vascular guidewires market outlook - 2025

The global vascular guidewires market size in 2017 is $883 million, and is projected to reach $1,336 million by 2025, growing at a CAGR of 5.4% from 2018 to 2025.A guidewire is a flexible wire (may also be a spring in some cases), which helps the surgeons for introduction and proper placement of a medical device (particularly prosthesis) into a patient’s body. The use of guidewires is essential during an interventional procedure as guidewires assist a medical practitioner and guide a medical device through the patient’s anatomy. Therefore, vascular guidewires are used during various surgical procedures such as placement of angioplasty balloons, angioplasty stents, endovascular aneurysm repair stent grafts, plaque modification devices, hemodynamic flow alteration devices, and inferior vena cava filters.

The global vascular guidewires market experiences growth due to rise in prevalence of cardiovascular disorders and increase in geriatric population. In addition, demand for minimally invasive procedures and rapid technological advancements in guidewires further drive the market growth. However, risks & complications associated with guidewires and availability of effective conventional treatment options is projected to impede growth of the vascular guidewires market. On the contrary, increase in use of nitinol in vascular guidewires and growth opportunities in the emerging economies of the Asia-Pacific and LAMEA regions are expected to provide significant profitable opportunities for the manufacturers in the vascular guidewires industry. Hence, these drivers and opportunities help increase the global vascular guidewires market share.

The vascular guidewires market is segmented based on application, coating type, end user, and region. Based on product, the market is bifurcated into coronary guidewires and peripheral guidewires. Depending on coating type, the market is categorized into coated and non-coated. Coated segment is further bifurcated into hydrophilic coating and hydrophobic coating. Based on end user, the market is segmented into hospitals and ambulatory surgical centers (ASCs). Based on region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

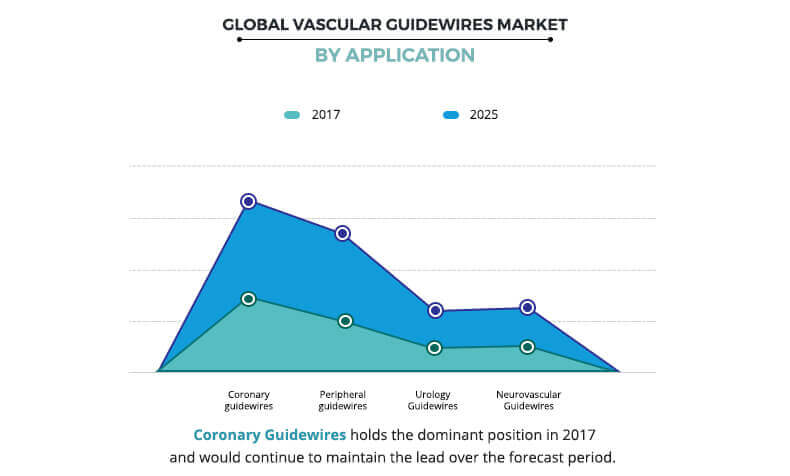

Application segment review

Based on application, the vascular guidewires market is segmented into coronary guidewires, peripheral guidewires, urology guidewires, and neurovascular guidewires. The coronary guidewires segment was the major revenue contributor in 2017, and is anticipated to continue this trend during the forecast period, owing to the increase in prevalence of cardiac disorders and rise in number of minimally invasive surgeries to treat blocked arteries. On the other hand, the peripheral guidewires segment is projected to exhibit the highest growth during the forecast period, due to increase in number of patients who suffer from peripheral artery diseases (PAD).

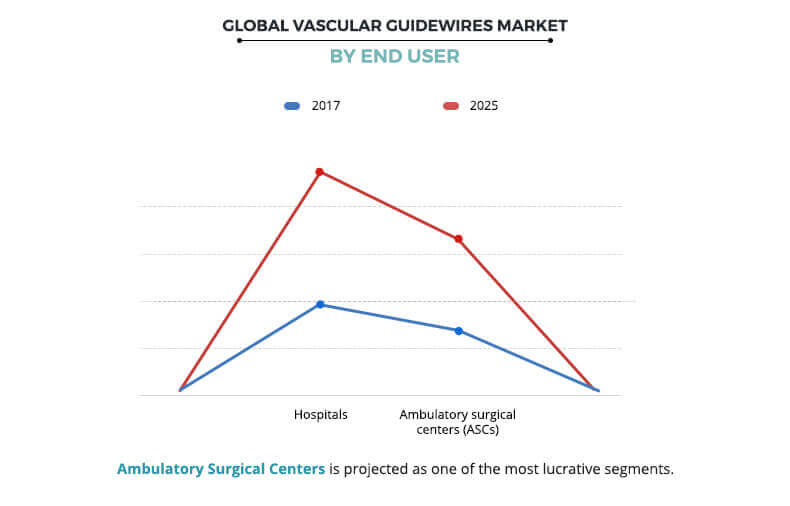

End user segment review

Depending on end user, the vascular guidewires market is categorized hospitals and ambulatory surgical centers (ASCs). The ambulatory surgical centers segment is projected to exhibit the highest growth during the forecast period owing to the increased popularity of ASCs due to their cost-effective, high-quality alternatives to hospital-based treatment. On the other hand, the hospitals segment was the major revenue contributor in 2017, and is anticipated to continue this trend during the forecast period, as hospitals are well-equipped with cardiovascular units to cater to various needs of cardiac procedures and immediate requirements can be fulfilled.

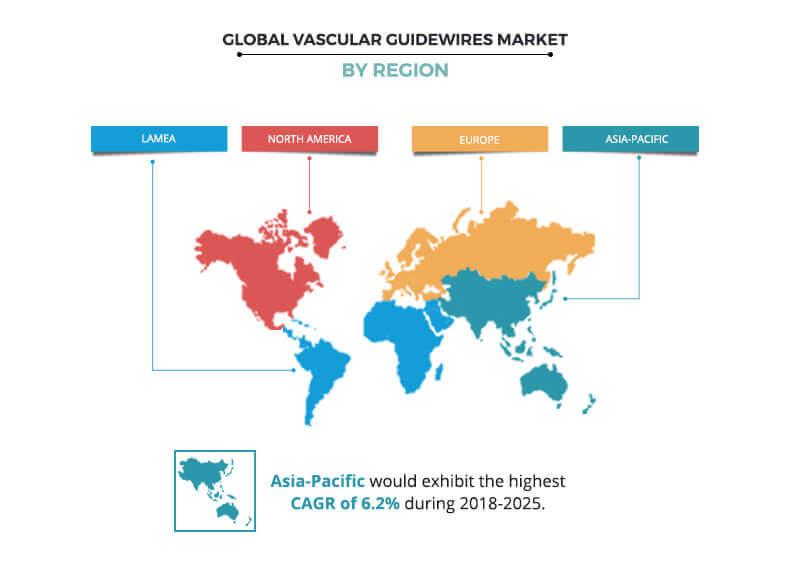

Region segment review

Based on region, the vascular guidewires market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2017, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to the development of innovative devices, adoption of minimally invasive surgeries, and mergers & acquisitions to acquire novel technologies are the important market trends. The market in Asia-Pacific is expected to grow at the highest CAGR during the forecast period, attributable to high prevalence of chronic diseases and increase in mortality rate, mainly due to an adoption of the western lifestyle and changes in the dietary habits of people. In addition, high population base, increase in disposable income of people, presence of unmet medical needs, and rise in medical tourism in the region further drives the vascular guidewires market growth.

The report provides a comprehensive vascular guidewires market analysis of the key players operating in the global vascular guidewires industry, namely Abbott Laboratories, B. Braun Melsungen AG, Becton, Dickinson and Company (C.R. Bard), Biotronik SE & Co. KG, Boston Scientific Corporation, Cardinal Health, Inc., Cook Medical Inc., Olympus Corporation, and Terumo Corporation. The other guidewire competitors in the value chain include Stryker Corporation, Teleflex Incorporated, AngioDynamics, Asahi Intecc USA, Inc., Bard Peripheral Vascular, Inc., and others.

Key Benefits for vascular guidewires market:

- This report provides a detailed quantitative vascular guidewires market analysis of the current vascular guidewires market trends and vascular guidewires market forecast estimations from 2018 to 2025, which assists to identify the prevailing market opportunities.

- An in-depth market analysis includes analysis of various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the market is provided.

- Region-wise and country-wise vascular guidewires market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2018 to 2025 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of global vascular guidewires market.

vascular guidewires Key Market Segments:

By Application

- Coronary Guidewires

- Peripheral Guidewires

- Urology Guidewires

- Neurovascular Guidewires

By Coating Type

- Coated

- Hydrophilic Coating

- Hydrophobic Coating

- Non-Coated

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Vascular Guidewires Market Report Highlights

| Aspects | Details |

| By APPLICATION |

|

| By COATING TYPE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Terumo Corporation, Becton, Dickinson and Company (C.R. Bard), Cardinal Health, Inc., Cook Medical Inc., Abbott Laboratories, B. Braun Melsungen AG, Olympus Corporation, Boston Scientific Corporation, Biotronik SE & Co. KG, Medtronic Plc. (Covidien Ltd.) |

Analyst Review

The adoption of vascular guidewires is expected to increase in the near future, owing to high prevalence rate of cardiovascular disorders and rise in geriatric population. The market drew the interest of healthcare providers, owing to the benefits associated with these devices for the treatment of cardiac disorders. There are remarkable technological advancements in vascular guidewires to facilitate advanced treatments for disease management. The Asia-Pacific and LAMEA regions are expected to offer lucrative opportunities to market players, as the markets in the developed nations are saturated with large number of vascular guidewires providers.

Growth in incidences of cardiac disorders, increase in geriatric population, rise in patient awareness for minimally invasive cardiovascular surgeries, adoption of minimally invasive procedures, and presence of high-unmet medical needs (especially in developing and under developed regions of the world) drive the market growth. However, risks & complications associated with guidewires and preference for drugs over treatment devices restrict the market growth. Conversely, increase in use of nitinol in vascular guidewires and growth opportunities in the emerging economies of the Asia-Pacific and LAMEA regions are expected to provide several opportunities for market growth during the forecast period. Moreover, North America is expected to dominate the global vascular guidewires market during the forecast period, followed by Europe.

Loading Table Of Content...