U.S. Pin and Sleeve Devices Market Outlook - 2026

The U.S. pin and sleeve devices market size was valued at $14,452.5 million in 2018, and is projected to reach $30,549.2 million by 2026, registering a CAGR of 9.6% from 2019 to 2026. Pin and sleeve devices are high-current power sources that help insulate power from chemicals, dirt, moisture, and grime. These devices are made up of high-quality components such as RFI filters, battery holders, LED lighting connectors, solid brass pins, and others. These highly secured devices protect the electrical connections in abusive environments. Pin and sleeve devices are used in various product ranges from metal-housed to high resistant plastic products. These devices are ideal for various applications as they act as medium between electronic device and current. They enable the flow of current though receptacle (socket) to the device through plug.

The rise in need for electronic devices requiring consistent current flow are adopting various optimum wiring devices such as plugs, receptacles, inlets, and connectors in industry verticals including mining & construction, aerospace & defense, automotive, entertainment, oil & gas, and others. The pin and sleeve connector is a cost-effective device, which offers several advantages over other connecting devices such as it can prevent disconnecting under high load and seal power connection. There is an increase in the demand for pin and sleeve devices, owing to growth in applications of connectors, sockets, plugs devices in residential, commercial, and industrial sector. Moreover, ease of installation, high durability, and safety measures according to the convenience of electrical connection also contribute toward the growth of the U.S. pin and sleeve devices market.

There is an increase in the installation of plugs and sockets in the U.S. residential sector as the growth in construction activity in the U.S. is generating need for power-efficient connections to make any home appliance work. In addition, the advancement in construction methods such as prefabricated homes and others has pre-installed sockets for use of electronics. This is expected to boost the demand for pin and sleeve devices in the U.S market. Furthermore, increase in demand for dust proof and splash proof plugs & sockets also contribute to the market growth, owing to shift in consumer preference toward adoption of highly durable and water-resistant devices. Moreover, secure plugs & sockets help monitor and control the flow of electricity, which can otherwise be harmful for the workers. Rise in R&D activities in military & defense sector has a huge impact on the market growth, owing to surge in consumption of advanced electronic appliances such as large batteries, power sources, and others that requires power connection. Thus, the U.S. government is investing in wiring devices for better connectivity, which in turn fuels the growth of the pin and sleeve devices market in the U.S. However, complex fault detection, troubleshooting process, and increase in investment in wireless connectivity to the appliances such as wireless chargers and others is expected to limit the growth of the pin and sleeve devices market.

Nonetheless, rapid growth in advancement of smart infrastructures, which offers remote access to the smart electronics is expected to provide growth opportunities to the market players, as the adoption of IoT and artificial intelligence is converting homes into smart homes, which is expected to increase usage of smart plugs and sockets. Moreover, there are numerous applications such as UPS, PDUs, servers, and data storage services in data centers that are totally dependent on power supply, which in turn increases the demand for plugs and sockets. Thus, wide presence of data centers in the U.S. is also projected to provide lucrative opportunities for the pin and sleeve devices market.

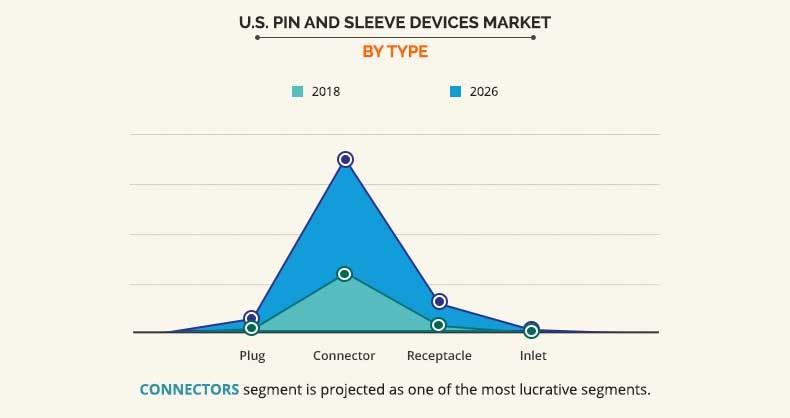

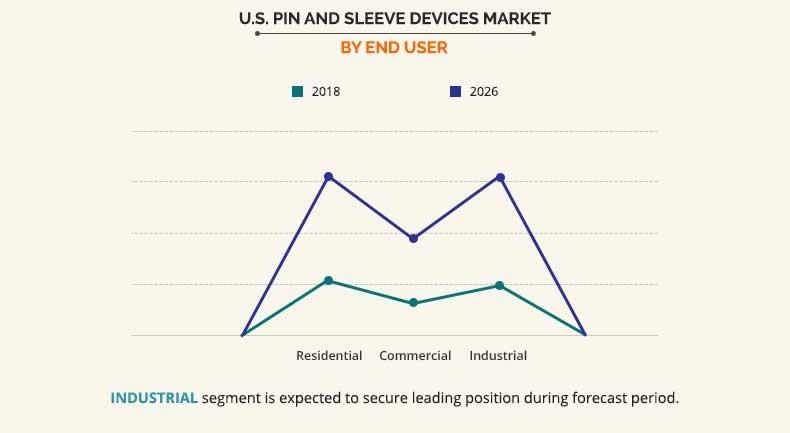

The U.S. pin and sleeve devices market is analyzed by type and end user. Based on type, the market is fragmented into plug, connector, receptacle, and inlet. The connectors segment dominated the U.S. pin and sleeve devices market in terms of revenue in 2019 and is expected to follow the same trend during the forecast period, owing to rise in development of computing technologies, consumer electronics, and communication (3C). Based on end user, it is segmented into residential, commercial, and industrial sectors, wherein the industrial sector is further divided into automotive, manufacturing, oil & gas, energy & power, and others. In 2018, the residential sector secured the highest U.S. pin and sleeve devices market share; however, the industrial segment is expected to witness highest CAGR of 10.4% during the forecast period. The oil & gas industry is expected to grow at highest CAGR of 12.3% from 2019 to 2026.

Top Impacting Factors

The significant impacting factors in the U.S. pin and sleeve devices market include increase in demand for splash proof, waterproof, and dustproof plugs & sockets, surge in adoption of electronic appliances across various industry verticals, and rise in demand for plugs & sockets in residential sector in the U.S. are the major key drivers for the U.S. pin and sleeve devices market growth. However, increase in investment in wireless communication hinders the market growth. Furthermore, growth in adoption of smart plugs and sockets in the U.S. market and wide presence of data centers provides lucrative opportunities for the market growth.

Competition Analysis

Competitive analysis and profiles of the major U.S. pin and sleeve devices market players, such as ABB Ltd., Eaton Corporation, Emerson Electric, Meltric Corporation, Schneider Electric, Walther Electric, Inc., Amphenol Corporation, Mennekes Electrotecnik GmbH & Co. KG, Hubbell Corporation, and Legrand SA. are provided in this report.

Key Benefits for U.S. Pin and Sleeve Devices Market:

- This study comprises analytical depiction of the U.S. pin and sleeve devices market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall U.S. pin and sleeve devices market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current U.S. pin and sleeve devices market forecast is quantitatively analyzed from 2019 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the U.S. pin and sleeve devices industry.

- The report includes the U.S. pin and sleeve devices market trends and share of key vendors in the market.

U.S. Pin and Sleeve Devices Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| Key Market Players | Legrand SA, Walther Electric, Inc., Schneider Electric, ABB Ltd., Meltric Corporation, Hubbell Corporation, Mennekes Electronik GmbH Co. KG, Amphenol Corporation, Emerson Electric Co, Eaton Corporation |

Analyst Review

The U.S. pin and sleeve devices market is projected to depict a prominent growth during the forecast period, owing to various factors, such as increase in demand for dustproof and splash proof plugs & sockets, rise in adoption of electrical appliances across various industry verticals, and surge in installation of plugs & sockets in the U.S. residential sector.

Pin and sleeve devices are widely used in various industries that include automotive, manufacturing, oil & gas, and energy & power. Moreover, they have huge demand in multiple commercial and residential applications, as these devices offer safe connectivity and high durability. It also provides suitable result in abusive environments. The oil & gas industry experiences the highest demand for pin and sleeve devices. Furthermore, increase in various applications such as UPS and data storage services completely rely on power, which is further expected to boost the demand for pin and sleeve devices such as plugs & sockets. Moreover, increase in adoption of smart plugs & sockets, owing to surge toward adoption of IoT enabled and remotely operated devices is expected to provide lucrative growth opportunities to the players in the U.S. market.

Various leading manufacturers, such as ABB Ltd., Eaton Corporation, Emerson Electric, Meltric Corporation, Schneider Electric, Walther Electric, Inc., Amphenol Corporation, Menneskes Electrotecnik GmbH & Co. KG, Hubbell Corporation, and Legrand SA. occupy a prominent revenue share in the U.S. pin and sleeve devices market.

Loading Table Of Content...