Vehicle Retarder Market Research, 2033

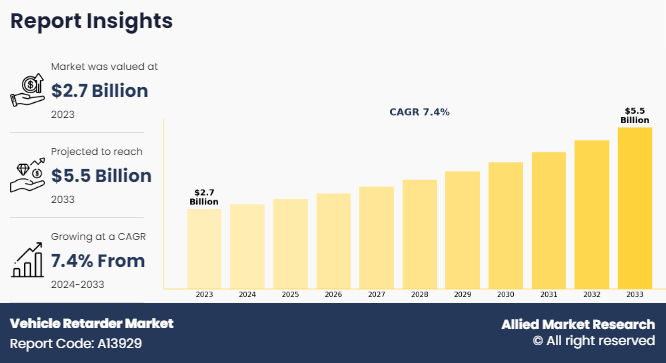

The global vehicle retarder market size was valued at $2.7 billion in 2023, and is projected to reach $5.5 billion by 2033, growing at a CAGR of 7.4% from 2024 to 2033.

A vehicle retarder is an auxiliary braking system used primarily in commercial and heavy-duty vehicles to complement the main friction brakes. The primary function of a retarder is to decelerate a vehicle without using the traditional brake pads, thereby reducing wear and tear on the braking system. Retarders work by converting the vehicle’s kinetic energy into heat, which is then degenerate, resulting in a controlled reduction in speed.

Furthermore, there are two main types of retarders hydraulic and electric. Hydraulic retarders, often integrated into the vehicle's transmission, use a fluid coupling mechanism to slow the vehicle down. Electric retarders, on the other hand, generate magnetic resistance to decelerate the vehicle. Both systems offer advantages in terms of providing smooth, wear-free braking, which is particularly useful on long downhill drives or in scenarios where frequent braking is required, such as in urban transit buses or heavy-loaded trucks.

In addition, the use of retarders helps enhance vehicle safety by reducing brake fade, which occurs when traditional brakes overheat and lose effectiveness. They also improve fuel efficiency and reduce maintenance costs by minimizing reliance on the main brake system. Commonly used in buses, trucks, and mining vehicles, retarders are an important component in the transportation industry, contributing to safer and more efficient vehicle operations.

For instance, In August 2023, Voith Turbo launched the Mechatronic Retarder Control Unit (MRCU) as a new standard feature. This unit integrates the electronic control unit (ECU) directly into the retarder, saving space in the driver’s cab and simplifying the vehicle's system layout. The MRCU enhances safety by continuously monitoring the retarder's operation and swiftly restoring a safe state in case of faults. Compliant with the latest automotive cyber security standards, it utilizes the open AUTOSAR standard for future-proof operation.

The vehicle retarder market share is largely influenced by the growing demand for heavy-duty vehicles in sectors such as mining, construction, and logistics. Rise in demand for heavy commercial vehicles, and expansion of the mining and construction sectors are the major factors that propel the vehicle retarder market growth. However, high installation and maintenance costs, and limited adoption in emerging markets are the major factors that hamper the vehicle retarder market growth. On the contrary, surge in investments in smart transportation systems, and rise in adoption of electric and hybrid commercial vehicles are the factors that are expected to offer growth opportunities for the market during the forecast period.

Recent Developments in the Vehicle Retarder Industry

- In May 2023, Scania unveiled Scania R620-A6X4 heavy hauler for the mining sector. Scania R620-A6X4 heavy hauler is equipped with a retarder system that helps reduce speed before main braking is carried out. This allows the driver to anticipate braking, especially in downhill road conditions, so that the operator’s safety while driving is ensured, and operational safety is better maintained.

- September 2022, Komatsu launched HD1500-8E0 mechanical haul truck, featuring hydraulic wet multiple-disc brakes on all four corners. These continuously cooled, large-capacity brakes function as a highly responsive retarder, ensuring reliable performance and operator confidence at high speeds during downhill travel. The truck's automatic retard speed control (ARSC) system allows for precise speed regulation, applying the brake retarder to maintain the desired descent speed, enhancing safety and control on steep gradients.

- In February 2022, Cummins Inc. planned to acquire Jacobs Vehicle Systems (JVS), a subsidiary of Altra Industrial Motion Corp., and a supplier of engine braking, cylinder deactivation, start and stop, and thermal management technologies. This agreement brings the addition of new technologies to provide growth opportunities for Cummins’ current and future advanced diesel engine platforms. Through this strategy, Cummins plans to maintain JVS’ customer relationships and offer improved value and other benefits to the customers of both the companies.

Market Overview

Rise in demand for heavy commercial vehicles

The rise in demand for heavy commercial vehicles is significantly driving the vehicle retarder industry. As industries such as logistics, construction, and mining expand, there is an increase in dependance on heavy trucks, buses, and other large vehicles to transport goods and materials. These vehicles often operate under demanding conditions, including steep gradients and heavy loads, which place considerable stress on their braking systems.

For instance, in August 2024, Ashok Leyland a leading commercial vehicle manufacturer launched the GARUD 15M, India's first front-engine multi-axle bus chassis, at Prawaas 4.0. Engineered for long-distance travel, the GARUD 15M offers advanced features such as a spacious luggage compartment, front-wheel disc brakes, and an electromagnetic retarder for enhanced safety and braking efficiency. efficiency. The vehicle retarder market forecast indicates strong growth in the coming years, driven by the increasing adoption of advanced braking systems in heavy-duty vehicles across sectors such as mining, construction, and logistics.

In addition, vehicle retarders, which are designed to enhance braking efficiency and safety, become crucial in these scenarios. They help manage the high braking demands by providing additional braking power and reducing the strain on traditional braking systems, thereby improving vehicle control and safety. As more heavy commercial vehicles are deployed, the need for advanced retarder systems grows, leading to increased adoption and market expansion. This trend reflects the broader shift towards ensuring safety and reliability in heavy-duty vehicle operations. Therefore, rise in demand for heavy commercial vehicles is driving the demand for the vehicle retarder market.

Expansion of the mining and construction sectors

The expansion of the mining and construction sectors is significantly driving the demand for the vehicle retarder industry. As these industries grow, the need for heavy-duty vehicles such as dump trucks, excavators, and loaders increases. In mining and construction, vehicle retarders are crucial for heavy machinery and trucks, helping manage speed on steep or uneven terrain. They enhance safety and reduce brake wear, essential in these industries for maintaining equipment longevity and operational efficiency.

For instance, in December 2023, General Motors (GM) partnered with Komatsu's on a hydrogen fuel cell power module for the 930E mining drum truck that may integrate advanced vehicle retarder systems to optimize energy efficiency during braking. This partnership enhances the truck’s braking capability, reducing wear and tear while maintaining performance in rugged mining environments. The rising emphasis on vehicle safety and energy efficiency is expected to further expand the vehicle retarder market size globally.

Furthermore, vehicle retarders, which provide additional braking power and help manage the high demands of heavy loads, are crucial in these settings. They enhance safety by improving vehicle control and reducing brake system wear, ensuring reliable operation under strenuous conditions. The growing scale and intensity of mining and construction projects amplify the need for robust braking solutions, leading to increased adoption of retarder systems. Consequently, the expansion of these sectors fuels the overall growth of the vehicle retarder market, highlighting the critical role of advanced braking technologies in heavy-duty applications. Therefore, expansion of the mining and construction sectors is driving the demand for the vehicle retarder market.

High installation and maintenance costs

High installation and maintenance costs are major factors hampering the demand for the vehicle retarder market. Vehicle retarders, designed to enhance braking efficiency and safety, involve significant upfront investment and ongoing expenses. The initial cost of installing advanced retarder systems can be prohibitive for some operators, particularly in price-sensitive segments of the market. This expense is compounded by the cost of specialized components and the need for skilled technicians for installation and maintenance.

In addition, the maintenance of vehicle retarders often requires regular inspections and servicing to ensure optimal performance, further increase in operational costs. The high total cost of ownership can deter potential buyers, especially in regions where budget constraints are a significant concern. Smaller fleet operators and those in emerging markets may find it challenging to justify the investment in retarders compared to the potential benefits. This financial barrier can limit the adoption of vehicle retarders, affecting market growth. To address these challenges, industry players need to focus on reducing costs through technological advancements, offering more cost-effective solutions, and providing comprehensive support and training to lower the overall expense associated with retarder systems. Therefore, high installation and maintenance costs is hampering the demand for the vehicle retarder market.

Surge in investments in smart transportation systems

The surge in investments in smart transportation systems presents a lucrative vehicle retarder market opportunity for the vehicle retarder market. As cities and governments increasingly invest in modernizing transportation infrastructure, integrating advanced technologies becomes a priority. Smart transportation systems aim to enhance safety, efficiency, and sustainability, creating a demand for sophisticated vehicle components such as retarders. These systems often include advanced braking solutions that can integrate with other smart technologies, such as vehicle-to-infrastructure (V2I) communication and automated driving systems.

For instance, in February 2023, the National Health Service's (NHS) initiated USD 621.27 million transport infrastructure framework emphasizes sustainable transport, which could benefit from the inclusion of vehicle retarders to enhance safety in public transport systems. Retarders can reduce brake wear and improve control on buses or ambulances, contributing to more efficient and safer nationwide transport services.

Vehicle retarders, with their ability to provide precise and reliable braking performance, align well with these smart transportation goals. They contribute to improved vehicle safety, better control, and reduced wear on traditional braking systems. As the focus shifts towards creating intelligent and resilient transportation networks, the need for advanced retarders that can seamlessly integrate into these systems is expected to grow. This presents a significant opportunity for market expansion, driven by the increasing adoption of smart technologies in the transportation sector. Therefore, surge in investments in smart transportation systems is lucrative opportunity for the vehicle retarder market.

Segment Review

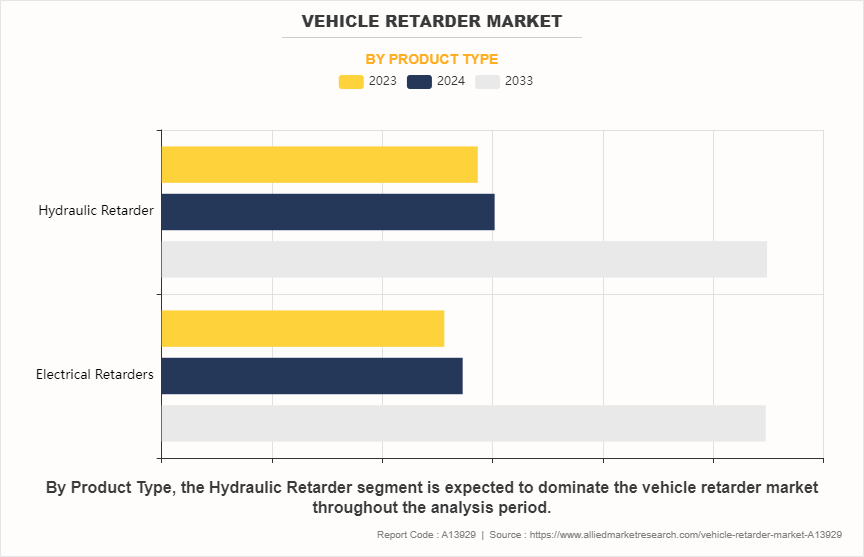

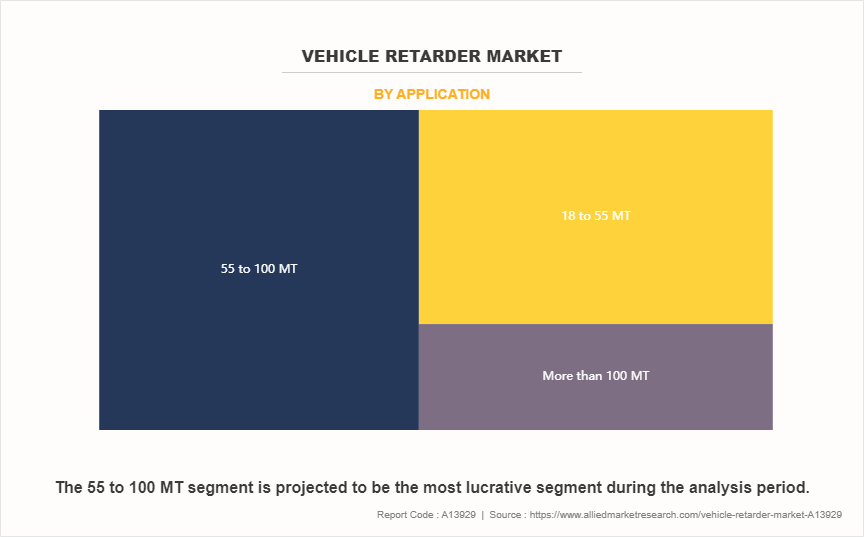

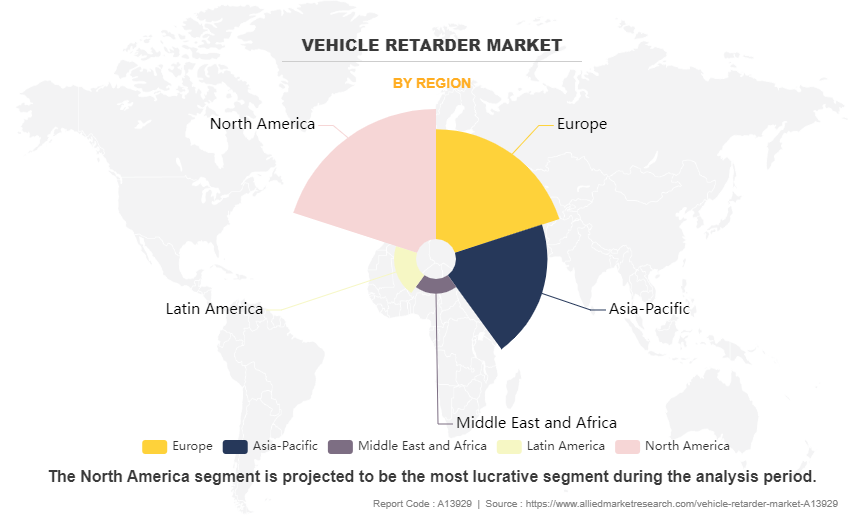

The vehicle retarder market is segmented into product type, application, and region. On the basis of product type, the market is divided into electrical retarders, and hydraulic retarders. As per application, the market is segmented into 18 to 55 MT, 55 to 100 MT, and greater than 100 MT. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

By Product Type

On the basis of product type, the hydraulic retarder segment generated the highest revenue in 2023, as hydraulic retarders are extensively utilized in heavy-duty commercial vehicles, particularly in the mining, construction, and transportation industries. Their ability to provide superior braking performance in harsh conditions and efficiently handle heavy loads makes them essential for operations in open-pit mining and large-scale construction projects.

By Application

On the basis of application, the 55 to 100 MT segment generated the highest revenue in 2023, driven by the growing global demand from the mining and construction industries. The rapid expansion of infrastructure development projects globally is leading to increased utilization of heavy-duty vehicles equipped with advanced braking systems, further boosting demand in this segment.

By Region

By region, North America generated maximum revenue in 2023. This growth is attributed to government regulations on vehicle safety standards and emissions, which have driven manufacturers to invest in more advanced and energy-efficient retarder technologies.

Competitive Analysis

The key players profiled in the dump truck market include Cummins Inc., Frenelsa, Industrias Zelu (Klam Retarder), Scania AB, Shaanxi Fast Auto Drive Group Company, SORL Auto Parts, Inc., TBK Co., Ltd., Telma S.A., Voith Group, and ZF Friedrichshafen AG. The vehicle retarder market share is being shaped by competitors focusing on innovation and sustainability.

Key Takeaways

- On the basis of product type, the hydraulic retarder segment held the largest share in the dump truck industry in 2023.

- On the basis of application, the 55 to 100 MT segment held the largest share in the dump truck market in 2023.

- By region, North America held the largest share in the market in 2023.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vehicle retarder market analysis from 2023 to 2033 to identify the prevailing vehicle retarder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vehicle retarder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vehicle retarder market trends, key players, market segments, application areas, and market growth strategies.

Vehicle Retarder Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.5 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 289 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Frenelsa, TBK Co., Ltd., Cummins Inc., ZF Friedrichshafen AG, SORL Auto Parts, Inc., Scania, INDUSTRIAS ZELU, Voith GmbH & Co. KGaA, Shaanxi Fast Auto Drive Group Co., Ltd, Telma S.A.S. |

Upcoming trends of Vehicle Retarder Market in the globe are surge in investments in smart transportation systems, and rise in adoption of electric and hybrid commercial vehicles

Leading application of Vehicle Retarder Market is 55 to 100 MT segment

Largest regional market for Vehicle Retarder is North America

The global vehicle retarder market was valued at $2.7 billion in 2023, and is projected to reach $5.5 billion by 2033, growing at a CAGR of 7.4% from 2024 to 2033.

The key players profiled in the dump truck market include Cummins Inc., Frenelsa, Industrias Zelu (Klam Retarder), Scania AB, Shaanxi Fast Auto Drive Group Company, SORL Auto Parts, Inc., TBK Co., Ltd., Telma S.A., Voith Group, and ZF Friedrichshafen AG.

Loading Table Of Content...

Loading Research Methodology...