Utility Terrain Vehicle Market Overview

The global utility terrain vehicle market size was valued at USD 1 billion in 2022, and is projected to reach USD 1.8 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

A utility terrain vehicle (UTV), also commonly referred to as a utility task vehicle or side-by-side (SxS), is a type of off-road vehicle designed for various utility and recreational purposes. UTVs are similar in appearance to small dune buggies or golf carts but are specifically engineered for rugged outdoor environments. UTVs typically feature side-by-side seating, accommodating 2 to 4 passengers. This seating arrangement facilitates communication and interaction among occupants.

They usually have features like sturdy suspension systems, durable frames, and high ground clearance to navigate rough trails, rocky terrain, mud, and other obstacles. UTVs are equipped with powerful engines that provide the necessary torque and horsepower to handle demanding tasks, whether it's towing, hauling, or navigating steep inclines.

UTVs have gained significant popularity as recreational vehicles, appealing to outdoor enthusiasts, off-road adventurers, and families looking for outdoor activities. Their versatility, ruggedness, and ability to traverse challenging terrains make them an attractive choice for recreational purposes. Moreover, UTVs offer the opportunity for families to engage in outdoor adventures together. They typically come with multiple seats, allowing parents to take their children along for the ride. The safety features and adjustable seating options make UTVs an appealing option for family-oriented outdoor experiences. Furthermore, the UTV market offers a plethora of aftermarket parts and accessories, allowing owners to personalize their vehicles according to their preferences and needs. This customization aspect has attracted a community of hobbyists who enjoy upgrading and modifying their UTVs for specific recreational activities.

Utility terrain vehicle industry provide a platform for social interactions and group activities. Enthusiast communities often organize group rides, events, and rallies, fostering a sense of camaraderie among riders who share a passion for outdoor exploration and off-road adventures. Furthermore, the overall trend of people seeking outdoor recreational activities has boosted the demand for vehicles like UTVs. The UTV market's growth in recreational use can be attributed to UTV’s versatility, family-friendly nature, customization options, social aspects, accessibility, effective marketing, alignment with outdoor trends, economic factors, and technological advancements. These factors collectively contribute to UTVs' appeal to a wide range of consumers seeking exciting outdoor experiences.

Stricter emission regulations, especially those related to off-road vehicles, can impact the design and production of UTVs. Meeting these regulations might require manufacturers to invest in cleaner engine technologies or alternative fuel sources, which could increase manufacturing costs. Moreover, these regulations might also influence the performance characteristics of UTVs, potentially affecting their power and efficiency.

Moreover, UTV regulations and safety standards can vary between different regions and countries. Manufacturers operating in international markets might need to adapt their designs and production processes to comply with a multitude of regulatory frameworks, adding complexity and cost to their operations. Additionally, ensuring compliance with safety standards might lead to longer development cycles, impacting time-to-market for new UTV models. Higher manufacturing costs due to regulatory compliance can potentially affect the accessibility of UTVs to a wider range of consumers. If prices increase significantly, it might limit the affordability of UTVs for certain market segments.

Incorporating advanced technology features such as GPS navigation, touchscreen displays, smartphone integration, advanced suspension systems and telematics could enhance the appeal of UTVs to tech-savvy consumers. Moreover, smartphone integration can allow users to connect their devices to the UTV, enabling features like hands-free calling, music streaming and even vehicle diagnostics. This enhances safety by reducing distractions and adds convenience for users who want to stay connected while on the go. Advanced suspension systems can be integrated with sensors and actuators to adapt to different terrains automatically.

This enhances the vehicle's performance by optimizing suspension settings in real-time, providing a smoother and more controlled ride. Furthermore, UTV manufacturers can use technology integration as a unique selling proposition. Vehicles equipped with advanced technology features stand out in the market and can attract tech-savvy consumers looking for modern and feature-rich options. Furthermore, the integration of technology can expand the potential customer base for UTVs. It can attract not only traditional off-road enthusiasts but also those who value technology and connectivity in their outdoor activities.

Key Market Players

The key players profiled in this report include Polaris Industries (U.S.), John Deere (U.S.), Kawasaki (Japan), Yamaha Motor (Japan), Kubota (Japan), Arctic Cat (U.S.), Honda (Japan), Bombardier Aerospace (U.S.), Suzuki (Japan), and Tomcar (U.S.)

Investment and agreement are common strategies followed by major market players. For instance, in August 2020, Polaris Inc. announced the launch of new ATVs, Sportsman 570 and Sportsman 450 H.O. The launch helped the company to improve its product portfolio and cater to consumer demands.

Segment Overview

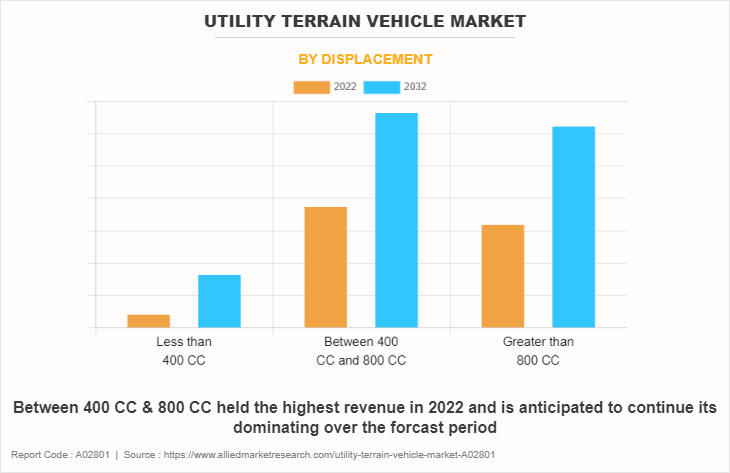

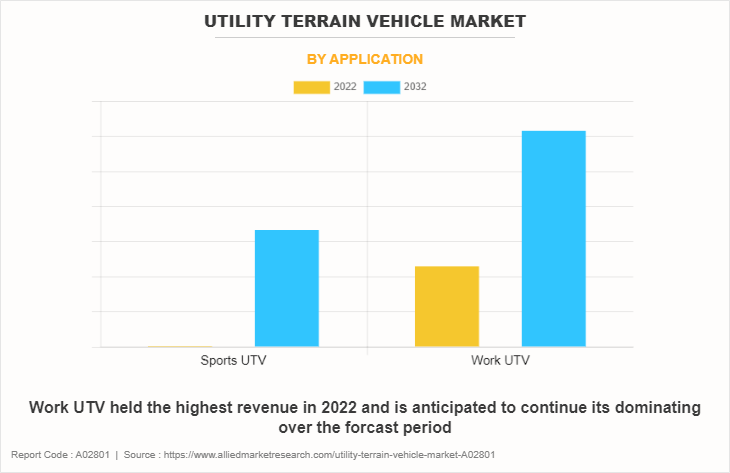

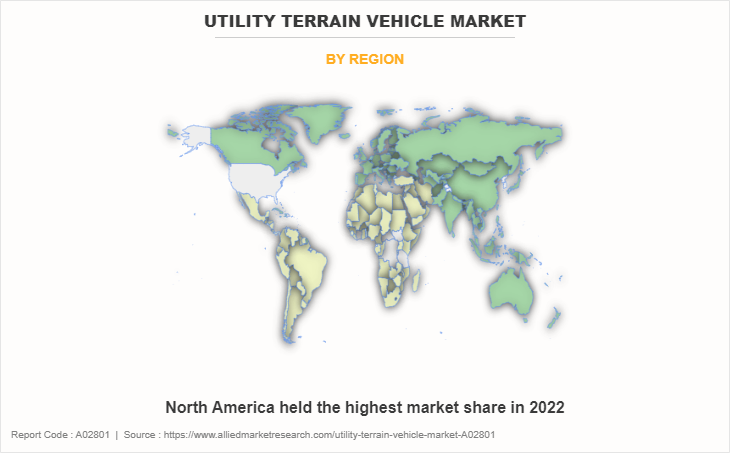

The utility terrain vehicle market is segmented on the basis of displacement, application, and region. By displacement, the market is divided into Less than 400 CC, Between 400 CC and 800 CC, and Greater than 800 CC . By application, the market is classified into sport UTV and work UTV. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The utility terrain vehicle market is segmented into Displacement and Application.

By displacement, the Between 400 CC & 800 CC sub-segment dominated the market in 2022. UTVs in the 400-800 CC segment are versatile and can be used for a variety of purposes. They are used in agriculture, construction, hunting, and recreational activities, making them attractive to a broad customer base. Many consumers purchase UTVs for recreational purposes, such as off-roading, trail riding, and dune bashing. The 400-800 CC segment provides a balance between power and affordability, making these UTVs accessible to adventure enthusiasts. Moreover, UTVs are commonly used on farms, ranches, and construction sites for hauling, towing, and transportation.

The 400-800 CC UTVs offer enough power to handle these tasks efficiently. In some regions, regulations classify UTVs with engine displacements below 800 CC as off-highway vehicles, which can be driven without a driver's license in certain situations. This eases accessibility and attracts a wider customer base. Furthermore, UTVs in this segment are often more affordable than larger and more powerful models. This pricing makes them accessible to a wider range of consumers, including those who are cost-conscious. The UTV market is influenced by changing demographics, with more families and individuals seeking outdoor and recreational activities. The 400-800 CC UTVs are well-suited to accommodate these trends.These are predicted to be the major factors affecting the utility terrain vehicle market size during the forecast period.

By application, the work UTV sub-segment dominated the global utility terrain vehicle market share in 2022. Work UTVs are valued for their ability to handle a wide range of tasks across industries such as agriculture, construction, forestry, landscaping, and more. They can carry heavy loads, tow equipment, and navigate challenging terrains, making them indispensable for various work-related applications. Work UTVs are built to withstand demanding environments. They are designed with robust chassis, suspension systems, and drivetrains that can handle heavy workloads and rough terrains without compromising performance. Many manufacturers offer a variety of customization options for work UTVs. This allows businesses to tailor the vehicles to their specific needs, whether it is adding specialized attachments, cargo beds, or other accessories that enhance productivity.

In industries where larger equipment might be too costly to operate or not practical for certain tasks, work UTVs offer a cost-effective solution. They consume less fuel, have lower maintenance costs, and require less storage space compared to larger machinery. Increasing regulations around emissions and noise levels in certain work environments have led businesses to consider UTVs as a more environmentally friendly option compared to larger, more traditional equipment. Work UTVs also appeal to outdoor enthusiasts who require a vehicle that can transition between work and recreational use. This crossover appeal has contributed to the popularity of work UTVs.

By region, North America dominated the global market in 2022. North America has been one of the major regions driving the utility terrain vehicle (UTV) market. UTVs are popular for recreational activities such as trail riding, off-roading, and outdoor adventures. North America's vast landscapes, including forests, deserts, mountains, and trails, provide ample opportunities for enthusiasts to use UTVs for leisure activities. Many rural areas in North America rely on UTVs for agricultural tasks, ranching, and other outdoor work. UTVs offer the ability to transport equipment, tools, and materials across challenging terrains, making them essential for various agricultural and utility-related tasks.

The outdoor and adventure-oriented lifestyle is deeply ingrained in North American culture. This has contributed to the popularity of recreational vehicles like UTVs among individuals and families looking to explore and experience nature. North America has a strong off-road and powersports community that supports the UTV market. Off-road events, clubs, and gatherings further contribute to the popularity and growth of the UTV industry. UTV manufacturers continually introduce new models with advanced features, better performance, and enhanced safety measures. This constant innovation and competition in the market attract consumers who are interested in the latest technology and capabilities.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the utility terrain vehicle market analysis from 2022 to 2032 to identify the prevailing utility terrain vehicle market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the utility terrain vehicle market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global utility terrain vehicle market trends, key players, market segments, application areas, and market growth strategies.

Utility Terrain Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.8 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Displacement |

|

| By Application |

|

| By Region |

|

| Key Market Players | Textron Inc., KWANG YANG MOTOR CO., LTD., BRP Inc., Deere & Company, CFMOTO Powersports Inc., Honda Motor Co., Ltd., Hisun Motors Corp., Ltd., KUBOTA Corporation, Yamaha Motor Co., Ltd., Suzuki Motor Corporation, Kawasaki Heavy Industries Ltd., Polaris Industries Inc. |

The global utility terrain vehicle market size was valued at $1 billion in 2022, and is projected to reach $1.8 billion by 2032.

The global utility terrain vehicle market is projected to grow at a compound annual growth rate of CAGR of 5.5% from 2023 to 2032 to reach $1.8 billion by 2032.

The key players that operate in the utility terrain vehicle market such as Polaris Industries (U.S.), John Deere (U.S.), Kawasaki (Japan), Yamaha Motor (Japan), Kubota (Japan), Arctic Cat (U.S.), Honda (Japan), Bombardier Aerospace (U.S.), Suzuki (Japan), and Tomcar (U.S.).

North America is the largest regional market for utility terrain vehicle.

The UTV market is influenced by changing demographics, with more families and individuals seeking outdoor and recreational activities. The 400-800 CC UTVs are well-suited to accommodate these trends. These are predicted to be the major factors affecting the utility terrain vehicle market size during the forecast period.

Loading Table Of Content...

Loading Research Methodology...