Utility Poles Market Overview

The global utility poles market was valued at USD 51.5 billion in 2022, and is projected to reach USD 67 billion by 2032, growing at a CAGR of 2.7% from 2023 to 2032. Rapid industrialization and modernization have led to an increase in demand for power which has a significant positive impact on the utility poles industry. Furthermore, the increased adoption of sustainable power generation and the development of smart cities across the world create attractive opportunities for the expansion of the utility poles market.

Key Market Insight

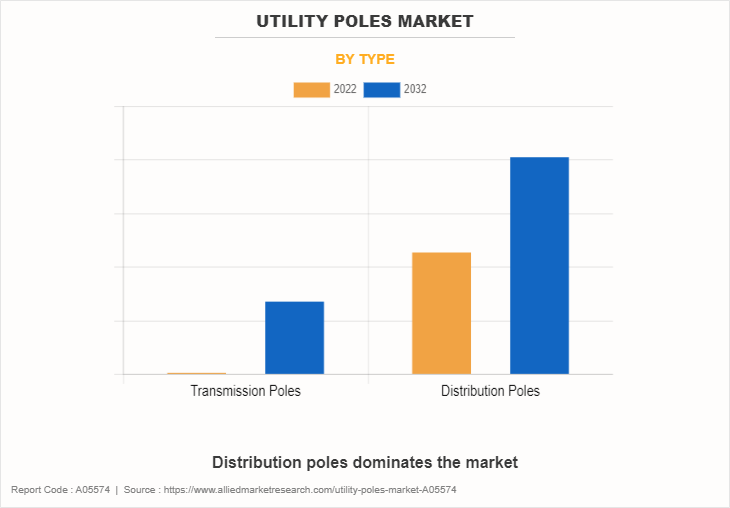

Type: Distribution poles dominated the market, holding over three-fifths share in 2022.

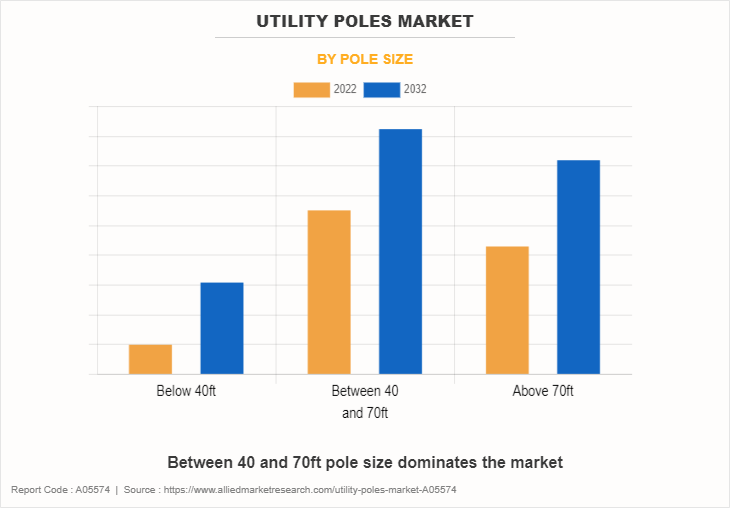

Pole Size: Below 40ft poles are the fastest-growing segment with a CAGR of 3.1% (2023–2032).

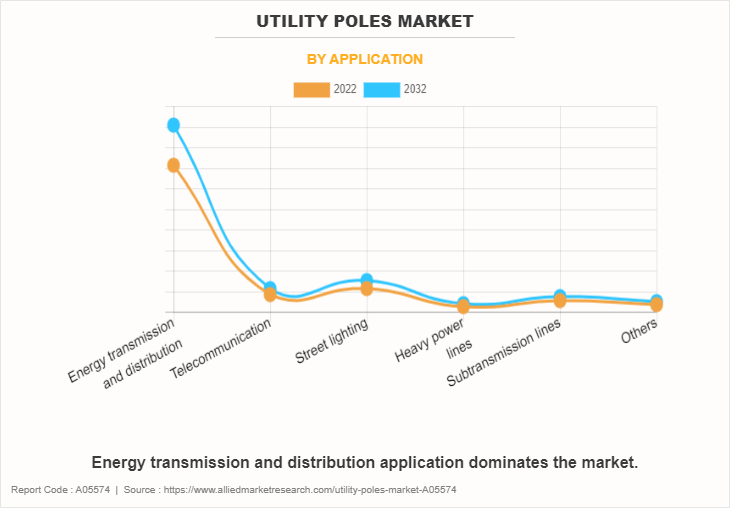

Application: Energy transmission & distribution led the market with over two-thirds share in 2022.

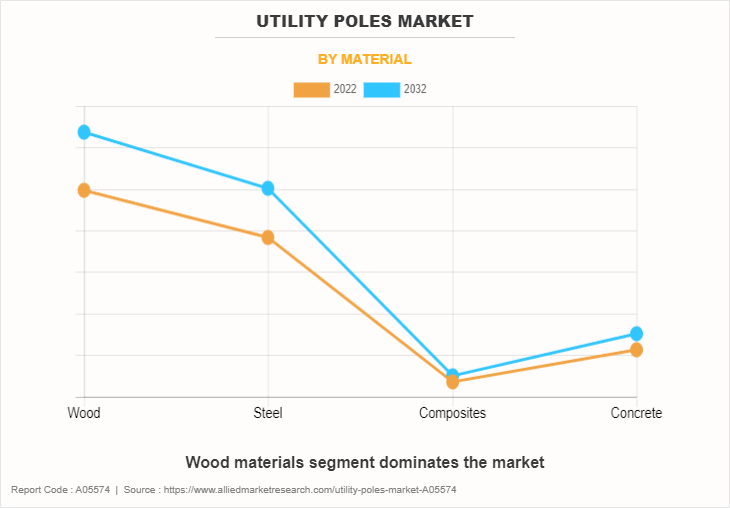

Material: Steel poles are projected to grow steadily at a CAGR of 2.7% during the forecast period.

Region: Asia-Pacific captured the largest revenue share in 2022.

Market Size & Forecast

- 2032 Projected Market Size: USD 67 billion

- 2022 Market Size: USD 51.5 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 2.7%

Key Takeaways

The utility poles market is highly fragmented, with several players including Stella-jones Inc., El Sewedy Electric Company, Fuchs Europoles GmbH, RS Technologies Inc., Omega Factory, Nippon Concrete Industries Co., Ltd., Hill & Smith Holdings Plc, Valmont Industries Inc., Skipper Ltd., Pelco Products Inc.

More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value utility poles market statistics and industry insights.

- The study covers more than 20 countries across the world in terms of value and market price analysis during the forecast period 2022-2032 is covered in the utility poles market forecast report.

Market Dynamics

The primary catalysts for the expansion of the utility poles market growth is the escalating demand for efficient and reliable support structures for overhead power lines and telecommunication cables. As urbanization and population growth persist, there is a corresponding surge in the need for robust utility poles to ensure the seamless transmission of electricity and data.

The global shift towards renewable energy sources also significantly influences the utility poles market. As renewable energy projects, such as wind and solar farms, become more prevalent, there is a growing demand for sturdy and adaptable utility poles that can support the necessary infrastructure. These poles must withstand various environmental conditions and provide a reliable foundation for the transmission of renewable energy to the grid.

Versatility is a key feature driving the widespread adoption of utility poles across different applications. These poles are utilized not only for power distribution but also for supporting telecommunication equipment, street lighting, and other urban amenities. The diverse range of materials and designs available in the market allows for tailored solutions to meet specific requirements, contributing to the flexibility and adaptability of utility pole installations.

Despite the evident advantages, challenges exist within the utility poles market. The fluctuating prices of raw materials, such as wood, steel, and concrete, can impact production costs and overall market dynamics. Additionally, ensuring the structural integrity and safety of utility poles is paramount, given their critical role in supporting essential services. Any failure in utility pole infrastructure can have significant consequences for both power distribution and communication networks.

Ongoing research and development efforts in the utility poles sector aim to enhance manufacturing processes and explore alternative materials. Innovations in pole design, treatment technologies, and testing methodologies seek to improve the longevity, resilience, and cost-effectiveness of utility poles. These advancements align with the global push for sustainable and resilient infrastructure, ensuring that utility poles continue to play a crucial role in supporting the evolving needs of modern society. As the demands on utility networks evolve, the utility poles market remains dynamic, contributing to the advancement of reliable and efficient infrastructure systems.

Market Segmentation

The global utility poles market overview is segmented based on type, material, pole size, application, and region. By type, the market is divided into transmission poles and distribution poles. On the basis of the material, it is segmented into wood, steel, composites, and concrete. Depending on pole size, the market is categorized into below 40ft, between 40 & 70ft, and Above 70ft. On the basis of application, the market is categorized into electric transmission & distribution, telecommunication, street lighting, heavy power lines, sub-transmission lines, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Based on type, the distribution poles segment held the highest market share in 2022, accounting for more than three-fifths of the utility poles market size, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the transmission poles segment is projected to manifest a fastest growing type during the forecast period. The demand for transmission poles is on the rise due to factors such as increasing energy consumption, renewable energy expansion, infrastructure development, grid modernization, replacement of aging infrastructure, government initiatives, grid interconnectivity, and technological advancements.

By Material

Based on material, wood segment held the highest market share in 2022, accounting for nearly half of the utility poles market share, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the steel segment is projected to manifest fastest growing CAGR during the forecast period. Steel utility poles are gaining popularity due to their durability, strength, and resilience. They are resistant to environmental elements like corrosion, pests, and weathering, ensuring a longer lifespan and reduced maintenance costs. Steel poles are suitable for supporting heavy equipment and power lines, especially in extreme weather conditions.

By Size

Based on the pole size, the between 40 and 70ft segment held the highest market share in 2022, accounting for more than two-fifths of the utility poles market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, above 70ft utility poles segment is the fastest growing pole size in the forecast period. Utility poles above 70 ft are highly sought after for their efficiency in high voltage transmission, urbanization, infrastructure development, renewable energy integration, grid resilience, load-bearing capacity, long-term investment, and global connectivity, making them a sustainable and cost-effective solution for future power demand increases.

By Application

Based on the application, the energy transmission and distribution segment held the highest market share in 2022, accounting for more than two-third of the utility poles market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, street lighting segment is fastest growing application during the forecast period. The demand for street lighting utility poles has surged due to factors such as rapid urbanization, population growth, road safety, city beautification, crime deterrence, energy efficiency, smart city initiatives, infrastructure upgrades, and government regulations. Utility poles play a crucial role in enhancing visibility, traffic management, and security in public spaces.

By Region

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2022, accounting for more than two-fifths of the utility poles market revenue, and is likely to dominate the market during the forecast period. The Asia-Pacific region is experiencing a surge in demand for utility poles due to urbanization, infrastructure development, population growth, government initiatives, renewable energy integration, natural disasters, electrification of rural areas, and technological advancements, supporting efficient transmission and distribution of electricity in rural areas.

Competitive Analysis & Development

The major players operating in the utility poles market are Stella-jones Inc., El Sewedy Electric Company, Fuchs Europoles GmbH, RS Technologies Inc., Omega Factory, Nippon Concrete Industries Co., Ltd., Hill & Smith Holdings Plc, Valmont Industries Inc., Skipper Ltd., Pelco Products Inc.

In September 2022, Stella-Jones signed a definitive agreement to acquire substantially all of the assets employed in the wood utility pole manufacturing business of Texas Electric Cooperatives, Inc. (TEC) for a total purchase price of $28 million, along with inventories of approximately $4 million.

In November 2021, Stella-Jones Inc., through a subsidiary in the U.S., completed the previously disclosed acquisition of the shares of Cahaba Pressure Treated Forest Products, Inc. The total purchase price, which included working capital worth an estimated $8 million, was $66 million.

Key Benefits for Stakeholders

- This market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the utility poles market analysis from 2022 to 2032 to identify the prevailing utility poles market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the utility poles market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as utility poles market trends, key players, market segments, application areas, and market growth strategies.

Utility Poles Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 67 billion |

| Growth Rate | CAGR of 2.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 256 |

| By Pole Size |

|

| By Application |

|

| By Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | Omega Factory, Stella-Jones Inc., El Sewedy Electric Company, Nippon Concrete Industries Co., Ltd., RS Technologies Inc., Hill & Smith Holdings Plc, Skipper Ltd, pelco products, inc., Fuchs Europoles GmbH, Valmont Industries, Inc. |

Analyst Review

According to CXOs of the leading companies, the global utility poles market is highly mature and it is expected to report moderate growth during the forecast period. Traditionally, only wood poles were used in the utility sector, which is now gradually replaced by steel poles. Especially, after the steel’s material profile was approved as a green material in 2013. Now, poles made from composite material are showing better benefits over both steel and wood poles and the global market could see a possibility of composite poles replacing steel poles after the next 20 years. This is mainly due to the longest lifespan and better benefits offered by composite poles. However, the current utility poles market is mainly dominated by wood and steel poles and their demand is growing significantly across the globe. An increase in energy consumption and expansion of existing electricity infrastructure are the major forces that surge the growth opportunities of this market.

Governments from underdeveloped or developing countries are mainly looking forward to increasing the electricity access rate, which requires heavy investment in the utility sector to set up overall electricity infrastructure. Therefore, countries such as Brazil, Nigeria, and Africa are expected to witness new investment in utility infrastructure in the coming years.

The primary application driving the utility poles market is energy transmission and distribution.

Upcoming trends in the global utility poles market include the integration of smart poles, adoption of sustainable materials, renewable energy integration, modernization and grid upgrades, as well as the development of resilient and durable designs.

Asia-Pacific stands as the leading regional market in the global utility poles industry.

$67 billion is the estimated industry size of utility poles market in 2032.

Stella-jones Inc., El Sewedy Electric Company, Fuchs Europoles GmbH, RS Technologies Inc., Omega Factory, Nippon Concrete Industries Co., Ltd., Hill & Smith Holdings Plc, Valmont Industries Inc., Skipper Ltd., Pelco Products Inc. are the top companies to hold the market share in utility poles market.

Loading Table Of Content...

Loading Research Methodology...