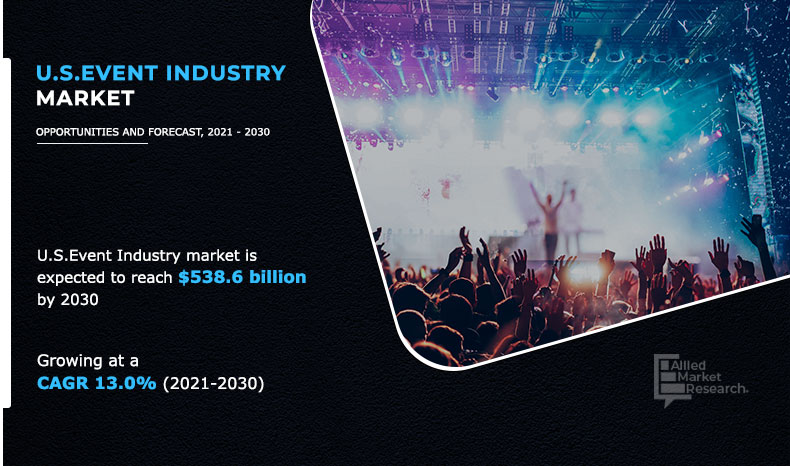

The U.S. events market size was valued at $94.8 billion in 2020 and is expected to reach $538.6 billion by 2030, registering a CAGR of 13.0% from 2021 to 2030.

Events refer to public gathering of populace art at a determined time and place. The purpose for staging an event can be increase in business profitability, celebratory, entertainment, and community causes among others. The most popular events include conference & exhibition, corporate events & seminars, promotion & fundraising, music & art performance, sports, festival, trade shows, and product launch. The key stakeholders within the events market are corporate organizations, public organizations & NGOs.

The initial stage of a major event involves understanding the audience and the behavior that excites and emotionally engages them. The final stage involves conducting events, such as music concerts, sports, exhibitions & conferences, seminars, and others, appropriately. It has been witnessed that events such as music concerts attract the majority of the population, especially the youth and middle-aged individuals, which boosts the growth of the U.S. events industry size. Although album sales have drastically reduced, a shift in preference of artists and performers toward touring and conducting music concerts at various places across the world has further driven the U.S. events market growth.

In addition, rock and pop music dominates most of the markets, globally while the U.S. population prefers rap and hip-hop. Thus, an increase in such music concerts and events offers valuable opportunities for promoters and brands to align themselves with people attending concerts. Furthermore, sports events have become more commercialized in recent years. Thus, sports serve as a significant marketing advertisement opportunity for event management companies, which sponsor these events. In addition, sponsorships from various brands such as Redbull, Monster Energy, Nike, and Cocoa Cola for major global three-day festivals as well as small gigs or act in a social club or arena boost the growth of the events industry. Moreover, the deployment of best-in-class technology that can handle the entire event propels industry growth. However, higher entry barriers and the presence of alternatives are some of the major challenges of the market. On the contrary, an increase in infrastructural investment and technological upgradation, such as projection mapping that creates an augmented reality of experience created through projectors as well as branded multi-use apps that are used to book tickets, survey attendees, and poll crowds in real-time accelerate the market growth. These factors are anticipated to offer ample opportunities for the players in the U.S. events industry.

To increase awareness about products and services offered by various companies, the leading players operating in myriad industry sponsor events such as music concerts and sports events. Sponsorship is done to provide material support to an event or an organization. In addition, sponsorship enables the leading players to advertise their products and reach a wide range of consumer base, thereby fueling the adoption of their products. Moreover, it helps to focus on consumer preference and to foster brand loyalty. Furthermore, it draws attention to the existing and potential customers of a brand or company and creates a positive impact on them, thereby leading to increased brand loyalty. Sponsors further check the past proven records of a particular event as well as the probability of success of the event before they sponsor an event, as they invest in a plan, and expect a positive return on the investment. The most common sponsorship can be seen in the field of sports and entertainment, ranging from local to regional and international events. Thus, an increase in sponsorship led to spur the market growth.

Advancements such as online booking, phone calls, emails, and video conferences have made communication and transactions significantly cost-effective and easy in real-time. Apart from the change in approach and purpose in event management, technology has been a key turning point in the evolutionary process of event management. In addition, digital evolution has introduced various creative ways to reach a wide customer base for events. Smartphones, desktop apps, and mobile apps have made events efficient and manageable. It has helped people get all tasks organized, managed, and executed without losing much time and effort. Furthermore, events can now be conducted online through webinars and video conferences, which is expected to offer remunerative opportunities for market expansion during the forecast period.

Improvement in economic condition and upsurge in disposable income are significant factors that propel the growth of the events industry. After the 2009 economic crisis across globally, the global economy has witnessed a standstill. However, a strong recovery from the crisis resulted in strong economic growth, especially in developing economies, and has led to increase in disposable income among the middle-income groups, consequentially adding to the middle-class population.

In addition, disposable income of individuals in North America and Asia-Pacific has witnessed a significant increase, thus acting as a major driver for the industry, as medium- and high-income consumers in urban areas are shift in trend from essential products & services to entertainment and better experience services. This trend boosts the growth of the U.S. events industry, thus enhancing their service offering across various segments at a global level.

By Organizer

Entertainment segment would witness the fastest growth, registering a CAGR of 13.9% during the forecast period.

The U.S. Events market is segmented into segmented based on type, revenue source, organizer, age group, and income group. Depending on type, the industry is divided into music concert, festivals, sports, exhibitions & conferences, corporate events & seminar, webinar, hybrid events, and others. On the basis of revenue source, it is segregated into ticket sale, sponsorship, and others. As per organizer, it is categorized into corporate, sports, education, entertainment, and others. By age group, it is fragmented into below 20 years, 21–40years, and above 40 years. Based on income group, it is segmented into upper class, upper middle class, lower middle class, and lower class.

By Income Group

Upper class segment would witness the fastest growth, registering a CAGR of 13.7% during the forecast period.

According to the U.S. Events market analysis on the basis of type, the corporate events & seminar type segment accounted for the maximum share in the 2020. This is attributed to to rise in number of corporate companies coupled with frequent seminars and events conducted by them. In addition, seminars and events involve interaction between speaker and audience, thereby increasing the number of attendees.

By Type

The Hybrid Events segment would witness the fastest growth, registering a CAGR of 17.3% during the forecast period.

By revenue source, the sponsorship segment dominated the market, which accounted for 48% U.S. Events market share in 2020, and is expected to continue this trend throughout the U.S. Events market forecast period. Moreover, sponsoring an event increases reach among potential buyers and customers, which drives the sales.

By Revenue Source

Club segment would witness the fastest growth, registering a CAGR of 7.29% during the forecast period.

On the basis of age group, the 21–40 years segment contributed to the maximum share in 2019, owing to rise in interest toward entrepreneur & business seminars along with music concerts and festive gatherings.

By Age Group

Below 20 Years segment would witness the fastest growth, registering a CAGR of 13.4% during the forecast period.

The major players analyzed in U.S. Events market report are Access Destination Services, LLC, Anschutz Entertainment Group, BCD Meeting & Events, BI Worldwide, Creative Group, Inc., Cvent, Inc., ITA Group, Maritz Holdings, Inc., The ATPI Group, and 360 Destination Group.

KEY BENEFITS FOR STAKEHOLDERS

- The report provides a quantitative analysis of the current U.S. Events market trends, estimations, and dynamics of the market size from 2020 to 2030 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assists to determine the prevailing U.S. Events market opportunities.

- Drivers and restraints are analyzed in the U.S. Events industry.

U.S. Events Market Report Highlights

| Aspects | Details |

| By Type |

|

| By REVENUE SOURCE |

|

| By ORGANIZER |

|

| By AGE GROUP |

|

| By INCOME GROUP |

|

| Key Market Players | ACCESS DESTINATION SERVICES, THE ATPI GROUP, BI WORLDWIDE, BCD MEETING & EVENTS, CREATIVE GROUP, INC., MARITZ HOLDINGS INC., CVENT, INC., ITA GROUP, 360 DESTINATION GROUP, ANSCHUTZ ENTERTAINMENT GROUP |

Analyst Review

According to the perspective of the top-level CXOs, the U.S. events industry is growing at a significant pace, and is anticipated to continue this trend in the coming years. Events are playing a vital role in revenue generation and brand equations for corporates and associations. It has been witnessed that events of the recent years are equally interesting than the past decade, driving shifts in choice and pressurizing event planners and owners. This industry is witnessing the entry of new and independent players who are leveraging technology to gain a competitive advantage in the today’s consolidated environment. However, companies are facing challenges in this industry to manage live inventory for simple and small events. Conversely, the focus of companies is to enhance attendee experience and witness successful completion of an event without any hindrance. Moreover, the hybrid events is likely to gain a major share in the coming years owing to enormously valuable for sponsors because of their increased reach. Also, sponsors may themselves have the opportunity to participate remotely by setting up virtual event booths and giving presentations via video conference.

The U.S. events market size was valued at $94.8 billion in 2020 and is expected to reach $538.6 billion by 2030, registering a CAGR of 13.0% from 2021 to 2030.

The CAGR of U.S. Events Market is 13.0%.

Kindly get in touch with sales team for better option.

The forecast period in the market report is 2021-2030.

The major players analyzed in U.S. Events market report are Access Destination Services, LLC, Anschutz Entertainment Group, BCD Meeting & Events, BI Worldwide, Creative Group, Inc., Cvent, Inc., ITA Group, Maritz Holdings, Inc., The ATPI Group, and 360 Destination Group.

The U.S. Events market is segmented into segmented based on type, revenue source, organizer, age group, and income group.

Increase in infrastructural investment and technological upgradation, such as projection mapping that creates an augmented reality of experience created through projectors as well as branded multi-use apps that are used to bool tickets, survey attendees, and polling crowds in real time accelerate the market growth.

The U.S. Event industry is likely to recover the covid impact by the end of 2023.

Loading Table Of Content...