U.S. Colonic Stents Market Outlook:2026

The U.S. colonic stents market was valued at $6.44 million in 2018 and is projected to reach $9.41 million by 2026, registering a CAGR of 4.8% from 2019 to 2026. A colonic stent is a hollow tube, which is made up of a flexible metal or an alloy. It helps to keep the lumen (segment) of the large bowel open, when it becomes blocked by a stricture or a tumor. A stent is the size of a pen when it is inserted, and it is designed to gently expand once it is released inside the colon. By this way, colonic stent will make a channel through the blockage and allow the bowel to function more easily and thus reduce pain. However, stents can be used when there is either a partial or a complete blockage in the bowel to reduce the pressure in the bowel and relieve the obstruction. Further, stents are also used when surgery is not recommended as an alternative to keep the bowel working. It is performed by specialist doctors including endoscopist or by an interventional radiologist in the X-ray department.

The major factors that drive the U.S. colonic stent market growth include significant rise in incidences of colorectal cancer in the U.S. and technological advancements associated with colonic stents such as usage of self-expanding alloys in the manufacturing of stents. In addition, surge in demand for minimally invasive procedures further propels the market growth of colonic stents in near future. However, complications and high costs associated with colonic stents is anticipated to hamper the growth of the colonic stents market in the U.S. Moreover, colonic stenting improves the primary anastomosis rate with a low stoma creation in comparison with emergency surgery. Improved colonic stents such as self-expandable metallic stents (SEMS) is used for the bridge to surgery and is also able to cure patients with the palliative intent with advanced neoplastic disease, to avoid stoma and health care costs related to stoma. This provides a lucrative opportunity for the growth of the U.S. colonic stents market.

The report covers the U.S. colonic stents market forecast and analysis based on three categories that include product type, indication, and end user. Based on product type, the market is categorized into nitinol self-expandable metal stents, and elgiloy self-expandable metal stents. On the basis of indication, it is categorized into colorectal cancer, colonic benign strictures, and others. By end user, the market is bifurcated into hospitals and specialty clinics.

Product Type segment review

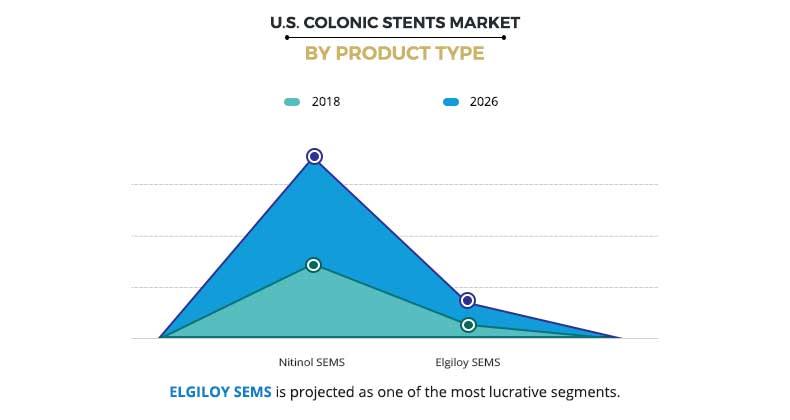

The U.S. colonic stents market analysis is segmented based on nitinol self-expandable metal stent and elgiloy self-expandable metal stents. Based on product type, the nitinol self-expandable metal stents occupied the largest share in 2018, and this trend is expected to continue throughout the forecast period. This is attributed to the fact that most of the key market players of colonic stents in the U.S. prefer nitinol over any other metal available. Moreover, nitinol is an alloy of nickel and titanium that yields amplified flexibility, which is helpful for stenting sharply angulated regions at the cost of lesser radial force relative to stents made with other metals. Nitinol is the most widely used alloy in the manufacturing of stents used against acute colonic obstruction. Key players in the U.S. are using this alloy for colonic stents. For instance, SX-ELLA stent colorectal, offered by Cook Medical is a metal stent made of nitinol and is being used as a bridge to surgery in the patients suffering from colorectal cancer.

Indication segment review

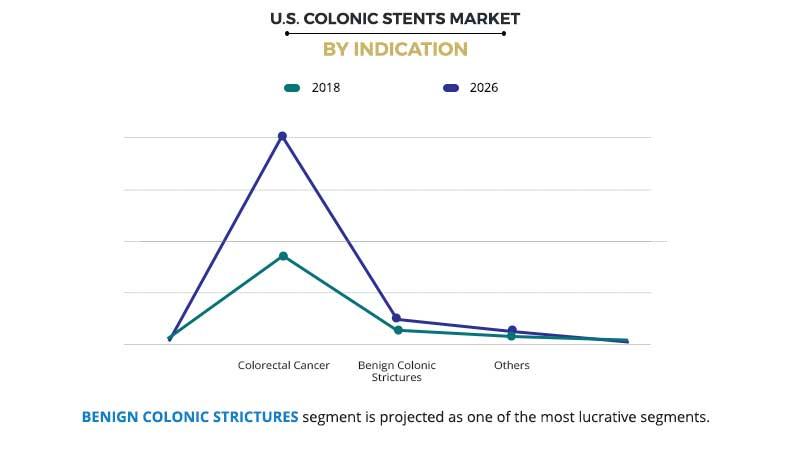

Depending on the indication segment, the U.S. colonic stents market is classified into colorectal cancer, benign colonic strictures, and others. The colorectal cancer segment accounted for the majority of the market share in 2018 and is anticipated to remain dominant during the forecast period. This is attributed to the increased use of metallic stents as a bridge to surgery in patients suffering from acute colonic obstruction. In addition, colorectal cancer is the third largest cause of mortality in the U.S. that further propels the market growth of colonic stents in the near future.

The U.S. colonic stents market is highly competitive and the prominent players in the market have adopted various strategies for garnering maximum market share. These include expansion of their geographical presence through collaborations and focus on R&D activities for the development of more flexible and biocompatible stents. Major players operating in the market include Boston Scientific Corporation, Cook Medical Inc., Ella-CS, Taewoong, MI-TECH and Olympus Corporation.

Key Benefits for U.S. Colonic Stents Market :

- This report entails a detailed quantitative analysis along with the current U.S. colonic stents market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The study provides an in-depth analysis of the U.S. colonic stent market share with the current trends and future estimations to elucidate the imminent investment pockets.

- The U.S. colonic stents market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market

U.S. Colonic Stents Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Indication |

|

| By End User |

|

| Key Market Players | M.I. TECH, ELLA - CS, s.r.o. (ELLA-CS), BOSTON SCIENTIFIC CORPORATION, TAEWOONG, Olympus Corporation, COOK MEDICAL INC. |

Analyst Review

Self-Expandable metallic colonic stent is the most popular and preferred form of stents for the treatment of colonic diseases. Metallic colonic stents are self-expandable (SEMS) and can expand to full diameter once placed in the body. The diameter at full SEMS expansion is 6–10 mm, the duration of patency is much longer, approximately 10 months contributing to the market growth of metallic colonic stents. The two most widely used alloy for colonic stents are nitinol and elgiloy. Among these two alloys, nitinol is the most preferred by the leading players in U.S. including Cook Medical, Taewoong and others.

Significant rise in the incidence of colonic cancers and other colonic diseases across the U.S. is expected to propel the growth of the colonic stents market. In addition, technological advancements associated with colonic stents and surge in demand for minimally invasive procedures further boost the market growth. Further, the rise in preferences toward minimally invasive surgical procedures has been one of the most revolutionary developments in the modern medicine. Minimally invasive procedures are now widely practiced as a preferred treatment option for variety of disease conditions. However, high cost associated with colonic stents is expected to hamper the market growth in the near future.

Loading Table Of Content...