Unmanned Helicopter Market Research, 2033

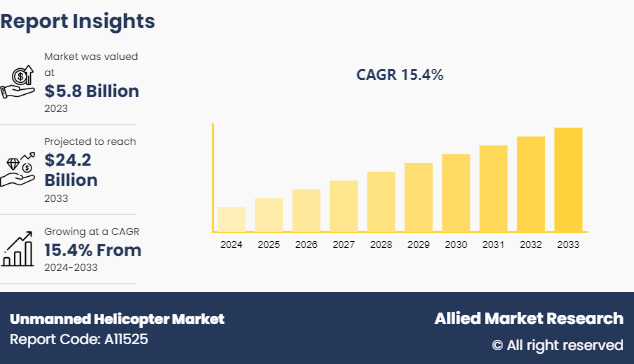

The global unmanned helicopter market was valued at $5.8 billion in 2023, and is projected to reach $24.2 billion by 2033, growing at a CAGR of 15.4% from 2024 to 2033.

Market Introduction and Definition

An unmanned helicopter, also known as an unmanned aerial vehicle (UAV) helicopter or drone helicopter, is a type of rotorcraft that operates without a human pilot onboard. It is controlled either autonomously by onboard computers or remotely by a human operator. Unmanned helicopters come in different sizes and capabilities, from small, lightweight models suitable for hobbyists to larger, more robust models used for industrial or military purposes. The unmanned helicopter industry is experiencing rapid advancements, transforming various sectors including defense, agriculture, and logistics. The unmanned helicopter market size has expanded significantly in recent years due to technological innovations and increasing adoption across industries.

Key Takeaways

- The unmanned helicopter market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major unmanned helicopter industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- In October 2022, Turkish engineering company Titra selected to receive government subsidies to develop the country's first unmanned helicopter, named the Alpin. This initiative has been designated as a "regional priority investment" by the Ankara government, indicating that it will receive support in the form of government incentives.

- In November 2023, Rotor Technologies achieved a significant milestone in autonomous aviation by completing an extensive flight campaign with its experimental R220Y autonomous helicopters. Rotor Technologies successfully conducted autonomous flights with its R220Y helicopters, marking the first time a full-scale civilian helicopter has been flown autonomously. This achievement highlights advancements in automation technology within the aviation industry.

- In September 2020, China successfully conducted the maiden flight of its first unmanned helicopter drone designed specifically to operate in plateau areas. This unmanned helicopter, named the AR500C, is equipped with capabilities for conducting reconnaissance and firing from high altitudes. The AR500C unmanned helicopter drone is developed by the Aviation Industry Corp of China (AVIC) . It has been specifically designed to operate effectively in plateau areas, which are characterized by high elevations and challenging environmental conditions.

Key Market Dynamics

The global unmanned helicopter market is growing due to several factors such as enhanced surveillance and reconnaissance capabilities, cost-effectiveness and risk reduction, and technological advancements. However, regulatory and airspace management challenges, and high initial costs and maintenance restrain the development of the market. In addition, commercial and industrial applications, and disaster response and humanitarian aid will provide ample opportunities for the market's development during the forecast period. The unmanned helicopter market size is anticipated to grow further, reaching new heights driven by the demand for efficient and versatile aerial solutions.

Unmanned helicopters, also known as unmanned aerial vehicles (UAVs) or drones, offer superior surveillance and reconnaissance capabilities compared to traditional manned aircraft. Unmanned helicopters can be deployed for extended periods, providing continuous surveillance without the need for rest breaks. This is crucial for missions requiring long-term observation, such as border patrol or wildlife monitoring. Equipped with advanced cameras and sensors, these UAVs can capture high-definition video and imagery, transmitting data in real-time to command-and-control centers. This immediate feedback allows for quick decision-making in dynamic situations. The unmanned helicopter market opportunity is vast, with emerging applications in disaster management, environmental monitoring, and beyond. New entrants are finding substantial unmanned helicopter market opportunity in regions where traditional piloted helicopters are less practical or cost-effective.

Market Segmentation

The unmanned helicopter market is segmented into type, application, government agency, and region. On the basis of type, the market is divided into small (0-20 lbs) , and medium (21-55 lbs)) . As per level of application, the market is segregated into military, government agency, industrial, and others. On the basis of end user, the market is bifurcated into military defense, law enforcement, emergency services, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The North American unmanned helicopter market is experiencing significant growth, driven by various factors including advancements in technology, increasing military and defense applications, and rising demand for efficient surveillance and reconnaissance solutions. Improvements in sensor technologies, navigation systems, and autonomous flight capabilities are making unmanned helicopters more effective and reliable for a variety of applications. The evolving nature of combat and the need for modernization in military operations are driving significant investments in unmanned helicopters for intelligence, surveillance, reconnaissance (ISR) , and combat roles. The unmanned helicopter market forecast, highlights continued growth expected as technology advances and regulatory frameworks become more supportive

- In January 2024, Hanwha Systems, a major defense contractor in South Korea, has been selected to develop an unmanned helicopter for use by the Republic of Korea Navy and Marine Corps. This development aims to enhance the operational capabilities of South Korea's naval and marine forces by integrating advanced unmanned aerial technology.

- In August 2023, the AR-500 unmanned helicopter, developed by the China Helicopter Research and Development Institute (CHRDI) under the Aviation Industry Corporation of China (AVIC) , has been designated as maritime management equipment in Shandong Province, China. Its primary functions include investigating and collecting evidence related to illegal vessels, conducting search and rescue operations, and monitoring oil spills.

- In January 2024, Airbus Helicopters announced its acquisition of Aerovel, a move aimed at enhancing its portfolio of unmanned aerial systems (UAS) and strengthening its tactical unmanned solutions. The acquisition includes Aerovel's unmanned aerial system, Flexrotor, which is designed for intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) missions both at sea and on land.

Competitive Landscape

The major players operating in the unmanned helicopter market include Schiebel Group, Yamaha Motor Company, MD Helicopters, CybAero, Elbit Systems, Northrop Grumman, Leonardo, AVIC Helicopter Company, Airbus Helicopters, and Lockheed Martin. Major companies are capturing a significant unmanned helicopter market share, setting the standard for innovation and reliability in the industry.

Industry Trends

- In April 2024, UAVOS successfully deployed its UVH 170 unmanned helicopter to support wildfire suppression efforts. The primary goal was to assist wildfire suppression agencies by providing timely and accurate data for better situational awareness during fire-fighting operations.

- In June 2024, at the International Aerospace Exhibition and Air Show (ILA) 2024 in Berlin, Airbus unveiled its latest unmanned aerial system, the VSR700. This unmanned helicopter is designed primarily for naval applications, combining advanced technology and operational flexibility to meet modern maritime needs.

- In November 2023, China inducted its first batch of unmanned maritime helicopters to improve the management of water traffic and respond to maritime accidents. This deployment took place in Weihai, a coastal city in East China's Shandong Province. The main goals are to better manage water traffic and address maritime accidents effectively.

Key Sources Referred

- Association for Unmanned Vehicle Systems International (AUVSI)

- International Council of the Aeronautical Sciences (ICAS)

- Vertical Flight Society (VFS)

- Unmanned Aircraft Systems Canada (UAS Canada)

- European Association for Unmanned Aerial Systems (EUROCAE)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the unmanned helicopter market analysis from 2024 to 2033 to identify the prevailing unmanned helicopter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the unmanned helicopter market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global unmanned helicopter market trends, key players, market segments, application areas, and market growth strategies.

Unmanned Helicopter Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.2 Billion |

| Growth Rate | CAGR of 15.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 233 |

| By Type |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Yamaha Motor Company, Airbus Helicopters, CybAero, Leonardo, AVIC Helicopter Company, Elbit Systems, Lockheed Martin, Schiebel Group, MD Helicopters, Northrop Grumman |

The unmanned helicopter market was valued at $5.8 billion in 2023 and is estimated to reach $16.2 billion by 2033, exhibiting a CAGR of 15.4% from 2024 to 2033.

The largest regional market for unmanned helicopter is North America.

The top companies to hold the market share in unmanned helicopter are Schiebel Group, Yamaha Motor Company, MD Helicopters, CybAero, Elbit Systems, Northrop Grumman, Leonardo, AVIC Helicopter Company, Airbus Helicopters, and Lockheed Martin

The leading type of unmanned helicopter market small (0-20 lbs).

The upcoming trends of unmanned helicopter market in the globe are commercial and industrial applications, and adoption of unmanned helicopters in disaster response and humanitarian aid.

Loading Table Of Content...