U.S. Trailer Component Market Overview

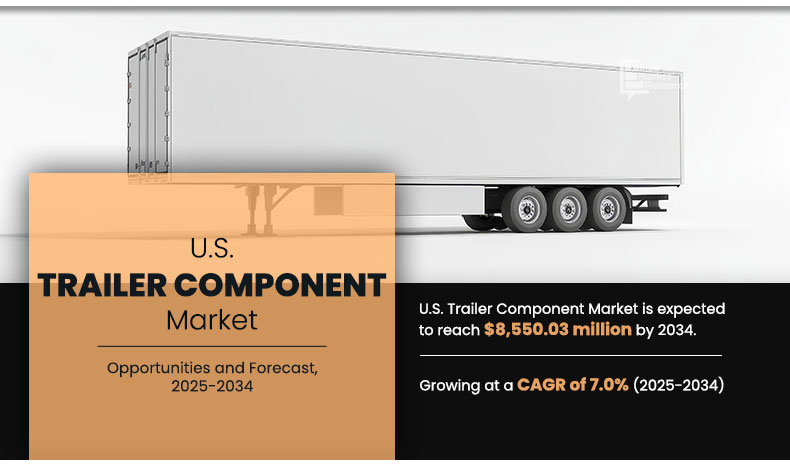

The U.S. Trailer component Market was valued at $4,631.98 million in 2025 and is estimated to reach $8,550.03 million by 2034, exhibiting a CAGR of 7.0% from 2025 to 2034.

The U.S. trailer component market in the encompasses the manufacturing, distribution, and integration of essential parts used in trailers across diverse applications such as logistics, construction, agriculture, and recreation. These components include axles, suspensions, braking systems, hitches, lighting, tires, flooring, and other structural and functional elements. The market plays a critical role in supporting freight transport, last-mile delivery, supply chain efficiency, and recreational vehicle (RV) activities in the country.

Key Takeaways

- The U.S. trailer component market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2025-2034.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

The U.S. trailer component market has witnessed steady growth, driven by rising freight volumes, expansion of the e-commerce sector, growing demand for durable commercial trailers, and strong investments in infrastructure and logistics. The market is also shaped by evolving safety regulations, technological advancements in braking and suspension systems, electrification trends, and the need for lightweight materials to enhance fuel efficiency. For instance, in 2024 Lippert Components Inc. collaborated with Keystone RV Company to offer anti-locking braking system (ABS) for all Keystone Cougar travel trailers and fifth wheels trailers.

Also, federal and state governments play a crucial role in shaping the U.S. trailer component market through safety standards, emissions regulations, and infrastructure development programs. For instance, the Federal Motor Carrier Safety Administration (FMCSA) has continued to strengthen requirements around trailer braking, lighting, and inspection compliance to ensure road safety. These regulatory frameworks push manufacturers and suppliers to adopt advanced technologies such as electronic braking systems (EBS), LED-based lighting, and telematics-enabled components.

Furthermore, the market is also influenced by broader logistics and supply chain challenges. With urban congestion and driver shortages adding complexity, fleet operators are seeking high-performance trailer parts that enhance load capacity, reduce downtime, and improve overall operational efficiency. In addition, trailer components are increasingly being integrated with smart technologies such as IoT sensors for load monitoring, tire pressure management systems (TPMS), and predictive maintenance solutions.

In addition to this, sustainability is emerging as another major driver of market growth. Lightweight composite flooring, aluminum-based structural parts, and low-rolling-resistance tires are gaining traction as operators seek to reduce fuel consumption and carbon emissions. The integration of electric axles and regenerative braking systems in trailers is expected to accelerate in the next decade as the U.S. freight industry adapts to electrified trucks and decarbonization targets.

Despite strong growth prospects, the U.S. trailer components market faces several challenges. These include fluctuations in raw material prices (steel, aluminum, composites), supply chain disruptions, labor shortages in manufacturing, and rising costs associated with advanced safety and telematics technologies. Additionally, the aftermarket segment struggles with counterfeit parts and inconsistent quality standards, which impact both fleet performance and road safety.

Nevertheless, opportunities remain high, particularly with the expansion of electric freight fleets, digital fleet management platforms, and government support for smart transportation infrastructure. Strategic partnerships between trailer OEMs, component suppliers, and technology providers are expected to define the competitive landscape, as companies work toward delivering safer, more efficient, and sustainable trailer solutions.

The U.S. trailer market is segmented into components, trailer type, end use sector, sales channel and region. By component, the market is bifurcated into axles, braking systems, suspension systems, wheels and tires, trailer jacks and landing gear, lighting and electrical components, trailer couplers and hitches & other. By trailer type, it is classified into flatbed trailers, dry van trailers, refrigerated trailers, tank trailers, lowboy trailers, dump trailers, utility trailers & others. By end use sector, it is divided into logistics and freight, construction, agriculture, oil and gas, mining, refrigerated goods & others. By sales channel, it is categorized into OEM & aftermarket. Region wise, it is analyzed across U.S.

Based on component, the axles segment dominated the market in the year 2025. This is due to the growing demand for heavy-duty and specialized trailers, coupled with increasing freight volumes and long-haul transportation needs in the U.S., has driven the adoption of high-performance and durable axle systems. Additionally, advancements in axle technology, such as lightweight designs, improved suspension integration, and enhanced durability for extreme operating conditions, have further strengthened their market position.

By Component

Braking System is projected as the most lucrative segments

Based on trailer type, flatbed trailers accounted for the largest market share in 2025 and are projected to lead during the forecast period. This is due to their versatility in transporting a wide range of goods, including oversized and heavy machinery, construction materials, and industrial equipment, which makes them essential for the construction, manufacturing, and logistics sectors. The growing infrastructure development, increasing industrial activities, and rising demand for efficient freight transportation across the U.S. further support the adoption of flatbed trailers.

By Trailer Type

Dry Van Trailers is projected as the most lucrative segments

Based on end use sector, the logistics and freight truck held the highest market share, owing to rapid growth of e-commerce, increasing demand for efficient supply chain operations, and expansion of domestic and cross-border freight transportation in the U.S. Freight trucks require durable and reliable trailer components such as axles, braking systems, suspensions, wheels, and lighting systems to handle heavy loads over long distances and varying road conditions.

By End-use Sector

Mining is projected as the most lucrative segments

Competition Analysis

The key players included in the U.S. trailer component market analysis are BPW Group, Cummins Inc., (MERITOR, INC.), Dexter Group Company, Hendrickson USA, L.L.C., Horizon Global, JOST-Werke Deutschland GmbH, Knorr-Bremse AG, Lippert, SAF-HOLLAND SE, and STEMCO Products Inc.

By Sales Channel

OEM is projected as the most lucrative segments

Analyst Review

This section provides the opinions of various top-level CXOs in the U.S. trailer component market. The U.S. trailer component market is witnessing steady expansion, supported by rising demand across logistics, construction, agriculture, and recreational segments. Furthermore, rising freight transportation needs, infrastructure development, and consumer preference for recreational vehicles (RVs) and utility trailers fueled growth of market. Investments in supply chain modernization, fleet efficiency, and advanced trailer technologies are further driving market momentum. Key growth drivers include the steady rise in e-commerce activities, growing demand for lightweight and durable trailer parts, and the adoption of advanced braking, suspension, and telematics systems to enhance safety and performance.

Furthermore, shifting toward advanced technology-integrated trailer components significantly shaping the market. Trailer component manufacturers in the U.S. region are increasingly focusing on lightweight materials such as high-strength steel and composites to improve fuel efficiency and payload capacity. At the same time, innovations in braking systems, smart sensors, electronic stability controls, and predictive maintenance solutions are transforming trailer operations. Additionally, sustainability trends are influencing trailer design, with growing emphasis on recyclable materials, aerodynamic components, and energy-efficient systems that align with broader carbon reduction goals across the transportation industry.

Moreover, regulatory standards remain a major market influencer, with agencies such as the National Highway Traffic Safety Administration (NHTSA) and the Federal Motor Carrier Safety Administration (FMCSA) enforcing strict safety and performance guidelines. Policies focused on vehicle emissions, load safety, and operational efficiency are accelerating adoption of high-quality trailer components. Furthermore, collaborations between OEMs, aftermarket suppliers, and technology providers are enabling the development of innovative solutions, strengthening distribution networks, and improving aftermarket servicing capabilities.

However, the market also faces several challenges, including fluctuating raw material costs, supply chain disruptions, and competitive pricing pressures. Additionally, the fragmented nature of aftermarket services and variations in regional demand create complexities for manufacturers and distributors. Cybersecurity and data privacy risks are also emerging concerns as connected trailer technologies and telematics solutions gain traction. Addressing these challenges will require strong supplier partnerships, investments in digitalization, and proactive regulatory compliance strategies.

Regional market dynamics vary, with the U.S. holding a dominant position in the trailer component market due to its large-scale freight transportation industry, advanced logistics infrastructure, and high demand for heavy-duty and specialized trailers. States with strong industrial and agricultural bases, such as Texas, California, and Ohio, have emerged as key hubs for trailer component consumption and production. Additionally, the U.S. is witnessing steady progress in the adoption of advanced technologies such as smart braking systems, telematics integration, and lightweight materials, supported by government safety regulations and sustainability initiatives. Meanwhile, regions with strong construction and mining activities are further contributing to market growth, as the need for durable, high-performance trailer components remains critical for heavy-duty applications.

The U.S. Trailer Components Market was valued at $ 4,631.98 million in 2025, and is projected to reach $ 8,550.03 million by 2034, registering a CAGR of 7.0% from 2025 to 2034.

Adoption of lightweight materials, smart braking and suspension systems, telematics integration, and electrification of trailers.are the upcoming trends in U.S. Laser Defense Eyewear industry

The sample for U.S. Trailer Components Market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report

End-Use Sector is the most influencing segment growing in the U.S. Laser Defense Eyewear report

The company profiles of the top market players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry

Acquisition, Investment, Expansion, Partnership, Partnership, Agreement & product launch are the key strategies adopted by the top players in the market.