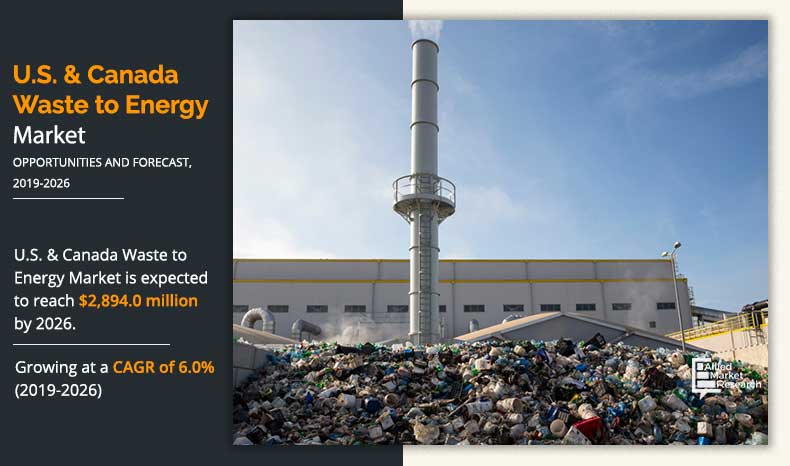

U.S. & Canada Waste-to-Energy Market Outlook - 2026

The U.S. and Canada waste-to-energy (WtE) market was valued at $1,811.0 million in 2018, and is projected to reach $2,894.0 million by 2026, growing at a CAGR of 6.0% from 2019 to 2026.Waste-to-energy is the process of energy generation by the primary treatment of waste. This process produces electricity or heat directly by combustion. In addition, it produces combustible fuel commodities such as methanol, methane, synthetic fuels, or ethanol.

Increase in demand for renewable sources of energy drives the growth of the U.S. & Canada waste-to-energy market. In addition, rise in demand for electricity consumption fuels the growth of the market during the forecast period. However, high initial cost associated with waste-to-energy plant installation is the key factor that is expected to hamper the growth of the market during the forecast period. Moreover, increase in waste generation and government initiatives to promote relevant utilization of waste in the U.S. and Canada is anticipated to offer growth opportunities for the market growth.

The U.S. & Canada waste-to-energy market is segmented on the basis of type of technology and U.S. & Canada region. On the basis of type of technology, the market is divided into thermal, biochemical, and others. The thermal segment is further categorized into incineration, pyrolysis, and gasification. The incineration segment is anticipated to register a significant CAGR during the forecast period. Country wise, the market is analyzed across the U.S. & Canada.

The U.S. & Canada waste-to-energy market analysis covers in-depth information of the major industry participants. Some of the major players in the waste-to-energy market include John Wood Group PLC, Babcock & Wilcox Enterprises, Inc., Covanta Holding Corporation, Waste Management, Inc., Mitsubishi Heavy Industries, Plasco Energy Group, Inc., Xcel Energy, Inc., Wheelabrator Technologies Inc., BlueFire Renewables, and Ener-Core, Inc.

Other players operating in the value chain of the U.S. & Canada waste-to-energy market are Global Clean Energy, Inc., Natural Energy Systems, Inc., Greenlight Energy Solutions, International Composting Corporation, and WaterSmart Environmental, Inc.

Key players are adopting numerous strategies such as partnership, agreement, acquisition, and business expansion to stay competitive in the U.S. & Canada waste-to-energy market.

For instance, B&W Volund A/S a subsidiary of the B&W turned over a biomass-to-energy plant in Margam, Wales, to Margam Green Energy Ltd. This expansion is designed to burn waste wood to generate approximately 40 megawatts of electricity and features Vølund’s patented DynaGrate® technology.

Moreover, in January 2018, Covanta partnered with Lancaster County Solid Waste Management Authority (LCSWMA), based in Lancaster, PA. The aim of the partnership was the operation and maintenance of LCSWMA’s two energy-from-waste facilities, the Lancaster Waste-to-Energy (WTE) facility, located in Bainbridge, PA, and the Susquehanna Resource Management Complex (SRMC), located in Harrisburg, PA.

By Technology

Themal technology is projected as the most lucrative segment

U.S. & Canada Waste-to-energy market, by type of technology

By type of technology, the thermal technology segment accounted for the highest market share in 2018, owing to increase in the demand for thermal gasification in energy generation for waste materials due to rise in demand for clean energy across the countries. In addition, unavailability of landfills is expected to drive the growth of the U.S. & Canada waste-to-energy market during the forecast period

By Country

U.S. is projected as the most lucrative segment.

U.S. & Canada waste-to-energy market, by country

By country, the U.S. dominated the highest market share in the year 2018. This is owing to rise in energy prices coupled with increase in consumer focus to use the generated energy efficiently. In addition, increase in stress on energy conservation in the highly waste generating areas in the U.S. is expected to exhibit growth of the waste-to-energy market.

This report highlights the factors that influence the waste-to-energy market growth, such as forecast, trends, drivers, restraints, opportunities, and roles of different key players that shape the market growth. Moreover, it focuses on the overall demand for waste-to-energy across various countries and different applications, presenting data in terms of both value and volume. The revenue is calculated by proliferating the volume by country-specific prices and considering the country-wise differentiated prices.

COVID-19 Impact on the Market

COVID-19 pandemic affected most of the industries including automotive, construction, processing and others. This has affected waste generation from this industries which in turn affecting the waste to energy market in the U.S. and Canada region. This affect will remain for upcoming one or two years. Governments put lockdown across the globe which is further resulted in the slowing down of transport, trade and economic activity. Owing to the lockdown in these countries, there is rise in waste generation in municipal area and also generation of waste from hospital is on the verge of increasing further stabilizing the growth of the market in the ongoing year.

Key Benefits For Stakeholders

- The report provides extensive qualitative and quantitative analyses of the current waste-to-energy market trends and future estimations of the U.S. and Canada waste-to-energy market size from 2018 to 2026 to determine the prevailing opportunities.

- Comprehensive analysis of factors that drive and restrict the growth of the market is provided.

- Estimations and waste-to-energy market forecast are based on factors impacting the market growth, in terms of both value and volume.

- Profiles of leading players operating in the U.S. and Canada waste-to-energy market has been provided, and this can be useful for understanding the competitive scenario in both countries.

- The report provides extensive qualitative insights on the significant segments and countries exhibiting favorable market growth.

U.S. & Canada Waste-to-Energy Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By Country |

|

| Key Market Players | JOHN WOOD GROUP PLC, BABCOCK & WILCOX ENTERPRISES, INC., PLASCO ENERGY GROUP, INC., BLUEFIRE RENEWABLES, XCEL ENERGY, INC., WHEELABRATOR TECHNOLOGIES INC., COVANTA HOLDING CORPORATION, WASTE MANAGEMENT, INC., ENER-CORE, INC., MITSUBISHI HEAVY INDUSTRIES |

Analyst Review

Waste-to-energy involves generation of power from trash as a fuel, similar to other electric power plants employing oil, coal, or natural gas as substitutes. Fuel burns and produces heat to convert water into steam, which drives the turbine to generate electricity. The process is expected to minimize a community’s landfill volume by approximately 90% and prevent one ton of carbon dioxide emission from every ton of waste transformed. Rise in power consumption, owing to rapid industrialization, and increase in focus to derive energy through renewable sources are the major factors anticipated to drive the growth of the U.S. and Canada waste-to-energy market. Moreover, increase in investments to improve electricity production and conservation by governments, rapid urbanization, and rise in consumer spending capabilities drive the U.S. & Canada waste-to-energy market growth.

Among the analyzed countries, U.S. is expected to account for the highest revenue in the waste-to-energy market throughout the forecast period (2019-2026) followed by Canada.

In terms of revenue growth, the CAGR of the U.S. & Canada waste to energy market is 6.0% by 2026.

Potential growth opportunities from the government regulations is the key trend in the waste to energy market.

To get latest version of U.S. & Canada waste-to-energy market report can be obtained on demand from the website.

The potential customers of the waste to energy market are residential, commercial and industrial.

On the basis of technology, thermal technology will drive the waste to energy market growth during the forecast period.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The applications of the waste to energy market are recycled batteries, recycled materials, electricity consumers and other recycled products from waste.

Top players in the waste to energy market are John Wood Group PLC, Babcock & Wilcox Enterprises, Inc., Covanta Holding Corporation, Waste Management, Inc., Mitsubishi Heavy Industries, Plasco Energy Group, Inc., Xcel Energy, Inc., Wheelabrator Technologies Inc., BlueFire Renewables, and Ener-Core, Inc.

In terms of revenue, the market size of waste to energy market is anticipated to reach $2,894.0 million by 2026, growing at CAGR of 6.0% from 2019 to 2026.

U.S. will provide business opportunities for waste to energy market during the forecast period. This is attributed to the huge consumer base, rise in energy prices, coupled with increase in consumer focus to use the generated energy efficiently.

Loading Table Of Content...