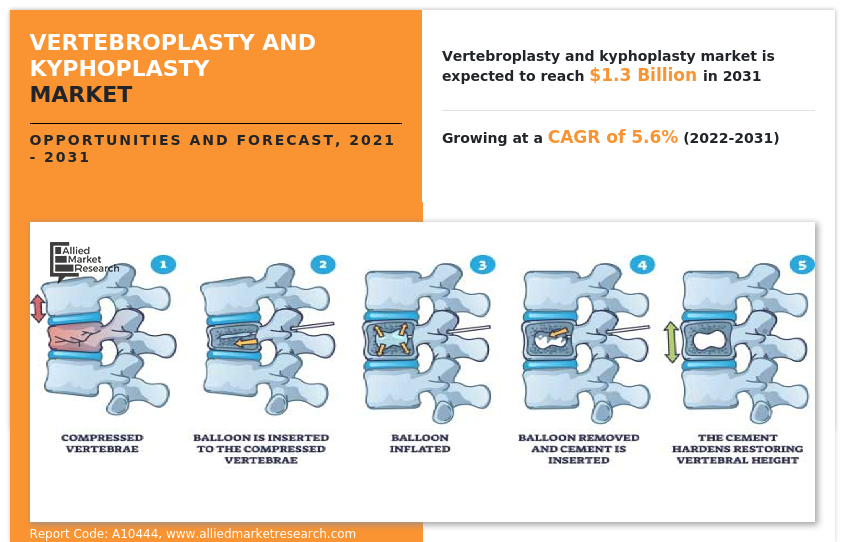

Vertebroplasty And Kyphoplasty Market Research, 2031

The global vertebroplasty and kyphoplasty market size was valued at $757.1 million in 2021, and is projected to reach $1,308.1 million by 2031, growing at a CAGR of 5.6% from 2022 to 2031. Vertebroplasty and kyphoplasty are surgical procedures used to treat painful vertebral compression fractures in spine. Vertebral compression fractures result from condition such as osteoporosis, which causes bones to become weak and brittle. Vertebroplasty refers to the procedure of injecting cement into the fractured bone with the help of imaging techniques whereas kyphoplasty refers to procedure of injecting cement by creating a void or space with the help of balloon in the fractured bone. This void is further filled with cement and thus, helps in restoration of the fractured bone.

Historical Overview

The market was analyzed qualitatively and quantitatively from 2018-2020. The vertebroplasty and kyphoplasty market size grew at a CAGR of around 4-6% during 2018-2021. Most of the growth during this period was derived from Asia-Pacific, owing to industrial development and investments from developed countries in Asia-Pacific and rise in awareness regarding new treatment approaches and technologies in this region.

Market Dynamics

In recent years, there is rise in adoption of minimally invasive surgeries around the globe. Vertebroplasty and kyphoplasty are few of the minimally invasive procedures adopted by healthcare providers and patients for feasible and efficient management of vertebral column fractures. These techniques offer several advantages over the traditional surgeries, such as faster recovery, less hospital stay, less invasion to the body, and improved perioperative pain management, which lead to rise in demand for vertebroplasty and kyphoplasty in the healthcare sector.

In addition, the vertebroplasty and kyphoplasty procedures are typically outpatient, and have shorter recovery periods. Small incisions can also mean better cosmetic results, and there is less potential for blood loss, infection, and postoperative pain. These benefits result in the preferences of population to minimally invasive spine procedures over the other choices, eventually contributes toward the vertebroplasty and kyphoplasty market growth.

Furthermore, there is witnessed rise in incidence of spinal disorders among the population due to various factors, such as age and accidental injuries. Increase in spinal disorders, especially osteoporosis, is a major factor that drives the market. For instance, according to National Osteoporosis Foundation, by 2025, experts predict that osteoporosis is expected to be responsible for three million fractures and result in cost of $25.3 billion for the healthcare system. This also highlights rise in number of other spinal disorders, with subsequent rise in demand for vertebroplasty and kyphoplasty. Thus, propelling the market growth during the forecast period.

Moreover, rise in accidental cases further lead to severe injuries, thus driving the vertebroplasty and kyphoplasty market. For instance, according to the report published in February 2022 by Ministry of Road Transport and Highways, Government of India, during 2020, the total recorded 3,66,138 road accidents caused loss of 1,31,714 persons lives and injured 3,48,279 persons. Thus, rise in the road accidents caused increase in incidence of spinal fracture and other spinal abnormalities, driving the vertebroplasty and kyphoplasty market.

Furthermore, increase in geriatric population is expected to drive the growth of the vertebroplasty and kyphoplasty market. Geriatric population is more prone to diseases that lead to inability in movement, which are mainly attributed to conditions such as vertebral column fractures, degenerative discs, spinal stenosis, and deteriorated joints. Thus, vertebroplasty and kyphoplasty procedures are becoming more popular for treatment of spinal conditions in geriatric population, which notably contributes toward growth of the global market.

In addition, growth of the vertebroplasty and kyphoplasty market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of spinal disorders, and surge in demand for effective surgical techniques.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries. This is attributed to further support the market growth.

Furthermore, rise in consumer awareness related to advance technologies in diagnostic and treatment is expected to drive the market growth. Moreover, increase in promotional activities by manufacturers and growth in awareness about the new techniques among the general population are expected to fuel their adoption in the near future.

Although several factors drive the growth of the market, high cost associated with this procedure hinder to the growth of market. Accessibility to these procedures for population with financial constraints is limited and such high prices create limitations in accessing these techniques majorly in developing and underdeveloped countries. In addition, in emerging countries there is lack of reimbursement policies to avoid coverage for such costly devices, which hampers demand for vertebroplasty and kyphoplasty.

However, emerging economies of Asia-Pacific and LAMEA present lucrative vertebroplasty and kyphoplasty market opportunity for market players. Surge in healthcare solutions, industrial development, and investments from developed countries in Asia-Pacific, along with rise in awareness regarding new treatment approaches and technologies will provide lucrative opportunities for the market during the forecast period.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector globally. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of healthcare. The global vertebroplasty and kyphoplasty industry experienced decline in 2020 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries like food & beverage, healthcare, and industrial. However, the market is anticipated to witness recovery in 2021, and show stable growth in the coming future and is expected to improve as governments have started relaxing norms globally for resuming business activities.

Segmental Overview

The vertebroplasty and kyphoplasty market is segmented on the basis of product, end user, and region. By product, the market is segmented into vertebroplasty and kyphoplasty. On the basis of end user, the market is segmented into hospitals and ambulatory surgical centers. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

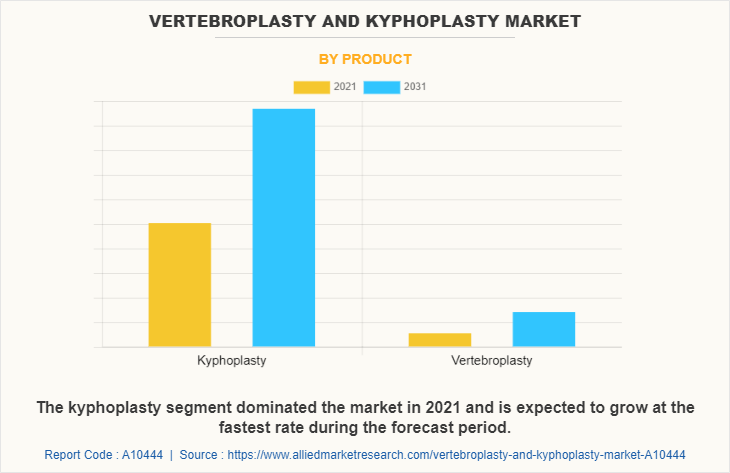

By Product

Based on product, the market is segmented into vertebroplasty and kyphoplasty. The kyphoplasty segment dominated the global vertebroplasty and kyphoplasty market share in 2021, and is expected to remain dominant during the forecast period, owing to advantages that kyphoplasty provides over vertebroplasty, such as reduction in back pain, as well as restoration of vertebral body height and a lower rate of cement extravasation. This is mainly done by placing balloons to gently elevate the fractured vertebrae in an attempt to return it to the correct position.

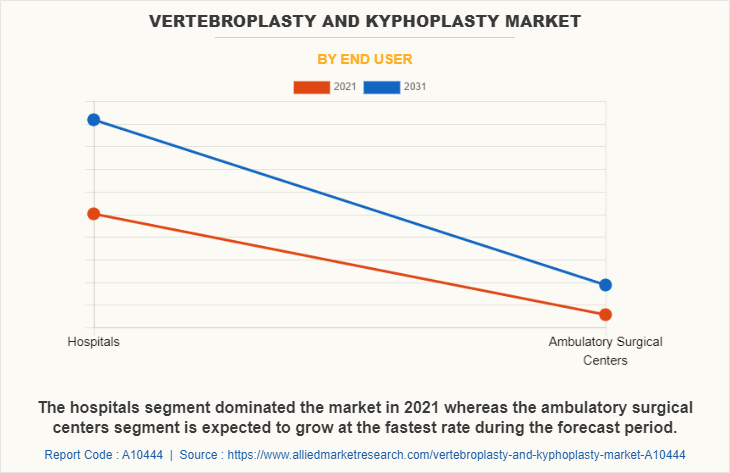

By End User

Based on end user, the market is classified into hospitals and ambulatory surgical centers. The hospitals segment held the largest market share in 2021, whereas the ambulatory surgical centers segment is expected to grow at highest CAGR during the forecast period, owing to huge rise in number of outpatient facilities and ambulatory surgical centers and shift of patients to outpatient facilities than hospitals and clinics.

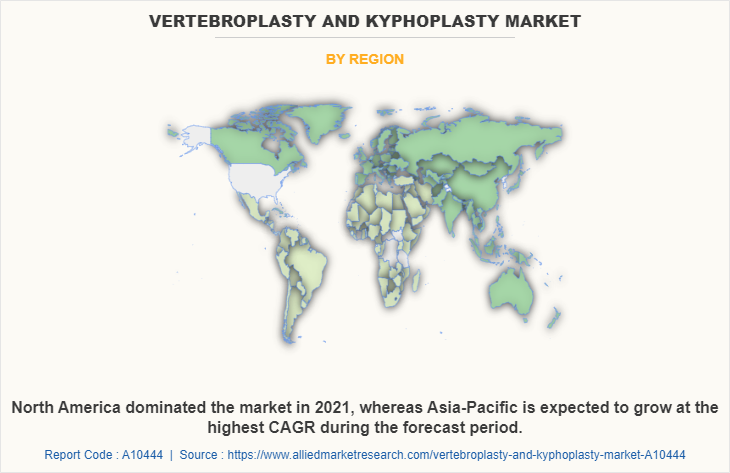

By Region

The vertebroplasty and kyphoplasty market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major vertebroplasty and kyphoplasty market share in 2021, and is expected to maintain its dominance during the forecast period. This dominance is mainly attributed the strategies adopted by key market players in this region, such as acquisitions, partnerships, product launch and product approvals.

On the other hand, Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of pharmaceutical and medical devices companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Furthermore, the Asia-Pacific region exhibits the largest supply of healthcare products and is the largest pharmaceuticals industry with availability of raw material in abundance, which can be easily accessed by manufacturers. This, in turn, drives the growth of the market.

Furthermore, cost of minimally invasive surgeries, such as spinal surgeries in India and other emerging countries, such as China and Japan is comparatively less than other developed countries. This leads to shift of patients toward emerging countries for treatment, which contributes toward growth of the market.

Competition Analysis

Competitive analysis and profiles of the major players in the vertebroplasty and kyphoplasty, such as BPB Medica – Biopsybell, Johnson & Johnson (DePuy Synthes), Globus Medical Inc., Halma plc. (IZI Medical Products), Joimax GmbH, Medtronic plc, Merit Medical Systems Inc., Seawon Meditech, Stryker Corporation, and Zavation are provided in this report. Some of the other key market players includes Joline and Fuse Medical which provides many kyphoplasty products. Major players have adopted product launch, partnership, acquisition and product approval as key developmental strategies to improve the product portfolio of the vertebroplasty and kyphoplasty market.

Product Launch

In January 2020, Merit Medical announced launch of Arcadia Steerable and Straight Balloons for vertebral augmentation to help physicians achieve controlled, precise cavity creation during unipedicular or bipedicular vertebral augmentation procedures.

Acquisitions

In October 2022, Halma announced acquisition of IZI Medical Products, a leading designer, manufacturer and distributor of medical devices used across a range of diagnostic and therapeutic procedures. IZI Medical Products offers vertebroplasty and kyphoplasty products such as DURO-JECT Bone Cement Injector Set, Vertefix HV High Viscosity Bone Cement and Kiva VCF Treatment System, which further expands Halma’s product portfolio.

In December 2020, Medtronic plc announced acquisition of Medicrea International, a pioneer in the transformation of spinal surgery through artificial intelligence (AI), predictive modeling, and patient specific implants. This further expands the spinal treatment and solution product portfolio of Medtronic plc.

Partnership

In May 2021, Joimax and Trang Thi announced the partnership in bringing the Joimax full-endoscopic and minimally invasive spinal surgery technology to the Southern Provinces of Vietnam including Da Nang market. This strategy is further expected to lead to rise in sales of vertebroplasty and kyphoplasty products of Joimax in Vietnam.

In October 2020, Joimax announced a new partnership with Transmedic Group, a top medical device distributor headquartered in Singapore, which will represent joimax in Singapore, Hong Kong, Philippines and Indonesia and which is expected to further propel the sales of vertebroplasty and kyphoplasty products of joimax in Singapore.

Clinical Trials

In December 2021, Medtronic plc. announced the results of a study published in Osteoporosis International that demonstrate decrease, and in some cases elimination of oral opioids, and decrease in payer costs following balloon kyphoplasty (BKP) or vertebroplasty (VP) procedures in patients suffering from spinal fractures, known as vertebral compression fractures (VCF), which further causes rise in demand for vertebroplasty and kyphoplasty procedures.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vertebroplasty and kyphoplasty market analysis from 2021 to 2031 to identify the prevailing vertebroplasty and kyphoplasty market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vertebroplasty and kyphoplasty market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global vertebroplasty and kyphoplasty industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vertebroplasty and kyphoplasty market trends, key players, market segments, application areas, and market growth strategies.

Vertebroplasty and Kyphoplasty Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.3 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 183 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Globus Medical Inc, Joimax GmbH, Halma plc, Stryker Corporation, Zavation LLC, Merit Medical Systems Inc., Medtronic plc, BPB MEDICA – BIOPSYBELL, Johnson and Johnson (DePuy Synthes), Seawon Meditech |

Analyst Review

The adoption of vertebroplasty and kyphoplasty witnessed a significant increase over the past few years. This is majorly attributed to rise in adoption of minimally invasive spinal surgeries and increase in technological advancements in spinal surgery sector. In addition, surge in geriatric population, which are more susceptible to spinal conditions, such as osteoporosis, vertebral column fractures, as well as rise in number of spinal stenosis and other spine disorders are expected to drive the market. Also, rise in number of accidental injuries around the globe leading to severe spinal or vertebral column fractures, is expected to propel the growth of vertebroplasty and kyphoplasty market.

In addition, development of advanced and reliable vertebroplasty and kyphoplasty systems by key market players, has led to extensive number of applications of this technique, thus fueling growth of the market. In addition, increase in demand for minimally invasive procedures and better healthcare services are also expected to propel the market growth due to advantages such as less pain and faster recovery with reduced hospital stays.

Similarly, increase in awareness regarding emerging techniques in surgeries and advancements in instruments and equipment associated with surgical procedures are expected to propel the growth of the vertebroplasty and kyphoplasty market in the future. In addition, new launches and product approvals by key market players around the globe boost the market growth.

Conversely, higher costs associated with the procedure hinder the growth of the market. Furthermore, North America dominated the vertebroplasty and kyphoplasty market in terms of revenue in 2021, owing to well-established healthcare infrastructure, presence of key market players, sufficient government

funding, and awareness among people regarding endoscopic spinal surgery. On the other hand, Asia-Pacific is expected to grow at a prominent CAGR during the forecast period, owing to surge in investments by key market players and availability of resources and raw material in this region.

The forecast period for vertebroplasty and kyphoplasty market is 2022 to 2031

The total market value of vertebroplasty and kyphoplasty market is $ 757.1 million in 2021.

The base year is 2021 in vertebroplasty and kyphoplasty market.

The market value of vertebroplasty and kyphoplasty market in 2031 is $1308.13 million

Top companies such as, Medtronic plc, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Globus Medical Inc and Merit Medical Systems Inc. These key players held a high market postion owing to the strong geographical foothold in different regions.

Kyphoplasty is the most influencing segment in vertebroplasty and kyphoplasty market which is attributed to rise in demand for kyphoplasty surgery as it shows significant result than the tradiitonal surgical treatments.

The major factor that fuels the growth of the vertebroplasty and kyphoplasty market are increase in incidence of spinal disorders, rise in demand for advanced and effective treatment for vertebral compression fractures, rise in adoption of minimally invasive surgeries and increase in healthcare spending.

vertebroplasty and kyphoplasty are the minimally invasive surgeries used to treat the vertebral compression fractures.

Loading Table Of Content...