Vehicle Telematics Hardware Market Research, 2033

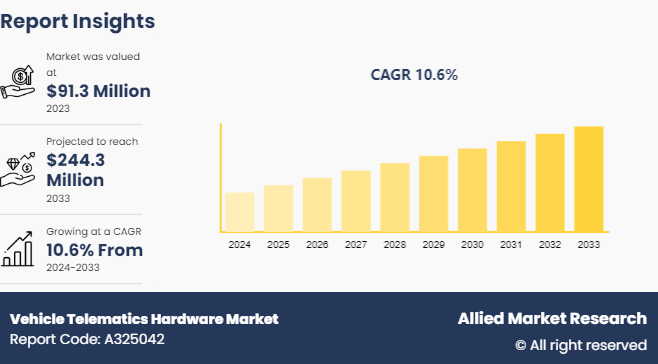

The global vehicle telematics hardware market was valued at $91.3 million in 2023, and is projected to reach $244.3 million by 2033, growing at a CAGR of 10.6% from 2024 to 2033.

Market Introduction and Definition

The vehicle telematics hardware market consists of industry segments related to the production, distribution, and application of hardware devices that are utilized in telematics systems for vehicles. Furthermore, vehicle telematics hardware is related to physical components that are implemented in different vehicles that facilitate telematics services. The vehicle telematics hardware market is important for modern transportation, providing advantages such as enhanced operational efficiency, improved safety, decreased impact on the environment, and better customer service. This technology helps in different sectors such as the logistics sector, transport sector, automotive manufacturing sector, insurance sector, and car-sharing services sector.

Key Takeaways

- The vehicle telematic hardware market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major vehicle telematic hardware industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

- In January 2021, Aptiv Plc, a global technology company launched a next-generation level 1-3 capable ADAS platform. Aptiv's ADAS platform can incorporate future technologies and features, including those developed in collaboration with Motional, providing further scalability to higher levels of automation. Such type of solution launches are expected to create a growth for vehicle telematics hardware market opportunity.

- In October 2023, Nauto, a leading provider of AI-powered driver and fleet safety platforms launched a new telematics solution to provide fleets with a powerful solution that enhances driver and road safety, but also optimizes day-to-day operations and reduces cost. This strategic move is expected to enhance the vehicle telematics hardware market growth.

- In November 2023, Brigade launched a new vehicle telematics system. Businesses can create an image of hazardous driving patterns and identify the activities of a particular driver by analyzing the data that the system gathers on different elements of driver performance, such as speeding, abrupt braking, and quick acceleration. This strategic move will enhance vehicle telematics hardware market share.

- In May 2022, Bosch and Astrata signed a 5-year partnership for an advanced fleet management system. This partnership will help Bosch to reduce the risk of shortages and that will allow Astrata to improve the flexibility and scalability of its supply chain to meet the demand. This strategic implementation is expected to increase vehicle telematics hardware market size.

- In April 2021, ALD Automotive signed a partnership agreement with Danlaw, a leader in connected car technology and automotive electronics to take advantage of its Bitbrew cloud platform and its industry-leading DataLogger line of OBD-II devices in support of ALD ProFleet. Fleet managers and drivers access real-time connected car data with ALD ProFleet, a recently improved connected car solution that uses Vinli's cloud-connected car and data intelligence platform for smart car data integration and processing. This strategic implementation will increase vehicle telematics hardware market size.

Key Market Dynamics

Strong regulations enforcement for vehicle safety and emissions and demand for fleet management solutions are two primary drivers driving the growth of the global vehicle telematics hardware market. Furthermore, growing consumer demand for connected car services and investment in smart transportation and infrastructure are the two main opportunities that are expected to enhance the growth of the global vehicle telematics hardware market during the vehicle telematics hardware market forecast. High investment costs and cybersecurity issues are the two main restraints that can hold the growth of the global vehicle telematics hardware market.

Market Segmentation

The vehicle telematics hardware market is segmented into type, application, and region. Based on type, the market is divided into 2G, 3G, 4G, and 5G. As per application, the market is bifurcated into passenger vehicles and commercial vehicles. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

- Crown Commercial Service (CCS) launched the latest vehicle telematics hardware technology under the RM6315 agreement in the UK. The new agreement is designed to improve the purchasing process and provide a detailed range of telematics products and services. The new agreement will be effective till March 4, 2026.

- In October 2023, Suntech International developed a strategic plan to restructure and form Suntech U.S. Holdings Inc. The objective behind the strategy is to invest in telematic hardware technology, artificial intelligence technology, and video capabilities, to assist the network platform providers in U.S. and Canada.

- Shell Canada, launched a comprehensive telematics solution. Shell Telematics combines vehicle data with its fleet card system, allowing businesses to track and optimize their fleet operations. The platform helps in reducing fuel fraud, enhancing the efficiency of routes, and monitoring the behavior of drivers thus upgrading the productivity of fleet and protection.

Competitive Analysis

The major players operating in the vehicle telematic hardware market include Actia, Aptiv, Bosch, Continental, Denso, Harman, Lear, LG Electronics, Marelli, Valeo, Visteon, Zonar, Omintracs, Brigade, Nauto, ALD Automotive, Danlaw, Astrata, Samsara, and Cal Amp. These players adopted product launches, partnerships, and other strategies to increase their market share in the global vehicle telematic hardware industry.

Industry Trends

- The Canadian government invested in next-generation and digital technology to accelerate innovation and collaboration in the business sector, education sector, and government sector. This trend is expected to increase the growth of vehicle telematics hardware industry.

- The U.S. government made several efforts such as the government introduced National Highway Traffic Safety Administration (NHTSA) regulations, and Corporate Average Fuel Economy (CAFE) standards to improve the position of the global vehicle telematics hardware market. This trend is expected to increase the growth of vehicle telematics hardware industry.

- The UK government implemented the road to zero strategies, the Automated Vehicles Act, formed effective transport systems and introduced autonomous vehicles.

- The Mexican government has implemented various initiatives, including the National Development Plan, National Strategy for Electric Mobility, and Urban Mobility Plans, to boost the global vehicle telematics hardware market.

Key Sources Referred

- PRNewswire

- Fleet equipment

- Brigade Electronics.com

- ISED

- Danlaw

- ET Auto

- International Council on Clean Transportation

- GOV.UK

- NHTSA

- Shell India

- Suntech

- Crown Commercial Service

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vehicle telematics hardware market analysis from 2024 to 2033 to identify the prevailing vehicle telematics hardware market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vehicle telematics hardware market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vehicle telematics hardware market trends, key players, market segments, application areas, and market growth strategies.

Vehicle Telematics Hardware Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 244.3 Million |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zonar, ACTIA, BOSCH, Harman, Samsara, ALD Automotive, Lear Corporation, Visteon, Danlaw, Astrata Group, Cal Amp, Marelli, Valeo, Omnitracs, Continental AG, Brigade, Aptiv PLC, LG Electronics Inc., Denso Corporation, Nauto |

The UK government has implemented several initiatives such as the road to zero strategy, the Automated and Electric Vehicles Act, intelligent transport systems, the Center for connected and Autonomous Vehicles, and other initiatives to enhance the growth of the global vehicle telematics hardware market.

The commercial vehicle is the leading application of vehicle telematics hardware market, as commercial vehicles, including trucks, delivery vans, and buses, heavily rely on telematics for fleet management.

North America is the largest regional market for vehicle telematics hardware. This is because North America, particularly the United States and Canada, has a highly developed telecommunications infrastructure, which supports the widespread adoption and implementation of telematics hardware.

$244.3 million is the estimated industry size of vehicle telematics hardware.

Actia, Aptiv, Bosch, Continental, Denso, Harman, Lear, LG Electronics, Marelli, Valeo, Visteon, Zonar, Omintracs, Brigade, Nauto, ALD Automotive, Danlaw, Astrata, Samsara, and Cal Amp are the top companies to hold the market share in vehicle telematics hardware

Loading Table Of Content...