Ureteroscopy Market Research, 2031

The global ureteroscopy market size was valued at $807.34 million in 2021, and is projected to reach $1,379.82 million by 2031, registering a CAGR of 5.5% from 2022 to 2031. A ureteroscope is a particular kind of endoscope which is either rigid, flexible, or semi-flexible with a camera and light source at one end. Ureteroscopes are the types of endoscopes used for visualization and examination of the urinary tract. Ureteroscopes are particularly long and thin, they can be inserted into the urethra and moved up into the bladder and into the ureter. These endoscopes are used for examination of interior of the ureter with tools and doing visual inspections. This procedure is helpful in the identification and treatment of conditions like kidney stones, kidney cancer, urinary stricture, and urothelial cancer of the upper urinary tract. The ureteroscopes are available in various types such as flexible, rigid, semi-rigid, single use, and double channel ureteroscopes.

“The ureteroscopy market size was hindered during the lockdown period owing to decrease in demand for ureteroscopes devices. Decline in elective surgical procedures due to pandemic led to negatively impact the market growth.”

Market dynamics

Growth and innovations in the technology industry for the manufacturing of ureteroscopy devices owing to massive pool of health-conscious consumers, creates an opportunity for the ureteroscopy market. The growth of the ureteroscopy market share is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, and rise in prevalence of kidney diseases. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by governments to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries. In addition, increase in cases of urinary stones has led to high adoption of ureteroscopes thus driving the ureteroscopy market growth.

The demand for ureteroscopy is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuels the growth of the market. Key factors such as advanced technology and higher accuracy rate for identification and estimation of kidney stone location further drive the growth of market. Furthermore, rise in the prevalence of diseases such as chronic kidney diseases, diabetes, and others has led to high chances of getting kidney stones leading to increase in the demand for ureteroscopy to examine the diseases. Moreover, increase in manufacturing companies for photoacoustic imaging devices and growth in awareness about urological disorders, kidney diseases and its treatment options among the general population is expected to fuel the market growth in the near future. In addition, rise in urological surgeries increases the demand for ureteroscopy and the patients globally prefer minimally invasive urological surgeries for the diagnosis and treatment. Thus, this factor is driving the demand for ureteroscopy devices such as flexible and semi rigid ureteroscopes which, in turn, boosts the market growth. Furthermore, rise in technological advancements in ureteroscopy devices further drive the market growth.

In contrast, the side effects associated with ureteroscopes devices restrains the market growth. For instance, side effects of ureteroscopes devices include abnormal bleeding, abdominal pain, burning feeling or pain during urination, injury to the urethra, urethral narrowing due to scar tissue formation, and the inability to urinate due to swelling of surrounding tissues. In addition, lack of skilled professionals to handle the ureteroscope devices in emerging countries such as China, and Japan may negatively impact the market growth. Moreover, clinical barriers of ureteroscopes and risk of infection from ureteroscopy devices act as a major restraint for the global ureteroscopy market. Ureteroscopy devices are expensive than the other treatments which are used for kidney stones and cancer. Thus, high cost of advanced ureteroscopes has led to limiting the adoption of ureteroscopes devices, due to poor infrastructure in emerging countries such as China and India. In addition, poor purchasing power or low affordability power in emerging countries negatively impacted the market growth.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global ureteroscopy

market experienced a decline in 2021 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries like healthcare, medical devices, and industrial. Moreover, decrease in hospital visits and less hospitals for urology during pandemic may reduce the adoption of ureteroscopes devices and hamper the market growth. Furthermore, decline in urological surgeries due to the lockdown led to decrease in demand for ureteroscopes which also hampers the market growth. However, the market is anticipated to witness recovery in 2021, and show stable growth for the ureteroscopy market in the coming future owing to rising cases of urological disorders.

Segmental Overview

The ureteroscopy market is segmented into product, application, end user, and region. By product, the market is categorized into flexible ureteroscope and semi rigid ureteroscope. On the basis of application, the market is segregated into urolithiasis, kidney cancer, urinary stricture, and others. As per end user, the market is classified into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

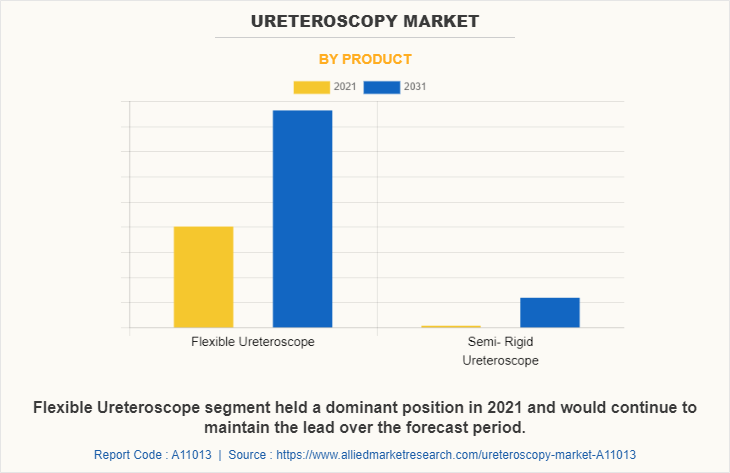

By product the market is segmented into flexible ureteroscope and semi rigid ureteroscope. The flexible ureteroscope segment dominated the global market in 2021, and is expected to grow at fastest rate during the ureteroscopy market forecast period. This is attributed to advantages of flexible ureteroscopes, surge in awareness, and demand associated with early diagnosis of the chronic diseases such as urinary tract infections, kidney cancer, and others which require extensive usage of endoscopes for diagnostic purposes. Thus, the rise in prevalence of these diseases leads to surge in demand for flexible ureteroscopes. For instance, according to the Centers for Disease Control and Prevention (CDC), chronic kidney disease (CKD) is more common in people aged 65 years or older (38%) than in people aged 45–64 years (12%) or 18–44 years (6%). In addition, more than 1 in 7, or 15% of U.S. adults or 37 million people, are estimated to have chronic kidney disease. Thus, surge in prevalence of chronic cases and high preference of the patient population toward flexible ureteroscopes boost the segment growth.

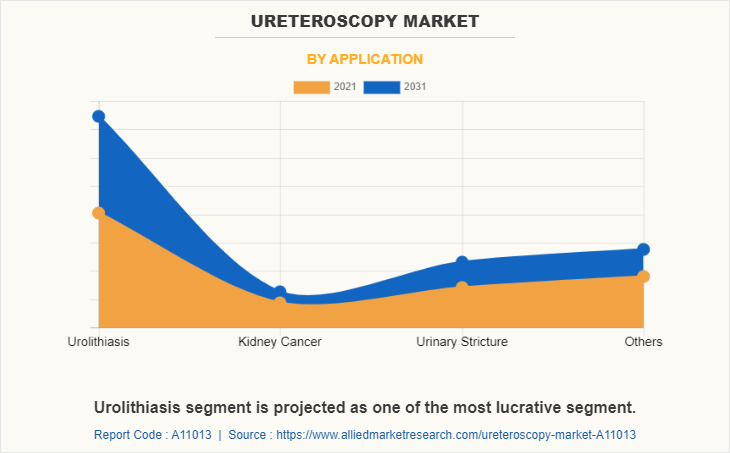

By application ureteroscopy market is segregated into urolithiasis, kidney cancer, urinary stricture, and others. The urolithiasis segment dominated the global market in 2021, and is anticipated to continue this trend during the forecast period. This is attributed to high incidences of chronic kidney diseases and occurrence of kidney stones, especially in the adults which has increased the demand for ureteroscopes.

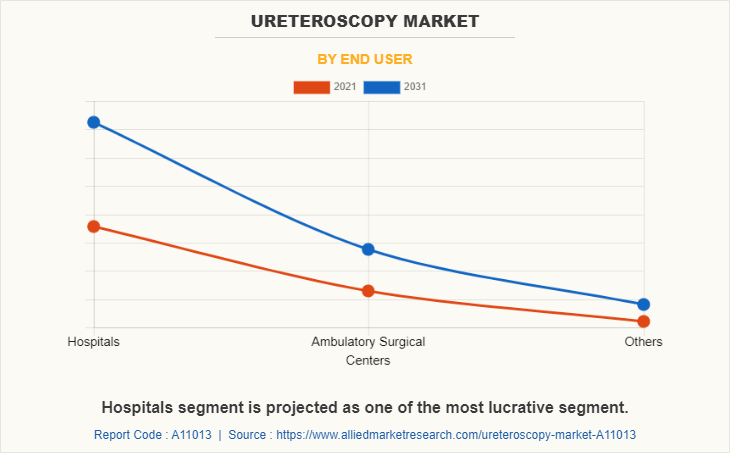

By end user the market is classified into hospitals, ambulatory surgical centers, and others. The hospitals held the largest market share in 2021, and is expected to remain dominant throughout the forecast period, owing to well-equipped infrastructure, higher buying power, rise in patient admission, and adoption of technologically advanced ureteroscope devices. In addition, increase in patient’s preference toward hospitals as they safely provide treatment under the observation of skilled physicians drive the segment growth.

By region the ureteroscopy market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the ureteroscopy market in 2021, and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as OTU Medical, STERIS plc, Boston Scientific Corporation, Stryker Corporation and advancement in manufacturing technology of ureteroscopes devices in the region drive the growth of the market. Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption of ureteroscopy devices are expected to drive the market growth. In addition, rise in demand for medical services and healthcare facilities in North America is estimated to considerably impact growth of the market in the region. Moreover, rise in spending by the population in countries such as the U.S. and Canada further leads to growth of the industry. According to Centers for Disease Control and Prevention, it was estimated that total national healthcare spending in 2019 grew 4.6% and reached up to $3.6 trillion or $11,172 per capita. This can be attributed to substantial demand for novel medical technologies and healthcare assistance in North America.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of medical devices manufacturing companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in personalized medicine expenditure and adoption of high-tech processing to improve the production of ureteroscopes devices drive the growth of the market. Furthermore, the Asia-Pacific region exhibits the largest medicine supply and the largest pharmaceuticals industry with availability of raw material in abundance, which can be easily accessed by manufacturers of ureteroscopy. This, in turn, drives the growth of the market. Asia-Pacific offers profitable opportunities for key players operating in the ureteroscopy market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region. Furthermore, availability of favorable reimbursement policies coupled with growth in preference for minimally invasive procedures boost the market growth.

Competitive Analysis

Competitive analysis and profiles of the major players in the ureteroscopy industry, such as Advin Health Care, Boston Scientific Corporation, Cliniva Healthcare, Hoya Corporation, KARL STORZ SE & Co. KG, Olympus Corporation, OTU Medical, Richard Wolf GmbH, STERIS plc, and Stryker Corporation are provided in this report. There are also some important players in the market such as Catalant, Aenova Group, and others.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ureteroscopy market analysis from 2021 to 2031 to identify the prevailing ureteroscopy market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ureteroscopy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ureteroscopy market trends, key players, market segments, application areas, and market growth strategies.

Ureteroscopy Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.4 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Boston Scientific Corporation, Advin Health Care, OTU Medical, KARL STORZ SE & Co. KG, Hoya Corporation, STERIS plc, Richard Wolf GmbH, Cliniva Healthcare, Stryker Corporation, Olympus Corporation |

| Other Players | Philips |

Analyst Review

The global ureteroscopy market is expected to exhibit high growth potential attributable to rise in the demand for minimally invasive surgical procedures. Moreover, reimbursement policies pertaining to endoscopy devices in developed countries such as U.S. and Germany, and surge in patient preference for minimally invasive surgeries drive growth of the global ureteroscopy market.

There are several advanced features in ureteroscopy devices such as camera miniaturization, improved optical systems, digital video capability, smaller ureteral stone baskets and dual working channels which enables the continuous pressurized irrigation for enhanced visualization. In addition, increase in awareness regarding technologically advanced ureteroscopy devices drive the market growth. For instance, presently flexible ureteroscopes are the most preferred ureteroscopes in the market.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in the knowledge about novel devices which is expected to boost the demand for ureteroscopes in this region, rise in awareness regarding urological disorders, and strong presence of key players that provide the ureteroscopes. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in distribution network of ureteroscopy devices and growth in demand for minimally invasive surgical procedures and development of healthcare infrastructure.

Increase in prevalence of urological disorders such as urinary tract infections, kidney stones, rise in urological surgeries, and, rise in technological advancements in ureteroscopy devices are the factors responsible for the market growth.

The flexible ureteroscope segment is the most influencing segment owing to rise in prevalence of urological disorders such as urinary tract infections and urolithiasis which increases the demand for flexible ureteroscopes.

North America accounted for a major share of the ureteroscopy market in 2021, and is expected to maintain its dominance during the forecast period. Presence of several major players, such as OTU Medical, STERIS plc, Boston Scientific Corporation, Stryker Corporation and advancement in manufacturing technology of ureteroscopes devices in the region drive the growth of the market.

The global ureteroscopy market was valued at $807.34 million in 2021, and is projected to reach $1,379.82 million by 2031, registering a CAGR of 5.5% from 2022 to 2031

Top companies such as Olympus Corporation, OTU Medical, Stryker Corporation, Richard Wolf GmbH, Boston Scientific Corporation, and Hoya Corporation held high market share in 2021.

The total market value of ureteroscopy market is 807.34 million in 2021.

The base year is 2021 in ureteroscopy market.

Loading Table Of Content...