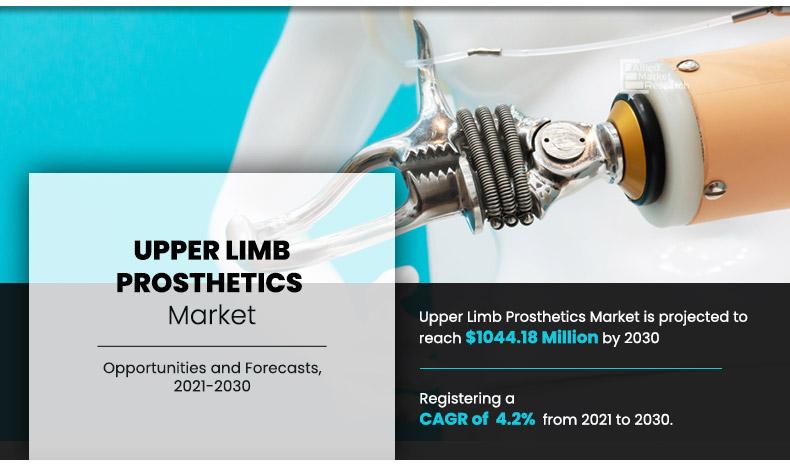

Upper Limb Prosthetics Market Statistics- 2030

The global upper limb prosthetics market size generated $687.73 million in 2020, and is projected to reach $1,044.18 million by 2030, growing at a CAGR of 4.24% from 2021 to 2030. Upper limb prosthetics is an artificial device that serves as a substitute for a partially or entirely lost hand or arm due to an accident, injury, illness, trauma, or congenital defect. Upper limb prosthetics includes terminal device (TD), interposing joints, socket, suspension, and control system. Typically, there are four general classes of upper extremity prostheses. These include cosmetic or passive prosthetic devices, body-powered, myoelectric and hybrid type prostheses. Technological advancements in prosthetic, increase in number of accidents and trauma, and rise in prevalence of bone conditions such as osteosarcoma, osteoporosis and osteopenia are the key factors that fuel the growth of the global upper limb prosthetics market.

Moreover, high cost and greater maintenance associated with these devices and lack of reimbursement policies hamper the growth of the market. However, increased government initiatives to support amputee initiatives to support amputee provides lucrative growth opportunities to the market.

The global upper limb prosthetics market is segmented into product type, component, and end user. By product type, the market is classified into passive prosthetic devices, myoelectric prosthetic devices, body powered prosthetic devices, and hybrid prosthetic devices. By component, it is divided into prosthetic wrist, prosthetic arm, prosthetic elbow, prosthetic shoulder, and others. By end user, it is categorized into hospitals, prosthetic clinics, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Impact of Covid-19 on Upper Limb Prosthetics Market (Pre and Post Analysis)

Coronavirus (COVID-19) was discovered in late December in Hubei province of Wuhan city in China. The disease is caused by a virus, namely, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted from humans to humans. After its discovery in Wuhan, the disease has rapidly spread to other parts of the globe. Moreover, this virus causes various symptoms in a patient, which range from common symptoms to serious symptoms. For instance, the common symptoms include fever, dry cough, and fatigue.

However, serious symptoms include difficulty in breathing or shortness of breath, chest pain or pressure, and loss of speech or movement. Furthermore, the virus has a high potential of lethality in geriatric population. On March 11, 2020, the World Health Organization made an assessment that COVID-19 can be characterized as a pandemic. In addition, there are no drugs that are currently licensed for the treatment of COVID-19 treatment or prevention. Thus, social-distancing is observed as the most important measure to stop the spread of this disease. Furthermore, to maintain social distancing, various countries across the world have adopted nationwide lockdowns.

The COVID-19 pandemic impacted the upper limb prosthetics market in the negative manner as incidence of acute limb ischemia associated with patients with COVID-19 who require hospitalization ranges from 3% to 15%. This corresponded to between 600 and 3000 acute limb ischemia (ALI) cases in the U.S. with an estimated 20,000 patients requiring intensive care at that time according to the data of UpToDate, Inc. in 2020. This number is huge and so was difficult to manage and some of the cases needed to be postponed. In addition, the recovery and rehabilitation following amputation may be prolonged, because patients with COVID-19 are commonly severely deconditioned from prolonged illness with COVID-19.

From the initial period of the COVID-19 pandemic, the limb surgeries have been delayed, which led to a decline in the consumption of prosthetics. According to the data provided by the University of Birmingham, published in the British Journal of Surgery in May 2020, about 6.3 million orthopedic surgeries were postponed or canceled worldwide due to COVID-19. However, as the activities are resuming, a sudden upsurge in the consumption of prosthetics can be expected.

Moreover, the transportation was major issue for availability of the advanced prosthetic devices. The slowdown in the supply of the devices at the preferred location resulted in the negligence of the customers to have one. The manufacturing plants were also impacted by the government restriction norms for the production of the devices. This further resulted in the increasing supply and demand gap. This led to the negative impact again on the market.

Overall, the impact of the COVID-19 pandemic on the upper limb prosthetics market was reported to be negative. This was attributed to the factors like difficulty in the management of the amputation cases which require hospital stay, prolong recovery time in the covid-19 conditions and delay in the limb surgeries. However, this impact is expected to change post COVID-19 pandemic and is expected to increase the growth of the market.

By Product Type Segment Review

By product type, the upper limb prosthetics market is categorized into passive prosthetic devices, myoelectric prosthetic devices, body powered prosthetic devices, and hybrid prosthetic devices. Passive prosthetic devices segment dominated the global market in 2020, and is anticipated to continue this trend during the forecast period owing to the key factors such as rise in demand for upper limb prosthetic surgeries, surge in patient awareness towards prosthetic devices and advancements in the prosthetic devices.

By Product Type

Passive Prosthetic Devices segment held a dominant position in 2020.

By Component Segment Review

By component, the market is segregated into prosthetic wrist, prosthetic arm, prosthetic elbow, prosthetic shoulder, and others. At present, the prosthetic arm segment accounts for the majority of upper limb prosthetics market share, owing to rise in prevalence of joint disorders in both developed as well as developing countries. In addition, surge in demand for prosthetic arm devices, rise in number of accidents, and increase in geriatric population are other factors that boost the growth of the market.

By Component

Prosthetic Arm segment held a dominant position in 2020.

End User Segment Review

By end user, the market is categorized into hospitals, prosthetic clinics, and others. The prosthetic clinics segment accounts for the majority of upper limb prosthetics market share, owing to rise in benefits offered by the organization, increase in the number of organizations, and surge in funding by the government organizations.

By End User

Prosthetic Clinics segment is projected as one of the most lucrative segment.

Region segment review

By region, the market is analyzed across North America, Asia-Pacific, Europe, and LAMEA. North America dominated the upper limb prosthetics market in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This was attributed to increase in number of accidents and trauma, rise in patient awareness towards prosthetic surgeries, surge in demand for prosthetic devices, availability of advanced healthcare facilities with trained medical professionals, and presence of key players in the region.

By Region

North America was holding a dominant position in 2020 and it will maintain the lead over the analysis period.

This report provides comprehensive competitive analysis and profiles of prominent upper limb prosthetics market players such as CBPE Capital LLP (Blatchford Limited), Coapt LLC., Colfax Corporation (DJO, LLC), Ossur (college park industries), Mobius Bionics LLC, Motorica LLC, Naked Prosthetics, Ottobock SE & Co. KGaA, Protunix, and Steeper Group.

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current upper limb prosthetics market trends and forecast estimations from 2020 to 2030, which assists to identify the prevailing market opportunities.

- An in-depth upper limb prosthetics market analysis includes analysis of various regions, which is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of factors that drive and restrain the growth of the global is provided.

- The projections in this report are made by analyzing the current trends and future market potential from 2021 to 2030, in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the upper limb prosthetics market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of the upper limb prosthetics market.

Upper Limb Prosthetics Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Component |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The population of upper-extremity amputees, including congenitally limb-deficient persons, in the U.S. and abroad is placing increased demand upon the profession for improved prosthetic designs and devices which will allow its members to participate competitively in sports and recreation activities. The measure of performance by the amputee in any activity depends upon proper limb design, socket design, materials, alignment, and components. Another important factor is the amputee's physical condition. The prosthesis cannot supplement atrophied muscle, limited range of motion, or inadequate strength of the amputee.

The factors such as increase in patient awareness toward prosthetic surgeries, surge in prevalence of joint disorders, technological advancements in prosthetic devices, rise in demand for prosthetic devices, and increase in geriatric population are expected to drive the growth of the upper limb prosthetics market. Furthermore, easy reimbursement policies associated with the prosthetic surgeries propel the market growth. However, high cost of the devices and lack of government policies are expected to hinder the growth of the market.

North America is expected to remain dominant during the forecast period, due to increase in demand for upper limb prosthetics, rise in prevalence of bone related diseases, and presence of major key players in this regions. Moreover, Asia-Pacific is expected to offer lucrative opportunities to the key players during the forecast period, due to increase in number of hospitals equipped with advanced medical facilities along with surge in availability of advanced upper limb prosthetics

The total market value of Upper Limb Prosthetics market is $1,044.18 million in 2030.

Top companies such as CBPE Capital LLP, Ossur (College Park Industries), Coapt LLC, Steeper Group, Ottobock SE & Co. KGaA, Mobius Bionics LLC held a high market position in 2020. These key players held a high market postion owing to the strong geographical foothold in India, Bangladesh, Sri Lanka, Nepal.

Passive prosthetic devices segment is the most influencing segment owing to the increasing prevalence of bone conditions such as osteosarcoma, osteoporosis and osteopenia and increasing number of accidents.

The forecast period for Upper Limb Prosthetics market is 2020 to 2030

The market value of Upper Limb Prosthetics market in 2020 is $687.69 million.

The base year is 2020 in Upper Limb Prosthetics market

Technological advancements in the prosthetics, increasing number of accidents and trauma, increasing prevalence of bone conditions such as osteosarcoma, osteoporosis and osteopenia are the key trends in the Upper Limb Prosthetics market report.

North America has the highest growth rate of 5.1% in the market which is growing due to increase in the prevalence of bone diseases in this region and presence of market players.

Yes, the Upper Limb Prosthetics market companies are profiled in the report.

Yes, the Upper Limb Prosthetics market report provides PORTER Analysis

Loading Table Of Content...