Used Bike Market Overview

The global used bike market size was valued at USD 38.7 billion in 2021, and is projected to reach USD 66.2 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031. Increase in demand for two-wheeler due to traffic congestion, high cost associated with new bikes, rise in internet-based sale, and rising popularity & evolution in motorcycles events in developed economies are the major factors that propel the used bikes market growth. However, the high risk of accidents and other industrial vehicles, and rise in maintenance issues related to used bikes are the major factors that hamper the growth of the used bike industry. Furthermore, an increase in demand for bike taxi services, and the rising adoption of electric motorcycles are the factors that are expected to offer growth opportunities for the market during the forecast period.

Key Market Trends & Insights

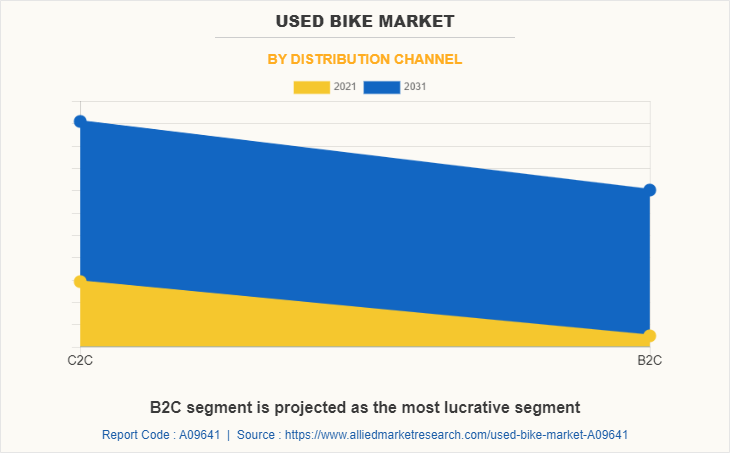

- C2C distribution channel segment is expected to witness significant growth in the used bikes market.

- Domestically manufactured segment is projected to show strong growth in the near future.

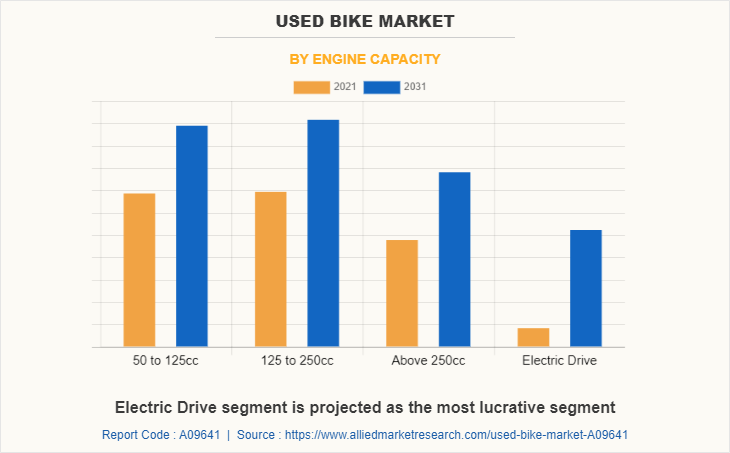

- 125 to 250cc engine capacity segment is anticipated to grow significantly in the coming years.

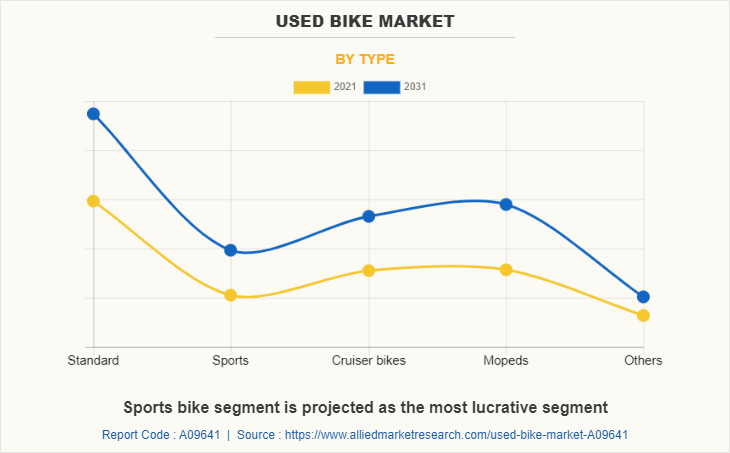

- Standard bike type segment is expected to exhibit notable growth in the used bikes market.

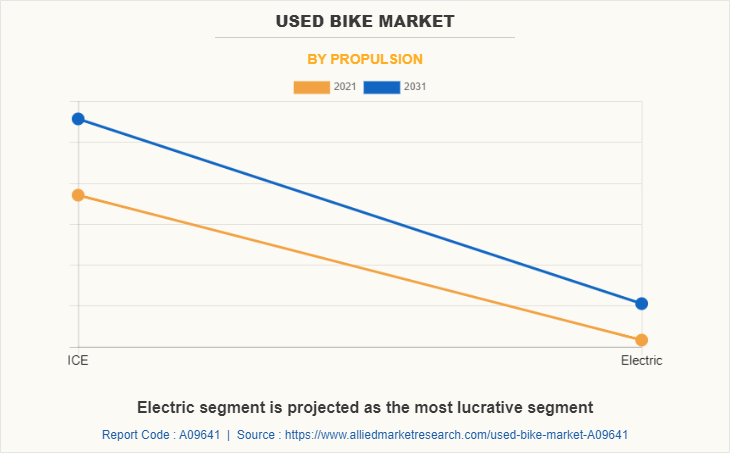

- ICE propulsion segment is projected to dominate growth in the near future.

- Asia-Pacific region is anticipated to register the highest CAGR during the forecast period.

Market Size & Forecast

- 2031 Projected Market Size: USD 66.2 billion

- 2021 Market Size: USD 38.7 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 5.6%

Introduction

The second-hand vehicle that can be sold is a used bike. Used bikes can be purchased from a variety of places, including franchise and independent auto dealers, rental bike businesses, auctions, private party sales, and leasing agencies. Due to the high expense of vehicles and the maintenance of personal bikes, millennials own fewer bikes overall. Additionally, millennials prefer to save money on their bikes and frequently choose used bikes for transportation. Additionally, the high cost of new bikes prevents many people from purchasing them, which increases demand for used bikes.

Market Dynamics

E-commerce players have made use of digital transformation to increase their footprint in their respective markets. E-commerce breaks down geographic barriers for companies and allows sales in places that can be challenging to reach with traditional models, owing to which the used bike market players across the globe are shifting their focus to online sales channels. Owing to all these factors, the growth of internet-based sales is expected to propel the demand for used bikes during the forecast period.

Three-phase DC motors are used instead of engines in electric motorcycles (EV) as a particularly effective deterrent against the ever-tightening exhaust gas laws. Furthermore, there is an increasing demand for high-performance, fuel-efficient, and low-emission electric vehicles as a result of stricter regulations on carbon emissions, falling battery costs, and rising gasoline prices. Thus, growth in the market's demand for electric bikes is anticipated in the near future. Additionally, old electric vehicles that have been officially reconditioned or refreshed have begun to be offered by manufacturers of electric vehicles, which supports the market's expansion. For instance, in January 2023, Swedish electric motorcycles manufacturer CAKE, announce the launch of a new program- re:CAKE, offering customers the option to purchase a certified pre-owned CAKE bike. In addition, the re:CAKE program offers customers the opportunity to buy a refurbished bike that has been thoroughly inspected, overhauled, and given the Cake stamp of approval.

In Europe, France receives the most international visitors. Due to rising tourism, bike-taxi and car-rental services are becoming more popular in France. Drivers and companies that offer vehicle rental services have a greater need for used motorcycles as a result. Additionally, purchasers' attention is being drawn to used vehicles, especially used bikes for occasional use, as a result of the European Union's intentions for transactions involving electric vehicles. Additionally, there is a growing preference for high-end used bikes, and this tendency is projected to support the market for cruisers and sports bikes in the near future.

Market Segmentation

The used bike market segmentation is based on the distribution channel, source, engine capacity, type, propulsion, and region. By distribution channel, it is divided into C2C (Consumer-to-consumer), and B2C (Business-to-consumer). By source, it is classified into domestically manufactured and imported bikes. By engine capacity, it is categorized into 50 to 125cc, 125 to 250cc, above 250cc, and electric drive. By type, it is divided into standard, sports, cruiser, mopeds, and others. By propulsion, it is bifurcated into ICE and electric. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific comprises China, India, Japan, ASEAN, and the Rest of Asia-Pacific has one of the most advanced automotive sectors across the globe. Rest of Asia-Pacific includes Australia, South Korea, New Zealand, and others. Countries such as China, Japan, India, and others in the region are highly developed in terms of infrastructure and automotive manufacturing facilities. In addition, the Asia-Pacific is one of the leading markets for used bikes, owing to growth of ride-hailing services or bike taxi services in the region.

The Indian bike industry accounts about 40% of global sales. The growth of the used bike market is driven by multiple factors such as affordability, improvement in online buying infrastructure, lower tax rates on used bikes compared to new bikes, and huge online platforms to buy and sell used bikes and vehicles drive. For instance, in January 2022, CredR, a used two-wheeler buying and selling platform announced to invest $15 million (around Rs 110 crore) in 2022-23 to expand its business. It plans to open 50 CredR showrooms for used two-wheelers in FY22-23 and over 100 showrooms by 2024. Such developments by online service providers are expected to drive the growth of the market across the country during the forecast period.

U.S. is largest market for used bikes in North America region. The development of online platforms and new facilities or centers for used bikes by present automakers and bikes manufacturers across the country is a key factor that is expected to drive the growth of the market across the U.S. during the forecast period. For instance, in July 2021, Harley-Davidson launched an online portal on its official website called the HD-1 Marketplace. This facility is for buying and selling pre-owned Harley-Davidson motorcycles, which are currently available only in the U.S.

The HD-1 Marketplace enables customers to look for used Harley-Davidson motorcycles across the manufacturer’s dealer network. Apart from browsing the available options, customers can also customize their motorcycles online before making the purchase. The online portal also offers existing customers the chance to sell their motorcycles directly to official dealers that are willing to buy them. These additional features also help to boost the market across the region.

Which are the Top Used Bike companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the used bike industry.

- Bafta Japan Inc.

- Blade Motorcycles

- Droom

- India Kawasaki Motors Pvt. Ltd.

- Motohunt Inc.

- Motorbikes4All

- Mundimoto Europe SL

- Triumph Motorcycles

- Used Motorcycle Store.com (Dealer Spike)

- Yamaha Certified Pre-Owned

What are the Recent Developments in the Used Bike Market

In May 2022, Yamaha launched a certified pre-owned platform to ensure second-hand bikes quality. The new Certified Pre-Owned platform gives customers a ‘one stop shop’ to search for approved used Yamaha motorcycles or scooters, where customers can see all the UK Franchised Dealer stock in one place.

In February 2022, Mundimoto raised $22.6 million to expand its platform beyond its home country of Spain and into Europe, starting with Italy and Holland. Mundimoto is an online motorcycle buying and selling startup. It plans to hire 50 engineers and 250 new employees to advance the technology product and support international expansion.

In October 2021, Triumph launched its 'Total Care' program which includes a range of services and products. The Total Care umbrella covers a wide variety of services offered by Triumph, ranging from online service bookings and Extended Warranty (EW) to RSA, service packages, and the condition & history of their chosen used bike.

In September 2020, Triumph Motorcycles is confirmed to start selling pre-owned Triumph bikes in India. Triumph mentioned that they exclusively retail only Triumph motorcycles via its pre-owned business and the bikes are available for purchase at the company's official dealerships.

The leading companies are adopting strategies such as product launch and expansion to strengthen their market position. In May 2022, Yamaha launched a certified pre-owned platform to ensure second-hand bikes quality. The new Certified Pre-Owned platform gives customers a ‘one stop shop’ to search for approved used Yamaha motorcycles or scooters, where customers can see all the UK Franchised Dealer stock in one place. In addition, in February 2022, Mundimoto raised $22.6 million to expand its platform beyond its home country of Spain and into Europe, starting with Italy and Holland. Mundimoto is an online motorcycle buying and selling startup. It plans to hire 50 engineers and 250 new employees to advance the technology product and support international expansion.

What are the Top Impacting Factors

Key Market Driver

Increase in demand for two-wheeler due to traffic congestion

A significant issue in a number of developing urban regions around the world is growing traffic congestion. Due to the way society currently functions, everyone now has to deal with traffic congestion during rush hour. The numerous time zones worldwide have inevitably resulted in daily congestion of the current highways. The worrying situation is that, despite numerous solutions being tried to ease traffic congestion, there hasn't really been any significant improvement in this area. With each passing year, traffic is becoming worse. Thus, the rise in traffic congestion is fueling the demand for used bikes in developing regions, thereby fostering the global used bikes market.

Moreover, bikes are the most common means of transportation to get from one place to another. It allows the riders to maneuver through confined spaces, is quick and nimble, and provides an exhilarating experience when riding on various surfaces. Thus, several types of motorcycles, such as sports bikes, cruiser bikes, and touring bikes have increased in number over the years to meet the needs of different customers. Also, demand for motorcycles and scooters has increased significantly in rural areas owing to the lack of well-established public transportation. Consumers in rural regions turned to buy used motorcycles to avoid the high selling prices and tax rates of four-wheelers. Such factors are expected to drive the growth of the market during the forecast period.

High cost associated with new bikes

The high cost associated with new bikes is the major factor that is expected to fuel the growth of the global used bikes market. Prices for bikes increase periodically. This is due to the characteristics of the industry. Many companies position their bikes in markets where they can turn a sufficient profit and keep their stock moving. Notably, too inexpensive bikes would not cover the expenditures of manpower and supplies. The material used in motorcycles is a significant reason they cost more or as much as cars. Materials such as carbon fiber come in several shapes and grades, and the better the carbon fiber, the more expensive it is. This also covers the cost of the additional maintenance needed during refrigerated storage and transportation.

Moreover, new sport bikes/motorcycles are typically outfitted with high-performance shocks, brakes, and engines that can withstand the demands at the expense of comfort, fuel economy, and storage in comparison with other motorcycles for riding. As a result, new sports motorcycles can range in price from a few hundred dollars to several thousand. Hence, the upsurge in adopting sport motorcycles in other than developed countries, such as China and the U.S., is limited by high costs. Therefore, the craze for sports bikes and their high costs is a significant factor that is anticipated to create demand for used bikes or motorcycles.

Restaints

High risk of accidents

The motorcycle and used bikes industry is frequently constrained by the rising risk of road accidents for riders, even though motorized two-wheelers have advanced quickly due to their many benefits and improvements. Data from the European Commission show that head injuries were present in around 80% of motorcycle fatalities. In Europe, more than 6,500 two-wheeler riders lose their lives each year, and the risk of mortality for riders is 20 times more than that of passengers, according to the report, which cites two-wheelers as the most hazardous mode of transportation on roadways. However, to encourage the use of helmets and to take preventative measures, a number of programs and campaigns are being proposed. This will aid manufacturers in getting around this restriction. Similar to cars, motorcycles are anticipated to lower these dangers due to better safety features.

Opportunity

Increase in demand for bike taxi services

Bike taxis enable passengers to hail a vehicle using online platforms and provide door-to-door services to their customers owing to which it is one of the most convenient means of transportation. Moreover, while hailing a ride, information about the driver and the passenger is exchanged which makes ride-hailing services much safer than traditional taxi services. Used bikes are less expensive than brand-new bikes and the value of the motorcycle and, consequently, the insurance premium are both diminished by its age. Owing to this, bike taxi service providers and drivers connected with online platform services mostly used pre-owned bikes in their fleets to minimize investment costs.

In recent years, demand for ride-hailing services has increased significantly, especially among office commuters. Moreover, a significant rise in the preference for on-demand services such as taxis, passenger vehicles, and charter vehicles, which provide tracking of vehicles, real-time feedback, and rating for service experience provided to the end customers has encouraged the consumers to opt for ride-hailing services. Furthermore, ride-hailing services ensure that customers can accurately locate the vehicles and track their journey alongside offering safety to the occupants.

In addition, an increase in the bike taxi services offered by the leading market players, including LIMOBIKE, Rapido, Uber, & Ola, and the option to choose convenient pick-up and drop locations have encouraged consumers to opt for ride-hailing services, which in turn is expected to boost the demand for used bikes market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the used bike market analysis from 2021 to 2031 to identify the prevailing used bike market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the used bike market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global used bike market trends, key players, market segments, application areas, and market growth strategies.

Used Bike Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 66.2 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 461 |

| By Distribution channel |

|

| By Source |

|

| By Engine capacity |

|

| By Type |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | India Kawasaki Motors Pvt. Ltd., Yamaha Certified Pre-Owned, Mundimoto Europe SL, Batfa Japan Inc., Blade Motorcycles, Used Motorcycle Store (Dealer Spike), Triumph Motorcycles, Motohunt Inc., Motorbikes 4 All, Droom |

Analyst Review

The used bikes market is expected to witness remarkable growth in the future, owing to the high cost associated with new bikes. The key factors that drive the growth of the used bikes market are the rise in popularity & evolution of motorcycle events in developed economies and the rise in internet-based sales. However, the rise in maintenance issues related to used bikes is anticipated to hinder the used bike market growth. Furthermore, the rising adoption of electric motorcycles is expected to provide remarkable growth opportunities for players operating in the used bikes market.

The internet has expanded from just being a tool to check updates over social media or emails to purchasing and sales of goods as well. The e-commerce industry is a booming sector and, in this sector, the pre-owned vehicle sale as well as a purchase is a profit-making business. Moreover, in the purchase of used bike online platforms, the popularity from a consumer to consumer has escalated. For instance, in 2020, CredR, a used bike sales platform announced the delivery of second-hand bikes to the doorstep of consumers. Besides, the on-demand doorstep bike service segment was also launched under the name of CredR Care.

Moreover, the automotive e-commerce industry has witnessed growth due to the availability of a variety of products, bargaining options, and consumer-focused targeting by market players. In addition, e-commerce offers a lot of advantages for online sellers to expand their businesses and become multinational, and also presents an opportunity to sell their products directly to consumers place, relieving them from the complex supply chain. Growing digital service adoption index in the emerging country will boost the use of the internet-based used bikes market globally

The global used bike market was valued at $38.71 billion in 2021, and is projected to reach $66.21 billion by 2031

Some major companies operating in the market include Batfa Japan Inc., Blade Motorcycles, Droom, India Kawasaki Motors Pvt. Ltd., Motohunt Inc, Motorbikes4All, Mundimoto Europe SL, Triumph Motorcycles, Used Motorcycle Store. Com (Dealer Spike), and Yamaha Certified Pre-Owned.

Standard bike is the leading segment of Used Bike Market

Asia-Pacific is the largest regional market for Used Bikes

Rise in internet based sale, Increase in demand for two-wheeler due to traffic congestion and increase in demand for bike taxi services are the upcoming trends of Used Bike Market in the world

Loading Table Of Content...