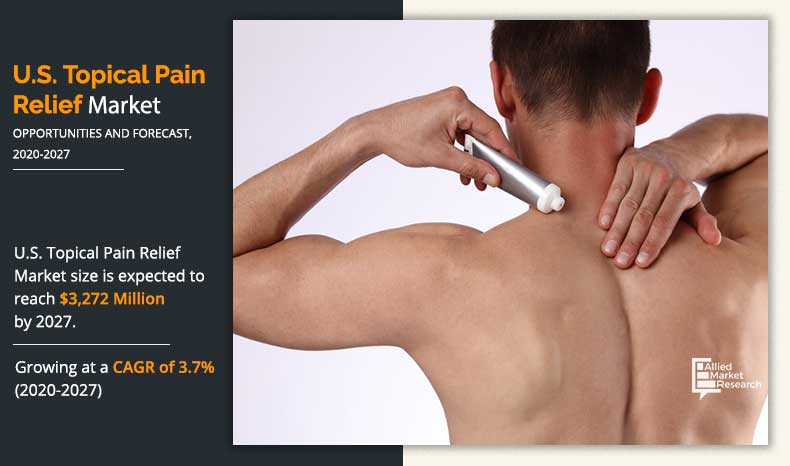

The U.S. topical pain relief market was valued at $2,612 million in 2019, and is projected to reach $3,272 million by 2027 at a CAGR of 3.7% from 2020 to 2027.

Topical pain relief medications are applied directly to the epidermal layer of the skin at the area of inflammation or pain. Topical pain relief products are designed to relieve pain and utilize skin as the vehicle for drug administration and exert major action at the targeted site & in the central nervous system. These formulations are analgesic or anesthetic agents which are applied on or around the painful site. The aim is to offer a slow and gradual release of pain relief medication into the bloodstream by keeping the blood levels relatively constant for a certain period of time. These medications offer lesser side effects as compared to oral medications. Topical pain relievers include the administration of non-opioids and opioids drugs. Non-opioids drugs include nonsteroidal anti-inflammatory drugs (NSAIDS), methyl salicylates, capsaicin, lidocaine, and other non-opioids. Opioids drugs include buprenorphine and fentanyl.

The growth of the U.S. topical pain relief market is majorly driven by increase in prevalence of arthritis and other bone-related conditions, diabetic neuropathy, leading to pain. Other factors that boost the U.S. topical pain relief market growth include rise in adoption of topical pain relief products as they cause lesser side effects as compared to oral pain relief, upsurge in geriatric population across the U.S., and increase in demand for topical pain relief by sports players. However, factors such as topical pain relief medications can cause irritated skin and they have a strong odor or unpleasant smell that hamper the market growth. Conversely, the development of online platform for the topical therapeutics is expected to provide lucrative growth opportunities for the market.

The World Health Organization (WHO) on January 30, 2020 declared COVID-19 outbreak a public health emergency of international concern. COVID-19 has affected around 210 countries across the globe. Nationwide lockdown, government regulations, and continuous increase in infection rate across the country created a widespread financial impact on clinics and pain services. Large number of clinics and pain services has witnessed a drop in number of patient visits amid COVID-19 ultimately reducing client contact. Moreover, most chronic pain facilities were deemed non-urgent, both outpatient and elective interventional procedures were limited or stopped during the COVID-19 pandemic to minimize risk of the viral spread. Thus, a negative impact of COVID-19 on opioids topical pain relief market is observed.

U.s. Topical Pain Relief Market Segmentation

The U.S. topical pain relief market is segmented into therapeutic class, type, formulation, and distribution channel. On the basis of therapeutic class, the market is bifurcated into non-opioids and opioids. The non-opioids segment is further divided into nonsteroidal anti-inflammatory drugs (NSAIDS), methyl salicylate, capsaicin, lidocaine, and other non-opioids. The opioids segment is further bifurcated into buprenorphine and fentanyl. On the basis of type, the market is segmented into prescription pain relief and over-the-counter (OTC) relief. On the basis of formulation, the market is classified into cream, gel, spray, patch, and others. The distribution channels covered in the study include pharmacies & drug stores, e-commerce, and retail & grocery stores.

By Therapeutic Class

Non-Opioids segment holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Segment review

Presently, on the basis of therapeutic class, non-opioids segment is the major revenue contributor, and is projected to grow significantly during the forecast period due to its preferable use over the opioid drugs for treatment of mild to moderate pain. Due to less side effects as compared to opioids and no substance abuse, non-opioids are the preferred choice for the treatment of pain. However, due to restricted analgesic effects of the non-opioid drugs, their use is limited for the treatment of severe pain.

Increase in awareness regarding adverse effects of non-opioids, surge in number of geriatric population, growth in number of patients with chronic pain, rise in prevalence of arthritis and other joint problems, majorly drive the growth of this segment. Arthritis is one of the most common and widely spread disorder that affects millions of people in the U.S. According to Centers for Disease Control and Prevention data, approximately 22.8% of total adult population was affected by arthritis in 2017.

According to distribution channel, the market is classified into pharmacies & drug stores, e-commerce, and retail & grocery stores. The e-commerce segment is anticipated to depict significant growth during the forecast period due to rise in preference for online purchase of drugs over the traditional methods, increase in awareness of online pharmacy, and rise in number of internet users.

The key players profiled in this report include Advacare Pharma, Glaxosmithkline Plc (GSK), Johnson & Johnson, Nestlé S.A., Novartis AG, Pfizer Inc., Reckitt Benckiser Group Plc., Sanofi, Sun Pharmaceutical Industries Ltd., and Topical Biomedics, Inc.

By Type

Prescription Pain Relief segment is projected as one of the most lucrative segment.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the U.S. topical pain relief market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers U.S. topical pain relief market analysis from 2019 to 2027, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of factors that drive and restrain the growth of the U.S. topical pain relief market is provided.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook and U.S. Topical pain relief Market growth.

U.S. Topical Pain Relief Market Report Highlights

| Aspects | Details |

| By Therapeutic Class |

|

| By Formulation |

|

| By Type |

|

| By Distribution Channel |

|

| Key Market Players | TOPICAL BIOMEDICS, INC., JOHNSON & JOHNSON, SUN PHARMACEUTICAL INDUSTRIES LTD., PFIZER INC., GLAXOSMITHKLINE PLC (GSK), NESTLÉ S.A., ADVACARE PHARMA, SANOFI, NOVARTIS AG, RECKITT BENCKISER GROUP PLC |

Analyst Review

Pain is the most prominent symptom of musculoskeletal conditions; thus, effective pain treatment is necessary. Topical pain relief products are medications that are directly rubbed onto the skin over the painful body part. These medications are available as prescription drugs or as over the counter medication. These products include creams, lotions, patches, or sprays that are applied to the skin to relieve pain from sore muscles and arthritis. Topical pain relief products use several active ingredients, such as menthol, camphor, capsaicin, and others, to relieve pain.

Rise in patients suffering from bone pain conditions such as osteoarthritis and diabetic neuropathy, especially the geriatric population, is the major factor that drives the growth of the U.S. topical pain relief market. Other factors such as rise in demand for pain relief products by sports persons, increase in geriatric population, easy availability of the drugs, higher healthcare awareness, and less side effects caused due to topical pain relief as compared to oral medications are expected to have a significant impact on the growth of the market. However, factors such as topical pain relief products cause irritated skin and are usually characterized by unpleasant odor, which is further expected to hamper the market growth.

The total market value of U.S. Topical Pain Relief Market is $2,612.13 million in 2019.

The forcast period for U.S. Topical Pain Relief Market is 2019 to 2027

The market value of U.S. Topical Pain Relief Marketin 2020 is $2,536.49 million .

The base year is 2019 in U.S. Topical Pain Relief Market

Top companies such as GlaxoSmithKline plc, Johnson & Johnson, Nestlé S.A., Novartis AG, Pfizer Inc., and AdvaCare Pharma held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in U.S.

Non-opioids segment is the most influencing segment owing to lesser side effects as compared to opioids and no substance abuse, thus, non-opioids are preferably used as topical pain relief medication.

Increase in prevalence of arthritis and joint pain is the major factor that contributes toward the growth of the topical pain relief market in the U.S. Moreover, other factors that fuel the market growth include growth in geriatric population, lesser side effects caused due to use of topical analgesics as compared to oral pain relief, wide availability of topical pain relieving drugs, and high demand for topical pain relief by sports players.

No, there is no value chain analysis provided in the U.S. Topical Pain Relief Market report

Topical pain relief medications are pain killers that are directly applied, rubbed, or sprayed on the skin over painful muscles or joints

Topical Pain Relief are used to relieve pain as they are composed of different ingredients such as opioids, nonsteroidal anti-inflammatory drugs (NSAIDS), salicylates, capsaicin, and others. These products have a heating or cooling effect that stimulate the nerves near the pain point and relieve pain.

Loading Table Of Content...