V2X Cybersecurity Insights, 2031

The global V2X cybersecurity market size was valued at USD 0.72 billion in 2021, and is projected to reach USD 5.7 billion by 2031, growing at a CAGR of 21.6% from 2022 to 2031. Factors such increase in cybersecurity mandates, advancement in Cellular-V2X (C-V2X) technology, and growing automotive cybersecurity threat are anticipated to boost the growth of the global V2X cybersecurity market during the forecast period. However, challenges in making secure applications, and high cost of implementation are expected to hinder the growth of the global market during the forecast period. Moreover, increase in demand for connected vehicles, and enhancing vehicle security using adaptive security is expected to create an opportunity for the V2X cybersecurity industry in near future.

Key Market Trends

- On-board unit segment is expected to witness significant growth in the coming years.

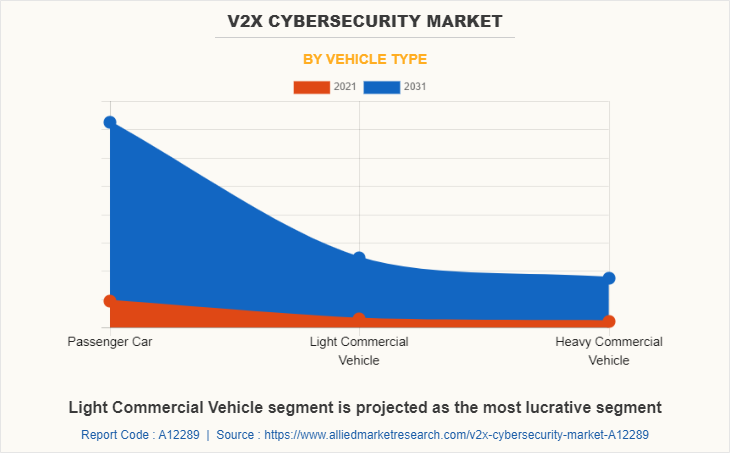

- Light commercial vehicles are projected to lead the global V2X cybersecurity market.

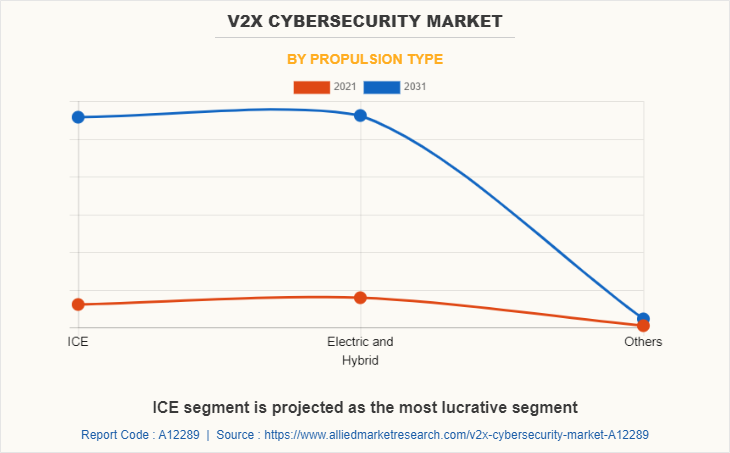

- ICE propulsion vehicles are anticipated to dominate the V2X cybersecurity market.

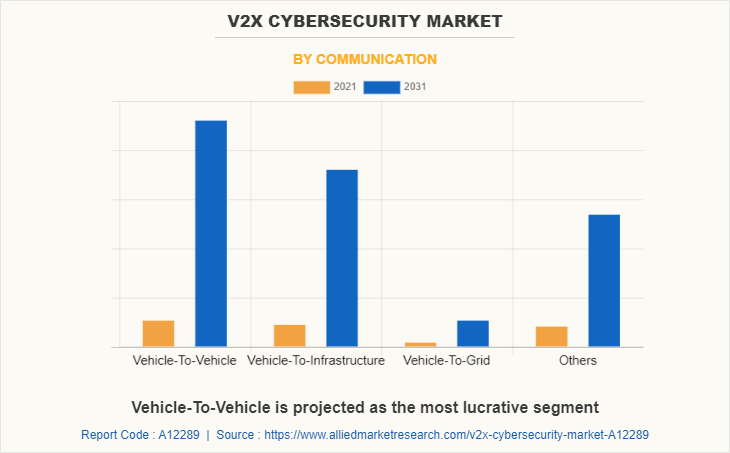

- Vehicle-to-Vehicle (V2V) communication is expected to hold the leading market share.

- Asia-Pacific region is forecasted to record the highest CAGR during the period.

Market Size & Forecast

- 2031 Projected Market Size: USD 5.7 billion

- 2021 Market Size: USD 0.72 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 21.6%

Introduction

Vehicle-to-everything (V2X) is a communication technology that allows a vehicle to communicate with other vehicles, road users, and infrastructure. The major purpose of V2X technology is to improve road safety, energy savings, and traffic efficiency on roads. The key components of V2X include vehicle-to-vehicle (V2V) & vehicle to- infrastructure (V2I), vehicle-to-pedestrian (V2P), vehicle-to-grid (V2G), vehicle-to-cloud (V2C), and vehicle to- device (V2D) communication systems. With the introduction of connected technology in new-generation vehicles the chance of cyber-attack is also increases. Events, such as unauthorized access to multiple vehicle connectivity solutions or breaking into the in-vehicle connectivity system has created the demand for V2X cybersecurity market. Moreover, there is an increased investment in the production of connected vehicles thus, increase in the demand for V2X cybersecurity. V2X cybersecurity requires external cloud services due to continuously changing security protocols & cloud updates to store data and provide better security.

The Covid-19 pandemic has brought about marked changes in consumer habits and behaviors. Covid-19 is accelerating the development of autonomous vehicles, connected mobility and smart cities across the world, creating the new opportunities for the automotive industry and related intelligent solutions including V2X have stood out. For instance, Baidu, one of the leaders in autonomous and connected vehicle technology, has released 104 driverless vehicles in 17 cities across the China. These autonomous vehicles are helping carry out frontline anti-epidemic work such as cleaning, disinfecting, logistics, and transportation.

In addition, Baidu Apollo has won bids to build V2X pilot zones in Chongqing’s Yongchuan district, Shanxi province’s Yangquan city, and Anhui province’s Hefei city. A V2X pilot zone within 20 square kilometers of Yongchuan district in Chongqing, is testing level-4 autonomous vehicles, which can drive almost all the time without human control.

Therefore, demand for autonomous and connected vehicles in emergency services are expected to the act as a positive impact on automotive industry in post COVID scenario. COVID-19 has impacted the operations of many OEMs, from production to R&D. While industry participants might see short-term disruption to autonomous vehicles (AV) development and roll-outs, this disruption may propel the adoption of V2X technology within the consumer segments and accelerate adoption in various commercial segments, which in turn will create an opportunity for V2X cybersecurity market.

Market Segmentation

V2X cybersecurity market is segmented basis of unit type, vehicle type, propulsion type, communication, and region. On the basis of unit type, it is divided into on-board unit, and roadside unit. By vehicle type, it is segmented into passenger car, light commercial vehicle, and heavy commercial vehicle. By propulsion type, it is divided into ice, electric & hybrid, and others. By communication, it is divided into Vehicle-To-Vehicle (V2V), Vehicle-To-Infrastructure (V2I), Vehicle-To-Grid (V2G), and Others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Top V2X Cybersecurity companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the V2X cybersecurity industry.

- Altran

- APTIV

- AUTOCRYPT Co., Ltd.

- Autotalks Ltd.

- Continental AG

- ESCRYPT

- Green Hills Software LLC

- HARMAN International

- ID Quantique SA

- Infineon Technologies AG

- Karamba Security

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- SafeRide Technologies

- Vector Informatik GmbH

What are the Top Impacting Factors

Key Market Driver

Increase in Cybersecurity Mandates

In recent years, the issue of V2X cybersecurity market has gained importance in automotive industry, and this trend is projected to continue in the future. The World Forum for Harmonization of Vehicle Standards (WP.29) of the United Nations Economic Commission for Europe (UNECE) has established two new regulations that require cybersecurity when new vehicle types are approved. The rules apply to passenger cars, trucks, buses, and vans, and include specifications for four distinct areas: managing cyber-attacks in automobiles, securing vehicles by design to reduce risks throughout the value chain, detecting and responding to security issues across a fleet of vehicles, as well as providing safe and secure software upgrades and maintaining vehicle safety, as well as establishing a legal framework for over-the-air updates to on-board vehicle software.

From July 2024, the new cybersecurity law will be mandatory for all new vehicle types in the European Union. Moreover, various countries across the globe are developing new rules for automotive cybersecurity For instance, South Korea and Japan are attempting to establish cybersecurity rules. Furthermore, the automotive industry is developing ISO/SAE 21434, Road vehicles – Cybersecurity engineering standard within the International Organization for Standardization (ISO) and the Society of Automotive Engineers (SAE). The standard implementation is intended to assist manufacturers in keeping up with evolving technology and cyber-attack strategies. Hence, the increase in cybersecurity regulations in the automotive sector is expected to fuel growth of the global V2X cybersecurity market during the forecast period.

Advancement in Cellular-V2X (C-V2X) Technology

Artificial intelligence (AI) and 5G have an important role in the future of the automotive industry as predictive capabilities are becoming more prevalent in cars, personalizing the driving experience. In addition, 5G and AI is better equipped with V2X cybersecurity market to carry out critical communications for safer & secure driving. Moreover, Cellular-V2X is a key contributor to the expansion of vehicle automation by establishing lines of communication between vehicles, roadside units and pedestrians, making the vehicle more aware of its surroundings.

The C-V2X technology is also designed to be compatible with upcoming 5G network technologies, which will further enable the mission-critical V2X cybersecurity market communications and expected to act as ultimate platform to enable the Cooperative Intelligent Transport Systems (C-ITS) services. Thus, the rapidly emerging use cases include autonomous driving, platooning, vehicle safety and traffic efficiency expected to offer lucrative growth opportunities for automotive C-V2X. Also, the growing interest among the government agencies, automakers and mobile operators to conduct extensive tests & trails of C-V2X along with 5G connectivity are opening the future growth opportunities for V2X cybersecurity market.

For instance, in January 2018, Continental, Ericsson, Nissan, NTT DOCOMO, OKI and Qualcomm Technologies, announced plans to carry out Cellular Vehicle-to-Everything (C-V2X) trials in Japan. In addition, in January 2019, a leading automaker Ford, has announced to deploy 5G enabled C-V2X in all their new vehicle models in the U.S. in 2022. Though, the C-V2X provides significant mobility benefits and transportation safety, it also vulnerable to cyber-attacks that could impact the user privacy, traffic and vehicle safety. The successful attacks on communications infrastructure can affect all endpoints, including vehicles. Owing to all these factors, the demand for V2X cybersecurity market is expected grow significantly during the forecast period.

Restraints

Challenges in Making Secure Applications

The ability to enable 3rd party applications and services that may be pre-installed or added by car users is one of the benefits of shifting to Linux-based platforms. While this offers numerous potential benefits for all parties involved, it also opens up new attack avenues. Over the years, experts have witnessed disastrous effects of developers putting harmful code inside applications and making them downloadable in the desktop and mobiles from rendering devices unusable to ransomware assaults. Although OEMs can check which services and applications are offered to vehicles, black hat hackers will concentrate their efforts in this area if they use platforms that are well-known to them. According to the Upstream Security, around 13% of automotive cyber-attacks reported in 2019 were led by means of mobile applications. Rise in attacks on automobiles through vulnerable mobile applications is anticipated to obstruct growth the global V2X cybersecurity market during the forecast period.

Opportunity

Increase in Demand for Connected Vehicles

Connected vehicles enable cars to communicate via V2X platform with drivers, other vehicles, road infrastructure, and the cloud. These services allow automotive dealers, fleet operators, and drivers to optimize resource usage, improve safety, and automate certain driver functions, while generating valuable data including vehicle performance and road conditions.

Connected vehicles work by collecting information from their surroundings and communicating it to each other, as well as intelligent transportation infrastructure and provide transport authorities with real-time traffic data for better road management and improved infrastructure planning. Thus, increase in the demand for connected car services is majorly due to the demand for basic vehicle connectivity applications, such as real time updates, navigation, and in-car infotainments. Moreover, increasing demand for connectivity solutions, rise in the demand for an enhanced driving experience, and introduction of internet of things (IoT) in the automotive industry are the other key factors that are contributing toward the adoption of connected car.

Moreover, connected car services are important for development of autonomous vehicles. The United States Department of Transportation (USDOT) is dedicated to developing a new way of transportation, innovation, and safety while ensuring the country's position as an automation leader. Hence, to assist the safe development, testing, and integration of connected vehicle technologies, the USDOT is acting as a convener and facilitator, engaging with a broad coalition of industry, academic, state and municipal, safety advocacy, and transportation partners.

The Automated Vehicles Comprehensive Plan was produced by USDOT in January 2021, with the purpose of enhancing the Department's efforts to prioritize safety while planning for the future of transportation. The plan specifies three aims to realize this vision for Automated Driving Systems (ADS): prepare the transportation system, update the regulatory environment, and promote collaboration and openness, all of which are based on the ideas articulated in the automated vehicle (AV) 4.0 program. Furthermore, as part of an EU strategy on internet-connected vehicles, the European Commission instructed auto producers in 2016 to ensure that new models include a host of digital technology that helps reduce fuel consumption and make roads safer.

Several companies, including Volkswagen, PSA, and Renault Nissan Alliance have launched their connected car models in the European markets. Such government initiatives are expected to expedite development of connected vehicles across the world. As cybersecurity ecosystem (software, hardware, and services) are of paramount importance to guard the connected vehicles against rising cyber-attacks, increase in demand for connected cars is expected to propel growth of the global V2X cybersecurity market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the V2X cybersecurity market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The V2X cybersecurity market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global V2X cybersecurity market market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the V2X cybersecurity market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

V2X Cybersecurity Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.7 billion |

| Growth Rate | CAGR of 21.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 353 |

| By Unit Type |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Communication |

|

| By Region |

|

| Key Market Players | KARAMBA SECURITY, CONTINENTAL, NXP, AUTOCRYPT, GREEN HILLS SOFTWARE, ESCRYPT, SafeRide Technologies, HARMAN INTERNATIONAL, INFINEON TECHNOLOGIES AG, AUTOTALKS LTD., Altran, ONBOARD SECURITY (QUALCOMM), ID QUANTIQUE, TRILLIUM SECURE INC., Aptiv |

Analyst Review

The Vehicle-to-everything (V2X) is the new era of connected technology in the automotive industry, and is penetrating with the significant rate. Automotive V2X enabled connected vehicle gain advantages in the area of safety, mobility and environmental benefits. The V2X cybersecurity market is expected to witness significant growth, owing to rise in demand for connected cars throughout the world. A connected car is quite vulnerable to cyber-attacks and in absence of robust cybersecurity solution, it can become an easy target for hackers. Thus, the increase in adoption of connected vehicles in developing countries such as China, India, Brazil, and South Africa is expected to provide lucrative opportunities for the growth of the V2X industry which in turn is expected fuel the V2X cybersecurity market. In addition, in some undeveloped countries, there is an increase in the production and sales of luxury vehicles, which is expected to boost the V2X cybersecurity market.

Factors such increase in cybersecurity mandates, advancement in Cellular-V2X (C-V2X) technology, and growing automotive cybersecurity threat are anticipated to boost the growth of the global V2X cybersecurity market during the forecast period. However, challenges in making secure applications, and high cost of implementation are expected to hinder the growth of the global V2X cybersecurity market during the forecast period. Moreover, increase in demand for connected vehicles, and enhancing vehicle security using adaptive security is expected to create an opportunity for the V2X cybersecurity market in near future.

To fulfil the changing demand scenarios, market participants are concentrating on product launch and product development strategy to expand their product portfolio and create new business opportunities. For instance, in January 2022, AUTOCRYPT Co., Ltd. launched AutoCrypt SCMS Version 5.0, a Security Credential Management System (SCMS) for Vehicle-to-Everything (V2X) communications, and a crucial component of its AutoCrypt V2X security solution. Moreover, in December 2019, SafeRide Technologies & NXP Semiconductors launched the integration of vSentry Edge AI platform – an embedded anomaly detection solution for connected vehicles to provide real-time advanced vehicle health-monitoring capabilities & valuable insights for OEMs on cybersecurity. In addition, market participants are continuously focusing on collaboration strategy to improve the product and customer reach. For instance, in February 2022, AUTOCRYPT Co., Ltd. entered into collaboration with the China Academy of Information and Communications Technology (CAICT). Under this collaboration, its V2X security solution, AutoCrypt V2X, implements YD/T 3957-2021, the newest standard for LTE-based V2N communications and credential management released by the China Academy of Information and Communications Technology (CAICT).

The key players that operate in this market are Altran, APTIV, AUTOCRYPT Co., Ltd., Autotalks Ltd., Continental AG, ESCRYPT, Green Hills Software LLC, HARMAN International, ID Quantique SA , Infineon Technologies AG, Karamba Security, NXP Semiconductors, Qualcomm Technologies, Inc., SafeRide Technologies, and Vector Informatik GmbH

The global V2X cybersecurity market is projected to grow at a compound annual growth rate of 21.6% from 2021-2031.

The global V2X cybersecurity market size was valued at USD 0.72 billion in 2021, and is projected to reach USD 5.7 billion by 2031,

Factors such increase in cybersecurity mandates, advancement in Cellular-V2X (C-V2X) technology, and growing automotive cybersecurity threat are anticipated to boost the growth of the global V2X cybersecurity market during the forecast period. However, challenges in making secure applications, and high cost of implementation are expected to hinder the growth of the global V2X cybersecurity market during the forecast period. Moreover, increase in demand for connected vehicles, and enhancing vehicle security using adaptive security is expected to create an opportunity for the V2X cybersecurity market in near future.

Europe is the largest regional market for V2X cybersecurity

The key players that operate in the V2X cybersecurity market such as HARMAN INTERNATIONAL, SafeRide Technologies, Aptiv, TRILLIUM SECURE INC., ESCRYPT, NXP, AUTOCRYPT, GREEN HILLS SOFTWARE, AUTOTALKS LTD., INFINEON TECHNOLOGIES AG, ONBOARD SECURITY (QUALCOMM), CONTINENTAL, ID QUANTIQUE, KARAMBA SECURITY, Altran.

Loading Table Of Content...