Variable Life Insurance Market Research, 2034

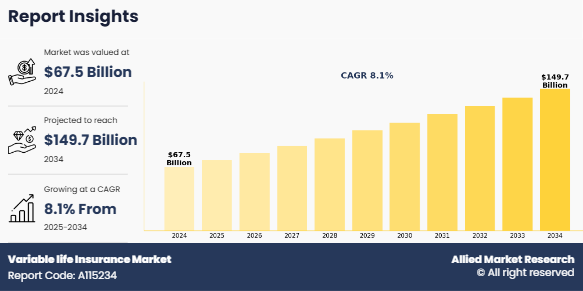

The global variable life insurance market was valued at $67.5 billion in 2024, and is projected to reach $149.7 billion by 2034, growing at a CAGR of 8.1% from 2025 to 2034. Variable life insurance combines life coverage with investment options. Policyholders allocate a portion of their premiums to various investment funds, including equities, bonds, or mutual funds, allowing the cash value of the policy to fluctuate with variable life insurance market performance. Unlike traditional life insurance, variable life policies offer both death benefits and a potential for higher returns, however, they carry investment risks. Variable life Insurance market includes individual and group policies offered by insurance companies through direct and indirect distribution channels. The scope of the Variable life Insurance market extends across regions and demographics, influenced by factors such as financial literacy, regulatory frameworks, technological advancements, and growing consumer interest in flexible, unit-linked life insurance products for long-term financial planning.

Key Takeaways:

By Type, the fixed premium variable insurance segment held the largest Variable life Insurance market size for 2024.

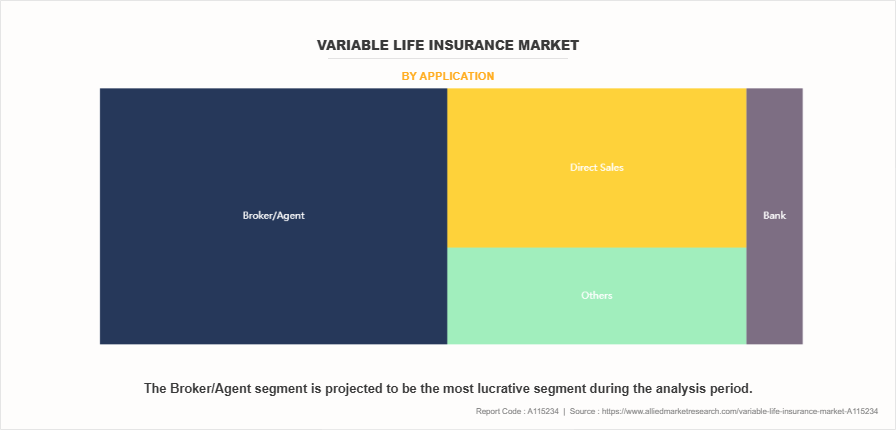

By Application, the broker/agent segment held the largest share in the Variable life Insurance market for 2024.

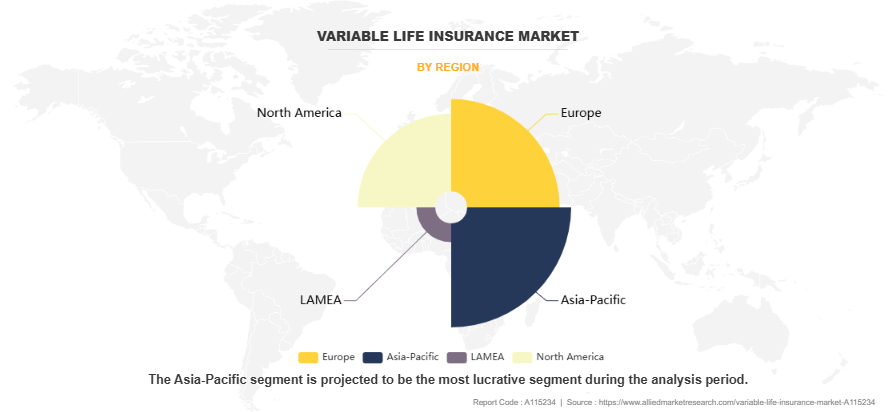

Region-wise, Asia-Pacific held largest Variable life Insurance market share in 2024. However, LAMEA is expected to witness the highest variable life insurance market growth.

Moreover, the ongoing digital transformation in the insurance sector, including the use of AI-driven advisory tools and online policy management platforms, is expected to provide remunerative growth opportunities for the variable life insurance market in the forecast period. These technologies are enabling insurers to deliver more personalized and efficient services, from automated risk assessments to real-time investment tracking and customer support. Digital tools also streamline the onboarding process, enhance transparency, and reduce operational costs, making variable life insurance (VLI) products more accessible and appealing to a wider customer base. In addition, the integration of mobile apps and robo-advisory platforms allows policyholders to actively monitor and adjust the investment portfolios, improving engagement and satisfaction. As digital adoption accelerates, especially among younger and tech-savvy consumers, these advancements are anticipated to drive the growth of the variable life insurance market.

Segment Review

The variable life insurance market is segmented into type, application, and region. On the basis of type, the variable life insurance market is bifurcated into fixed premium variable insurance and variable universal life insurance. By application, the variable life insurance market is classified into direct sales, brokers/agents, banks, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the brokers and agents segment held the largest variable life insurance market share in 2024, driven by their extensive distribution networks and personalized customer advisory services that build strong trust and facilitate complex policy sales. These intermediaries have long-established relationships with clients, enabling them to effectively explain the benefits and risks of variable life insurance products. However, the banks segment is expected to register the highest growth rate during the variable life insurance market forecast period, owing to the increasing adoption of bancassurance models, expanding financial service offerings, and rising collaboration between insurers and banks. Banks provide convenient access to a broad customer base, especially in emerging markets, and their integration of insurance products into holistic financial planning is accelerating sales.

On the basis of region, the Asia-Pacific region dominated the Variable Life Insurance market share in 2024, fueled by rapid economic development, rising disposable incomes, and increasing financial literacy across countries like China, India, and Southeast Asian nations. The widespread adoption of digital platforms and supportive regulatory reforms have further propelled market penetration in this region. However, the LAMEA (Latin America, Middle East, and Africa) region is expected to witness the highest growth rate during the forecast period, owing to low current insurance penetration, growing middle-class populations, urbanization, and improving regulatory environments. The expansion of bancassurance and mobile financial services in these emerging markets presents significant opportunities for insurers to capture new customer segments.

Competition Analysis

The report analyzes the profiles of key players operating in the Variable life Insurance market outlook are MetLife Inc., Chubb Limited, Protective Life Corporation, Transamerica Corporation, Lincoln Financial Group, New York Life Insurance Company, Northwestern Mutual Life Insurance Company, Nationwide Mutual Insurance Company, Allstate Insurance Company, Aditya Birla Capital Ltd, Prudential plc, Guardian Life Insurance Company of America, Pacific Life Insurance Company, Manulife Financial Corporation, Securian Financial Group, Inc., State Farm Life Insurance Company, FUTURE GENERALI INDIA INSURANCE COMPANY LTD, Tata AIA Life Insurance Company Limited, The OneLife Company S.A., and Quantum Leben. These players have adopted various strategies to increase their market penetration and strengthen their position in the Variable life Insurance industry.

Recent Developments in the Variable life Insurance Market

- In February 2023, Chubb Life Insurance Vietnam Company Limited launched new Unit-Linked Insurance Plan - Premier Variable Universal Life, offering Vietnamese customers a well-suited solution satisfying both the need for protection and investment. The new solution is designed with features to meet the needs of people in Vietnam for both effective risk management planning and for investment opportunities that can generate a sustainable increase in financial assets. The new solution is designed with features to meet the needs of people in Vietnam for both effective risk management planning and for investment opportunities that can generate a sustainable increase in financial assets.

- In January 2024, Nationwide recently announced a new variable universal life (VUL) product that offers a flexible solution for long-term financial goals with guaranteed death benefit protection, plus cash value growth potential. Nationwide VUL Protector II features improved guaranteed pricing, an Extended No-Lapse Guarantee (ENLG) Rider with a guarantee to age 120, and a new ENLG Advantage program that offers a meaningful discount on single premiums in exchange for participation in the program. The product also offers a guaranteed Nationwide VUL Rewards Program, which reduces the cost of insurance rates by 25% when clients meet a net accumulated premium test.

Top Impacting Factors

Driver

Rising demand for investment-linked insurance products

The rising demand for investment-linked insurance products is a key driver of the variable life insurance market. Consumers are increasingly seeking financial products that offer both protection and investment opportunities. The growing middle-class population with rising disposable incomes, especially in emerging economies, driven by the demand for investment-linked policies that combine protection with investment potential, drives the growth of the variable life insurance market. In addition, the investment-linked insurance products offering flexibility in premium payments, a wide range of fund options, and the potential for higher returns based on market performance further augments the growth of the variable life insurance market. Furthermore, the governments favorable regulatory frameworks supporting in the development and distribution of variable life insurance products by encouraging innovation, simplifying compliance, and promoting financial inclusion, contribute toward the growth of the variable life insurance market.

Moreover, rise in cost of living and surge in healthcare expenses drive individuals to seek insurance solutions that provide protection and offer wealth accumulation benefits such as variable life insurance offerings. In addition, the rise in proliferation of online platforms and mobile apps presents significant opportunities for the growth of the variable life insurance market by simplifying the process of researching, comparing, and purchasing variable life insurance policies. Furthermore, the integration of these policies with fintech firms, particularly those offering advanced analytics, robo-advisory services, and digital customer onboarding, further enhances the customer experience by enabling real-time policy tracking, monitoring of fund performance, and access to personalized investment advice. For instance, in April 2024, Protective Life Insurance Company launched a new Advisory Variable Universal Life (VUL) product, called Protective Investors Benefit Advisory VUL, which is now available on the FireLight digital platform. This launch is aimed at enhancing the experience for fee-based advisors, such as RIAs and OIDs, by streamlining application and submission processes through FireLight’s e-application tools. The move supports Protective’s strategy to expand in the advisory insurance space and improve digital efficiency for financial professionals. This is expected to enhance Protective’s position in the advisory insurance market and promote wider adoption of digital tools in the variable life insurance industry. By streamlining application processes and improving efficiency, such innovations make VLI products more accessible and appealing to advisors and clients, supporting market growth.

Restraints

Market volatility and investment risk

The major restraint impacting the growth of the variable life insurance market is market volatility and the inherent investment risk associated with these products. Unlike traditional life insurance, VLI policies are tied to underlying investment sub-accounts, often comprised of equities, bonds, or mutual funds. While this structure offers the potential for higher returns, it also exposes policyholders to the unpredictability of financial markets. Volatile market conditions lead to significant fluctuations in the cash value and death benefit of VLI policies. During economic downturns or market crashes, policyholders experience losses in the policy’s investment component, which result in the need for higher premium payments to keep the policy active. This unpredictability deters risk-averse consumers and limit the appeal of variable life insurance compared to more stable alternatives such as whole life or permanent life insurance. Furthermore, the complexity of variable life insurance (VLI) products, coupled with performance driven by market factors, demands a higher level of financial literacy from policyholders to make informed investment choices. This poses a barrier for many consumers and lead to reluctance in adoption. Furthermore, regulatory oversight and the requirement for comprehensive disclosures increase administrative costs and compliance burdens for insurers. Moreover, the investment risk associated with market volatility presents a major challenge for the variable life insurance market, as it reduces the predictability and security typically associated with life insurance products. Addressing this issue necessitates better product education, enhanced risk management features, and greater market stability, which helps to drive the growth of the variable life insurance market.

Opportunity

Integration with Wealth Management Platforms

The increase in the integration with wealth management platforms presents numerous opportunities for insurers, financial advisors, and policyholders. Rise in consumer awareness regarding the importance of holistic financial planning enables both clients and advisors to view insurance policies alongside other investments, creating a complete picture of the client's financial situation. This facilitates the recommendation of variable life insurance products that align with the client's overall risk tolerance and long-term objectives. In addition, the integration with wealth management platforms enhances client engagement and retention by providing real-time performance data, promoting transparency, and allowing for proactive adjustments to the VLI strategy, such as reallocating investments or increasing coverage.

Moreover, the integration with wealth management platforms enhances operational efficiency by streamlining the application and servicing process, reducing paperwork and minimizing manual errors, which helps improve compliance. In addition, the surge in the adoption of data-driven decision-making helps to provide valuable insights into client behavior and investment preferences, which boost more personalized product recommendations and portfolio optimizations. Furthermore, the integration aids in regulatory compliance by automating processes that improve record-keeping, documentation, and audit trails, ensuring adherence to fiduciary and regulatory standards. For instance, in January 2025, Lincoln Financial expanded its life insurance offerings with the launch of two new Variable Universal Life (VUL) products: Lincoln AssetEdge VUL (2025) and Lincoln AssetEdge SVUL. These products are designed to offer greater investment flexibility, enhanced protection features, and competitive pricing. The individual VUL includes an updated overloan protection feature and access to a broad range of investment options, while the survivorship version targets estate planning and wealth transfer needs. This move reinforces Lincoln’s commitment to delivering performance-driven, customizable insurance solutions for long-term financial planning.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the variable life insurance market analysis from 2024 to 2034 to identify the prevailing variable life insurance market opportunity

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the variable life insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global variable life insurance market trends, key players, market segments, application areas, and market growth strategies.

Variable life Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 149.7 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

Analyst Review

Variable life insurance is a permanent life insurance that enables policyholders to invest policy cash value in stocks, bonds, or mutual funds, suitable for those comfortable with market volatility and potentially higher premiums. Variable life insurance includes fixed premium and variable universal life policies. It offers death benefits and optional add-ons, with fixed premiums requiring regular payments. These products are distributed through agencies, brokers, bancassurance, and digital channels. Rise in the adoption of digital platforms, mobile applications, and artificial intelligence by insurers is one of the significant trends enhancing customer engagement and streamlining operations. In addition, there is a rise in trend toward hybrid policies that integrate life insurance with long-term care or critical illness coverage. These products offer comprehensive protection, addressing both death benefits and healthcare needs, catering to the aging population's requirements. Furthermore, there is growing interest among policyholders in aligning their investments with ethical and sustainable values, prompting insurers to offer options that incorporate Environmental, Social, and Governance (ESG) criteria. Moreover, there is a growing trend in providing customizable policies, allowing policyholders to tailor their coverage with flexible riders and options that better suit the individual needs and lifestyles.

The variable life insurance market growth is majorly driven by the increase in the demand for investment-linked insurance products that offer both life coverage and wealth-building opportunities. In addition, the surge in awareness among consumers regarding financial planning, along with the desire for flexible and customizable policies, has significantly contributed to market growth. Many policyholders are attracted to the potential for higher returns through investment options, such as equities and mutual funds, within their insurance plans. Moreover, the integration of artificial intelligence (AI) into variable life insurance enhances operational efficiency, improves customer experience, and provides risk assessment accuracy. AI-powered tools enable insurers to analyze vast amounts of customer data to deliver personalized policy recommendations, automate underwriting processes, and detect potential fraud. Chatbots and virtual assistants are improving customer service by offering instant support and guidance, while machine learning algorithms help in predicting policyholder behavior and optimizing investment strategies. This technological advancement streamlines internal operations and empowers policyholders with real-time insights and smarter decision-making tools, thus fueling the growth of the market.

On the basis of type, the global variable life insurance market was dominated by the fixed premium variable insurance segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the rise in awareness regarding the importance of financial planning driving demand for VLI products that provides insurance coverage with investment opportunities. In addition, there is a growing trend in the adoption of digital tools and AI-driven analytics streamlining operations and offering personalized products and services. However, the variable universal life insurance segment is expected to experience the highest growth during the variable life insurance market forecast period. This segment is experiencing increase in the integration of digital platforms with VUL policies enabling real-time policy management, enhancing customer experience and engagement.

By region, Asia-Pacific dominated the market share in 2024 for the variable life insurance market. This is due to rise in middle-class population coupled with increase in disposable incomes, boosting insurance penetration and demand for investment-linked products such as variable life insurance products, contributing significantly to the region’s market growth. However, LAMEA (Latin America, Middle East, Africa) is expected to experience the fastest growth during the forecast period. The region is experiencing increase in the collaborations between insurers and banks through bancassurance, combined with flexible and locally tailored insurance products, enhancing market reach and adoption of VLI products in emerging markets, which is expected to provide lucrative growth opportunities for the market in this region.

The Variable life Insurance Market is estimated to grow at a CAGR of 8.1% from 2025 to 2034.

The Variable life Insurance Market is projected to reach $149.73 billion by 2034.

The Variable life Insurance Market is expected to witness notable growth include rising demand for investment-linked insurance products, increasing financial literacy and awareness, and favorable regulatory framework in some markets

The key players profiled in the report include MetLife Inc., Chubb Limited, Protective Life Corporation, Transamerica Corporation, Lincoln Financial Group, New York Life Insurance Company, Northwestern Mutual Life Insurance Company, Nationwide Mutual Insurance Company, Allstate Insurance Company, Aditya Birla Capital Ltd, Prudential plc, Guardian Life Insurance Company of America, Pacific Life Insurance Company, Manulife Financial Corporation, Securian Financial Group, Inc., State Farm Life Insurance Company, FUTURE GENERALI INDIA INSURANCE COMPANY LTD, Tata AIA Life Insurance Company Limited, The OneLife Company S.A., and Quantum Leben.

The key growth strategies of Variable life Insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...