Venture Capital Investment Market Overview

The Global Venture Capital Investment Market size was valued at USD 173.5 billion in 2021, and is projected to reach USD 1068.5 billion by 2031, growing at a CAGR of 20.1% from 2022 to 2031. Growing demand for digital technology, adoption of digital platforms such as innovative digitalization business models by SMEs, and increasing digital-savvy consumers in developing markets contribute to the growth of the market.

Market Dynamics & Insights

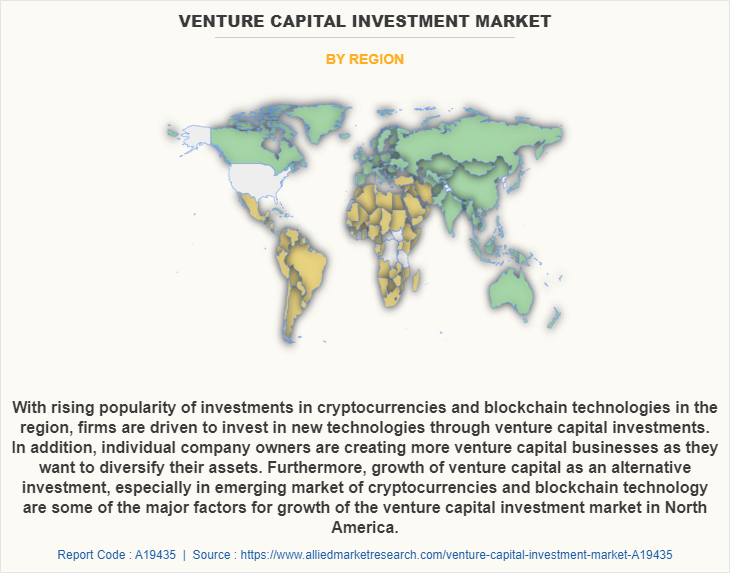

- The venture capital investment industry in North America held a significant share of 39% in 2021.

- The venture capital investment industry in India is expected to grow significantly at a CAGR of 26.4% from 2022 to 2031.

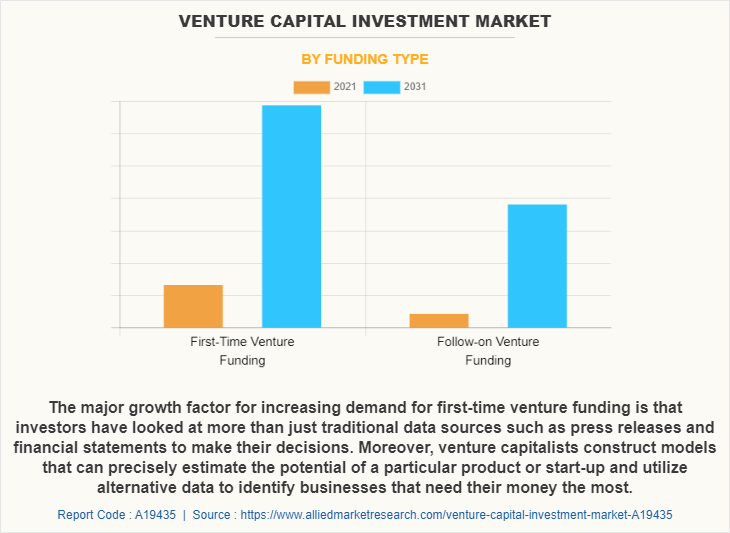

- By funding type, the first-time venture funding segment dominated the market, accounting for the revenue share of 75% in 2021.

- By industry vertical, the computer and consumer electronics segment dominated the industry in 2021 and accounted for the largest revenue share of 29%.

Market Size & Future Outlook

- 2021 Market Size: USD 173.45 Billion

- 2031 Projected Market Size: USD 1068.5 Billion

- CAGR (2022-2031): 20.1%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

What is Meant by Venture Capital Investment

Venture capital investment is a type of private equity investment that involves investing in companies that require capital. Business often requires capital for initial setup or expansion. Venture capital investing may be done at an even earlier stage, known as the idea phase. A venture capitalist may provide resources to an entrepreneur if the former believes that the latter can come up with a good business idea. Venture capital investing projects are usually run by private equity funds, with each fund running a portfolio of projects it specializes in. For instance, a private equity fund specializing in artificial intelligence may invest in a portfolio of ten venture capital projects on fully intelligent vehicles.

Market Drivers

Surge in the technology sector is a major driver for the venture capital investment market. The two technologies generating the most corporate venture capital investment currently are artificial intelligence (AI) and cloud technology, which together grew more than twice as fast as venture investments in all other sectors over the past decade and now account for more than a third of total tech venture investment value. However, time-consuming process of venture capital exits, as it takes several years for any startup to exit from its IPO. Thus, the longer the holding period of investments, the more negative implications it has on the capital investment performance, meaning greater stress on the entrepreneurs to return the capital in a timely manner. In addition, requirement for an extensive due diligence process is one of the major factors hampering the growth of the market. On the contrary, technological advancement in the field of venture capital investment is expected to provide major and lucrative opportunities in the growth of the venture capital investment market in the upcoming years.

Type Insights

The venture capital investment market refers to a detailed understanding of the different types of investments, sectors, and opportunities that shape the VC landscape. These insights are crucial for investors to make informed decisions, optimize their portfolios, and stay ahead of market trends.

Venture capital is divided into seed, early-stage, and late-stage investments, each with unique risks and rewards. Seed-stage focuses on high-potential, high-risk nascent companies with disruptive ideas. Early-stage, often Series A or B, supports companies ready to scale but needing capital for expansion. Late-stage, typically Series C and beyond, targets established companies seeking additional funds to reach profitability or prepare for an exit event like an IPO or acquisition.

Industry-specific opportunities are crucial in venture capital. Sectors like technology, healthcare, and clean energy attract significant VC funding due to their high growth potential and transformative impact. Promising areas for investment include fintech, artificial intelligence, and sustainability-driven innovations. Additionally, emerging markets and new geographies are gaining importance as VCs diversify their portfolios.

Moreover, investor strategies are shifting towards prioritizing Environmental, Social, and Governance (ESG) criteria. VCs are increasingly seeking startups that provide social impact along with financial returns. By understanding these insights, investors can align their objectives, mitigate risks, and capitalize on high-growth opportunities in the evolving VC landscape.

Venture Capital Investment Market Trends Insights

The venture capital investment market is expected to witness several noteworthy trends in the market. One of the key trends currently driving the VC market is artificial intelligence (AI) and machine learning (ML). These technologies have applications across virtually every sector, from healthcare to finance to transportation. VCs are increasingly focusing on AI-powered solutions that enhance operational efficiency, automate processes, and offer predictive capabilities. Understanding the technical intricacies of AI models and the market landscape surrounding them enables VCs to make informed decisions about which startups have the potential to achieve rapid growth and scale. In addition, there is increase in the integration of Internet of Things (IoT). As devices become more interconnected, businesses are leveraging IoT to optimize operations, gather real-time data, and create smarter consumer experiences. VCs who understand the potential applications of IoT can better assess the value proposition of startups that are harnessing this technology for novel solutions.

Furthermore, blockchain technology, particularly in decentralized finance (DeFi), has also gained popularity due to considerable attention from venture capitalists. Blockchain offers the promise of transparency, security, and efficiency, which can revolutionize sectors like banking, supply chain management, and digital identity verification. Investors who keep an eye on blockchain’s evolving use cases are in a better position to identify early-stage projects with disruptive potential. Technology insights provide venture capitalists with the knowledge necessary to navigate an increasingly complex market, helping them identify high-potential startups and make strategic investment decisions. By staying ahead of technological trends and innovations, VCs can capitalize on opportunities that will drive the next wave of growth and transformation.

Venture Capital Investment Market Segment Review

The venture capital investment market is segmented on the basis of funding type, fund size, industry verticals, and region. By funding size, it is segmented into first-time venture funding and follow-on venture funding. The first-time venture funding is further sub-segmented into private equity firms and HNWs. By fund size, it is segmented into on- under $50 m, $50 m to $100 m, $100 m to $250 m, $250 m to $500 m, $500 m to $1 b, and above $1 b. On the basis of industry verticals, it is segregated into computer & consumer electronics, communications, life sciences, energy, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of funding type, the first-time venture funding segment attained the highest growth in 2021. This is attributed to the fact that this is the first round of investment for gaining early-stage traction. The capital raised during the seed stage is usually used for market research and product development.

By region, North America attained the highest venture capital investment market share in 2021. This is attributed to the fact that the market is currently growing as a result of an increase in startups, financial institutions, and mutual funds venture capital firms, and the market's overall expansion. In addition, rise in investment activities across a variety of sector verticals, including healthcare, biotechnology, agriculture, and media & entertainment, are bolstering venture capital investment market growth.

Application Insights

The venture capital investment market is expected to witness substantial growth in recent years, driven by innovation, technology, and emerging sectors. VC firms provide funding to early-stage companies with high growth potential, typically in exchange for equity. Startups in industries like technology, healthcare, and clean energy attract the most attention, as investors seek opportunities with the potential for high returns. The growing trend of digital transformation and the increasing demand for sustainable solutions have spurred significant investments in these sectors. In addition, VC investments are expanding beyond traditional hubs, with emerging markets gaining traction. As the global economy recovers and new technologies continue to reshape industries, the VC market is expected to remain a critical driver of economic growth. This growing demand for capital, paired with an increased appetite for risk-taking, has elevated venture capital as a cornerstone of the entrepreneurial ecosystem. The report focuses on growth prospects, restraints, and trends of the venture capital investment market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers, on the venture capital investment market.

The report analyzes the profiles of key players operating in the venture capital investment market, such as Accel Partners Venture, Agoranov, Balderton Capital (UK) LLP, Battery Ventures, Caixa Capital Risc, Cherry Ventures, Eurazeo, Greylock Partners, HoxtonVentures LLP, Index Ventures, Lakestar, Seedcamp, Sequoia, Target Global, Union Square Ventures, Park Capital, and GetVantage. These players have adopted various strategies to increase their market penetration and strengthen their position in the venture capital investment industry.

COVID-19 Impact Analysis

The COVID-19 epidemic affects every aspect of global business, including venture capital investment. The COVID-19 has created less momentum in the investment pool and extra risk aversion as venture capital investment activity has been reduced on a global scale. Moreover, small and medium businesses have been halted and most of the businesses have been liquidated due to COVID-19. In addition, the portfolio's valuation deduction, the volatility of the foreign exchange market, and difficulties with current investments have all contributed to a worsening of the SME's assets' financial performance. Furthermore, Initial Public Offers (IPO), mergers, and acquisitions are delayed in the global market. Thus, seed venture capital investment has continuously declined due to investors’ looking for well-established and matured companies for their investments. Therefore, the COVID-19 pandemic has negatively impacted the venture capital investment market.

The venture capital investment market plays an important role in fostering innovation and the growth of emerging technologies. Key players in this ecosystem include angel investors, VC firms, and seed funding sources, all contributing to the development of high-growth startups. While private equity (PE) and VC share similarities, they differ in their investment strategies and stages of involvement. PE focuses on established companies seeking scale or restructuring, while VC targets early-stage startups, offering high-risk, high-reward opportunities, particularly in sectors like technology and biotech. In Angel investors vs. VC, Angel investors typically provide early-stage funding in exchange for equity, supporting startups with high growth potential but limited traction. Conversely, venture capitalists (VCs), often institutional investors, invest in businesses that have validated their model and show market potential, offering larger investments along with strategic guidance. Seed funding is essential at this early stage, helping with product development and market research. Recent seed funding trends include increased access to capital, the rise of micro-VC funds that are smaller and more nimble, sector-specific investments in high-growth areas like fintech, AI, and health tech, and the growing popularity of crowdfunding and alternative financing methods. Additionally, seed funding is becoming more geographically diverse, with emerging markets gaining prominence as hubs for innovation and early-stage investments. Overall, the venture capital market continues to evolve with diverse funding sources and global reach, enabling the growth of innovative startups worldwide.

What are the Top Impacting Factors in Venture Capital Investment Market

Venture Capital Investment Offers a Higher Potential Return

Most venture capitalists or venture capital returns expect to at least receive a 25% return on their investment. Depending on business's potential for growth, a venture capital investor may expect a much greater return. Additionally, venture capital investing is not accessible to the average investor, but it may be a key driver of economic growth for affluent individuals and institutions due to its ability to generate enormous profits. Moreover, the purpose of making venture capital firms is the ability to receive a tremendous return from these investments, and it is common for investors to desire that their initial investment be at least doubled. Therefore, this is one of the major driving factors of the venture capital investment market.

Time Taking Process of Venture Capital Exits

Exits are a primary element of the venture capital market which enables the managers to crystalize the paper gains and return the proceeds to the LPs. The sign of positive exits comes through mergers & acquisitions and IPOs, and the fact that their number has fallen is a sign that the corporate venture capital market is holding back. Moreover, in current times, the time to exit an IPO for a startup has become 8.2 years. Therefore, longer the holding period of investments, the more negative implications it has on the IRR performance, meaning greater stress on the entrepreneurs to return the capital in a timely manner. Therefore, this is one of the major factors that hampers the growth of venture capital investment market overview.

Rising Number of Retail Investors

With retail investors, the market is blessed with flexibility as their volume supersedes any scope of collusion or dominance. Even so, entrepreneurs face no undue pressure to scale their businesses and can focus on sustainable growth. In addition, for the retail investor revolution to materialize, blockchain technology, and crypto have a major role to play. Their ability to democratize the venture capital market and remove the barriers of entry is vital. Moreover, using smart contracts and tokenization, venture capital can be made accessible to all retail investors. Additionally, using bitcoins as a sign of worth and ownership makes investing simpler. Therefore, technological advancement in the field of social media analytics is expected to provide major and lucrative venture capital investment market opportunity for the growth of the market.

Key Industry Developments

- On March 20, 2025, All In Capital launched a ₹200 crore fund to support Indian startups in fintech, deeptech, and consumer tech1. This is their second fund, following the success of their first fund which backed 51 startups. The new fund aims to invest in 50 startups over the next three years, with initial investments of up to ₹5 crore

- On March 13, 2025, Informed Ventures launched an early-stage fund focused on digital health and vertical applications of AI. This new fund manages approximately $300 million in investments, targeting transformative companies in digital health, SaaS, and consumer products and services. The firm aims to support startups that drive change and redefine markets, leveraging their deep industry knowledge to help founders scale their companies.

- On October 22, 2024, The Asian Infrastructure Investment Bank (AIIB) has approved investments in Endiya Partners Fund III under its Venture Capital Investment Program. This initiative aims to support early-stage companies focused on green and technology-enabled infrastructure in India and Southeast Asia.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the venture capital investment market analysis from 2021 to 2031 to identify the prevailing venture capital investment market opportunities.

- The venture capital investment market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- Major countries in each region are mapped according to their revenue contribution to the global venture capital investment market forecast.

- The report includes the analysis of the regional as well as global venture capital investment market trends, key players, market segments, application areas, and market growth strategies.

Venture Capital Investment Market Report Highlights

| Aspects | Details |

| By Funding Type |

|

| By Fund Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Sequoia, Seedcamp, Lakestar, GetVantage, Union Square Ventures, Balderton Capital (UK) LLP, Hoxton Ventures LLP, Cherry Ventures, Accel Partners Venture, Caixa Capital Risc, Brighton Park Capital, Battery Ventures, Greylock Partners, Agoranov, Target Global, Eurazeo, Index Ventures |

Analyst Review

Venture capital aids startup founders in controlling the risk that comes with most new businesses. By having an experienced team oversee growth and operations, startups are expected to avoid major issues. The rate of failure for startups is still 20% in the first year, but when a complex situation arises, having a partner or investor with experience in helping startups succeed can improve the odds of making a good decision. When a venture capital firm invests in a business, it does so for equity in the company. This means that, unlike small business and personal loans, there are no regular payments for the business to make. This frees up working capital for the business, allowing them to reinvest in improving products, hiring a larger team, or further expanding operations. Moreover, many successful startup founders become partners at venture capital firms after they exit their businesses. These individuals often have experience scaling a company, solving day-to-day & longer-term problems, and monitoring financial performance. Even if they do not have a startup background, they often have experience with assisting startups and sit on the boards of as many as 10 at a time. This can make them valuable leadership resources for the companies in which they are invested. Most venture capital firms have a public relations team and media contacts, and it is in their best interest to get exposure for a startup. Working with a venture capital firm can add credibility to a startup, especially for founders that haven’t built other successful companies. Gaining more attention from potential employers, clients, partners, and venture capital companies who are looking to raise funds can result from increased publicity..

Furthermore, market players are adopting various strategies to enhance their services in the market and improve customer satisfaction. For instance, the U.S. Department of Health and Human Services (HHS) unveiled a new type of public-private partnership that enables investments using venture capital practices. Through the BARDA Ventures program, the Biomedical Advanced Research and Development Authority (BARDA), part of the HHS Office of the Assistant Secretary for Preparedness and Response, is launching a partnership with the nonprofit organization Global Health Investment Corporation (GHIC) to accelerate the development and commercialization of technologies and medical products needed to respond to or prevent public health emergencies, such as pandemics and other health security threats.

Through this partnership, BARDA intends to provide GHIC with a minimum of $50 million over five years, with potential for up to $500 million over 10 years. GHIC will launch a global health security fund with matching capital from other investors. This partnership will allow direct linkage with the investment community and establish sustained and long- term efforts to identify, nurture, and commercialize technologies that aid the U.S. in responding effectively to future health security threats. Some of the key players profiled include Accel Partners Venture, Agoranov, Balderton Capital (UK) LLP, Battery Ventures, Caixa Capital Risc, Cherry Ventures, Eurazeo, Greylock Partners, Hoxton Ventures LLP, Index Ventures, Lakestar, Seedcamp, Sequoia, Target Global, Union Square Ventures, Park Capital, and GetVantage. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Surge in the technology sector is a major driver for the venture capital investment market. The two technologies generating the most venture capital investment currently are artificial intelligence (AI) and cloud technology, which together grew more than twice as fast as venture investments in all other sectors over the past decade and now account for more than a third of total tech venture investment value.

On the basis of funding type, the first-time venture funding segment attained the highest growth in 2021. This is attributed to the fact that this is the first round of investment for gaining early-stage traction. The capital raised during the seed stage is usually used for market research and product development.

By region, North America attained the highest growth in 2021. This is attributed to the fact that the market is currently growing as a result of an increase in startups, financial institutions, and mutual funds venture capital investments, and the market's overall expansion. In addition, rise in investment activities across a variety of sector verticals, including healthcare, biotechnology, agriculture, and media & entertainment, are bolstering venture capital investment market growth.

The global venture capital investment market size was valued at $173.45 million in 2021, and is projected to reach $1,068.51 million by 2031, growing at a CAGR of 20.1% from 2022 to 2031.

Accel Partners Venture, Agoranov, Balderton Capital (UK) LLP, Battery Ventures, and Caixa Capital Risc, hold the market share in venture capital investment market.

Loading Table Of Content...