Unit-Linked Insurance Market Research, 2034

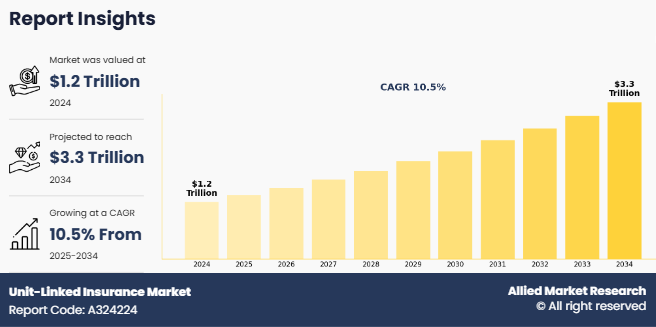

The unit-linked insurance market was valued at $1.1 trillion in 2024 and is estimated to reach $3.3 trillion by 2034, exhibiting a CAGR of 10.5% from 2025 to 2034. Unit-linked insurance is a type of life insurance policy that combines insurance coverage with investment opportunities. In this plan, a portion of the premium paid by the policyholder goes toward providing life insurance coverage, while the remaining portion is invested in equity, debt, or balanced funds, depending on the policyholder preference. The value of the investment, known as the fund value, fluctuates with market performance, making the returns market-linked. Policyholders also have the flexibility to choose and switch between different funds during the policy term to align with their changing financial goals. Unit-linked insurance plans provide dual benefits of wealth creation and financial protection under a single plan. They are particularly suited for individuals seeking long-term investment growth while ensuring life coverage. However, they carry inherent market risks due to the investment component. The unit-linked insurance market is expanding steadily, driven by rising financial literacy, digital adoption in insurance distribution, and growing demand for flexible, investment-linked policies. Moreover, emerging unit-linked insurance market trends, such as personalized fund options, integration of digital advisory platforms, and increasing focus on retirement planning solutions, are further boosting their appeal among diverse customer segments.

Key Takeaways:

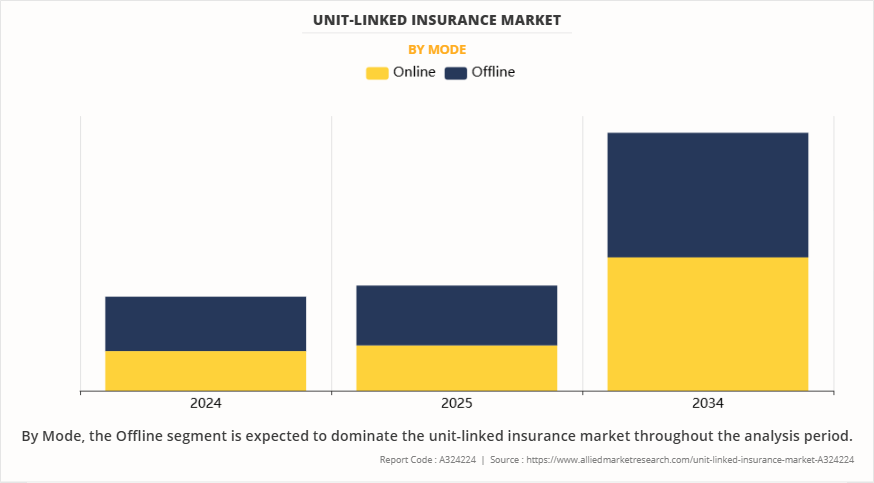

- By mode, the offline segment held the largest share in the unit-linked insurance market for 2024.

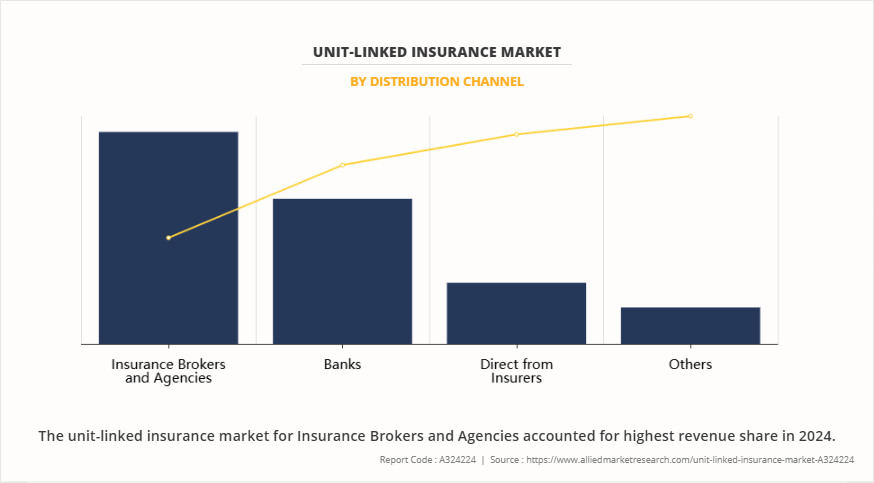

- By distribution channel, the insurance brokers and agencies segment held the largest share in the unit-linked insurance market for 2024.

- Region-wise, Asia-Pacific held the largest unit-linked insurance market share in 2024. However, Latin America is expected to witness the highest CAGR during the forecast period

The unit-linked insurance market is experiencing growth due to an increase in demand for products that offer both protection and investment benefits. People need insurance plans that offer more than providing life coverage. This may include rise in savings over time. Unit-linked insurance plans meet this need by offering life insurance along with the option to invest in different funds like equity, debt, or a mix of both. This dual benefit helps policyholders secure the future of the family while also building wealth. As people become more aware of financial planning and long-term goals such as buying a house or saving for the education of their children, they prefer flexible plans that combine insurance and investment. ULIPs also allow switching between funds, making them more attractive. This rise in interest in smart financial products that provide both safety and returns is a major factor driving the growth of the unit-linked insurance market.

Furthermore, the expansion of digital distribution channels is driving the growth of unit-linked insurance market . It has become easier to compare, buy, and manage ULIP policies online, with more people using smartphones and the internet. Insurance companies are also using apps and websites to reach more customers. This digital shift saves time, offers better information, and makes the buying process simple, encouraging more people to choose unit-linked insurance plans.

Segment Review

The unit-linked insurance market is segmented on the basis of mode, distribution channel, and region. By mode, it is bifurcated into online and offline. By distribution channel, it is classified into direct from insurers, insurance brokers and agencies, banks and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of mode, the offline segment dominated the unit-linked insurance market in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to the strong presence of traditional insurance agents, financial advisors, and branch networks that continue to build trust among policyholders. Furthermore, many consumers still prefer face-to-face consultations for understanding complex ULIP features, which is driving sustained growth of the offline segment.

However, the online segment is expected to register the highest CAGR during the forecast period in unit-linked insurance market owing to the surge in digital adoption, improvements in internet access, rise in presence of user-friendly platforms, faster policy issuance, and increase in preference for self-service insurance purchases.

On the basis of distribution channel, the insurance brokers and agencies segment dominated the unit-linked insurance market in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to the wide network, personalized advisory services, and ability to explain complex ULIP features in simple terms. Moreover, their established customer relationships and trust help drive policy sales. In addition, brokers assist customers in comparing plans and choosing suitable investment and protection options.

However, the direct from Insurers channel segment is expected to register the highest CAGR during the forecast period in unit-linked insurance market. This is attributed to the increasing adoption of digital platforms, which allow insurers to directly reach customers through websites and mobile apps. Furthermore, lower operational costs and personalized offerings make direct channels more appealing. In addition, younger, tech-savvy consumers prefer direct engagement with insurers for transparency, quicker services, and ease of policy management without intermediaries.

Competition Analysis

The report analyzes the profiles of key players operating in the unit-linked insurance market such as Aviva Life Insurance Company India Ltd., Kotak Mahindra Bank Limited, ICICI Prudential Life Insurance Company Ltd, HDFC Life Insurance Company Ltd, Bharti AXA, Life Insurance Company Limited, Bajaj Allianz Life Insurance Co. Ltd., SBI Life Insurance Company Ltd, Talanx, Zurich Insurance Company Ltd., PNB MetLife India Insurance Company Limited and KBC GROUP N.V. These players have adopted various strategies to increase their market penetration and strengthen their position in the unit-linked insurance industry.

Recent Key Developments in the Unit-linked Insurance Market

- In September 2024, AU Small Finance Bank partnered with Kotak Life Insurance to offer a comprehensive suite of life insurance and financial security solutions. This collaboration extends Kotak Life's previous relationship with Fincare Small Finance Bank, which has now merged with AU SFB. Through this partnership, AU SFBA's customers, including those from former Fincare branches can access Kotak Life's range of products such as term insurance, retirement plans, savings, and select investment plans. The initiative aims to enhance financial planning options and reach underserved segments of the population with tailored insurance solutions.

Top Impacting Factors

Driver

Rising Awareness about Investment-Linked Insurance Products

Rise in awareness about investment-linked insurance products is driving the growth of the unit-linked insurance market. People are focusing on financial planning and are looking for products that offer both life protection and investment opportunities. Unit-linked insurance plans provide this dual benefit, making them more attractive to individuals who want to secure their future while also increasing their wealth. Moreover, financial education campaigns by insurance companies, government bodies, and financial advisors are helping people understand the advantages of ULIPs. Many people now realize that ULIP Insurance Market offer flexibility in investment choices, transparency in charges, and the ability to switch funds based on market performance and personal goals. In addition, social media, digital platforms, and online tools are playing a major role in spreading awareness. Easy access to comparison websites, premium calculators, and detailed product information is helping consumers make informed decisions. Furthermore, the rise in interest in goal-based financial planning such as saving for children's education, retirement, or wealth creation, is fueling the Unit-Linked Insurance Plans Market. The demand for unit-linked insurance policies is expected to increase as more individuals understand the long-term benefits of these products, especially the combination of insurance and investment in one plan. This rise in awareness, along with digital support and better financial literacy, is significantly driving the unit-linked insurance market forecast.

Restraints

Market Volatility Affecting Returns

The impact of market volatility on investment returns is the major challenge in the unit-linked insurance market. The fund value depends on how these markets perform since unit-linked insurance policies invest a portion of the premium in market-linked instruments like equities and bonds. The returns from these investments can be low or even negative during times of economic instability or market downturns. This creates uncertainty for policyholders, especially those with short- to medium-term goals. Moreover, people who are new to investing may find it difficult to understand market risks and how they affect the value of their unit-linked insurance policies plans. This lack of knowledge can lead to poor investment decisions, dissatisfaction with returns, or even early policy surrender. In addition, market-linked risks make unit-linked insurance policies less attractive to highly risk-averse individuals who prefer guaranteed returns. Furthermore, a rise in inflation, interest rate fluctuations, and global financial instability also contribute to the unpredictability of returns. While unit-linked insurance policies offer flexibility and long-term growth potential, the fear of losing money due to market conditions discourages some people from choosing these plans. This challenge is slowing down the adoption of unit-linked insurance policies in certain segments of the population. To overcome this restraint, insurers need to offer better education, simpler fund choices, and clear communication about risks. Addressing these concerns can build trust and encourage more people to invest in unit-linked insurance policies, which is essential for driving the unit-linked insurance market growth.

Opportunity

Integration of AI And Analytics for Personalized Insurance Solutions

The integration of artificial intelligence (AI) and advanced analytics is creating new opportunities in the unit-linked insurance market outlook. These technologies help insurers better understand customer preferences, risk profiles, and financial goals. By analyzing customer data, insurers can offer personalized unit-linked insurance policy plans that match individual needs. This not only improves customer satisfaction but also encourages more people to invest in unit-linked insurance policies. Moreover, AI-powered chatbots and digital tools make it easier for customers to compare plans, understand fund performance, and make informed decisions. Furthermore, analytics helps insurers track market trends and manage risks more efficiently in unit-linked insurance market. It enables them to optimize fund allocation, provide real-time investment insights, and improve claims management. In addition, AI can assist in detecting fraud and reducing operational costs, which improves overall efficiency for insurance providers. The use of AI and analytics also supports automated underwriting, faster onboarding, and smoother policy servicing. This enhances the customer experience and builds trust in digital insurance platforms. As more tech-savvy consumers enter the market, they expect smart, user-friendly solutions that offer both protection and investment value. Overall, the growing use of AI and analytics is fueling the unit-linked insurance market opportunity by making unit-linked insurance policies more transparent, flexible, and personalized. This trend is expected to drive innovation and open new growth opportunities in the coming years in unit-linked insurance market. In July 2025, pnb metlife unveiled the value fund, an actively managed equity fund targeting undervalued companies. Available through pnb metlife ulip insurance market offerings, it aims for long-term wealth creation paired with life cover and tax benefits.

Key Benefits for Stakeholders

- The study provides an in-depth unit-linked insurance market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, & opportunities, and their impact analysis on the unit-linked insurance market size is provided in the report.

- Porter five forces analysis illustrates the potency of buyers and suppliers operating in the unit-linked insurance market industry.

- The quantitative analysis of the global unit-linked insurance market for the period 2024-2034 is provided to determine the unit-linked insurance industry potential.

Unit-Linked Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.3 trillion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 288 |

| By Mode |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

According to the CXOs, the unit-linked insurance market is experiencing growth, driven by the increase in demand for financial protection combined with investment opportunities. Unit-linked insurance policies have become an attractive option as consumers seek ways to secure their future while also increasing their wealth. These plans offer life insurance coverage along with the ability to invest in market-linked funds like equities or bonds. This dual benefit attracts individuals looking for flexible and goal-oriented financial solutions. The rise of digital platforms has further supported market growth by making it easier for customers to research, compare, and purchase unit-linked insurance policies online, increasing accessibility and awareness among young and tech-savvy investors.

In addition, flexible unit-linked insurance plans that suit various income levels and investment goals are gaining traction. These plans offer a combination of life insurance and market-linked investment options, making them attractive to young earners, new investors, and middle-income families. The ability to start with low premiums and choose between equity, debt, or balanced funds allows individuals to align coverage with their financial capacity and risk appetite. Employers in developing markets are also offering unit-linked insurance policies as part of employee benefit packages, boosting adoption.

Government efforts to promote life insurance awareness and financial inclusion are further supporting the market growth. Moreover, unit-linked insurance policies offering features like monthly premium payments, fund-switching options, partial withdrawals, and additional riders are drawing attention from consumers seeking flexible, long-term solutions. These options help reduce immediate financial burden while offering wealth-building potential. However, challenges exist in ensuring customers fully understand charges, lock-in periods, and market risks. Insurers must also improve digital onboarding and simplify policy communication to meet evolving customer expectations. Despite these issues, the unit-linked insurance market is expected to experience growth as individuals increasingly prioritize financial security, goal-based investing, and insurance protection in one integrated product. In July 2025, Canara HSBC introduced SecureInvest, a new ULIP savings plan offering life cover up to 100× the annualised premium. The plan includes loyalty bonuses and maturity boosters to encourage long-term investment behavior and is designed to match evolving financial needs across life stages.

The rise of digital distribution and robo-advisory platforms for personalized policies, along with growing demand for sustainable and ESG-linked investment options within insurance products are the upcoming trends of Unit-Linked Insurance Market in the globe.

Offline mode is the leading mode of Unit-Linked Insurance Market.

Asia-Pacific is the largest regional market for Unit-Linked Insurance.

$3.3 trillion is the estimated industry size of Unit-Linked Insurance by 2034

Aviva Life Insurance Company India Ltd., Kotak Mahindra Bank Limited, ICICI Prudential Life Insurance Company Ltd, HDFC Life Insurance Company Ltd, Bharti AXA, Life Insurance Company Limited, Bajaj Allianz Life Insurance Co. Ltd., SBI Life Insurance Company Ltd, Talanx, Zurich Insurance Company Ltd., PNB MetLife India Insurance Company Limited and KBC GROUP N.V. are the top companies to hold the market share in Unit-Linked Insurance

Loading Table Of Content...

Loading Research Methodology...