Vehicle Diesel Engine Market Research, 2032

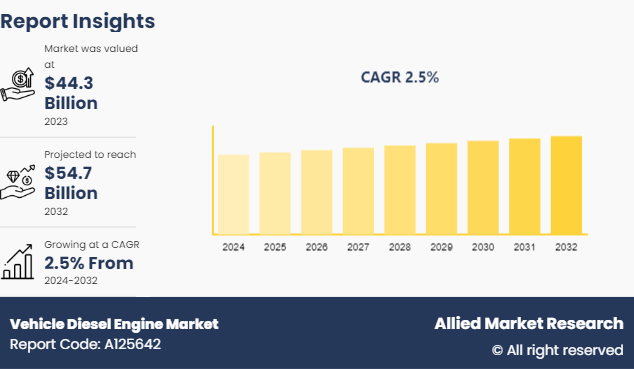

The global vehicle diesel engine market size was valued at $44.3 billion in 2023, and is projected to reach $54.7 billion by 2032, growing at a CAGR of 2.5% from 2024 to 2032.

Market Introduction and Definition

A vehicle diesel engine functions through compression ignition within a cylindrical chamber, were high-pressure compression of air triggers fuel combustion. This conversion of chemical energy into mechanical energy generates power and heat. Diesel engines are renowned for their substantial torque output, rendering them ideal for demanding tasks such as powering tractors, locomotives, and marine vessels. In addition, their elevated expansion ratio contributes to their widespread use across multiple sectors, attributed to their high thermal efficiency.

Diesel engines are renowned for producing a lot of torque, which qualifies them for heavy-duty uses. Diesel engines are more fuel-efficient than petrol engines, which means they consume less fuel to produce the same amount of power. This efficiency is especially beneficial in applications requiring a constant supply of power, such as in trucks, buses, and industrial machinery. Diesel engines operate on a higher compression ratio than petrol engines, leading to better fuel combustion and higher energy output per unit of fuel. over a longer period or distance.

Key Takeaways

The Vehicle Diesel Engine Industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In February 2021, Cummins provided Isuzu with midrange B6.7 diesel platforms for medium-size trucks to meet global customer needs. Cummins and Isuzu are expected to closely work together to integrate the engine with Isuzu’s chassis and to meet Japan’s emission regulations.

In June 2022, WinGD and Hyundai Heavy Industries’ Engine Machinery Division (EMD) collaborated on delivering the first WinGD engine capable of running on ammonia, providing a vital step in shipping’s progress toward decarbonization.

In March 2024, Caterpillar announced the development of the CAT C13D, a new 13 -liter diesel engine platform designed to achieve best-in-class power density, torque, and fuel efficiency for optimizing the performance of heavy-duty off-highway applications. The C13D would meet the emissions standards of higher regulated markets, such as EU stage v, US EPA tier 4 final, China non-road IV, Korea stage V, and Japan 2014, with models available for lesser regulated markets.

??????Key Market Dynamics

The global vehicle diesel engine industry is growing due to several factors such as rapid urbanization and industrialization, and development of diesel engines. However, high fuel costs and operation and maintenance restrain the growth of the market. In addition, surge in hybrid power generation in rural and remote areas is expected to provide lucrative growth opportunities for the market development during the forecast period.

In addition, the global vehicle diesel engine market share is expanding due to developments in diesel engine technology, such as the incorporation of cleaner emissions systems and greater fuel efficiency. These technological advancements meet rise in need for more environmentally friendly transportation options while also addressing environmental concerns. Furthermore, continued R&D initiatives to improve the efficiency and dependability of diesel engines are anticipated to fuel market growth in the upcoming years.

Value Chain Analysis of Global Vehicle Diesel Engine Market

A value chain analysis for diesel engines involves examining the key activities and processes involved in the creation, production, distribution, and maintenance of diesel engines, and identifying the value-added at each stage.

Raw Material and Component Manufacturing: The value chain begins with the sourcing of raw materials such as steel, aluminum, copper, and various other metals and components required for manufacturing diesel engines. This stage involves the manufacturing of individual components such as engine blocks, pistons, cylinders, fuel injectors, turbochargers, and exhaust systems. Suppliers may produce these components in-house or source them from external suppliers.

Engine Assembly: Components are assembled into complete diesel engines at manufacturing plants. This stage includes engine testing and quality control measures to ensure that engines meet performance and safety standards.

Distribution and Sales: Once assembled, diesel engines are distributed to various sales channels, including dealerships, wholesalers, and original equipment manufacturers (OEMs) for integration into vehicles, machinery, or equipment.

Installation and Integration: Diesel engines are installed and integrated into vehicles, heavy machinery, generators, marine vessels, and other applications by OEMs or end-users.

Aftermarket Services and Maintenance: This stage involves providing aftermarket services such as maintenance, repairs, spare parts, and technical support to ensure the continued performance and longevity of diesel engines throughout their lifecycle.

Disposal and Recycling: At the end of their lifecycle, diesel engines may be disposed of or recycled. Proper disposal and recycling practices are essential to minimize environmental impact and maximize resource efficiency.

Analyzing each step of the value chain helps identify opportunities for cost reduction, process optimization, quality improvement, and value creation. It also enables stakeholders to understand the competitive dynamics within the diesel engine industry.

Market Segmentation

The vehicle diesel engine market growth is segmented into speed, power rating, and region. On the basis of speed, the market is divided into low, medium and high. By power rating, the market is segregated into below 0.5 MW, 0.5-1.0 MW, 1.1-2.0 MW, and 2.1-5.0 MW. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Rise in demand for light-duty diesel vehicles, including pickup trucks and SUVs, is set to drive the need for efficient automotive diesel engines. This surge is further propelled by the ongoing expansion of diesel refueling infrastructures in the U.S, such as fueling stations and truck stops, facilitating the adoption of diesel-powered vehicles and equipment. Moreover, rise in public awareness regarding innovations in diesel engines, showcasing improved performance, reduced noise levels, and cleaner emissions, is anticipated to further boost vehicle diesel engine demand. In addition, the presence of a robust freight and logistics industry in the U.S. is expected to fuel the demand for diesel engines, particularly in delivery and long-haul trucking applications.

In addition, China infrastructure development projects, including ports, railways, and highways, are set to drive demand for industrial diesel engines. For instance, in July 2022, China planned to build 461, 000 km highways by 2035 and world class highway network by 2050. Such developments are increasing demand for diesel powered vehicles, which in turn drives the demand for vehicle diesel engine market.

Competitive Landscape

The major players operating in the vehicle diesel engine market include Cummins, DEUTZ, Perkins, MAN Energy Solutions, Volvo Penta, Mitsubishi, MTU, Caterpillar, EMD, and Weichai.

Other players in vehicle diesel engine market includes IHI Power Systems, Rolls Royce, Mahindra Power Train, Guangzhou Diesel Engines and others.

Industry Trends:

In January 2024, 2.32 million passenger vehicles, 3W, 2W, and quadricycles had been produced in India. Between April and January of FY24, 23.36 million passenger cars, commercial vehicles, two-wheelers, three-wheelers, and quadricycles were produced in India.

In July 2023, the the Truck and Engine Manufacturers Association (EMA) and the top U.S. truck manufacturers introduced a Clean Truck Partnership, which was announced by the California Air Resources Board (CARB) . According to a statement from CARB, the industry agreement supports the development of zero-emission vehicles (ZEVs) for the commercial trucking sector and provides manufacturers to meet requirements for emissions while also meeting the state's emission reduction and climate goals.

In January 2020, the U.S. Environmental Protection Agency (EPA) released an Advance Notice of Proposed Rule (ANPR) for Cleaner Truck Initiative. This initiative includes new emission standards for NOx and other pollutants for highway heavy-duty engines.

Key Sources Referred

India Brand Equity Foundation

California Air Resource Board

U.S. Department of Transportation

Global Environment Facility

United Nations Environment Programme

International Energy Agency

International Transport Forum

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vehicle diesel engine market analysis from 2024 to 2032 to identify the prevailing vehicle diesel engine market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vehicle diesel engine market forecast segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global vehicle diesel engine market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vehicle diesel engine market trends, key players, market segments, application areas, and market growth strategies.

Vehicle Diesel Engine Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 54.7 Billion |

| Growth Rate | CAGR of 2.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 324 |

| By Speed |

|

| By Power Rating |

|

| By Region |

|

| Key Market Players | MAN Energy Solutions, DEUTZ, MTU, Volvo Penta, Caterpillar, Mitsubishi, Weichai, Perkins, Cummins |

The high speed is the leading speed of Vehicle Diesel Engine Market.

The upcoming trends of vehicle diesel engine market rise in urbanization in development countries and increase in the production of vehicles.

Asia-Pacific is the largest regional market for Vehicle Diesel Engine.

The below 0.5 is the leading power rating of Vehicle Diesel Engine Market.

The vehicle diesel engine market was valued at $44.34 billion in 2023.

Loading Table Of Content...