Ventricular Assist Devices Market Overview

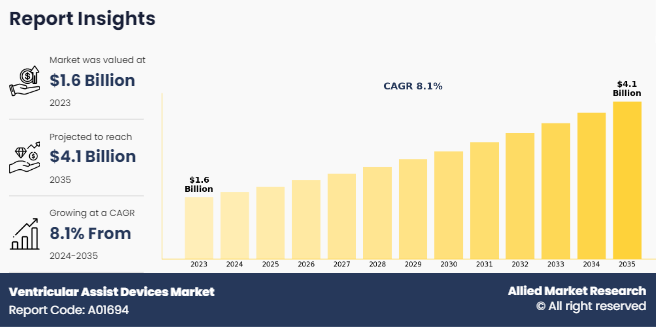

The global ventricular assist devices market was valued at $1.6 billion in 2023, and is projected to reach $4.1 billion by 2035, growing at a CAGR of 8.1% from 2024 to 2035. Rising prevalence of end-stage heart failure, increasing adoption of mechanical circulatory support systems, and advancements in device technology. are the other factors that contribute to the growth of the market.

Market Dynamics & Insights

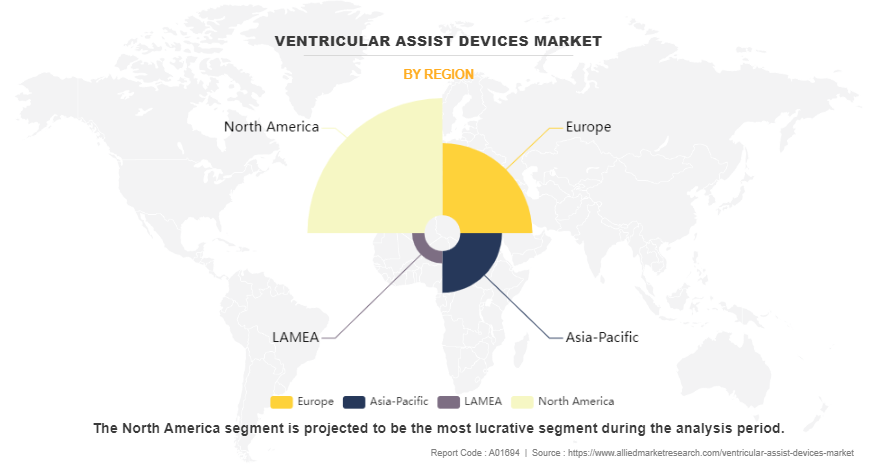

- The ventricular assist devices industry in North America held a significant share of over 48.2% in 2023.

- The ventricular assist devices industry in China is expected to grow significantly at a CAGR of 12.0% from 2024 to 2035.

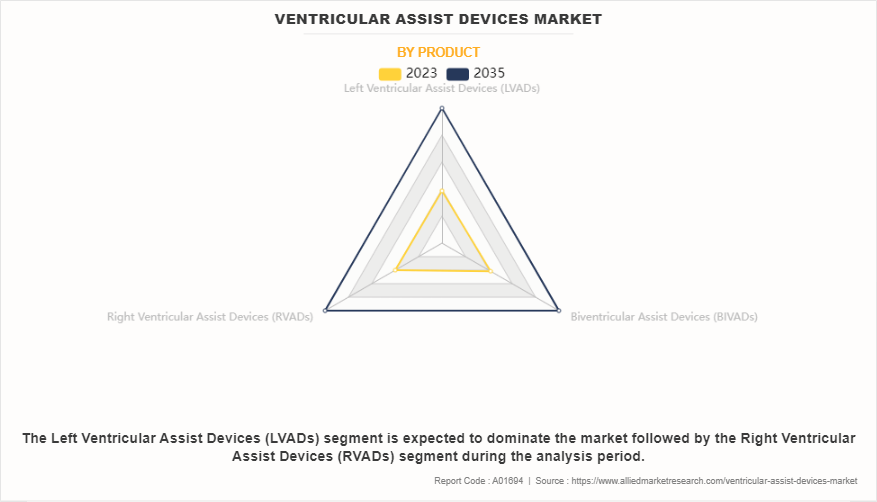

- By product, Left Ventricular Assist Devices (LVADs) is one of the dominating segment in the market and accounted for the revenue share of over 76.8% in 2023.

- By application, the Bridge-To-Transplant (BTT) segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2023 Market Size: $1.6 Billion

- 2035 Projected Market Size: $4.1 Billion

- CAGR (2024-2035): 8.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Increase in incidences of heart failures is the major factor driving the growth of the ventricular assist devices market. According to Centers for Diseases Control and Prevention (CDC), in January 2023, heart disease is the leading cause of death for both men and women in the U.S. and about 6.2 million adults in the U.S. have heart failure. Thus, high incidences of heart failure increases the demand for ventricular assist devices around the globe and thus propels the ventricular assist devices market growth.

What is Meant by Ventricular Assist Devices

Ventricular assist devices (VADs) are medical devices designed to support the function of the heart in patients with heart failure. It works by assisting the heart in pumping blood and maintaining blood flow throughout the body. VADs are typically used as a temporary measure to support patients with heart failure while the patient undergoes further treatment, such as heart surgery. They can also be used as a bridge to transplant, allowing patients with heart failure to wait for a heart transplant while still receiving support from a VAD.

Key Takeaways

- On the basis of product, the left ventricular assist devices (LVADs) segment dominated the ventricular assist devices market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

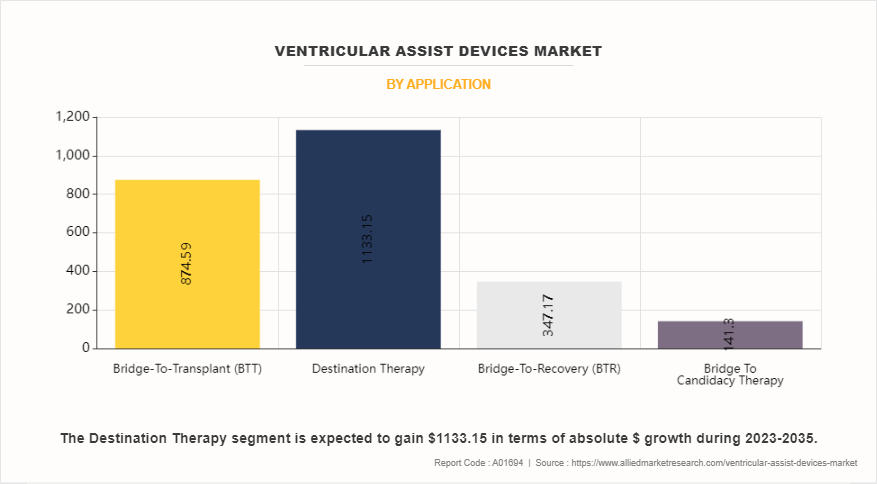

- By application, the bridge-to-transplant (BTT) was the major revenue contributor in ventricular assist devices market size in 2023. However, the destination therapy segment is anticipated to register the fastest CAGR during the forecast period.

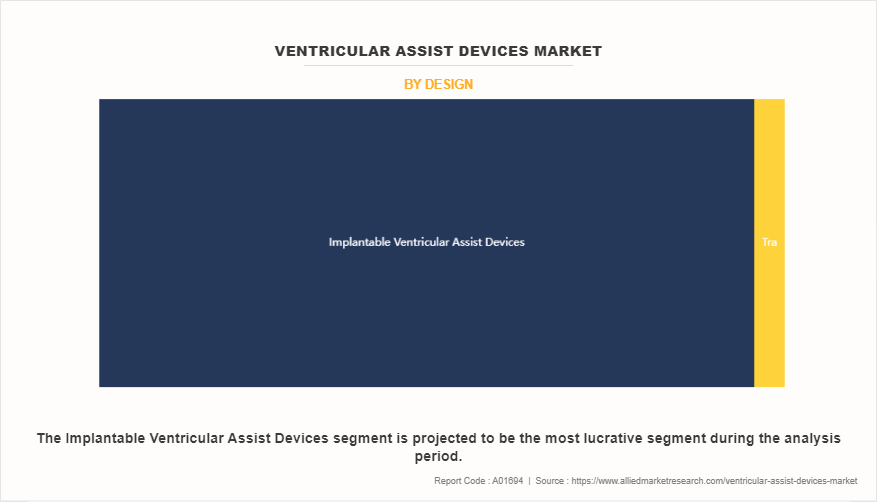

- Depending on design, the implantable ventricular assist devices segment accounted for the highest revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

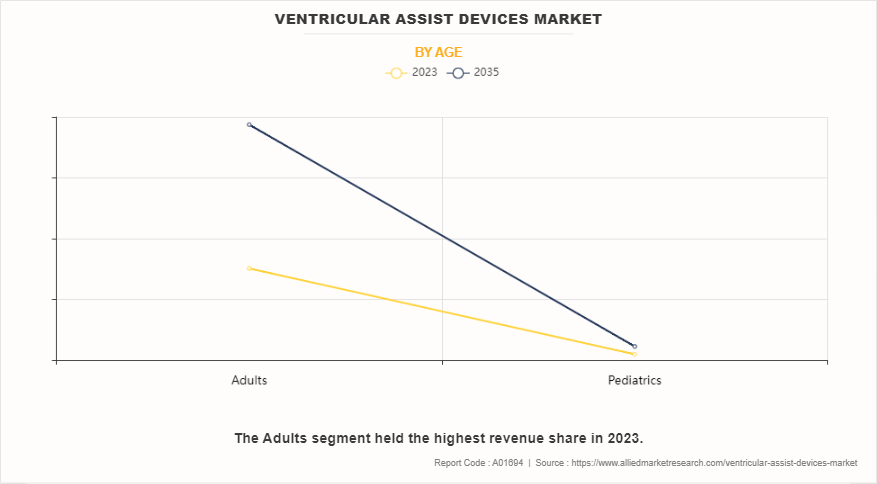

- On the basis of age, the adult segment accounted for the highest revenue in 2023. However, the pediatrics segment is anticipated to grow at the fastest CAGR during the forecast period.

- Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Ventricular Assist Devices Market Dynamics

The growth of the global ventricular assist devices market is majorly driven by increase in the prevalence of cardiovascular diseases, such as arrythmia, heart attack, and heart failure; and increased awareness about heart failure treatment options such as ventricular assisted devices. In addition, educational programs and initiatives led by governments and organizations like the Heart Failure Society of America, further contribute to the market growth. Social media, events, and support groups further disseminate information and success stories about ventricular assist devices (VADs), boosting patient demand. Collaboration with medical organizations, hospitals, and device manufacturers enhances education efforts, empowering patients and healthcare providers to make informed decisions about VADs. Overall, heightened awareness of heart monitoring and treatment options fuels market expansion by increasing acceptance and adoption of VADs among patients and healthcare professionals.

In addition, technological advancements in ventricular assist devices drive the growth of the market. In the past, the employed devices had disadvantages such as high chance of infection, clot formation, and blood damage. To overcome these issues, there were changes made to the ventricular assist devices (VADs) to increase the effectiveness and durability of the device.

Furthermore, the improvements in continuous flow technology have enhanced the outcomes for patients. In addition, the devices offer high efficiency, implant ability, and extended support. Moreover, the strength and effectiveness of the devices have made it possible to support patients with VAD implantation, who are not transplant candidates. As a result, the clinical use and applications of ventricular assist devices (VAD) is increasing, which further propels the growth of the market.

Advancements in ventricular assist devices have led to higher success rates in the treatment of heart failures. For instance, the third-generation VAD devices are significantly different from the second-generation and first-generation devices. The third generation left ventricular assist device (LVADs) consist of more advanced technology, which is known as magnetic levitation (MAGLEV). This technology allows for rotation without friction and thereby enhances efficiency and durability of the device. Thus, more such technological advancements in VAD drive the market expansion and are anticipated to offer potential growth for the market during the forecast period.

The high cost associated with ventricular assist devices (VADs) and procedures poses a significant barrier to market growth. VADs are complex devices requiring advanced components and manufacturing processes, leading to elevated prices. Limited manufacturers and high R&D costs further contribute to the expense. Adoption rates are hindered, particularly in emerging countries, due to costliness compared to alternative treatments. Inadequate insurance coverage and reimbursement policies, particularly in Asia-Pacific and LAMEA regions, exacerbate affordability challenges, limiting adoption in developing nations.

In addition, risks associated with VAD implantation hamper market expansion. Complications such as bleeding, blood clots, stroke, heart attack, device malfunctions, and infections are prevalent. Instances of VAD failure necessitating immediate medical attention or device replacement add to concerns. These factors collectively restrain the growth of the ventricular assist devices market, as they deter both patient acceptance and healthcare provider adoption.

In addition, major players have adopted some key strategies, which help expand the companys product portfolio and contribute to expansion of the business. For instance, in January 2023, Abiomed received regulatory approvals in three countries for Impella surgical products. The U.S. Food and Drug Administration's (FDA) granted Early Feasibility Study (EFS) and Investigational Device Exemption (IDE) approval to the Impella BTR (Bridge-to-Recovery) and on the other hand, in Asia, Impella 5.5 with SmartAssist received approval from Japans Pharmaceuticals and Medical Devices Agency (PMDA) and Hong Kongs Medical Device Division (MDD). Thus, more such product approvals and launches by companies are anticipated to augment the market growth during the forecast period.

Ventricular Assist Devices Market Segments Overview

The global ventricular assist devices market is segmented into product, application, design, age, and region. By product, the market is categorized into left ventricular assist devices (LVADs), right ventricular assist devices (RVADs), and biventricular assist devices (BIVADs). On the basis of application, the market is fragmented into bridge-to-transplant (BTT), destination therapy, bridge-to-recovery (BTR), and bridge to candidacy therapy. On the basis of design, the market is bifurcated into transcutaneous ventricular assist devices and implantable ventricular assist devices. By age, the market is divided into adults and pediatrics. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, North Africa and rest of Middle East & Africa).

By Product

Depending on product, the market is segmented into left ventricular assist devices (LVADs), right ventricular assist devices (RVADs), and biventricular assist devices (BIVADs). The left ventricular assist devices (LVADs) segment accounted for the largest ventricular assist devices market share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. Surge in adoption of left ventricular assist devices (LVADs) can be primarily attributed to their widespread use as compared to right ventricular assist devices (RVADs), for several reasons. The left ventricle serves as the primary pumping chamber of the heart, and supporting its function can profoundly impact overall heart performance. In addition, heart failure commonly stems from left ventricular dysfunction, making LVADs a targeted solution for addressing the underlying cause of the condition. Moreover, LVADs are used for a longer duration than RVADs, owing to their established safety and effectiveness.

By Application

Depending on application, the ventricular assist devices industry is divided into bridge-to-transplant (BTT), destination therapy, bridge-to-recovery (BTR), and bridge to candidacy therapy. The bridge-to-transplant (BTT) segment accounted for the largest ventricular assist devices market share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. This is driven by growing awareness of bridge-to-transplant therapy, which notably enhances transplant surgery success rates. BTT serves as an interim solution for patients awaiting heart transplants, providing mechanical circulatory support until a suitable donor becomes available. The growing recognition of this therapy's efficacy encourages its widespread adoption, reinforcing its prominence in the ventricular assist devices market.

However, the destination therapy segment is expected to exhibit the fastest CAGR during the ventricular assist devices market forecast period. Ventricular assist devices (VADs) have emerged as a significant treatment option for individuals suffering from heart failure, especially those unsuitable for heart transplantation. Destination therapy involves using VADs as a long-term solution to improve quality of life and survival in these patients. This increasing recognition of VADs as an alternative therapy fuels the anticipated growth in the destination therapy segment.

By Design

By design, the market is segregated into transcutaneous ventricular assist devices and implantable ventricular assist devices. The implantable ventricular assist devices segment accounted for the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. This is attributed to ongoing technological innovations and increased research endeavors aimed at enhancing the efficiency and quality of implantable VADs. These advancements have led to the development of more sophisticated and reliable devices, driving their adoption in the treatment of advanced heart failure. As a result, the implantable VADs segment maintains its leading position in the ventricular assist devices market.

By Age

Depending on age, the ventricular assist devices market is bifurcated into adults and pediatrics. The adults segment accounted for the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period, owing to rise in cases of heart failure in adults due to lifestyle changes such as smoking. However, the pediatrics segment is expected to exhibit the fastest CAGR during the forecast period owing to technological advancements in the field of VADs and development of pediatric VADs that are highly efficient in treating heart failure in pediatric patients.

By Region

Region-wise, the ventricular assist devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America acquired the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period owing to a well-established healthcare infrastructure, high healthcare spending, extensive adoption of advanced therapeutic technologies, robust R&D activities, and favorable government initiatives supporting healthcare innovation. In addition, the region's large population base and rise in the prevalence of cardiac failure contribute to the continued growth of the ventricular assist devices market.

However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period. The region's robust economic development, coupled with a rapidly expanding population, is contributing to increase in the number of patients suffering from permanent heart failure. In addition, rise in healthcare awareness and improving healthcare infrastructure in countries across Asia-Pacific are fostering greater access to ventricular assist devices.

Ventricular Assist Devices Market Competitive Analysis

The major players such as Abbott Laboratories and LivaNova have adopted product launch, acquisition, product development, product launch, and product approval as key developmental strategies to strengthen their foothold in the competitive market. For instance, in September 2022, Abiomed announced two approvals from the U.S. Food and Drug Administration (FDA) related to clinical research of Impella heart pumps in acute myocardial infarction (AMI) cardiogenic shock patients. The FDA has approved the on-label RECOVER IV randomized controlled trial (RCT) for AMI cardiogenic shock patients.

What are the Recent Developments in Ventricular Assist Devices Industry

- In March 2022, FineHeart S.A, announced the grant by the USPTO (United States Patent and Trademark Office) in the U.S. for the ICOMS FLOWMAKER, a fully Implantable Cardiac Output Management System designed to address the unmet need of patients suffering from severe heart failure.

- In October 2022, Abiomed announced that Impella RP Flex with SmartAssist received the U.S. Food and Drug Administration (FDA) pre-market approval (PMA), as safe and effective to treat acute right heart failure for up to 14 days.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ventricular assist devices market analysis from 2023 to 2035 to identify the prevailing ventricular assist devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ventricular assist devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ventricular assist devices market trends, key players, market segments, application areas, and market growth strategies.

Ventricular Assist Devices Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 275 |

| By Application |

|

| By Design |

|

| By Age |

|

| By Product |

|

| By Region |

|

| Key Market Players | LivaNova PLC, Berlin Heart GmbH, Carmat SA, CH Biomedical, Inc., Abiomed, Inc., Bivacor Inc., Fineheart, Abbott Laboratories, Evaheart, Inc., AdjuCor GmbH |

Analyst Review

Increase in demand for advanced treatment procedures for cardiovascular diseases is expected to offer profitable opportunities for the expansion of the market. Also, rise in demand for ventricular assist devices among heart failure patients is driving the growth of the ventricular assist devices market. Furthermore, technological advancements in ventricular assist devices contribute to the expansion of the market.

In addition, increase in awareness among the population regarding ventricular assist devices as a treatment option for heart failure and their advantages boosts its demand in the healthcare sector. Moreover, rise in funding and reimbursements for ventricular assist device (VAD) implantation offered by government and other organizations around the globe boosts the growth of the market.

Furthermore, North America is expected to remain dominant during the forecast period, due to surge in the use of ventricular assist devices. This is attributed to a well-established healthcare infrastructure and high healthcare expenditure. Furthermore, the presence of major market players fosters innovation and product development. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to key players, due to surge in awareness toward preventative healthcare, high population base, and upsurge in healthcare expenditure.

The total market value of ventricular assist devices market is $1.6 billion in 2023.

The forecast period for ventricular assist devices market is 2024 to 2035

The market value of ventricular assist devices market in 2035 is $4.1 billion

The base year is 2023 in ventricular assist devices market .

Top companies such as Abbott Laboratories, Abiomed, Inc., AdjuCor GmbH, Berlin Heart GmbH, Bivacor Inc., Calon Cardio-Technology Ltd, held a high market position in 202

3. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The Left Ventricular Assist Devices (LVADs) segment is the most influencing segment in ventricular assist devices market.This increase in adoption of LVADs is mainly attributed as it is used more commonly than RVADs for several reasons such as the left ventricle is the main pumping chamber of the heart and providing support to the left ventricle can have a significant impact on overall heart function..

The major factor that fuels the growth of the ventricular assist devices market are Increasing prevalence of cardiovascular diseases, technological advancements and shortage of donor organs for transplantation.

Ventricular assist device (VAD), also known as mechanical circulatory support (MCS) device, supports the pumping function of the heart. It is used to increase the amount of blood that flows through the patient’s body.

Loading Table Of Content...

Loading Research Methodology...