Utility Communications Market Research, 2033

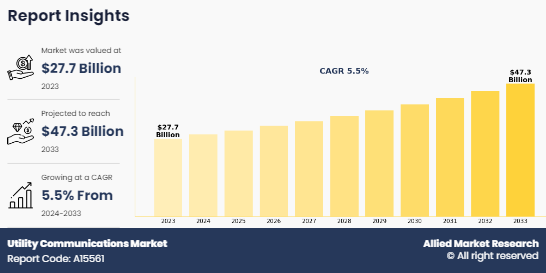

The global utility communications market size was valued at $27.7 billion in 2023, and is projected to reach $47.3 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033. Utility communications refer to the communication systems and processes used by utility companies to manage and coordinate their operations. Utility companies, such as those providing electricity, gas, water, and telecommunications services, rely on effective communication networks to monitor infrastructure, respond to service outages, and ensure smooth service delivery to customers.

Introduction

Utility communications are crucial in accommodating emerging technologies and trends in the utility industry, such as smart grids, renewable energy integration, and advanced metering. Effective communication systems enable the integration of these technologies, facilitate data exchange, and support the implementation of innovative solutions for improved energy management and customer engagement.

Key Takeaways

- The global utility communications market is highly fragmented, with several players including General Electric, Omicron, Hitachi, Ltd., Rad, Schneider Electric SE, Cisco Systems, Inc., ABB, Milsoft Utility Solutions, Motorola Solutions, Inc., and Itron Inc.

- More than 4,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and utility communications market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Utility communications market news and key industry trends are also included in the report.

- Comparative analysis of different types of utilities is also included in the report.

Market Dynamics

The rise in adoption of distributed energy resources (DERs) drives the utility communications market growth. Renewable energy sources, such as solar and wind power, are often decentralized and connected to the grid as distributed energy resources (DERs). Utility communications play a crucial role in integrating DERs into the grid by establishing communication links between the DERs, grid operators, and utility control centers. These communication networks enable real-time monitoring, control, and coordination of DERs, ensuring efficient integration and optimized grid performance.

Renewable energy sources are intermittent in nature, meaning their power generation fluctuates with weather conditions. Utility communications are essential for monitoring and managing the fluctuating power supply from renewable sources and maintaining grid stability. Real-time communication allows utilities to balance power generation & demand and adjust the variability of renewable energy sources. Besides, utility communications enable the transmission of energy production data from renewable sources to utility control centers. This data is crucial for accurate energy forecasting, load planning, and grid optimization. Effective communication networks allow utilities to monitor renewable energy generation patterns, predict power output, and align their operational strategies accordingly. However, the vulnerability to cybersecurity threats is expected to act as a major restraint for market growth.

Nevertheless, technological advancement is anticipated to offer many opportunities for market growth in the coming years. The integration of IoT devices and sensors into utility communications enables utilities to collect real-time data from various infrastructure components, such as smart meters, sensors, and distribution equipment. IoT devices enable remote monitoring, predictive maintenance, and asset management, thus improving operational efficiency and enabling data-driven decision-making. Also, advanced metering infrastructure, commonly known as smart meters, has revolutionized utility communications. Smart meters provide two-way communication capabilities, allowing utilities to collect real-time energy consumption data, monitor power quality, and enable time-of-use pricing. Smart metering improves billing accuracy, enhances customer engagement, and supports energy efficiency programs.

Supervisory Control and Data Acquisition (SCADA) Systems have evolved to leverage modern communication technologies, such as IP-based networks and cloud computing. SCADA systems enable utilities to monitor and control critical infrastructure, remotely operate devices, collect real-time data, and analyze system performance. Advanced SCADA systems offer improved scalability, security, and integration capabilities. Moreover, cloud computing and data analytics technologies have transformed utility communications by enabling scalable storage, processing power, and advanced analytics capabilities. Cloud-based solutions allow utilities to efficiently manage and analyze large volumes of data, improving grid management, outage response, load forecasting, and asset optimization. Consequently, technological advancement associated with utility communications are expected to offer lucrative opportunities in coming years.

Segments Overview

The utility communications market is segmented on the basis of technology, utility, component, application, end-use, and region. By technology, the market is categorized into wired and wireless. By utility, the market is divided into public and private. By component, the market is classified into hardware and software. By application, the market is segregated into oil & gas, power generation, and others. By end-use, the utility communications market is classified into residential, commercial, and industrial. By region, the utility communications market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

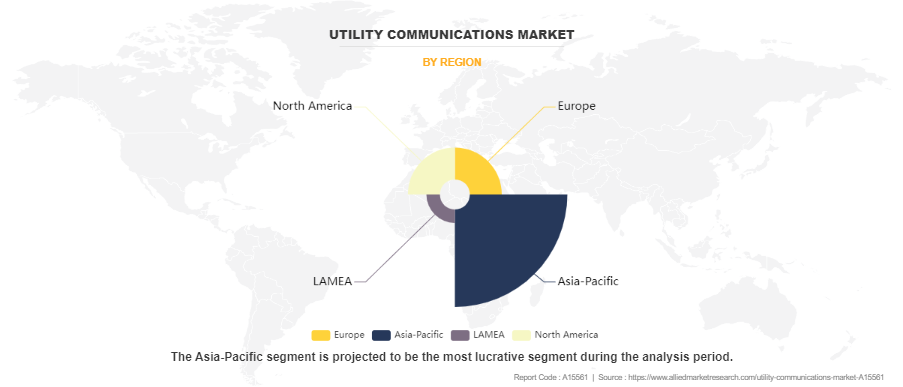

Asia-Pacific held the highest market share in terms of revenue in 2023, accounting for more than half of the global utility communications market revenue. The region is expected to dominate the market through the forecast period, growing at a CAGR of 5.7% from 2024 to 2033. This growth is driven by rapid urbanization, infrastructure development, renewable energy integration, energy efficiency initiatives, the need to serve remote areas, digitalization of utilities, and supportive government policies.

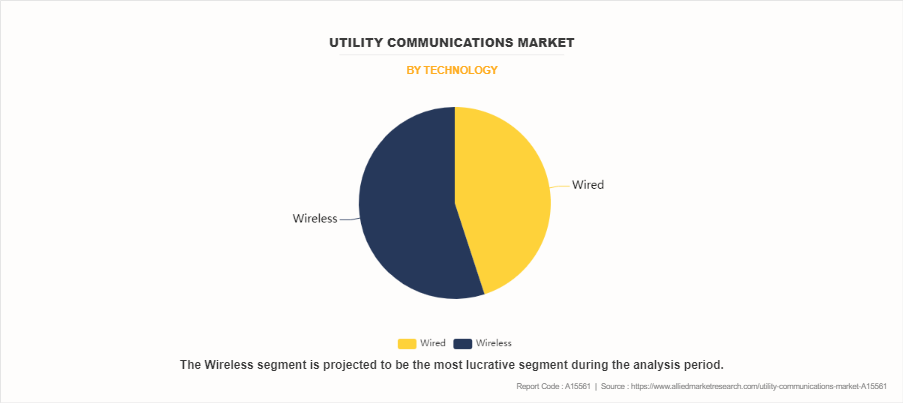

The wireless segment is expected to dominate the utility communications market based on technology. In 2023, it accounted for over half of the global market revenue and is projected to maintain its leading position through the forecast period, growing at a CAGR of 5.6% from 2024 to 2033. As utility infrastructure becomes more complex, the need for seamless communication between different components increases. Wireless communication offers a reliable and efficient way to connect devices and systems, allowing utilities to gather data from diverse sources and enable real-time monitoring and control. This technology also facilitates remote monitoring and control of utility assets such as power grids, water distribution systems, and gas pipelines, helping utilities manage infrastructure effectively, promptly identify issues, and respond quickly to ensure uninterrupted services.

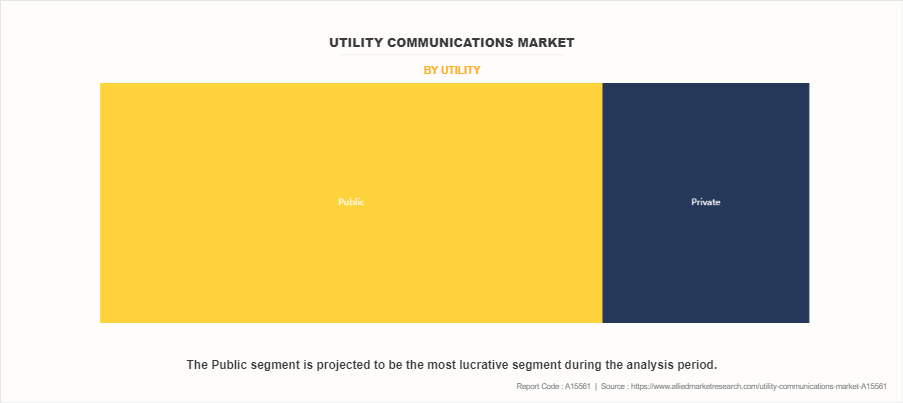

The public segment will continue to lead the utility communications market based on utility. In 2023, it contributed to over two-thirds of global market revenue and is expected to maintain this position through the forecast period. The integration of advanced technologies and the rise of smart grids and meters have increased the complexity of the utility industry, necessitating robust communication networks for data exchange, remote monitoring, and control of assets. The growing demand for public utility communications stems from the need to manage this complexity effectively. Meanwhile, the private segment is projected to grow at a CAGR of 5.8% from 2024 to 2033, offering higher security levels for critical infrastructure and sensitive data, reducing cyber threats and unauthorized access risks.

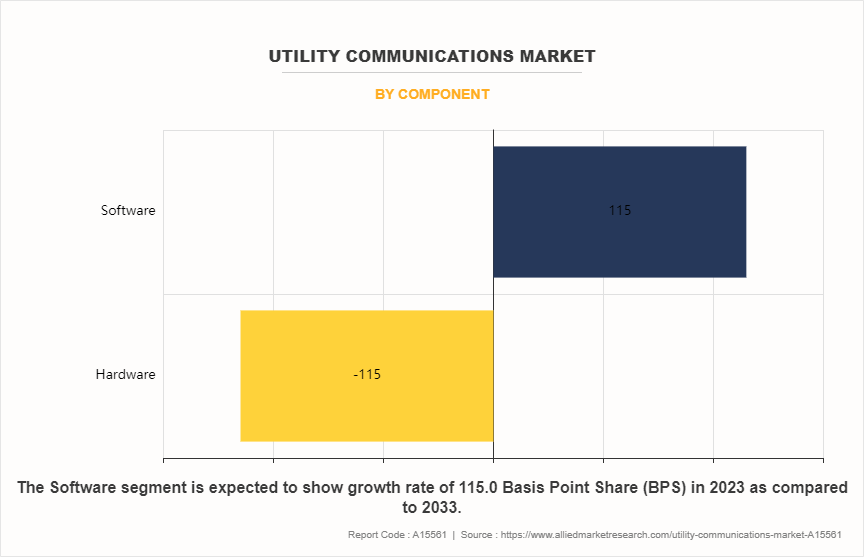

The software segment will continue to dominate the utility communications market based on component. In 2023, it accounted for more than half of the global market revenue and is projected to maintain this position, growing at a CAGR of 5.7% from 2024 to 2033. Software platforms enable utilities to gather real-time consumption data, monitor energy usage patterns, and provide accurate billing information to customers. They also facilitate efficient data management, storage, and analysis, allowing utilities to derive valuable insights, optimize operations, and make informed decisions.

The power generation segment will remain the largest application segment in the utility communications market. In 2023, it contributed to more than three-fifths of global market revenue and is projected to maintain this position, growing at a CAGR of 5.5% from 2024 to 2033. Utility communications are crucial for efficient and reliable communication across various aspects of the power generation process. These systems enable information exchange between power plants, grid operators, and transmission networks, supporting grid stability, load balancing, and efficient power dispatch.

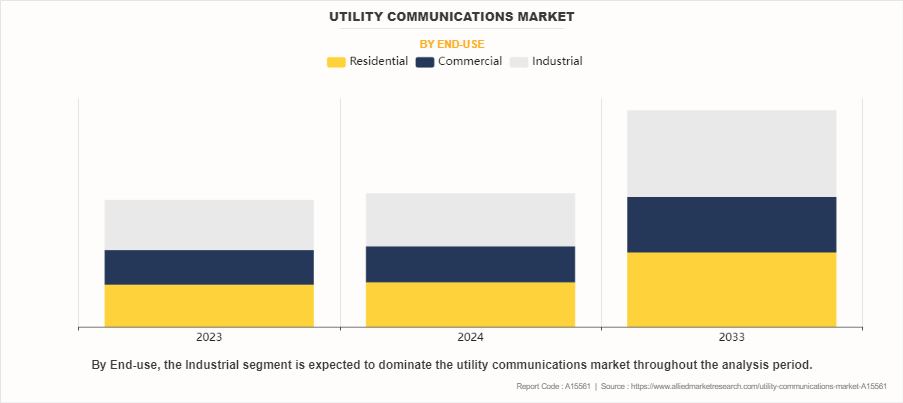

The industrial segment will continue to lead the utility communications market based on end-use. In 2023, it accounted for more than one-third of global market revenue and is projected to maintain this position, growing at a CAGR of 5.6% from 2024 to 2033. Utility communications are vital for process control and automation in industrial operations, connecting control systems, sensors, actuators, and other devices. This connectivity enables real-time monitoring and control of industrial processes, improving efficiency, enhancing safety, and optimizing process control.

Competitive Analysis

Key players in the utility communications industry include General Electric, Omicron, Hitachi, Ltd., Rad, Schneider Electric SE, Cisco Systems, Inc., ABB, Milsoft Utility Solutions, Motorola Solutions, Inc., and Itron Inc. Nowadays, the key manufacturers operating in the utility communications market have adopted strategies such as product innovation, joint venture, expansion, partnership, agreement, investment, and collaboration to increase their market share. For instance, in 2023, General Electric signed a collaboration agreement with Amazon Web Services (AWS) to help utilities accelerate grid modernization. Through this collaboration, GE Digital and AWS are planning to deliver intelligent grid orchestration solutions. These software solutions help utilities digitally transform, modernize the power grid, and accelerate the energy transition.

Key Benefits For Stakeholders

- The utility communications market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the utility communications market analysis from 2023 to 2033 to identify the prevailing utility communications market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the utility communications market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global utility communications market trends, key players, market segments, application areas, utility communications market statistics, and market growth strategies.

Utility Communications Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 47.3 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 327 |

| By Technology |

|

| By Utility |

|

| By Component |

|

| By Application |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Itron Inc., Hitachi, Ltd., Motorola Solutions, Inc., Cisco Systems, Inc., ABB, Milsoft Utility Solutions, General Electric Company, Schneider Electric, Rad, OMICRON |

Analyst Review

According to the opinions of various CXOs of leading companies, the utility communications market is expected to witness increased demand during the forecast period due to surge in demand for smart grid infrastructure. Smart grid infrastructure enables utilities to engage customers by providing real-time energy usage data, personalized insights, and energy management tools. Utility communications facilitate the secure transmission of customer data, billing information, and energy usage notifications, enabling utilities to deliver improved customer experiences and promote energy conservation.

Smart grid infrastructure requires robust cybersecurity measures to protect against cyber threats and ensure the privacy of customer data. Utility communications play a vital role in establishing secure communication networks, implementing encryption protocols, and monitoring network security to safeguard critical infrastructure and customer information.

The utility communications market was valued at $27.7 billion in 2023, and is estimated to reach $47.3 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

The increasing adoption of renewable energy sources is anticipated to drive market growth throughout the forecast period. Installations of renewable energy, such as solar farms and wind turbines, typically cover vast areas.

Power Generation is the leading application of Utility Communications Market.

Asia-Pacific is the largest regional market for Utility Communications.

Key players in the utility communications industry include General Electric, Omicron, Hitachi, Ltd., Rad, Schneider Electric SE, Cisco Systems, Inc., ABB, Milsoft Utility Solutions, Motorola Solutions, Inc., and Itron Inc.

Loading Table Of Content...

Loading Research Methodology...