U.S. & Canada pharmaceutical suppositories Market Size, Share and Trends

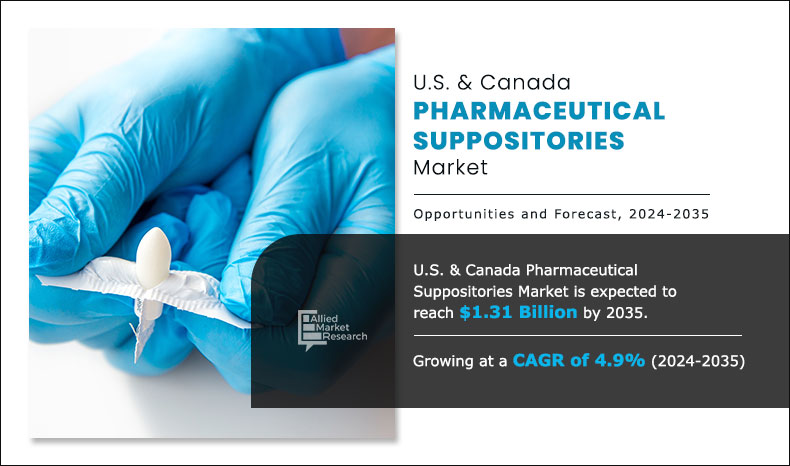

The U.S. & Canada pharmaceutical suppositories market size generated $0.74 billion in 2023 and is anticipated to generate $1.31 billion by 2035, witnessing a CAGR of 4.9% from 2024 to 2035. According to an article published by National Library of Medicine, in September 2023, the rising incidence of IBD is propelled by pediatric-onset IBD, which is rising by 1.23% per year from 15.6 per 100,000 in 2023 to 18.0 per 100,000 in 2035. This rising trend presents significant growth opportunities for pharmaceutical companies, encouraging the development of new suppository formulations to meet the needs of individuals with chronic diseases.

Pharmaceutical suppositories are solid dosage forms intended for insertion into body cavities, where they melt or dissolve to release active ingredients. These are typically formulated using base materials like cocoa butter, glycerinated gelatin, or polyethylene glycol (PEG), which provide stability and facilitate controlled drug release. The manufacturing process involves melting the base, blending it with the active pharmaceutical ingredient (API) and required excipients, and molding the mixture into the desired shape. After cooling, the suppositories solidify and are prepared for packaging and use. This method of drug delivery is designed to enable effective medication absorption through mucosal tissues.

Key Takeaways

- On the basis of type, the rectal suppositories segment dominated the market in terms of revenue in 2023. However, the vaginal suppositories segment is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of base type, the others segment held largest market share in 2023 and is expected to remain dominant throughout the forecast period. However, the progesterone suppository segment is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of prescription type, the prescribed suppositories segment held the largest market share in 2023. However, the OTC segment is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of distribution channel, the hospital pharmacies segment dominated the market in terms of revenue in 2023. However, the online providers segment is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of end user, the hospitals & clinics segment held the largest market share in 2023. However, the home care segment is anticipated to grow at the fastest CAGR during the forecast period.

- Country wise, U.S. generated the largest revenue in 2023. However, Canada is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The growing geriatric population is a key driver behind the rising demand for pharmaceutical suppositories in the U.S. and Canada. As individuals age, they often experience a decline in muscle function, including weakened digestive tract muscles, which can lead to conditions such as constipation, inflammatory bowel disease (IBD), and hemorrhoids. These age-related health issues make oral medications less effective or difficult to administer, as elderly individuals may struggle to swallow pills, and their digestive systems may not efficiently absorb drugs. Suppositories provide a valuable alternative by delivering medications directly through mucosal absorption, bypassing the gastrointestinal tract and ensuring proper drug administration and absorption.

Moreover, suppositories are ideal for localized treatments, which are common in elderly patients managing chronic constipation, hemorrhoids, and localized pain. The precise dosage delivery offered by suppositories reduces the risk of side effects and ensures optimal therapeutic effects. The demand for suppository-based treatments is set to grow with the aging global population, as projected by the WHO, which anticipates that 1 in 6 people will be 60 or older by 2030. Pharmaceutical companies are increasingly focusing on developing products that cater to the specific needs of elderly patients, further fueling the demand for suppositories in this demographic.

In addition, the pharmaceutical suppositories market is driven by the growing trend of outsourcing manufacturing to Contract Development and Manufacturing Organizations (CDMOs) and the rising adoption of generic suppositories. Pharma companies are increasingly outsourcing to CDMOs, such as trillium Health Care Products Inc., Adragos Pharma, and Cosette Pharmaceuticals, Inc., to reduce costs and focus on core competencies. These CDMOs offer advanced technology and specialized formulation expertise that improve product quality and optimize production. The expansion of generic suppository approvals and production further highlights the need for scalable, efficient manufacturing solutions. Outsourcing to CDMOs supports quicker market entry and cost-effective production, addressing global demand while ensuring adherence to strict regulatory standards.

Segmental Overview

The U.S. & Canada pharmaceutical suppositories market is segmented into type, base type, prescription type, distribution channel, end user and country. On the basis of type, the market is divided into rectal suppositories, vaginal suppositories and urethral suppositories. On the basis of base type, the market is classified into glycerin suppository, progesterone suppository, bisacodyl suppository, antifungal suppository, hyaluronic acid suppository, probiotic suppository, boric acid suppository, and others. On the basis of prescription type, the market is bifurcated into OTC and prescribed suppositories. On the basis of distribution channel, the market is divided into hospital pharmacies, retail pharmacies and online sales. On the basis of end user, the market is categorized into hospitals and clinics, home care, and others. Country wise, the market is analyzed across U.S. and Canada.

By Type

On the basis of type, the rectal suppository segment was the largest revenue contributor to the U.S. & Canada pharmaceutical suppositories Market in 2023. This is attributed to its versatility, efficacy, and the broad spectrum of medical conditions it addresses. In addition, ongoing research and healthcare provider recommendations contribute to its sustained growth.

The vaginal suppositories segment is expected to register the fastest growth during the forecast period. This is attributed to the increase in adoption of gynecological and health applications for women. Vaginal suppositories offer localized drug delivery for conditions such as vaginal infections and hormone therapy, resulting in quick, effective treatment while minimizing systemic side effects.

By Products

Rectal suppository segment held a dominant position in the market in 2023 and vaginal suppository segment is anticipated to grow at a fastest rate during the forecast period.

By Base Type

By base type, the others segment held the largest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the versatility of suppositories in treating a broad spectrum of conditions, ranging from pain management to skin care. The growing preference for non-invasive, targeted drug delivery methods, along with advancements in formulation and patient convenience, ensures the sustained growth of the segment.

However, the progesterone suppository segment is expected to witness the fastest CAGR during the forecast year, owing to its increasing use in managing conditions like infertility, hormone replacement therapy (HRT), and preventing preterm births. The growing awareness of its benefits in fertility treatments and its effectiveness in bypassing gastrointestinal issues are key drivers for the rapid expansion of the segment.

By Application

Others segment held a dominant position in the market in 2023 and progesterone suppository segment is anticipated to grow at a fastest rate during the forecast period.

The prescribed suppositories segment to maintain its lead position during the forecast period

By prescription type, the prescribed suppositories segment held the largest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the rising prevalence of chronic diseases and the demand for targeted drug delivery solutions. In addition, advancements in pharmaceutical formulations, availability of cosmetic suppositories and precision medicine allow for personalized prescriptions tailored to individual patient requirements, further driving growth in the segment.

However, the OTC segment is expected to witness the fastest CAGR during the forecast year. This is attributed to a growing consumer inclination toward self-care and convenience. OTC products are readily available without a prescription, providing an accessible and cost-effective option for managing common health issue.

By Prescription Type

prescription suppositories segment held a dominant position in the market in 2023 and OTC segment is anticipated to grow at a fastest rate during the forecast period.

By Distribution Channel

By distribution channel, the hospital pharmacies segment was the largest revenue contributor to the market in 2023. Hospitals commonly employ suppositories for targeted drug delivery, ensuring precise dosing and minimizing systemic side effects. This growing demand for suppositories within the hospital setting is driven by diverse medical conditions and treatment needs.

However, the online providers segment is expected to register the fastest growth during the forecast period owing to its convenience and accessibility. It offers discreet purchasing options, which appeal to consumers seeking privacy for sensitive products like suppositories.

By Distribution Channel

Hospital pharmacies segment held a dominant position in the market in 2023 and online providers segment is anticipated to grow at a fastest rate during the forecast period.

By End User

By end user, the hospitals and clinics segment was the largest revenue contributor to the U.S. & Canada pharmaceutical suppositories Market in 2023. Hospitals & clinics have increasingly shown an inclination toward pharmaceutical suppositories products. Moreover, a rise in number of government initiatives to ensure a high degree chronic disease treatment measure, and surge in number of hospitals with increased use of suppository therapy boost the growth of the hospitals & clinics segment.

However, the home care segment is expected to register the fastest growth during the forecast period. Patients increasingly prefer home-based healthcare, driving demand for user-friendly drug delivery methods like suppositories. In addition, the growing aging population and the trend toward self-administration boost the growth of the segment. Cosmetic suppositories, offering skin-nourishing benefits, further contribute to the popularity of home care treatments, enhancing convenience and accessibility.

By End User

Hospitals & Clinics segment held a dominant position in the market in 2023 and home care segment is anticipated to grow at a fastest rate during the forecast period.

By Country

By country, U.S. held the largest market share in terms of revenue in 2023, and is expected to dominate the market during the forecast period. This is attributed to increase in well-developed healthcare industry, presence of leading manufacturers in the region, and high adoption rate of suppositories in the region.

However, Canada is expected to witness the fastest CAGR from 2024 to 2035. This is attributed to an increase in geriatric population, rise in people suffering from constipation and hemorrhoids, and advancements in healthcare infrastructure in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the U.S. & Canada pharmaceutical suppositories market include Rillium Health Care Products Inc, Tri-Pac Indiana, Inc., DPT Laboratories, Unither, Delpharm Poznań, Noramco Group, Adragos Pharma, LGM Pharma LLC., Cosette Pharmaceuticals, Inc., and Cordenpharma. The key players have adopted strategies such as expansion, launch and acquisition to expand their product portfolio.

Recent Developments in Pharmaceutical Suppository Industry

- In November 2023, Noramco, a leading global active pharmaceutical ingredients (API) manufacturer, specializing in controlled substances, announced that it has completed the acquisition of the Cambrex Drug Product Business Unit previously known as Halo Pharmaceuticals. This acquisition will provide API customers of Noramco, and its subsidiary Purisys, additional service options such as drug product formulation development, clinical and commercial drug product manufacturing, and packaging from facilities in Mirabel, Québec and Whippany, New Jersey.

- In March 2022, LGM Pharma, a leading provider of tailored API and CDMO services for the full drug product lifecycle, announced a significant enhancement of its capabilities: a 50% expansion and an investment exceeding $2 million in its standalone offering for Analytical Testing Services (ATS) alongside the introduction of new suppository manufacturing capabilities to its contract development and manufacturing (CDMO) portfolio.

Analyst Review

This section provides the opinions of the top-level CXOs in the U.S. & Canada pharmaceutical suppositories market. According to the CXOs, pharmaceutical suppositories offer an effective alternative for drug delivery, particularly in cases where patients are unconscious or when direct, localized treatment is required. They emphasize that suppositories provide a practical solution for patients who cannot take oral medications or need immediate, on-site therapeutic action.

CXOs further added that increasing geriatric population, who often face challenges with oral medication intake, coupled with the rising incidence of gastrointestinal diseases globally, are the factors that boost the demand for suppositories in the market. Furthermore, the rise in intrauterine diseases and various chronic conditions are contributing to the growing need for this alternative drug delivery method. The increasing use of rectal suppositories and ongoing technological advancements in drug formulations and manufacturing processes are further expected to propel market expansion.

Moreover, the market is witnessing a growing interest in cosmetic suppositories, which offer targeted benefits such as skin hydration and anti-aging effects. These applications appeal to consumers seeking effective, non-invasive beauty solutions that integrate easily into their self-care routines. This niche yet expanding segment highlights the versatility of suppositories beyond traditional medical uses, contributing to market growth and innovation.

The total market value of U.S. & Canada pharmaceutical suppositories market is $ 0.74 billion in 2023.

The market value of U.S. & Canada pharmaceutical suppositories Market in 2033 is $1.31 billion.

The forecast period for U.S. & Canada pharmaceutical suppositories Market is 2024 to 2035.

The base year is 2023 in U.S. & Canada pharmaceutical suppositories Market.

Rectal Suppositories is accounted for the largest market share in 2023 owing to its versatility, efficacy, and the broad spectrum of medical conditions it addresses. In addition, ongoing research and healthcare provider recommendations contribute to its sustained growth

Pharmaceutical suppositories are solid dosage forms intended for insertion into body cavities, where they melt or dissolve to release active ingredients. These are typically formulated using base materials like cocoa butter, glycerinated gelatin, or polyethylene glycol (PEG), which provide stability and facilitate controlled drug release.

Loading Table Of Content...