Urinalysis Test Market Research Overview 2031

The global urinalysis test market size was valued for $3,194.13 million in 2021 and is estimated to reach $6,121.35 million by 2031, exhibiting a CAGR of 6.7% from 2022 to 2031. Urinalysis, commonly referred to as a urine test, analyses the physical, chemical, and microscopic components of urine.

Urine analysis involves various tests to check the urine contents for any abnormalities that indicate a medical condition or infection. It is used to detect and manage a wide range of disorders, such as urinary tract infections, kidney disease and diabetes. Urinalysis involves examining the color, consistency, and composition of urine. It involves a number of tests that use a single urine sample to determine and measure the different substances that are present in urine. The urinalysis test includes various products, such as reagents, dipsticks, urine analyzers, and disposables.

Market Dynamics

Growth & innovations in the medical devices industry for the manufacturing of urinalysis products such as urine analyzers, and pregnancy testing products, creates an opportunity for the urinalysis test market. The growth of the urinalysis test market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases such as diabetes, and surge in demand for urine analyzers, strips, and control solutions. For instance, according to the International Diabetes Federation (IDF), about 537 million adults were living with diabetes in 2021, across the globe. In addition, as per the same source, over 3 in 4 adults with diabetes live in low and middle-income countries such as India and China. Thus, the rise in number of people suffering from diabetes has increased the demand for urinalysis test and propel the market growth.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, and significant investments by government to improve healthcare infrastructure. E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods. This further supports market growth.

The demand for urinalysis test is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as the rise in adoption of urine analyzers, reagents, pregnancy testing and disposables for disease screening and pregnancy tests which further drive the growth of the market. Furthermore, rise in consumer awareness related to preventive healthcare and ease of accessibility boosts the adoption of urinalysis products.

In addition, screening programs are undertaken by governments for the early detection of diseases such as urological and renal disorders. For instance, according to the National Institute of Health (NIH), from February 2012 to March 2021, 12,497 school students from Pingyang, Cangnan, and Yongjia in Wenzhou were screened for urinalysis. Thus, a rise in the number of such programs is expected to drive the demand for urinalysis test industry .

Urinary tract infections are one of the most common types of infections, and they affect both men and women. Urinalysis tests are used to diagnose urinary tract infections, diabetes, other renal disorders, and the growing prevalence of these infections is driving the demand for urinalysis tests. Furthermore, there is a rise in demand for advanced devices for urinalysis due to the rise in prevalence of chronic diseases and the growing importance of preventive healthcare. These devices allow patients to monitor their health at home and reduce the need for frequent visits to healthcare providers. This has supported the market growth. Growing focus on preventive healthcare and early detection of medical conditions further supports the urinalysis test industry growth.

The lack of skilled laboratory technicians, healthcare facilities, and advanced equipment in underdeveloped countries negatively impact the growth of the urinalysis test market. In many developing countries, there is a shortage of trained laboratory technicians who can perform urinalysis tests accurately and efficiently. This shortage can limit the capacity of healthcare facilities to provide urinalysis testing, which in turn reduces the demand for testing and limits the growth of the market. In addition, the low quality of healthcare services in many developing countries can also hinder the growth of the urinalysis test market.

COVID-19 pandemic had a negative effect on the urinalysis test market owing to decrease in demand for urinalysis devices which can be used to diagnose the urological and renal diseases. Due to the low hospitalization rate and dropping sales of urine analysis tests during the early stages of the COVID-19 pandemic, the market for urinalysis was little affected. Moreover, less hospitals visits for urinalysis tests during pandemic decreases the adoption of urinalysis devices and hampers the market growth. Furthermore, decline in the urological surgeries due to lockdown led to decrease in demand for urine analysis also hampers the market growth. However, the market is recovering after pandemic, and show stable urinalysis test market growth in the future owing to rise in cases of urological disorders.

Segments Overview on Urinalysis Test Market

The urinalysis test market is segmented into product, application, end user, and region. By product, the market is categorized into instruments and consumables. On the basis of application, the market is segregated into disease screening and pregnancy & fertility. By end user, the market is classified into hospitals & clinics, diagnostic laboratories, and home care. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

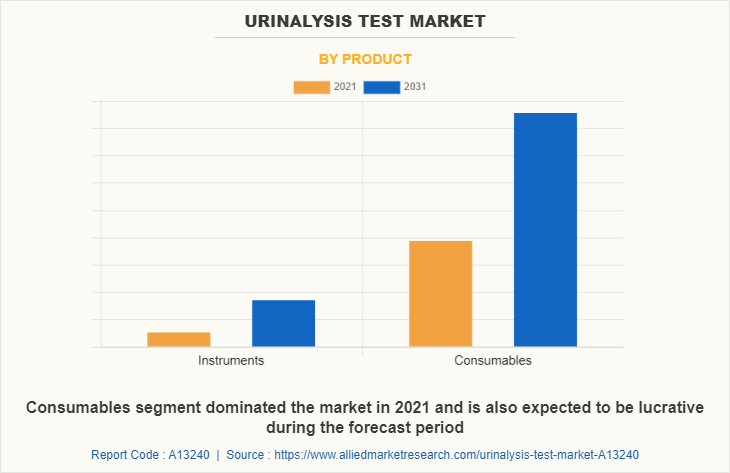

By Product

The urinalysis market is segmented into instruments and consumables. The consumables segment dominated the urinalysis test market size in 2021 and is also expected to witness significant growth during the forecast period. This is attributed to a rise in demand for advanced urinary consumables as they are easy to use, convenient to handle and can be stored for longer duration without compromising its quality. For instance, Bio-Rad Laboratories, Inc. a global provider of life science research and clinical diagnostics products, offer qUAntify Advance Control urinalysis product, which is an independent quality control used to monitor the precision of laboratory urinalysis test procedures, improve the efficiency, and reduce the risk of error. Thus, advancements in technology to improve the accuracy, and convenience of urinalysis testing, leading to increase in demand for urinalysis consumables, which is expected to drive the segment growth in urinalysis test market forecast .

By Application

The urinalysis test market is segregated into disease screening and pregnancy & fertility. The disease screening segment dominated the urinalysis test market share in 2021 and is also expected to witness significant growth during the forecast period. Urinalysis tests help in the early detection and screening of various diseases, including urinary tract infections (UTIs), kidney diseases, and diabetes, which supports the segment growth.

[APPLICATIONGRAPH]

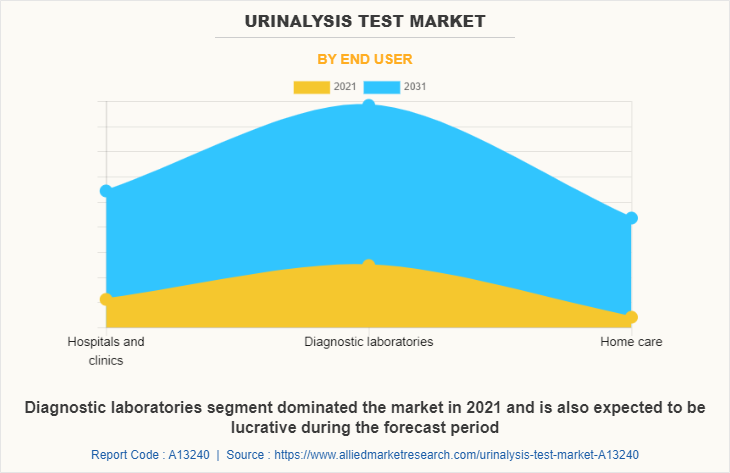

By End User

The urinalysis test market is classified into hospitals & clinics, diagnostic laboratories, and home care. The diagnostic laboratories held the largest urinalysis test market share in 2021 and is also expected to witness highest CAGR during the forecast period. This is attributed to the high adoption of urinalysis products in hospitals and clinics. In addition, urinalysis provides quick and relatively accurate results, making it a valuable tool for healthcare providers in diagnostic laboratories to diagnose and treat various conditions which led to increase in demand for urinalysis devices in diagnostic laboratories.

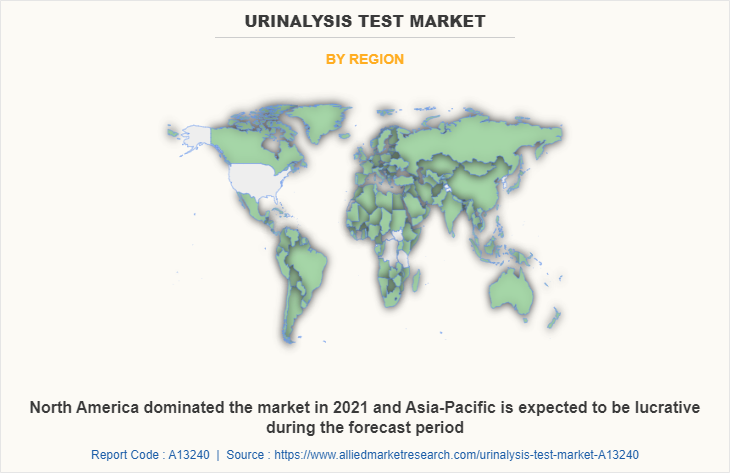

By Region

The urinalysis test market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the urinalysis test market in 2021 and is expected to maintain its dominance during the forecast period.

Advancement in manufacturing technology for urinalysis products in the region drives the growth of the market. Diabetes is a prevalent chronic condition in North America, and it is associated with abnormal urine composition. For instance, as per the data published by Endocrine Society, in January 2022, it was estimated that around 33% of adults aged 65 or older had diabetes. Urinalysis is a useful diagnostic tool for detecting early signs of diabetes-related kidney damage, which is driving the demand for urinalysis tests in this region. Furthermore, high purchasing power, and rise in adoption rate of urinalysis devices are expected to drive the market growth.

Moreover, rise in spending by population in countries such as the U.S. and Canada further leads to growth of the industry. Personal healthcare expenditure in the U.S, as stated by the Centers for Disease Control and Prevention, was estimated to increase by an annual percent change of 4.6% in 2019 to $3.6 trillion or $11,172 per capita. This is attributed to substantial demand for novel medical technologies and healthcare assistance in North America.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of medical devices companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Furthermore, rise in the prevalence of chronic diseases such as diabetes, kidney disease, and urinary tract infections and urinalysis tests are commonly used to diagnose and monitor these conditions, which is driving the growth of the urinalysis test market in the region. In addition, growing awareness about the importance of preventive healthcare in the Asia-Pacific region is driving the demand for diagnostic tests, including urinalysis tests, to detect health problems at an early stage.

Asia-Pacific offers profitable opportunities for key players operating in the urinalysis test market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides great opportunity for UA test market new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the players in the urinalysis market, such as Abbott Laboratories, ACON Laboratories, Inc., ARKRAY, Inc., Bio-Rad Laboratories, Inc., Cardinal Health Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Siemens AG, Sysmex Corporation, and 77 Elektronika Kft. are provided in this report.

Key players have adopted agreement as key developmental strategy to improve the product portfolio of the UA test market.

Recent Agreements in the Urinalysis Test Market

• In August 2020, Sysmex America, Inc., a part of Sysmex Corporation has announced an exclusive agreement with Siemens Healthineers that grants North American rights to distribute and service Siemens Healthineers CLINITEK Novus Automated Urine Analyzer for hospital and reference laboratory use.

• In January 2020, Sysmex Corporation has reached an agreement to invest in Astrego Diagnostics. In this agreement, Astrego was developing new urinalysis solutions for the primary care business.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the urinalysis test market analysis from 2021 to 2031 to identify the prevailing urinalysis test market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the urinalysis test market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global urinalysis test market trends, key players, market segments, application areas, and market growth strategies.

Urinalysis Test Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.1 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 256 |

| By Product |

|

| By Application |

|

| By End user |

|

| By Region |

|

| Key Market Players | Bio-Rad Laboratories, Inc. , Abbott Laboratories, Siemens AG, Cardinal Health Inc., ARKRAY, Inc., 77 Elektronika Kft, F. Hoffmann-La Roche Ltd., Sysmex Corporation, ACON Laboratories, Inc., Danaher Corporation |

Analyst Review

This section provides various opinions of top-level CXOs in the global urinalysis test market. According to the insights of CXOs, the global urinalysis test market is expected to exhibit high growth potential attributable to rise in prevalence of various disease and surge in awareness toward early diagnosis and treatment. However, shortage of skilled professionals in some regions limit the growth of the urinalysis test market.?

CXOs further added that rise in incidences of chronic diseases such as diabetes, hypertension, and kidney diseases and development of advanced urinalysis testing technologies, such as automated urine analyzers drive the market growth.??

Furthermore, North America was the major shareholder in 2021, in terms of revenue, owing to rise in incidences of chronic disease, higher health awareness along with developed healthcare infrastructure drives market growth in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in chronic disease and growth in urinalysis test along with growing awareness for early detection of disease.

Growth & innovations in the medical devices industry for the manufacturing of urinalysis products along with increasing diagnosis are the upcoming trends of urinalysis test market.

Disease screening is the leading application of urinalysis test market.

North America is the largest regional market for urinalysis test.

The urinalysis test market valued for $3,194.13 million in 2021 and is estimated to reach $6,121.35 million by 2031, exhibiting a CAGR of 6.7% from 2022 to 2031.

Abbott Laboratories, ACON Laboratories, Inc., ARKRAY, Inc., Bio-Rad Laboratories, Inc., Cardinal Health Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Siemens AG, Sysmex Corporation, and 77 Elektronika Kft. are the top companies to hold the market share in urinalysis test.

2021 is the base year of urinalysis test market.

2022 to 2031 are the forecast years of urinalysis test market.

Loading Table Of Content...

Loading Research Methodology...