U.S. Bovine Leather Goods Market Overview:

U.S. Bovine Leather Goods Market was valued at $10,931 million in 2016, and is expected to reach $14,480 million by 2023, growing at a CAGR of 4.2% from 2017 to 2023. Bovine leather is the most ample and common leather, made from cow, buffalo and calf-skin. In U.S, nearly, 65% of leather products produced are manufactured from cow hides. Cowhide offers various advantages over other sources of leather such as appearance, durability, texture, and comfort. Also, leather manufactured from cowhide is easy to care, relatively cheaper due to high availability, and dirt & water resistant. In addition, cowhide is tough and durable as it is one of the heaviest leathers. Bovine leather made from cow skin is used in virtually every leather product including footwear, handbags, shoulder bags, note case, upholstery, saddlery, holster, purse, wallet, belt, jackets, gloves, and other accessories. Calfskin, being soft, lightweight, abrasion resistant, and lustrous in look, is used to produce high quality, attractive leather for small sized and medium leather goods with a soft, fine feel.

Based on the U.S. Department of Agriculture (U.S.D.A) data, in 2016, the exports of wet salted cattle hides (refer to cattle rawhides that have been conserved using brine solutions) of U.S. accounted for $1.39 billion in value. Additionally, the export of wet blue cattle hides (refer to semi-processed hides that have undergone the first stages of leather tanning) similarly rose by 19% to reach $606 million. Also, for the year 2015, China was identified to be the largest buyer of both salted and wet blue cattle hides, with imports of over $861 million of wet salted cattle hides and $217 million of wet blue cattle hide products. The other prominent destination markets include Vietnam, Mexico, Korea, and the European Union.

The U.S. bovine leather goods market is expected to witness notable growth during the forecast period (2017-2023), owing to growth in disposable income and improvement in living standards of people, changing fashion trends, growing female working population, and growing domestic & international tourism. Surge in the luxury goods industry also supplements the growth of the bovine leather goods market. It has been identified that North America and South America jointly constituted about 31% of the global luxury goods industry size, of which U.S. accounted for the largest share of 90%. However, factors such as increase in counterfeit products, rising concerns over about animal cruelty and harsh environmental effects of leather processing are expected to restrain the market growth.

The market is segmented based on type and usage. Based on type, the market is classified into small/fancy leather goods, medium leather goods, and heavy leather goods. Small/fancy leather goods market is further bifurcated into purse, wallets, belt, passport & key case, note case, accessories and others. Medium leather goods market is further bifurcated into leather shoes, handbags, shoulder bags, document & attach cases, and others. Heavy leather goods market is further bifurcated into saddlery, upholstery, holster, tooling & leathercraft, and automotive. The usage of the market are divided into general goods, footwear, automotive, and other sectors.

Growth in Disposable Income and Living Standards

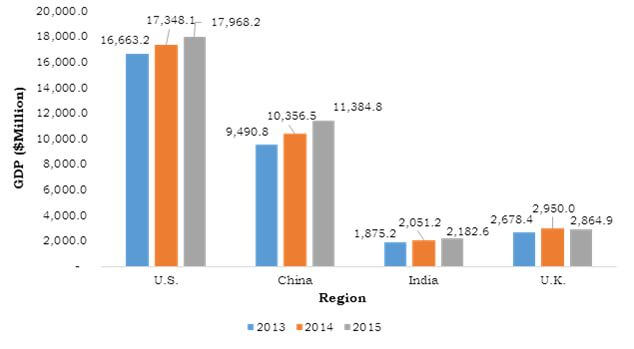

Growth in disposable income and improvement in living standards drive the growth of the U.S. bovine leather goods market. U.S. reported a GDP of $17.968 trillion in 2015, a 3.6% increase from the previous year, which is clearly indicative of the growing economy. Higher income levels encourage the consumers to opt for high quality branded products, which in turn supplements the demand of fine quality lifestyle products, with bovine leather products being one of them. Thus, this factor would continue to drive the market.

GDP Growth of Major Countries, 2013-2015

Surge in Female Working Professionals

The number of working female professionals has increased at a notable rate across the globe. According to International Labor Organization (ILO), share (%) of working women professionals in developed economies was 42% in 2015. This share is gradually increasing in the U.S. and other developed countries. Independent working women in the U.S generally prefer high quality leather handbags, wallets and footwear, owing to their increased spending capacity, making them key growth facilitators of the market. They also are a potential target segment for the companies offering bovine leather products.

The key players profiled in the U.S. bovine leather goods market include Horween Leather Company, Circa of America, LLC, Rancourt & Co. Shoecrafters, Russell Moccasin Co., Caleres, Inc. (Allen Edmonds Corporation), Hermes International S.A., Jack Georges, American Saddlery Inc., Garrett Leather Corp, and Tanner Goods Inc.

Key Benefits

- The study provides an in-depth analysis of the U.S. bovine leather goods market, with current trends and future estimations to elucidate the imminent investment pockets.

- It offers a quantitative analysis from 2016 to 2023, which is expected to enable the stakeholders to capitalize on prevailing market opportunities.

- The study also provides historical figures for base year 2016 and Y-o-Y forecasts from 2017 to 2023.

U.S. Bovine Leather Goods Market Report Highlights

| Aspects | Details |

| By Type |

|

| By USAGE |

|

| Key Market Players | Caleres, Inc. (Allen Edmonds Corporation), Garrett Leather corp, Circa of America, LLC, Horween Leather Company, Hermès International S.A, Jack Georges, Inc, Rancourt & Company Shoecrafters, Inc, American Saddlery Inc, Tanner Goods Inc, Russell Moccasin Company |

Analyst Review

Bovine leather goods constitute about 65% of leather goods industry in the U.S. The market would continue to witness a stable growth in the coming years driven by the increasing cattle population and rising disposable income of the populace. As per United States Department of Agriculture (U.S.D.A.) statistics, the cattle population in U.S. has grown from 88 million heads in 2014 to 93.5 million heads in 2017, registering a growth of 6.5%. This is due to supportive government initiatives in U.S., and high awareness regarding nourishment and caretaking of cattle.

However, high prices of leather products and availability of counterfeit products are expected to impact the growth of the U.S. bovine leather goods market.

Medium leather goods (handbags, leather shoes, shoulder bags, and others) constitute a significant portion of the U.S. bovine leather goods revenue. Increase in disposable income and the rising number of female working professionals are the major drivers of medium bovine leather goods market growth.

Global players are developing new patterns and multipurpose bovine leather goods that complement the wearer’s attire. They are targeting the growing working women segment, who are economically independent and have the capability to purchase premium quality handbags and wallets among other similar products and accessories. For instance, in 2015, Dior launched its new Fall-Winter 2015 handbag collection, which is available on the brand’s website and in Dior’s boutique. With this new collection, Dior aims to offer exotic and quality products to its customers. Further, the marketing initiatives under by the key market players such as celebrity endorsements, also help generate consumer’s attention and inclination towards branded leather products, in turn driving the sales of these products.

Loading Table Of Content...