Urinary Incontinence Market Overview:

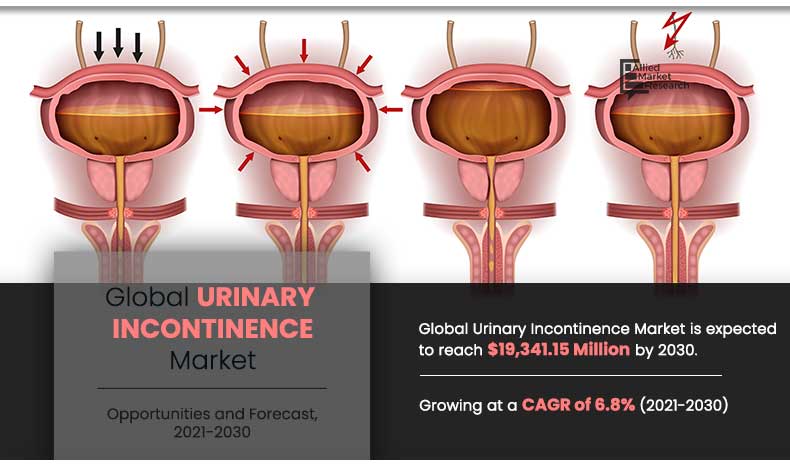

The global urinary incontinence market size was valued at $10,124.33 million in 2020, and is projected to reach $19,341.15 million by 2030, registering a CAGR of 6.8% from 2021 to 2030. Any involuntary urine leakage is referred to as incontinence. A broken sphincter or a malfunctioning bladder are the most common causes of male urinary incontinence. The sphincter is a circular muscle in the bladder that regulates urine flow. When this muscle is injured, it loses its ability to squeeze and seal the urethra, the tube that transports urine from the bladder to the outside of the body. Urinary incontinence devices assist in the collection and retention of urine and aid in the effective management of urinary incontinence. Urinary incontinence causes uncontrollable urine leakage

Increase in prevalence of urological disorders and development of advanced urinary incontinence device boost the growth of urinary incontinence market. In addition, rise in demand for minimally invasive operations, as well as an aging population that is more prone to urological problems drive the growth of the urinary incontinence device market. Furthermore, the number of urinary incontinent patients switching from traditional methods is expected to rise in the near future. The expansion of the market is aided by the increase in risk of associative urological disorders among people. However, the growth of the urinary incontinence market is hampered by a lack of awareness about new improvements in urinary incontinence devices and post-operative difficulties linked with the devices. Furthermore, rise in healthcare spending in developing nations is expected to open up new growth opportunities.

The outbreak of COVID-19 has disrupted workflows in the health care sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The overall impact of the COVID-19 pandemic remained negative for key players in the urinary incontinence industry. Outpatient clinics for female urinary incontinence, benign prostatic hyperplasia, infertility, and sexual medicine, benign scrotal conditions, renal stone, and bladder stone were most affected, according to a 2020 research study by Jeremy Yuen-Chun Teoh et al. titled 'A Global Survey on the Impact of COVID-19 on Urological Services. Moreover, during the COVID-19 pandemic 2020, there was a significant reduction in many types of outpatient tests and treatments, with surgical treatments for female urinary incontinence, infertility, kidney stones, and bladder stones having the greatest rates of cut-down services. Furthermore, due to COVID, several market players experienced a revenue drop in the urology platform. For instance, in the fiscal year 2019-20, Coloplast Corp.'s interventional urology segment experienced negative organic growth of -7 percent. The drop in sales of Altis single-incision slings and other goods was mostly due to the cancellation of elective operations and treatments in the United States as a result of the COVID-19 outbreak. Moreover, the elective procedures outside the U.S. were also postponed in several countries, due to the COVID-19 outbreak.

Urinary Incontinence Market Segmentation

The urinary incontinence market is segmented on the basis of product, incontinence type, end user, and region. By product, the market is divided into devices and disposables. The devices segment is further bifurcated into urinary catheters, vaginal slings, Electrical stimulation devices, artificial urinary sphincters, other devices and category. Urinary catheters are sub segmented into Foley catheters and other urinary catheters. Vaginal slings segment is sub segmented into conventional vaginal slings and advanced vaginal slings. On the basis of category, it is classified into external urinary incontinence devices and internal urinary incontinence devices. The disposables segment is further divided into disposable underwear, disposable shields, disposable diapers, disposable underpads, and others. By incontinence type, the market is categorized into stress urinary incontinence, urge urinary incontinence, overflow urinary incontinence, and functional urinary incontinence. Further, by end user, it is classified into hospitals and clinics, homecare, and others. By region, the urinary incontinence market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment review

By product, the disposables segment currently dominates the global urinary incontinence market and is expected to continue during the forecast period owing to the repetitive use or consumption along with repetitive purchase of urinary incontinence disposables.

By Product

Disposables Segment dominated the market in 2020 and would continue to maintain the lead over the forecast period.

By incontinence type, the stress urinary incontinence (SUI) segment dominated the global urinary incontinence market in 2020. This is attributed to high incidence of stress urinary incontinence witnessed among women globally. The epidemiological studies on the stress urinary incontinence in women have concluded that approximately 50% of women with urinary incontinence report symptoms of stress incontinence.

By end user, the hospital and clinics segment dominated the global urinary incontinence market in 2020 and is anticipated to continue this trend during the forecast period owing to urinary incontinence most commonly affects women and the prevalence is high among hospitalized older adults. Thus, the hospital segment has displayed maximum adoption of the urinary incontinence devices as large patient pool suffering from chronic conditions or pregnancy are associated with urinary incontinence.

By Incontinence Type

Stress Urinary Incontinence segment held a dominant position in 2020.

Region segment review

Region wise, North America dominated the market in 2020, owing to increase in prevalence of urinary incontinence in North America along with early adoption of novel urinary incontinence devices along with increase in prevalence of stress urinary incontinence among women in this region. However, Asia-Pacific is expected to register the highest CAGR in terms of revenue during the forecast period, owing to growth in healthcare expenditures in the developing economies of this region.

The key players in this market have adopted product launch as one of their key developmental strategies such as acquisitions and product launches. The major companies profiled in this report include Becton, Dickinson and Company (C.R. Bard Inc.), Boston Scientific Corporation, Caldera Medical, Coloplast A/S, ConvaTec Group plc, Cook Group Inc., Johnson and Johnson, Laborie Medical, Medtronic plc, Teleflex Incorporated, Ahlstrom-Munksjo, Asahi Kasei Corporation, Berry Global Inc., Cardinal Health, Inc., Domtar Corporation, First Quality Enterprises, Inc., Freudenberg & Co. KG, Georgia-Pacific LLC, Kimberly-Clark Corporation, and Unicharm Corporation.

By Region

Asia- Pacific region would exhibit the fastest CAGR of 8.2% during the forecast period.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global urinary incontinence market along with the current trends and future estimations to explain the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the urinary incontinence market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2020 to 2030 is provided to enable the stakeholders to capitalize on the prevailing urinary incontinence market opportunities.

- Extensive analysis of the key segments of the industry helps to understand the application and products of urinary incontinence device used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the urinary incontinence market.

Key Market Segments

By Product

- Devices

- Urinary Catheters

- Foley Catheters

- Other Urinary Catheters

- Vaginal Slings

- Conventional Vaginal Slings

- Advanced Vaginal Slings

- Electrical Stimulation Devices

- Artificial Urinary Sphincters

- Other Devices

- Category

- External Urinary Incontinence Devices

- Internal Urinary Incontinence Devices

- Urinary Catheters

- Disposables

- Disposable Underwear

- Disposable Shields

- Disposable Diapers

- Disposable Underpads

- Others

By Incontinence Type

- Stress Urinary Incontinence

- Urge Urinary Incontinence

- Overflow Urinary Incontinence

- Functional Urinary Incontinence

By End User

- Hospitals and Clinics

- Home Care

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

List of key players profiled in the report:

- Becton, Dickinson and Company (C.R. Bard Inc.)

- Boston Scientific Corporation

- Caldera Medical

- Coloplast A/S

- ConvaTec Group PLC

- Cook Group Inc.

- Johnson and Johnson

- Laborie Medical

- Medtronic plc

- Teleflex Incorporated

- Ahlstrom-Munksjo

- Asahi Kasei Corporation

- Berry Global Inc.

- Cardinal Health, Inc.

- Domtar Corporation

- First Quality Enterprises, Inc.

- Freudenberg & Co. KG

- Georgia-Pacific LLC

- Kimberly-Clark Corporation

- Unicharm Corporation

Urinary Incontinence Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Incontinence Type |

|

| By End User |

|

| By Region |

|

Analyst Review

This section provides various opinions of the top-level CXOs in urinary incontinence market. In accordance to several interviews conducted, the utilization of such devices is projected to witness a significant rise with growth in number of incontinent patients across the globe. The urinary incontinence market is largely fragmented, and bargaining power of suppliers clearly varies in patient centric medical app devices and patient centric medical app services market. Technological innovation is turning out to be a principal strategy to increase bargaining power of buyers.

The urinary incontinence market has gained the interest of healthcare professionals, patients, and surgeons owing to improved care of patients suffering from involuntary urine leakage. There have been remarkable technological advancements in the development of novel urinary incontinence devices including mini-slings, single-incision slings, advanced catheters, and electrical stimulation devices. As the market is growing at a steady rate in the developed nations, Asia-Pacific and Europe are expected to offer high growth opportunities to the key players in this market.

In addition, patients suffering from chronic ailments such as multiple sclerosis, Parkinson's disease, a stroke, a brain tumor, and spinal injury are affected by associated urinary incontinence. This offers large patient pool suffering from incontinence demanding development of novel devices for the management of the same.

A rise in demand for surgical treatment of urinary incontinence targeted toward an early cure, increase in geriatric population with a high risk of urinary incontinence, rise in the novel urinary incontinent products, and improvement in the prevention of hospital-acquired infections are the factors that propel the market growth. Moreover, rise in research activities to exploit the advantages offered by urinary incontinence devices, surge in healthcare expenditures in developing countries, and new advancements in the technologies offer lucrative opportunities for the market growth.

The involuntary flow of urine due to a loss of bladder control is known as urinary incontinence.

The total market value of Global Urinary Incontinence Market is $10,124.33 million in 2020.

The forcast period for Global Urinary Incontinence Market is 2021 to 2030.

The market value of Global Urinary Incontinence Market in 2030 is $19,341.15 million.

Becton, Dickinson and Company (C.R. Bard Inc.), Boston Scientific Corporation, Caldera Medical, Coloplast A/S, ConvaTec Group plc held a high market postion owing to the strong geographical foothold in different regions.

Disposables segment dominates the global market, owing to the repetitive use or consumption along with repetitive purchase of urinary incontinence disposables.

The major factor for the growth of Global Urinary Incontinence Market are various developments in the urinary incontinence devices, increasing demand for minimally invasive procedures, and shift to novel urinary incontinent products.

Owing to rise in the geriatic population in the market. Furthermore, increasing efficiency in the prevention of hospital-acquired infections.

The base year is 2020 in Global Urinary Incontinence Market.

Urinary incontinence devices aid in collecting and holding urine; such devices help in managing urinary incontinence effectively.

Loading Table Of Content...