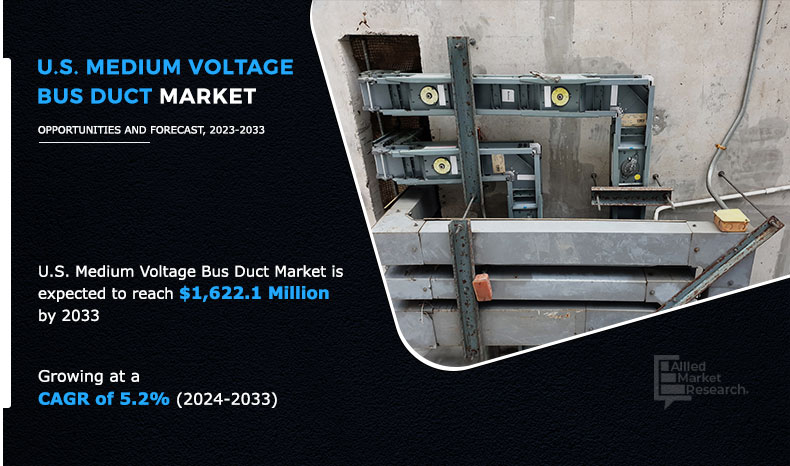

The U.S. medium voltage bus duct market size was valued at $963.4 million in 2023 and is projected to reach $1,622.1 million by 2033, registering a CAGR of 5.2% from 2024 to 2033.

Report Key Highlighters

- The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2023 to 2033.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The U.S medium voltage bus duct market share is marginally fragmented, with players such as Schneider Electric, General Electric company, Siemens AG, ABB, Ltd., Eaton Corporation plc, Crown Electric Engineering and Manufacturing LLC, IES Holdings, Inc., Powell Industries Inc, Avail Infrastructure Solutions, L&T Electrical & Automation, LS Cable & System, Ltd., Godrej & Boyce Mfg. Co. Ltd., Legrand Group, Saint-Augustin Canada Electric Inc. (STACE), Myers Power Products, Inc., and Vertiv Group Corp.

Bus duct is a factory-made electrical distribution system that consists of bus bars enclosed in a protective casing, as well as straight sections, connectors, devices, and add-ons. It is used to transport electricity and link to electrical equipment such as switchgear, panelboards, and transformers. Bus duct is a great substitute for cable and conduit in commercial and industrial settings due to its simpler configuration, lower installation costs, and easier replacement, particularly in situations where load locations may change frequently.

The U.S medium voltage bus duct market is segmented on the basis of conducting material, application, product type, and voltage. Depending upon the conducting material, the market is categorized into copper, and aluminum. On the basis of application, it is divided into utility segment is further divided into genration, distribution, and transmission, then Industry segment is divided into oil and gas, petrochemical, steel, and others. then renewable/alternative energy, datacenters, and others. Depending upon the product type, the market is classified on the basis of segregated phase bus duct, non- segregated phase bus duct, and isolated phase bus duct. Furthermore, on the basis of voltage, it is divided into 5KV To 38KV, and 38KV and 69KV.

Increasing industrialization in the U.S market

The growth of industrialization in the U.S. market is creating significant opportunities for medium voltage bus duct ducts. As industries expand and update their facilities to meet demand and remain competitive, there is an increasing need for efficient and reliable power distribution solutions. Medium voltage bus duct ducts offer a range of advantages, including flexibility, scalability, and a compact design. Industrial facilities are complex and often require adjustments to accommodate changing production needs. When an industrial facility needs to boost its power consumption from an existing distribution system, busducts provide a more adaptable solution compared to cables. Unlike cables, busducts are prefabricated units that can be easily connected to the current power distribution system without the need for extensive and labor-intensive work. When new loads arise, it is straightforward to adapt to changing conditions by adding tap-off units or new sections. This enables cost-effective installation in a smaller area. Moreover, bus duct systems use less copper and steel than cables and conduits with the same capacity. Additionally, the bus duct conductor bars are fully enclosed in a non-ventilated aluminum housing, ensuring the highest short-circuit ratings. These factors establish busducts as a crucial element of modern electricity distribution systems.

Increased demand for power transmission systems

Industries across the U.S. seeking to upgrade and modernize their facilities rely on medium voltage bus duct ducts for efficient power distribution to heavy machinery and equipment. The surge in data centers in the U.S. to support digital services is also escalating the demand for resilient power transmission solutions, consequently boosting the market for bus duct ducts.

Furthermore, with the U.S. government's emphasis on renewable energy objectives and commitment to grid modernization, there is a growing necessity for efficient power transmission infrastructure. Medium voltage bus duct ducts play a vital role in enabling the integration of renewables into the grid. Additionally, the rapid urbanization in U.S. cities is fueling the requirement for dependable power transmission solutions for urban infrastructure projects, where bus duct ducts offer flexibility and space-saving advantages. For example, the Department of Energy (DOE) in the U.S. recently announced a significant investment of $1.3 billion towards the development of three transmission lines. This substantial funding will drive projects aimed at increasing the grid's capacity by 3.5 GW, thereby supplying electricity to over three million households. This growing demand and investments in power transmission systems contribute to the rise in demand for the U.S. medium voltage bus duct market during the projected period.

Technological advancement in medium bus duct

General Electric's Spectra Series Bus duct System offers reliable power distribution through cutting-edge insulation materials, protective devices against faults, and remote monitoring capabilities, making it ideal for critical applications nationwide. In addition, ABB delivers bus duct solutions equipped with digital monitoring, predictive maintenance, and integration with smart grids, promoting energy-efficient and sustainable power distribution in various U.S. industries and infrastructure projects. These recent advancements underscore how technological innovations improve the performance, dependability, and safety of bus duct duct systems, empowering industries to enhance their electrical infrastructure and address the changing needs of modern energy environments. These factors are expected to drive the demand for advanced and efficient medium voltage bus duct duct systems in the foreseeable future.

Furthermore, prominent manufacturers such as Schneider Electric, Siemens, Eaton Corporation, General Electric, and ABB have played a crucial role in propelling technological advancements in bus duct duct systems. For instance, Schneider Electric's Square D I-Line Bus duct System offers remarkable flexibility and efficiency through its plug-in unit spaces and ground fault protection. This system finds extensive use in both commercial and industrial applications. On the other hand, Siemens' WL Bus duct System distinguishes itself with its quick-connect joints and arc-resistant enclosures, specifically tailored to meet the high-power density requirements of industrial facilities and data centers throughout the U.S. Furthermore, Eaton's Pow-R-Way III Bus duct System seamlessly integrates with Power Xpert Metering solutions, enabling real-time monitoring. This feature makes it an excellent choice for commercial buildings in the U.S.

Competitive Analysis

Competitive analysis and profiles of the major global U.S medium voltage bus duct market players that have been provided in the report include Schneider Electric, General Electric company, Siemens AG, ABB, Ltd., Eaton Corporation plc, Crown Electric Engineering and Manufacturing LLC, IES Holdings, Inc., Powell Industries Inc, Avail Infrastructure Solutions, L&T Electrical & Automation, LS Cable & System, Ltd., Godrej & Boyce Mfg. Co. Ltd., Legrand Group, Saint-Augustin Canada Electric Inc. (STACE), Myers Power Products, Inc., and Vertiv Group Corp.

Top Impacting Factors

The bus duct system is designed to be more efficient in terms of material usage as each component is custom-engineered for the specific job, resulting in a smaller cross-sectional area. Additionally, the bus duct system offers a lower voltage drop compared to traditional cable and conduit systems, its solid phase bars that contribute to reduced impedance. Moreover, the installation process for bus duct is generally less labor-intensive compared to cable and conduit, with the difference in labor becoming more significant as the ampere rating of the system increases.

Key Developments/ Strategies in U.S medium voltage bus duct market

For Instance, February 2024, Schneider Electric, a renowned company driving the digital revolution in energy management and automation, has recently unveiled its latest product, the SureSeT Medium Voltage (MV) switchgear, specifically tailored for the Canadian market. This advanced solution, supported by the cutting-edge EvoPacT circuit breaker, aims to cater to the requirements of primary switchgear applications by offering a compact, robust, and intelligent solution that efficiently handles digital operations on a daily basis.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the global U.S medium voltage bus duct market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall U.S medium voltage bus duct market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global U.S medium voltage bus duct market forecast is quantitatively analyzed from 2024 to 2033 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the U.S medium voltage bus duct market.

- The report includes the market share of key vendors and the U.S medium voltage bus duct market.

U.S Medium Voltage Bus duct Market Report Highlights

| Aspects | Details |

| By Conducting Material |

|

| By Application |

|

| By Product Type |

|

| By Voltage |

|

| Key Market Players | Siemens AG, IES Holdings, Inc., Avail Infrastructure Solutions, Eaton Corporation plc, L&T Electrical & Automation, Schneider Electric, General Electric Company, Powell Industries Inc., Crown Electric Engineering and Manufacturing LLC, ABB, Ltd |

Analyst Review

The U.S. Medium Voltage Bus Duct Market was valued at $963.4 million in 2023

The market value of the U.S. Medium Voltage Bus Duct Market in 2032 was $1,622.1 million

The forecast period in the U.S. Medium Voltage Bus Duct Market report is 2024 to 2033.

The base year calculated in the U.S. Medium Voltage Bus Duct Market report is 2023.

The top companies analyzed for U.S. Medium Voltage Bus Duct Market report are Schneider Electric, General Electric company, Siemens AG, ABB, Ltd., Eaton Corporation plc, Crown Electric Engineering and Manufacturing LLC, IES Holdings, Inc., Powell Industries Inc, Avail Infrastructure Solutions, L&T Electrical & Automation, LS Cable & System, Ltd., Godrej & Boyce Mfg. Co. Ltd., Legrand Group, Saint-Augustin Canada Electric Inc. (STACE), Myers Power Products, Inc., and Vertiv Group Corp.

By conducting material, the copper segment is the most influential segment in the U.S. Medium Voltage Bus Duct Market. ??

The rising investments in industrilization is a primary driver of the U.S. Medium Voltage Bus Duct Market growth. ?

The company profile has been selected on the basis of revenue, product offerings, and market penetration.?

Loading Table Of Content...