Vegan Footwear Market Overview, 2030

Increasing government initiatives for reducing plastic wastes and carbon footprint has encouraged the footwear manufacturers to invest in the development of sustainable manufacturing methods. Players, such as Adidas, Reebok, and Puma, are increasingly adopting recycled plastics as a material for manufacturing footwear products. This perfectly serves the growing demand for eco-friendly and vegan products by consumers especially in developed markets such as North America and Europe. Consumers in the developed markets are highly aware of the deteriorating environmental conditions due to global warming and different types of pollution. Therefore, the demand for eco-friendly products is high among consumers in developed economies.

The rapidly growing vegan population is a major driver of the vegan footwear market. According to the Vegan Society, adopting pure veganism may help to reduce healthcare costs, avoid climate damages, and reduce greenhouse gas emissions. The growing awareness regarding the benefits of veganism is encouraging the global population to adopt veganism. Further, growing number of animal lovers, rising initiatives of NGOs, such as PETA, regarding animal abuse and animal rights, and growing trend of animal humanization are factors that are expected to propel the growth of the market.

The recycled plastic segment is estimated to foresee rapid traction during the forecast period. According to the United Nations, around 300 million tons of plastic wastes is generated annually. It is a major source of water pollution. Top market players are undertaking initiatives to use those plastic wastes to manufacture shoes. This method of recycling plastic wastes and utilizing it to manufacture footwear is a sustainable solution for the market players and it is expected to drive the vegan footwear market growth.

There are several factors that may restrict the growth of the global vegan footwear market. Lack of awareness regarding vegan footwear, high cost of vegan footwear, and availability of counterfeit footwear products in underdeveloped and developing markets are major restraining factors that may hamper the expansion of the market in the forthcoming years.

The outbreak of the COVID-19 pandemic adversely impacted the production and sales of the market. Lockdown measures implemented by the government resulted in supply chain disruptions, closure of production facilities, closure of retail outlets, and declined the demand for footwear among consumers as there were traveling restrictions.

By End User

Women segment helds the major share of 52.6% in 2020

According to the global vegan footwear market analysis, the market is segmented on the basis of end user, material type, and distribution channel. On the basis of end user, the market is segregated into men, women, and children. On the basis of material type, it is classified into microfiber, polyurethane, recycled plastics, and others. On the basis of distribution channel, it market is divided into supermarkets/hypermarkets, specialty stores, e-commerce, and others.

On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Spain, Netherlands, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and the rest of LAMEA).

By Material Type

Polyurethane segment helds the major share of 45.9% in 2020

According to the vegan footwear market forecast, on the basis of end user, the women segment is expected to be the fastest-growing segment, owing to large variety of footwear available for women in the market.

On the basis of material type, the polyurethane segment accounted for the highest market share due to factors such as easy to use and wide availability of polyurethane footwear in the market.

By Distribution Channel

Specialty Stores segment helds the major share of 62.9% in 2020

As per the vegan footwear market trends, on the basis of distribution channel, the specialty stores segment collectively accounted for the largest vegan footwear market share in 2020 due to their increased popularity in developed markets such as North America and Europe.

Players operating in the market have used a variety of developmental strategies to expand their market share, exploit the vegan footwear market opportunities, and boost market profitability. The key players profiled in this report include Nike, Adidas, AVESU GmbH, Beyond Skin UK, Ethletic, Hexa Vegan Shoes, Matt & Nat, MooShoes, Susi Studio, and Veerah.

By Region

North AmeriNorth America region helds the higest market share of 33.8% in 2020 ca region helds the higest market share of 33.8% in 2020

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current market trends, estimations, and dynamics of the market size from 2020 to 2030 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the vegan footwear industry.

Vegan Footwear Market Report Highlights

| Aspects | Details |

| By End User |

|

| By Material |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | PUMA SE, Matt & Nat, Hexa Vegan Shoes, Garmont International S.r.l., ADIDAS AG (ADIDAS), MooShoes, NIKE, INC., ASICS Corporation, UNDER ARMOUR, INC., AVESU GMBH |

Analyst Review

Based on the insights of the top CXOs, with rise in internet penetration, the number of social media users has increased considerably. Taking this into consideration, most of the key players in the vegan footwear market strategize on promoting their products and services on the social media platforms such as Facebook, YouTube, Instagram, Pinterest, and Google. Social media marketing is one of the major strategies adopted by various companies and industries on imparting awareness about the growing environmental concerns, benefits of vegan footwear, and vegan product offerings among target customers on social media channels. Thus, through social media marketing strategy, global vegan footwear market sights critical opportunity in gaining traction and increasing its customer reach among its target segments.

The CXOs further added that high prices and rise in popularity of footwear brands such as Nike, Adidas, and Puma have led to the advent of counterfeit brands. Counterfeit brands are usually available in developing economies where customers are highly price-sensitive. This factor hampers the sale of the existing original vegan footwear brands in these economies. Counterfeit brands are of low quality, and often lead to inconvenience & safety issues that subsequently develop negative perceptions among customers. Online distribution channel is one of the major platforms where transaction of counterfeited brands can be easily be concealed. The rapid growth of various new online platforms that claims to offer branded footwear at huge discounts can easily influence the less aware consumers and may offer counterfeit footwear products to the consumers. Thus, development of the counterfeit industry is anticipated to hamper the growth of the vegan footwear market.

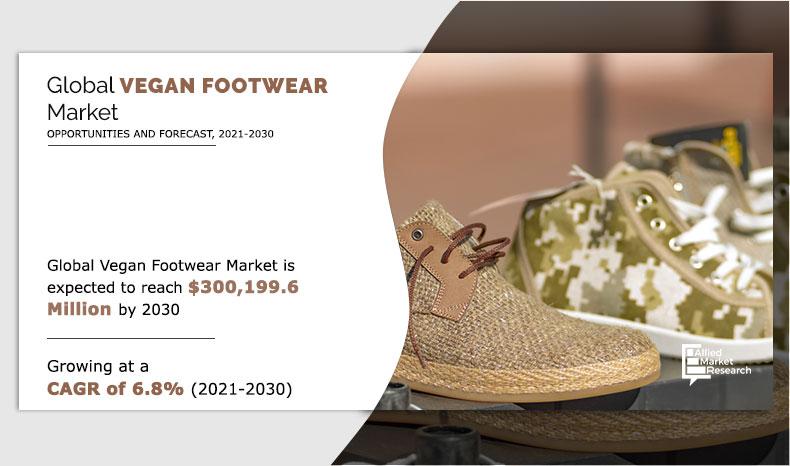

The vegan footwear market was valued at $157,898.2 million in 2020, and is estimated to reach $300,199.6 million by 2030, growing at a CAGR of 6.8% during the forecast period. The rising demand for sustainable products among the consumers is fostering the market growth.

The forecast period estimated in the global vegan footwear market report is 2021 to 2030. The report provides a detailed study about the current market trends and future market opportunities along with the future market estimations.

The base year calculated in the global vegan footwear market report is 2020. The year 2020 was an exceptional year characterized by the outbreak of the COVID-19 pandemic that changed the consumer behavior significantly. The report provides a detailed study about the impact of COVID-19 on the global vegan footwear market.

Players operating in the market have used a variety of developmental strategies to expand their market share, exploit the vegan footwear market opportunities, and boost market profitability. The key players profiled in this report include Nike, Adidas, AVESU GmbH, Beyond Skin UK, Ethletic, Hexa Vegan Shoes, Matt & Nat, MooShoes, Susi Studio, and Veerah.

According to the vegan footwear market forecast, on the basis of end user, the women segment is expected to be the fastest-growing segment, owing to large variety of footwear available for women in the market.

Europe was the dominating market in 2020 owing to the increased consumer awareness regarding vegan products, animal rights, eco-friendly products, and high demand for the sustainable and eco-friendly solutions among the consumers.

Players operating in the market have used a variety of developmental strategies to expand their market share, exploit the vegan footwear market opportunities, and boost market profitability. The key players profiled in this report include Nike, Adidas, AVESU GmbH, Beyond Skin UK, Ethletic, Hexa Vegan Shoes, Matt & Nat, MooShoes, Susi Studio, and Veerah.

The vegan footwear market was valued at $157,898.2 million in 2020, and is estimated to reach $300,199.6 million by 2030, growing at a CAGR of 6.8% during the forecast period. Rising awareness regarding animal rights and growing popularity of humanization of animals is fostering the growth of the global vegan footwear market.

Loading Table Of Content...