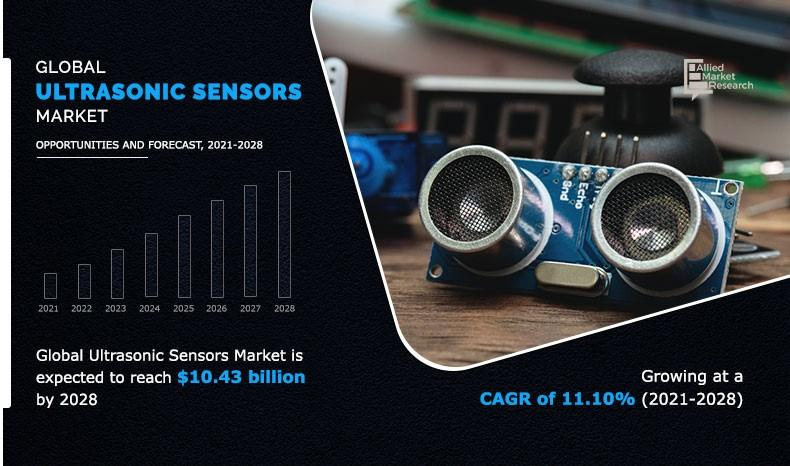

Ultrasonic Sensor Market Statistics - 2028

The global ultrasonic sensor market size was valued at $4.90 billion in 2020 and is projected to reach $10.43 billion by 2028, registering a CAGR of 11.10% from 2021 to 2028.

The global ultrasonic sensor market share is anticipated to witness significant growth during the forecast period. Factors, such as the growing use of ultrasonic sensors for object detection, pallet detection, and distance measurement across numerous industries, drive the ultrasonic sensor market growth. It is also widely used in the food & beverages industry for various purposes such as material handling, processing, and hygiene detection. However, the limitation of ultrasonic sensors, such as limited detection range, is a major restraint to the global ultrasonic sensor market revenue. In addition, growing demand from the healthcare sector for numerous applications, such as echocardiograms and echo graphs, is expected to create opportunities for the ultrasonic sensors industry.

The ultrasonic sensor is a type of electronic device, which is used to calculate the distance of any object through emitting ultrasonic sound waves and converts the reflected sound into an electrical signal. These waves are faster than the speed of audible sound. It consists of two main parts, transmitter and receiver. The transmitter is used to emit the sound by piezoelectric crystals, whereas the receiver is used to receive the reflected signal. Ultrasonic sensors are used in many applications and industries, such as food & beverages, to calculate liquid levels in bottles. In addition, the sensor is used in manufacturing for control maximizing efficiency, and automated processes in the factory. Ultrasonic sensor industrial-grade products are highly reliable for detecting objects and measuring distance and fill level. The industrial ultrasonic sensor price is versatile and has proven to be a better substitute for capacitive or optical sensors.

Segmentation Overview

The global ultrasonic sensor market is segmented into product type, application, end-user, and region. By product type, the market is bifurcated into proximity detection and range measurement.

Based on application, it is divided into level monitoring, anti-collision detection, distance measurement, object detection, loop control, robotic sensing, and others.

By Application

Level Monitoring segment is projected as one of the most lucrative segments.

Depending on the end-user, the market is segregated into automotive, industrial, consumer electronics, healthcare, food & beverages, aerospace & defense, and others.

By End User

Automotive segment is expected to secure leading position during forecast period.

Region-wise, the ultrasonic sensor market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is dominating the ultrasonic sensors market, owing to growing demand for consumer electronics and automotive products. Asia-Pacific is also projected to register a significant growth rate during the forecast period. Furthermore, North America holds a subsequent position and is anticipated to increase its growth rate by the end of the forecast period, followed by Europe.

By Region

Asia-Pacific region would exhibit the highest CAGR of 13.10% during 2021-2028

Top Impacting Factors

The prominent factors that impact the ultrasonic sensor industry growth are increasing adoption of robotics in industrial sectors and growing ultrasonic sensor usage in the healthcare industry. In addition, the rising adoption of ultrasonic sensors in the food & beverages sector drives the ultrasonic sensor market growth. However, the availability of other substitute sensors restricts the market growth. On the contrary, the rise in the adoption of surveillance drones and the increase in the usage of ultrasonic sensors in smart applications are expected to create lucrative opportunities for the market. Therefore, these factors are expected to affect the development of the global ultrasonic sensor market during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major ultrasonic sensor market players, such as Balluff GmbH, Banner Engineering Corp., Baumer Group, Hans Turck GmbH & Co. KG (Turck), Honeywell International Inc., Murata Manufacturing Co., Ltd, OMRON Corporation, Pepperl+Fuchs SE, Rockwell Automation, Inc., and Sick AG, are considered in the report.

Covid-19 Impact Analysis

The outbreak of COVID-19 has significantly affected the electronics and semiconductor sector. Business and manufacturing units across various countries were closed, owing to an increase in several COVID-19 cases, and are estimated to remain closed in 2021. Furthermore, partial or complete lockdown has disrupted global supply chains, posing challenges for manufacturers to reach customers. The overall production process has been adversely affected, but the surge in ultrasonic sensor usage in the healthcare industry has boosted the overall ultrasonic sensor market trends globally.

The COVID-19 pandemic is impacting the society and overall economy across the globe. The impact of this outbreak is growing day by day as well as affecting the overall business globally. The crisis is creating uncertainty in the stock market, falling business confidence, massive slowing of the supply chain, and increasing panic among the customer segments.

Asian and European countries under lockdowns have suffered major losses of business and revenue due to the shutdown of manufacturing units in these regions. The operations of the production and manufacturing industries have been heavily impacted by the outbreak of COVID-19, thereby declining the growth of the ultrasonic sensor market outlook in 2020.

The COVID-19 pandemic has impacted the electronics sector as the production facility has stalled, which, in turn, resulted in significant demand for electronics and semiconductor products in industries. Its major impact includes large-scale manufacturing interruption across Europe and interruption in Chinese parts exports, which are expected to hinder the ultrasonic sensor industry.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the global ultrasonic sensors market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall ultrasonic sensor market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current ultrasonic sensors market forecast is quantitatively analyzed from 2020 to 2028 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the ultrasonic sensor market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Ultrasonic Sensor Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Pepperl+Fuchs SE, Rockwell Automation, Inc., Hans Turck GmbH & Co. KG (Turck), OMRON Corporation, Honeywell International Inc., Balluff GmbH, Sick AG, Baumer Group, Banner Engineering Corp., Murata Manufacturing Co., Ltd |

Analyst Review

An ultrasonic sensor functions on similar principles as a radar system. An ultrasonic sensor translates electrical energy into acoustic waves and vice versa. A microcontroller is used for communication, which sends a trigger signal to the ultrasonic sensor. Generally, the duty cycle of this trigger signal is 10 µS. An ultrasonic sensor produces ultrasonic wave bursts and initiates a time counter. When an echo signal is received, the timer stops. The ultrasonic sensor output is a high pulse with similar duration as the time alteration between transmitted ultrasonic bursts and the received echo signal.

The global ultrasonic sensor market is anticipated to witness significant growth during the forecast period. Factors, such as growing use of ultrasonic sensors for object detection, pallet detection, and distance measurement across numerous industries, drive the growth of ultrasonic sensor market. The product is also widely used in the food & beverages industry for various purposes such as material handling, processing, and hygiene detection. However, limitation of ultrasonic sensors, such as limited detection range, is a major restraint to the global ultrasonic sensor market. In addition, growing demand from the healthcare sector for numerous applications, such as echocardiograms and echo graphs, is expected to create opportunities for the ultrasonic sensor industry.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Partnership, product launch, acquisition, and expansion are expected to be the prominent strategies adopted by the market players. Europe accounted for a major share of the market in 2020, owing to the presence of major players in the region; however, Asia-Pacific is expected to grow at the highest CAGR, owing to rise in adoption of ultrasonic sensor in a variety of fields.

Loading Table Of Content...