Ultrafiltration Market Research, 2031

The global ultrafiltration market was valued at $1.5 billion in 2021, and is projected to reach $3.7 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031.

Ultrafiltration is a purification process in which the liquid containing fine and ultrafine particulates are forced through a semipermeable membrane. This process is achieved by means of several types of ultrafiltration membranes such as hollow fiber ultrafiltration membrane, plate & frame ultrafiltration membrane, tubular ultrafiltration membrane, and others. Ultrafiltration membrane is used for filtration purposes in various end use sectors such as food & beverage, textiles, pulp & paper, municipal treatment, and others.

The growth of the global ultrafiltration market is driven by increase in demand for municipal and industrial water treatment sectors wherein ultrafiltration is widely used for producing pure and ultrapure water. This may act as one of the key drivers responsible for the growth of the ultrafiltration market. In addition, rise in demand for both, residential & commercial facilities have surged the growth of paints & coatings sector, which in turn has escalated the demand for highly efficient ultrafiltration that is used to remove fine particles from thinners and other paint formulations. This is anticipated to foster the demand for ultrafiltration during the forecast period.

Furthermore, surge in awareness toward skincare, beauty, and lifestyle has increased the demand for personal care & cosmetic products where ultrafiltration is used for water purification purposes, which is further used in various cosmetic formulations. These factors are expected to contribute toward global ultrafiltration industry growth. The ultrafiltration market forecast is done based on current demand and future prospects in the water treatment industry to cater the requirements of the continuously rising population.

However, the set-up of entire ultrafiltration process requires various sophisticated membranes and equipment that require high maintenance (depending on the water quality). These factors together make the entire ultrafiltration setup costlier as compared to other water treatment processes. This has made investors with less investment potential to refrain from entering into ultrafiltration market, which in turn may hamper the ultrafiltration market growth during the forecast period.

On the contrary, governments of various countries such as India, China, and others have laid acts as regulations for the proper discharge of wastewater coming from industries. Furthermore, several acts have been set up for water treatment activities before discharging into water bodies such as rivers, lakes, ponds, oceans, and others. For instance, the Indian Water (Prevention and Control of Pollution) Act, 1974 establishes standards for water quality and effluent that is discharged into water bodies. This has made several institutions such as manufacturing industries, hospitals, hotels, and others to set up water treatment plants in their respective premises where ultrafiltration is widely employed for the removal and purification of wastewater before direct discharge. This event is anticipated to increase the demand for ultrafiltration across various end-use sectors; thus, creating remunerative opportunities for the ultrafiltration market.

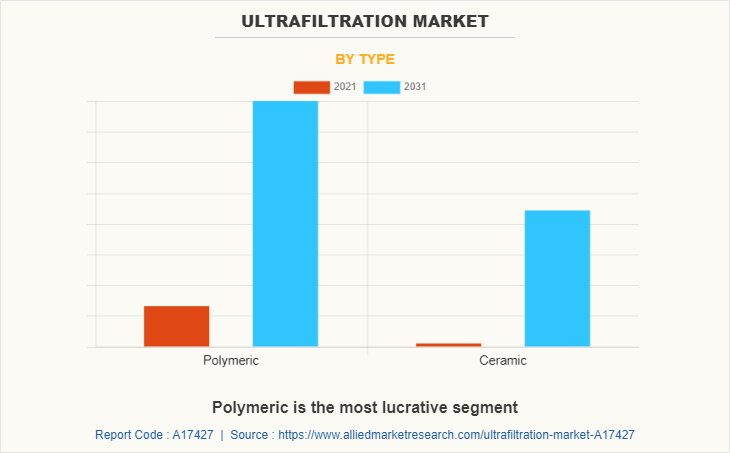

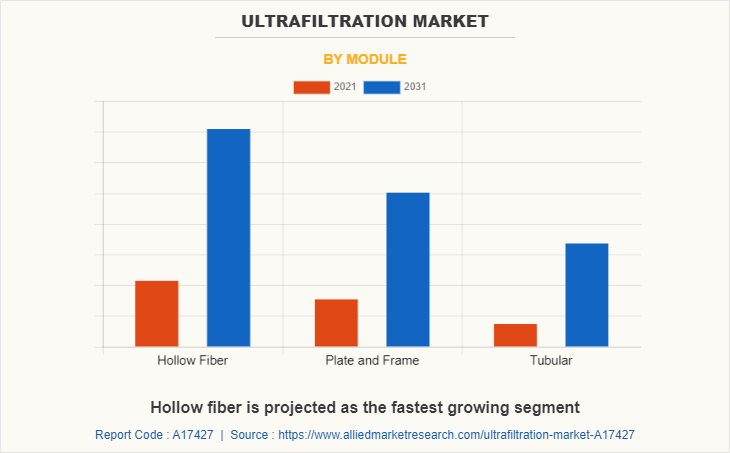

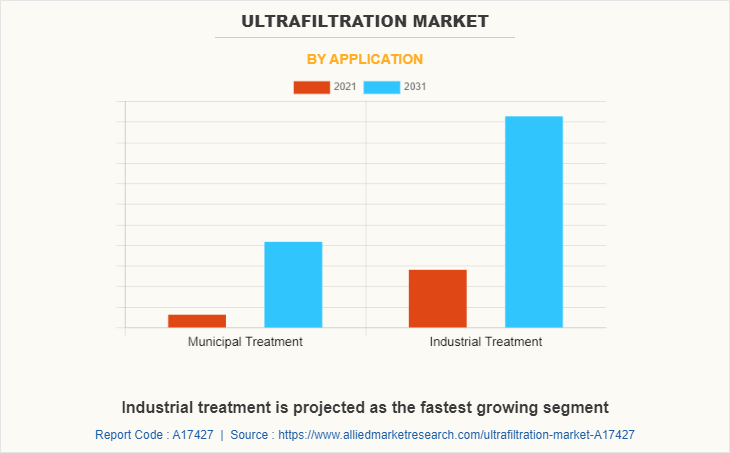

The ultrafiltration market is segmented on the basis of type, module, application, and region. On the basis of type, the market is categorized into polymeric and ceramic. On the basis of module, it is fragmented into hollow fiber, plate & frame, and tubular. By application, it is classified into municipal treatment and industrial treatment. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include, AECOM, Applied Membranes, Inc., Aquatech International LLC, Berghof Membrane Technology GmbH (BMT), DuPont, FUMATECH BWT GmbH, Genex Utility, Merck KGaA, Pall Corporation, Pentair plc, Sterlitech Corporation, SUEZ, Synder Filtration, Inc., The 3M Company, and Trucent.

By type, polymeric segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 9.8% during forecast period. This is attributed to the increasing awareness regarding wastewater treatment activities, which in turn have surged the necessity of polymeric ultrafiltration membranes used for separating fine and ultrafine waste matter from the feed water. This factor may act as one of the key drivers responsible for the growth of the ultrafiltration market for polymeric type. Furthermore, factors such as less capital investment, enhanced quality, and less maintenance costs of polymeric ultrafiltration membranes have led the customers become more linear toward using polymeric ultrafiltration membrane for water treatment purposes. This may foster the growth of the polymeric segment in the ultrafiltration market.

The ceramic segment is further bifurcated into sub-segments such as PS and PES, PVDF, and others. The PS and PES segment was the highest revenue contributor to the market, with $377.0 million in 2021, and is estimated to reach $984.1 million by 2031, with a CAGR of 10.1%

By module, the hollow fiber segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 9.9% during forecast period. This is attributed to the increasing demand for consumer goods, which in turn has surged the establishments of chemical manufacturing units in both developed and developing economies where hollow fiber ultrafiltration membrane is widely used for water treatment activities. This may act as one of the key drivers responsible for the growth of the ultrafiltration market for hollow fiber ultrafiltration module. Furthermore, government of various countries have mandated the treatment of wastewater before discharge into water bodies. This event has surged the utilization of hollow fiber ultrafiltration module in various end use sectors; thus, fueling the growth of hollow fiber segment in the global market.

In 2021, the industrial treatment segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.8% during the forecast period. This is attributed to the fact that ultrafiltration process is widely employed in industrial treatments for pre-filtration in reverse osmosis plants in order to separate the fine and ultrafine particles from the feed water or wastewater. It is an effective means for reducing the silt density index of water, which in turn reduces the fouling in reverse osmosis process. In this way, ultrafiltration enhances the shelf life of reverse osmosis membranes. Furthermore, ultrafiltration is widely used in various end use industries such as ultrapure water production in electronics sector, battery manufacturing, plastic & polymers sectors, beverage & juice production, and others.

The industrial segment is bifurcated into sub-segments named as food and beverages, pharmaceutical processing, chemical and petrochemical processing, and others. The food and beverages segment was the highest revenue contributor to the market, with $360.7 million in 2021, and is estimated to reach $929.6 million by 2031, with a CAGR of 9.9%

Municipal treatment segment was the second-largest contributor in terms of revenue in the global ultrafiltration market in 2021, and is anticipated to grow at a CAGR of 9.0% during the forecast period. The increasing setup of wastewater treatment plants in municipal units of countries such as India, China, and others have surged the demand for ultrafiltration membranes used for removing fine and ultrafine particles from wastewater. Furthermore, growing population and polluted water have surged the requirement of efficient municipal water treatment plant where ultrafiltration membranes are widely employed for water treatment activities. This factor is anticipated to increase the demand for ultrafiltration membrane for municipal treatment purposes.

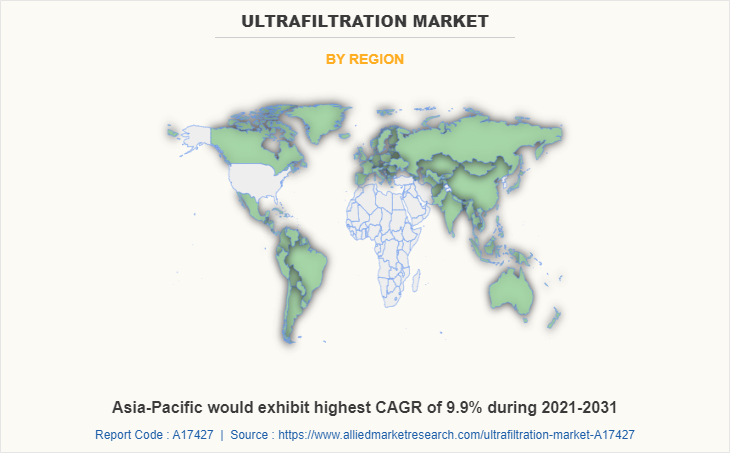

The Asia-Pacific ultrafiltration market size is projected to grow at the highest CAGR of 9.9% during the forecast period and accounted for 43.8% of ultrafiltration market share in 2021. This is attributed to the growth in pulp & paper sectors, which in turn have increased the performance of ultrafiltration used for removing fines and ultrafine particles form the feed or waste water. According to a report published by a research journal named as Paper and Biomaterials, the production and consumption of household paper in China in 2021 were 10.05 million tons and 9.30 million tons that is an increase of 3.61% and 3.22% as compared to 2020 respectively. Furthermore, India has witnessed a rapid increase in cosmetic manufacturing sectors where ultrafiltration is widely employed for producing ultrapure water that can be further used in producing a wide range of cosmetic formulations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ultrafiltration market analysis from 2021 to 2031 to identify the prevailing ultrafiltration market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the ultrafiltration market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global ultrafiltration market trends, key players, market segments, application areas, and market growth strategies.

Ultrafiltration Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.7 billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 232 |

| By Type |

|

| By Module |

|

| By Application |

|

| By Region |

|

| Key Market Players | Aquatech International LLC, AECOM, Genex Utility, MERCK KGAA, PALL CORPORATION, FUMATECH BWT GmbH, AND Trucent, SUEZ, Berghof Membrane Technology GmbH (BMT), DuPont, STERLITECH CORPORATION, Pentair plc, Applied Membranes, Inc., Synder Filtration, Inc., The 3M Company |

Analyst Review

According to CXOs of leading companies, the global ultrafiltration market is expected to exhibit high growth potential during the forecast period. Ultrafiltration process is used in a variety of end-use sectors such as pharmaceutical, municipal treatment, textiles, food & beverage, and others for inhibiting the flow of fine and ultrafine water particles. The food & beverage sector requires pure and ultrapure water for beverage production which can be accomplished with the use of an ultrafiltration process.

In addition, ultrafiltration offers numerous advantages such as low operating pressure, low energy consumption, few manual action requirements, and inexpensiveness that make it best-suited for filtration purposes in various end-use sectors. Furthermore, factors such as a rise in awareness about wastewater treatment activities have surged the popularity of ultrafiltration in both municipal and industrial water treatment plants. CXOs further added that sustained economic growth and development of the water treatment sector have increased the popularity of ultrafiltration.

increasing demand for municipal and industrial water treatment sectors wherein ultrafiltration is widely used for producing pure and ultrapure water.

The industrial treatment segment was the largest revenue generator and is anticipated to grow at a CAGR of 9.8% during the forecast period.

The Asia-Pacific ultrafiltration market 43.8% of the ultrafiltration market share in 2021.

The global ultrafiltration market is projected to reach $3.7 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031.

The major companies profiled in this report include, AECOM, Applied Membranes, Inc., Aquatech International LLC, Berghof Membrane Technology GmbH (BMT), DuPont, FUMATECH BWT GmbH, Genex Utility, Merck KGaA, Pall Corporation, Pentair plc, Sterlitech Corporation, SUEZ, Synder Filtration, Inc., The 3M Company, and Trucent.

Loading Table Of Content...