Urban Logistics Market Research, 2033

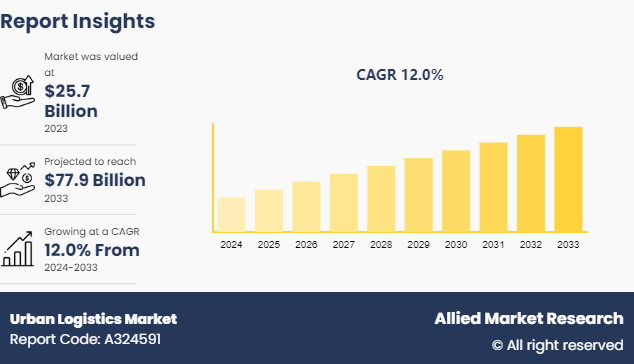

The global urban logistics market size was valued at $25.7 billion in 2023, and is projected to reach $77.9 billion by 2033, growing at a CAGR of 12% from 2024 to 2033.

Market Introduction and Definition

Urban logistics refers to the planning, implementation, and control of the efficient movement and storage of goods within urban areas. It encompasses a wide range of activities and processes designed to manage the flow of products from their point of origin to their final destination within a city, ensuring that they arrive in a timely, cost-effective, and environmentally sustainable manner.

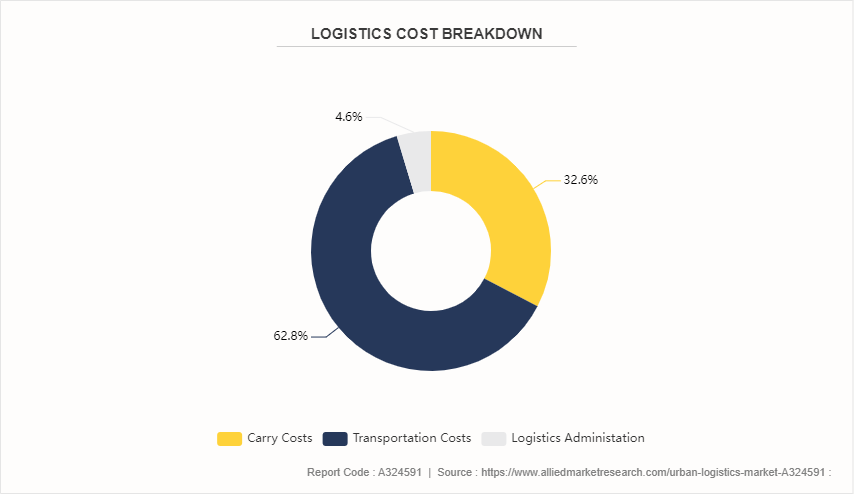

The final step in the delivery process is where goods are transported from a distribution center or warehouse to the end customer. This is often the most complex and expensive part of the logistics chain due to traffic congestion, limited parking, and the high density of delivery points. The strategic placement and management of storage facilities within or near urban areas ensures that goods can be quickly and efficiently distributed to their final destinations.

Key Takeaways

The urban logistics market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major urban logistics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In May 2024, Patrizia has acquired a 10-property urban logistics portfolio in Sweden, which will serve as the foundational asset for a EUR 300 million platform aimed at the Nordic urban industrial and logistics market. This investment is part of a strategic joint venture partnership with Broadgate Asset Management, a leading Nordic real estate operating partner. The collaboration leverages Patrizia's investment expertise and Broadgate's local market knowledge to capitalize on the growing demand for urban logistics in the Nordic region.

In October 2023, FOTON launched its latest offerings, the AUMARK and WONDER, in Changsha, China, with a dual focus on both the urban logistics and last-mile logistics markets. This launch underscores FOTON's commitment to its strategies of dual-carbon and new energy, aligning with the industry's shift towards sustainability and eco-friendly solutions. The AUMARK and WONDER models come equipped with a range of compelling features and advantages, including enhanced fuel efficiency, reduced emissions, and innovative technologies tailored to meet the evolving needs of urban and last-mile logistics operations.

Key Market Dynamics

The rise in urbanization is a significant driver of the urban logistics market share. Urban areas are characterized by high population density, resulting in a concentration of consumers and businesses in relatively small geographical areas. This concentration amplifies the need for efficient logistics solutions to handle the flow of goods to meet the demands of urban residents and businesses. Furthermore, the E-commerce growth, and technological advancement have driven the demand for the urban logistics market growth.

However, infrastructure challenges have hampered the growth of the urban logistics market size. Urban logistics faces challenges related to inadequate infrastructure, such as congestion, limited parking spaces, and restricted access to certain areas within cities. These infrastructure limitations can hinder the efficient movement of goods and increase operating costs for logistics providers. Moreover, high initial costs, and regulatory hurdle are major factors that hamper the growth of the urban logistics market forecast.

On the contrary, integration of IoT presents a significant and lucrative opportunity for the urban logistics market. IoT sensors and devices can be installed on vehicles, packages, and infrastructure to provide real-time visibility into the entire logistics process. This enables urban logistics providers to track the location and condition of shipments, monitor vehicle performance, and optimize routes in real-time, leading to improved efficiency and customer service.

Supply Chain Dynamics for the Urban Logistics Market

Last-mile delivery accounts for a significant portion of logistics costs and challenges in urban areas. Localization strategies involve strategically locating distribution centers and fulfillment centers closer to urban centers or within city limits. By minimizing the distance between distribution centers and end consumers, urban logistics providers can optimize last-mile delivery, reduce transportation costs, and improve delivery times. In addition, micro-fulfillment centers (MFCs) are small-scale warehouses located in urban areas that specialize in fulfilling online orders quickly and efficiently. These compact facilities enable urban logistics providers to store inventory closer to consumers, streamline order processing, and facilitate same-day or next-day delivery. MFCs leverage automation and robotics to maximize space utilization and operational efficiency in densely populated urban environments.

Urban logistics providers can optimize supply chain dynamics by integrating multiple modes of transportation, including trucks, bicycles, electric scooters, and drones, for last-mile delivery. By diversifying transportation options and leveraging alternative modes of transport, logistics companies can navigate traffic congestion, reduce emissions, and improve delivery flexibility in urban areas. Moreover, effective demand forecasting and inventory management are essential for optimizing supply chain dynamics in urban logistics. By leveraging data analytics, machine learning, and artificial intelligence, logistics providers can accurately predict demand patterns, optimize inventory levels, and reduce stockouts in urban warehouses and distribution centers. Real-time inventory visibility enables urban logistics companies to respond quickly to changing consumer preferences and market trends.

Market Segmentation

The urban logistics market is segmented into type, application and region. On the basis of type, the market is segmented into express logistics, LTL logistics, and hazardous chemical logistics. As per application, the market is divided into electric logistics vehicle, and fuel cell logistic vehicle. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America, particularly the U.S., has experienced significant growth in e-commerce adoption. The region has a mature e-commerce market with a large population of online shoppers accustomed to fast and convenient delivery options. This robust e-commerce ecosystem drives demand for urban logistics services to fulfill online orders and facilitate last-mile delivery in urban areas. Furthermore, many urban areas in North America, such as New York City, Los Angeles, and Chicago, have high population densities and dense urban cores. The concentration of consumers and businesses in these densely populated cities creates a strong demand for urban logistics solutions to efficiently manage the flow of goods within urban environments.

The Asia-Pacific region is experiencing rapid urbanization, with millions of people migrating from rural areas to cities in search of better economic opportunities. This urban population growth has led to increased demand for goods and services, driving the need for efficient urban logistics solutions to serve densely populated urban areas. Moreover, the Asia-Pacific is home to some of the world's largest e-commerce markets, including China, India, and Southeast Asian countries. The growth of e-commerce platforms and online retailing has fueled demand for urban logistics services, particularly last-mile delivery, as consumers increasingly turn to online shopping for their everyday needs.

Many countries in the Asia-Pacific region, such as China, India, Indonesia, and Vietnam, are experiencing rapid economic growth and industrialization. As these emerging markets develop and urbanize, there is a growing demand for urban logistics infrastructure and services to support the flow of goods and materials within urban areas.

In January 2024, Global Village Shipping (GVS) partnered with BITS Pilani in the field of transportation and logistics. The objective of this partnership is to address key challenges and explore opportunities in the transportation and logistics sectors. This could involve studying emerging technologies, optimizing supply chain processes, or analyzing market trends to drive innovation and efficiency.

In February 2023, Paloma, a well-established logistics company, made the strategic decision to sell its Amazon unit to a rapidly growing urban logistics platform. This move reflects Paloma's focus on optimizing its business portfolio and aligning with emerging trends in the logistics industry. By divesting its Amazon unit, Paloma aims to streamline its operations and allocate resources more effectively to areas of growth and innovation. Meanwhile, the urban logistics platform, poised for expansion in the dynamic urban logistics market, sees the acquisition of Paloma's Amazon unit as an opportunity to strengthen its presence and capabilities in last-mile delivery and e-commerce logistics.

Competitive Landscape

The report analyzes the profiles of key players operating in the urban logistics market such as Amazon, Alibaba Group, DHL, FedEx, JD.com, Maersk, SF Express, Uber Freight, UPS (United Parcel Service) , and XPO Logistics. These players have adopted various strategies to increase their market penetration and strengthen their position in the urban logistics market.

Industry Trends

In May 2024, urban logistics industry hails strong portfolio amid new lettings probably describes an instance in which a business that focuses on urban logistics, like Urban Logistics REIT (Real Estate Investment Trust) , claims growth and success that is fueled by new lease agreements.

In July 2022, "Urban Logistics slows pace of investment after 'truly transformational' year" suggests that following a period of notable growth and change, Urban Logistics, presumably a real estate investment trust (REIT) focused on urban logistics properties, is opting to decrease its rate of acquiring new assets. The term "truly transformational" implies that the preceding year saw significant alterations or accomplishments for Urban Logistics, such as acquisitions, portfolio expansions, strategic adjustments, or enhancements in financial performance, fundamentally reshaping the company's status or operations.

In September 2021, urban logistics is poised to play a central role in India's metropolitan economies as the growing preference for online purchasing driven by its convenience, transparency, and hygiene benefits during and after COVID-19 prompts a shift from traditional retail to automated and sustainable logistics spaces. This trend is encouraging e-commerce and third-party logistics (3PL) companies to adopt micro-fulfillment technology to enhance efficiency and optimize last-mile delivery, thereby boosting their business operations.

In December 2021, Panmure Gordon, a financial services firm, is pleased to have served as Joint Broker and Joint Bookrunner to Urban Logistics REIT plc for its £250 million Issue. This Issue refers to a significant capital raising event where Urban Logistics REIT plc raised £250 million through the issuance of new shares or other securities. The term "significantly oversubscribed" indicates that demand from investors exceeded the number of securities offered by a substantial margin, demonstrating strong investor interest in Urban Logistics REIT plc.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the urban logistics market segments, current trends, estimations, and dynamics of the urban logistics market analysis from 2022 to 2032 to identify the prevailing urban logistics market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the urban logistics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global urban logistics market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global urban logistics market trends, key players, market segments, application areas, and market growth strategies.

Urban Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 77.9 Billion |

| Growth Rate | CAGR of 12% |

| Forecast period | 2024 - 2033 |

| Report Pages | 456 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ALIBABA GROUP HOLDING LIMITED, UNITED PARCEL SERVICE OF AMERICA, INC., DHL, Uber Freight, JD.com, Inc., Amazon, XPO, Inc., FedEx, SF Express, A.P. Moller - Maersk |

Upcoming trends in the global Urban Logistics Market include the rise of last-mile delivery solutions, increased use of electric and autonomous vehicles, expansion of micro-fulfillment centers, adoption of smart logistics technologies (such as IoT and AI), and the integration of sustainable practices to reduce environmental impact, there is a growing focus on optimizing delivery routes and enhancing real-time tracking capabilities.

Electric Logistics is the leading application of urban logistics market

North America is the largest regional market for urban logistics

$77.9 billion is the estimated industry size of urban logistics

Amazon, Alibaba Group, DHL, FedEx, JD.com, Maersk, SF Express, Uber Freight, UPS (United Parcel Service), and XPO Logistics are the top companies to hold the market share in urban logistics

Loading Table Of Content...