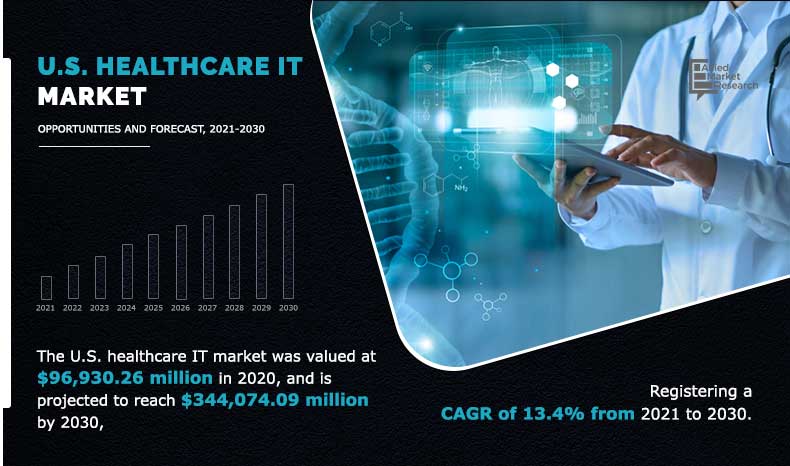

U.S. Healthcare IT Market Outlook, 2030

The U.S. healthcare IT market size was valued at $96,930.26 Million in 2020, and is projected to reach $344,074.09 Million by 2030, registering a CAGR of 13.4% from 2021 to 2030. The growth of the U.S. healthcare IT market is majorly driven by increase in demand for quality healthcare services & solutions, rise in acceptance of mHealth & telehealth practices, surge in demand for improved patient safety & patient care, and increase in government initiatives to promote healthcare IT. Furthermore, rise in integration of artificial intelligence (AI) for development of advanced healthcare devices drives the growth of market. For instance, in February 2022, AliveCor, the leading innovator in personal electrocardiogram (ECG) technology, received the U.S. FDA clearance for its KardiaMobile Card, the slimmest, most convenient personal ECG device. The KardiaMobile Card is an AI-enabled device, pairs with a smartphone using Bluetooth technology to detect six of the most common arrhythmias.

Market Introduction and Definition

Healthcare IT is the use of computer hardware, software, or infrastructure to record, store, protect, and retrieve clinical, administrative, or financial information. Healthcare IT includes electronic health records,, medical coding, personal health records, electronic, medical records, and electronic prescribing (e-prescribing).

Furthermore, increase in prevalence of chronic diseases such as diabetes, cancer, cardiovascular diseases (CVDs), and hypertension boosts the demand for advanced healthcare services. For instance, according to the Pan American Health Organization (PAHO), in 2019, 2.0 million people died from CVDs. Thus, prevalence of chronic diseases drives the focus of key players towards developing AI-integrated medical devices. For instance, Medtronic, the U.S. leader in medical technology, received the U.S. FDA clearance for two AccuRhythm AI algorithms for used with the LINQ II insertable cardiac monitor (ICM). AccuRhythm AI applies AI to heart rhythm event data collected by LINQ II, improving the accuracy of information physicians receive so they can better diagnose and treat abnormal heart rhythms.

Impact of COVID-19 on U.S. Healthcare IT Market

Increase in acceptability of mHealth and telehealth services in the U.S. due to the outbreak of the COVID-19 pandemic acts as a key growth driver of the healthcare IT market. In addition, surge in number of smartphone users encourages key players to develop health software, which is anticipated to notably contribute toward the market growth. For instance, in 2020, approximately, 294.15 million population in the U.S. were using smartphones. Moreover, in June 2020, Philips, a global leader in health technology, entered into a collaboration with American Telemedicine Association (ATA) to further help the adoption of telehealth software, demonstrating telehealth software efficiency in the connecting care sector across acute, post-acute, and home care settings. This collaboration spotlights the growing adoption of telehealth amidst COVID-19 and the need to for exponential shift to telehealth. Thus, all these factors collectively are expected to foster the growth of the healthcare IT market.

Rise in the disease burden in the U.S. and upsurge in geriatric population have escalated the demand for improved patient safety and patient care. Moreover, availability of advanced healthcare information technologies for wireless monitoring and treatment of patients suffering from different chronic diseases, such as blood pressure, heart rate, and diabetes, is one of the major factors that boosts the market growth in the U.S. With the help of health IT, telehealth, and telemedicine solution, chronic diseases can be controlled and prevented from becoming severe in nature.

For instance, according to the U.S. Administration for Community Living (ACL 2020) report, in 2019, the population aged 65+ was 54.1 million. Moreover, implementation of favorable healthcare reforms such as the U.S. Affordable Care Act (ACA) and telehealth initiatives boosts the growth of the healthcare sector and improves patient safety and patient care.

Furthermore, increase in prevalence of chronic diseases such as hypertension, diabetes, and cancer boosts the demand for advanced and safer treatments such as mHealth application for blood pressure monitoring, patient health analyzing software, and telehealth services.

In the recent years, IT has become the inevitable part of every business as it fosters innovation. Healthcare organizations face extraordinary challenges to improve quality, access, reduce harm, and increase efficiency, which can be addressed by innovations. The government in the U.S. has taken several efforts to promote healthcare IT in various settings.

For instance, in 2020, the American Medical Association supported the telehealth initiative to enhance the healthcare access. Moreover, in June 2021, the Government of the U.S. invested $80 million for creating a new public health informatics & technology program. Thus, increase in initiatives taken by the U.S. Government to integrate IT in the healthcare sector contributes toward the growth of the U.S. healthcare IT market

Market Segmentation

The U.S. healthcare IT market is segmented on the basis of product type and end user. By product type, the market is categorized into healthcare provider solutions, healthcare payer solutions, and HCIT outsourcing services. Depending on end user, it is segregated into healthcare providers and healthcare payers.

By Product

Healthcare Provider Solutions segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Segment Review

Depending on product type, the healthcare provider solutions segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to increase in demand for patient safety and care. However, the healthcare payer solutions segment is expected to witness considerable growth during the forecast period, due to rise in demand by payers for patient documentation and billing.

On the basis of end user, the healthcare providers segment garnered the major share in 2020, and is expected to dominate the U.S. market during the forecast period, owing to rise in prevalence of chronic diseases, high demand for accurate & precise patient documentation, and development of well-established healthcare infrastructure.

Competitive Landscape

The key players operating in the U.S. healthcare IT market include 3M, Allscripts Healthcare Solutions, Inc., athenahealth, Inc, Eclinicalworks, GE Healthcare, Greenway Health, LLC, HealthStream, Inc, International Business Machines Corporation, Koch Industries, and SAS Institute Inc.

By End User

Healthcare Providers was holding a dominant position in 2020 and would continue to maintain the lead over the analysis period.

Key Benefits for Stakeholders

- The report provides an in-depth analysis of the U.S. healthcare IT market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers market analysis from 2021 to 2030, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the U.S. healthcare IT market.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the U.S. healthcare IT market growth.

U.S. Healthcare IT Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| Key Market Players | athenahealth, Inc., Koch Industry, SAS Institute Inc., 3M, GE Healthcare, Eclinicalworks, HealthStream, Inc., International Business Machines Corporation, Greenway Health, LLC, Allscripts Healthcare Solutions, Inc. |

Analyst Review

The healthcare IT market in the U.S. has gained prominence in 2020, and is expected to witness a significant growth in the near future. This is attributed to the fact that the utilization of healthcare IT has increased significantly, owing to rise in prevalence of chronic diseases and surge in adoption of mHealth services and software.

The healthcare IT market has piqued the interest of healthcare IT companies, due to increase in adoption of mHealth & telehealth solutions and surge in penetration of smartphones, tablets, and laptops in the U.S. Moreover, these mHealth & telehealth solutions are in high demand due to their cost effectiveness, convenience in use, and improved healthcare service.

As per the CXOs, the adoption of healthcare IT solutions such as EMR & other hospital information systems has increased rapidly to provide improved healthcare services in emerging nations, which, in turn, is expected to offset the challenging conditions in the U.S.

The total market value of U.S. healthcare IT market is $96,930.3 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of U.S. healthcare IT market in 2021 was $110,637.1 million

The base year for the report is 2020.

Yes, healthcare IT companies are profiled in the report

The top companies that hold the market share in U.S. healthcare IT market are 3M, Allscripts Healthcare Solutions, Inc., athenahealth, Inc, Eclinicalworks, GE Healthcare, Greenway Health, LLC, HealthStream, Inc, International Business Machines Corporation, Koch Industries, and SAS Institute Inc.

The key trends in the U.S. healthcare IT market are by an increase in advanced health records by service providers; rise in incidences of chronic diseases such as diabetes; and integration of artificial intellegence in healthcare IT sector.

Loading Table Of Content...