U.S. & Europe Powder Coatings Market Outlook - 2026

The U.S. & Europe powder coatings market was valued at $2,965.7 million in 2018, and is projected to reach $4,292.5 million by 2026, growing at a CAGR of 4.71% from 2019 to 2026.

Powder coatings are dry fine particles that are electrostatically charged and sprayed onto a metal. Powder coating provides an attractive and durable finish, offering excellent resistance to corrosion, heat, and abrasion. It is widely used in automotive, appliances, architecture, and furniture industry.

Rapid growth in the automotive sector across developing economies such as the U.S. and Germany, has increased the demand for powder coatings to coat exterior of the automobile as they protect the automobile components and body from extreme weather conditions, heat, and corrosion. In addition, surge in demand for powder coatings in manufacturing of home appliances owing to their properties such as resistance to abrasion, chemicals, and weather changes, is anticipated to increase the demand for powder coatings. However, factors such as presence of contaminants in wastewater discharge and increase in cost of raw material is expected to hamper to the U.S. & Europe powder coatings market. On the contrary, emergence of new application methods such as electro-magnetic brush (EMB) technology, is anticipated to provide U.S. and Europe powder coatings market opportunity for the key market players.

The U.S. & Europe powder coatings market is segmented based on resin type, coating method, application, and region. Depending on resin type, the U.S. and Europe powder coatings market size is segmented into thermoset and thermoplastic. Thermoset is further categorized into epoxy, polyester, epoxy polyester hybrid, and acrylic. Thermoplastic is further classified into polyvinyl chloride (PVC), nylon, polyolefin, and polyvinylidene fluoride (PVDF). Based on coating method, it is bifurcated into electrostatic spray, and fluidized bed. Based on application, the market is classified into appliances, automotive, architectural, furniture, agriculture construction, and earthmoving equipment (ACE). Based on region, it is analyzed across the U.S. and Europe.

The major key players operating in the U.S. & Europe powder coatings industry include Arkema S.A., Braskem S.A., Celanese Corporation, DOW Inc., Exxon Mobil Corporation, Formosa Plastics Corporation, Hanwha Chemical Co, Ltd., Lyondell Basell Industries N.V., Sinopec Corporation, and Lotte Chemical Corporation. Other players operating in this market include Somar Corporation, Jotun, Marpol, Cloverdale Paint, Inc. and Hentzen Coating, Inc. These major key players are adopting different strategies such as acquisition, business expansion, and collaboration, to stay competitive in the U.S. & Europe powder coatings market.

U.S. & Europe Powder Coatings Market, By Region

Europe accounted for the major share in 2018 in the U.S & Europe powder coatings market, owing to increase in consumption of these resin for automotive and aerospace & defense sector. Powder coatings have many benefits such as, they provide a thicker, longer-lasting finish than a conventional coating. In addition, the application process does not release any solvents into the atmosphere, making it environment friendly. Foreign investments coupled with government initiatives, are supporting new aerospace R&D in the region to give a boost to the aerospace industry, in turn, driving the U.S. & Europe powder coatings market.

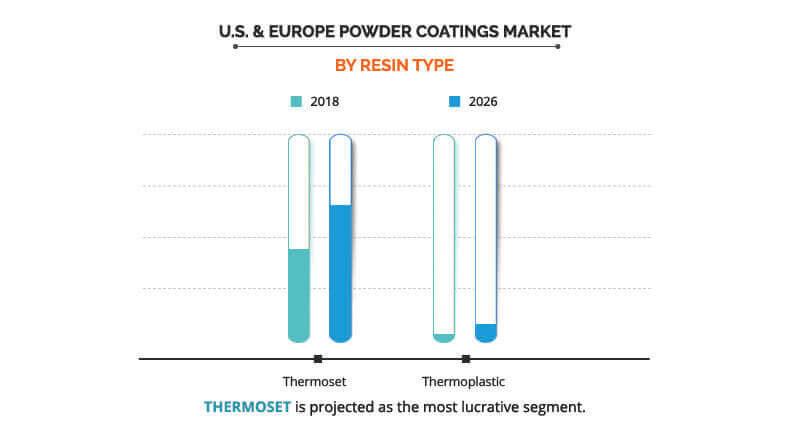

U.S. & Europe Powder Coatings Market, By Resin Type

Thermoset resins accounted for the major share in 2018 in the U.S & Europe powder coatings market, owing to increase in consumption of these resin to coat appliances and automobiles as they have resistance to corrosion, high temperature, and impact . In addition, owing to increase in investment in R&D activities from leading players in this market to offer product customization as per the requirements of the end user industry. These factors are expected to increase the demand for thermoset resin and is expected to drive the U.S. & Europe powder coatings market growth.

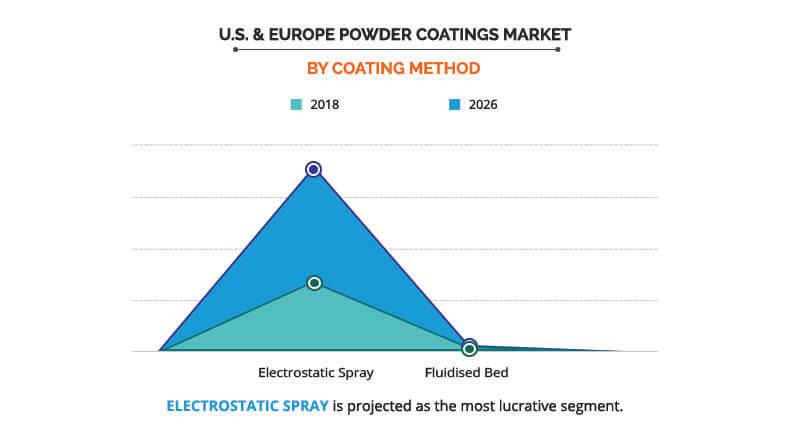

U.S. & Europe Powder Coatings Market, By Coating Method

Based on coating method, the electrostatic spray segment held the major share in 2018. Automotive industry uses electrostatic spray coating to coat car body panels owing to its benefits such as it creates a better-looking finish as the coating is distributed more uniformly. Stringent government regulations regarding control of environmental pollution have increased the demand for electric vehicles across the U.S. and Europe. This factor is expected to fuel the demand for electrostatic spray coating and is likely to offer growth to the U.S. & Europe powder coatings market trends.

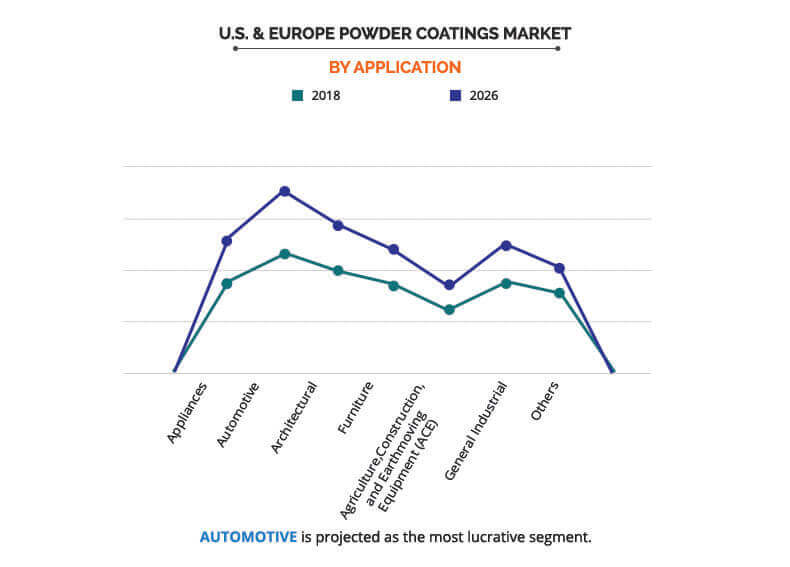

U.S. & Europe Powder Coatings Market, By Application

Depending on application, the automotive segment garnered the major U.S. & Europe powder coatings market share in 2018. Powder coating increases the life of automotive components and parts. It also provides superior finish and protection from corrosion, scratches, heat, wear-and-tear, and extreme weather conditions. It is applied to wheels, grilles, bumpers, door handles, roof racks, and exterior and interior trims. Increase in demand and production for light weight automobiles has led to increase in demand for powder coating, as they provide increased fuel efficiency, which in turn is expected to fuel the growth of the U.S. & Europe powder coatings market.

Key Benefits for U.S. & Europe Powder Coatings Market:

- The U.S. & Europe powder coatings market analysis covers in-depth information of major industry participants.

- The report provides an in depth analysis of the U.S. & Europe powder coatings market forecast for the period 2019-2026.

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- The report outlines the current market trends and future scenario of the U.S. & Europe powder coatings market from 2018 to 2026 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, and opportunities of U.S. & Europe powder coatings market and their detailed impact analysis is elucidated in the study.

U.S. & Europe Powder Coatings Market Report Highlights

| Aspects | Details |

| By Resin Type |

|

| By Coating Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | PPG INDUSTRIES, INC., IFS COATINGS, INC., BASF SE, Jotun, AXALTA COATING SYSTEMS, RPM International Inc., Tiger Drylac U.S.A., Inc., AMERICAN POWDER COATINGS INC., AKZONOBEL N.V., POWDER COATING USA, INC. |

Analyst Review

The U.S. & Europe powder coatings market witnessed significant growth in the recent years. This is attributed to increase in adoption of powder coating across numerous end users such as in general industrial, architectural, agriculture, construction, and earthmoving equipment (ACE), and others owing to their properties that include good chemical resistance, excellent durability, and mechanical performance. Due to increasing infrastructure development activities across the U.S. & Europe, it is widely used in various highway and building projects and used to coat light poles, guardrails, signs, posts, and fencing. There are significant growth opportunities for the U.S. & Europe powder coatings market owing to rapid increase in automobile and home appliance production. It is widely used in wheels, grilles, bumpers, door handles, roof racks, and exterior and interior trims of automobiles and provides durable finishes to appliances to protect them against the damages of everyday use. As per the analyst, Europe is projected to register a significant growth as compared to the saturated markets of the U.S., due to surge in production of electric vehicles and increase in infrastructure development activities.

Loading Table Of Content...