology.

Key Takeaways

UAV parachute recovery systems market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major UAV parachute recovery systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In March 2024, AVSS – Aerial Vehicle Safety Solutions Inc. launched the PRS-M3DT, a comprehensive Parachute Recovery System designed specifically for the DJI Dock 2 platform. It features integrated Flight Termination System (FTS) , Automatic Triggering System (ATS) , Manual Triggering Device (MTD) , and complies with EASA 2512 and ASTM F3322 standards. The PRS-M3DT offers plug-and-play compatibility with DJI M3DT and DJI M3D UAV models, ensuring enhanced safety and regulatory compliance for drone operations.

In October 2023, UVR LLC's latest UAV Electron 7 parachute recovery system introduces an innovative descent algorithm that ensures safe landings on the chassis rather than the front part of the fairing. This design enhancement aims to prevent damage to people, infrastructure, and the UAV itself during emergency situations. The system features both automatic deployment in response to critical flight parameters or component failures, and manual activation via the operator's control unit, offering flexibility and reliability in operation. The integration maintains the integrity of supporting system elements, fairing, and tail boom with the tail rotor, enhancing overall safety and operational efficiency of the UAV.

Key Market Dynamics

The rise in use of UAVs in military application drives demand for UAV parachute recovery systems due to the need for mission-critical safety and asset preservation, military UAVs often operate in hostile or unpredictable environments, making them susceptible to damage or failure. Parachute recovery systems ensure that these high-value UAVs and their sensitive payloads are safely retrieved, minimizing losses and enabling rapid redeployment. The safe recovery of UAVs mitigates risks associated with crashes in populated or restricted areas, aligning with stringent military safety protocols and operational requirements. Thus, enhancing UAV resilience and reliability boosts demand for these recovery systems. Furthermore, the surge in adoption of UAVs in the commercial sector and rise in investments in UAV technology development have driven the demand for UAV parachute recovery systems market share.

However, the high cost of parachute recovery systems hampers demand in the UAV parachute recovery systems market size by making them less accessible to smaller enterprises and budget-constrained operations. The significant investment required for these systems deters adoption, especially for commercial and recreational UAV users that prioritize cost-effective solutions. This financial barrier limits market expansion and slows the widespread implementation of safety mechanisms. High costs impede frequent upgrades or replacements, restricting technological advancements and reducing overall UAV parachute recovery systems market growth. Thus, the expense associated with parachute recovery systems remains a significant challenge for broader market penetration. Moreover, complexity in integrating recovery systems with various UAV models, and limited effectiveness in high-speed or high-altitude scenarios are major factors that hamper the growth of UAV parachute recovery systems market growth.

On the contrary, collaboration with regulatory bodies streamline safety standards and certifications, which presents a lucrative opportunity for the UAV parachute recovery systems market. By working closely with these authorities, manufacturers ensure their systems meet stringent safety requirements, facilitating faster approvals and market entry. Streamlined regulations reduce compliance costs and complexity, encouraging more widespread adoption of parachute recovery systems. This collaboration leads to the development of standardized safety protocols, enhancing the overall reliability and trust in UAV operations. As a result, increased regulatory support drives market growth, making it easier for companies to innovate and deploy advanced recovery solutions.

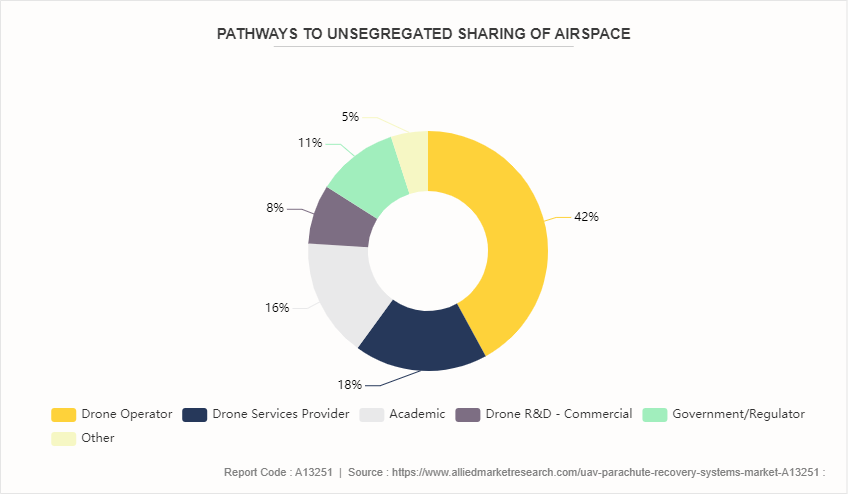

Fleet Composition and Utilization Trends for the UAV Parachute Recovery Systems Market

Fleet composition and utilization trends in the UAV parachute recovery systems market forecast are shaped by the diverse applications and operational requirements of UAVs across various sectors. The market is witnessing a growing mix of both fixed-wing and rotary-wing UAVs, each with specific recovery system needs. Fixed-wing UAVs, commonly used in military, surveillance, and long-distance missions, require robust and reliable parachute systems to ensure safe recovery over expansive areas. Rotary-wing UAVs, often employed in commercial, delivery, and inspection tasks, benefit from compact and lightweight recovery systems that are rapidly deployed in urban or confined environments.

In addition, utilization trends indicate an increasing reliance on UAVs for critical operations, driving demand for advanced recovery solutions. Military and defense sectors prioritize fleet readiness and mission continuity, leading to the integration of sophisticated parachute systems capable of operating under extreme conditions. In the commercial sector, industries such as agriculture, infrastructure inspection, and logistics are expanding their UAV fleets, necessitating efficient recovery mechanisms to protect valuable equipment and payloads.

Moreover, the trend towards larger and more complex UAVs for heavy-lift and long-endurance missions is pushing the development of scalable and adaptable parachute recovery systems. These trends underscore the need for versatile and innovative solutions to enhance the safety, reliability, and operational efficiency of diverse UAV fleets.

Market Segmentation

The UAV parachute recovery systems market is segmented into type, drone type, application, and region. On the basis of type, the market is segmented into spring release deployment, sling/catapult release deployment, pyrotechnic deployment, and compressed gas deployment. As per drone type, the market is segregated into fixed wing and rotary wing. On the basis of application, the market segmented into cargo transportation, agriculture, oil & gas, entertainment & media, military?& defense, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America has attained the highest market share for the UAV Parachute Recovery Systems market due North America region hosts a significant portion of the world's leading UAV manufacturers, particularly in the U.S., which drives demand for advanced safety systems to protect high-value assets. Stringent regulatory standards in North America necessitate reliable safety measures, prompting the adoption of robust parachute recovery systems that comply with these requirements.

Moreover, North America's extensive use of UAVs in diverse applications, including military operations, surveillance, agriculture, and infrastructure inspection, amplifies the need for dependable recovery solutions to minimize operational risks and ensure mission success. The region's strong technological infrastructure and innovative ecosystem further support the development and deployment of cutting-edge parachute recovery technologies.

In addition, the presence of established aerospace and defense industries facilitates collaborations between industry stakeholders and regulatory bodies to refine safety standards, fostering market growth. These factors collectively position North America as a dominant market for UAV Parachute Recovery Systems.

Asia-Pacific has emerged as the fastest-growing market for UAV Parachute Recovery Systems as the region is experiencing rapid economic growth, leading to increased investment in defense, infrastructure, and industrial sectors. This growth has spurred the adoption of UAVs for diverse applications such as surveillance, agriculture, disaster management, and logistics, creating a robust demand for reliable parachute recovery systems to ensure operational safety and asset protection.

Furthermore, the Asia-Pacific countries are expanding their defense capabilities and modernizing their armed forces, driving the deployment of UAVs in military operations. As governments prioritize national security and surveillance, there is a heightened need for effective recovery mechanisms to safeguard UAVs and their sensitive payloads.

Moreover, the region's burgeoning commercial drone market, fueled by innovations in e-commerce, delivery services, and aerial photography, further accelerates the demand for parachute recovery systems to mitigate operational risks and ensure regulatory compliance. In addition, technological advancements and increasing collaborations between regional UAV manufacturers and global technology providers are enhancing the availability and adoption of advanced parachute recovery solutions in Asia-Pacific, contributing to its rapid market growth.

In March 2024, the U.S. conducted its first airdrop of aid to Gaza, with more than 30, 000 meals being parachuted in by three military planes. The footage depicts the rescue mission utilizing parachutes in Rafah, Gaza's southernmost city, where approximately 1.5 million Palestinians are currently residing. The operation was carried out in collaboration with the Jordanian air force.

In March 2023, the U.S. Army trialed a new parachute system that allows soldiers to access airdropped equipment 40 percent faster. The capability, referred to as the Rapid Rigging De-Rigging Airdrop System (RRDAS) , comprises reusable, self-inflating airbags, as opposed to conventional honeycomb-like cardboard layers and steel palettes that commonly shatter upon contact with surfaces.

Competitive Landscape

The report analyzes the profiles of key players operating in UAV parachute recovery systems market such as Butler Parachute Systems, CIMSA Ingeniería de Sistemas S.A., Drone Rescue Systems GmbH, EKOFASTBA S.L., Fruity Chutes, Galaxy GRS, Indemnis, Mars Parachutes, ParaZero Ltd., and Skycat. These players have adopted various strategies to increase their market penetration and strengthen their position in the UAV parachute recovery systems market.

Industry Trends

In November 2023, AVSS, a Canadian aerospace manufacturer, has been awarded a contract from the Government of Canada to integrate the Guided Parachute Recovery System (GPRS) and the Real-Time Intelligence Landing Software (RILS) . The GPRS and RILS are expected to be integrated into DroneUp's Prism Sky platform, which is used for last-mile delivery for Walmart.

In November 2023, the Ministry of Defense (MOD) has announced its intention to procure parachute packing, maintenance, and inventory management services to support the MOD's parachuting program, which conducts an estimated 15,000-25,000 parachute descents per annum. The tender notice, published on October 20, 2023, details a contract with an estimated value between $25M and $30M, expected to last 4.5 years.

In August 2023, XPRIZE announced six finalists for its $10, 000, 000 Rainforest competition to develop new biodiversity assessment technologies, all featuring UAV technology and drones to improve scientific research and conservation in these increasingly endangered ecosystems. In collaboration with Northern Plains UAS, Drone Rescue Systems, and Freefly Systems, ArcherFRS completed 45 different flight scenarios. They could then certify the Drone Rescue System’s DRS-Alta X parachute recovery system for Freefly’s Alta X.

In May 2023, ? ParaZero, a leading provider of autonomous safety systems, has formed a partnership with Parallel Flight Technologies, a leading provider of heavy-lift drones and hybrid propulsion technologies, with the aim of integrating customized SafeAir parachute safety systems with their flagship heavy-lift, long endurance unmanned aerial vehicle.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of UAV parachute recovery systems market segments, current trends, estimations, and dynamics of UAV parachute recovery systems market analysis from 2023 to 2033 to identify the prevailing UAV parachute recovery systems market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of UAV parachute recovery systems market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global UAV parachute recovery systems market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global UAV parachute recovery systems market trends, key players, market segments, application areas, and market growth strategies.

UAV Parachute Recovery Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 246.2 Million |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 434 |

| By Type |

|

| By Drone Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Galaxy GRS, Mars Parachutes, Fruity Chutes, Butler Parachute Systems, EKOFASTBA S.L., CIMSA Ingeniería de Sistemas S.A., Indemnis, Drone Rescue Systems GmbH, Skycatch, ParaZero Ltd. |

Upcoming trends in the global UAV Parachute Recovery Systems market include the integration of advanced materials for lighter and more durable parachutes, increased adoption driven by regulatory requirements for safe UAV operations, and rising demand in commercial sectors like delivery services and urban air mobility.

Military and Defense is the leading application of UAV Parachute Recovery Systems Market

North America is the largest regional market for UAV Parachute Recovery Systems

$246.2 million is the estimated industry size of UAV Parachute Recovery Systems

Butler Parachute Systems, CIMSA Ingeniería de Sistemas S.A., Drone Rescue Systems GmbH, EKOFASTBA S.L., Fruity Chutes, Galaxy GRS, Indemnis, Mars Parachutes, ParaZero Ltd., and Skycat.

Loading Table Of Content...