Veterinary Infectious Disease Diagnostics Market Research, 2026

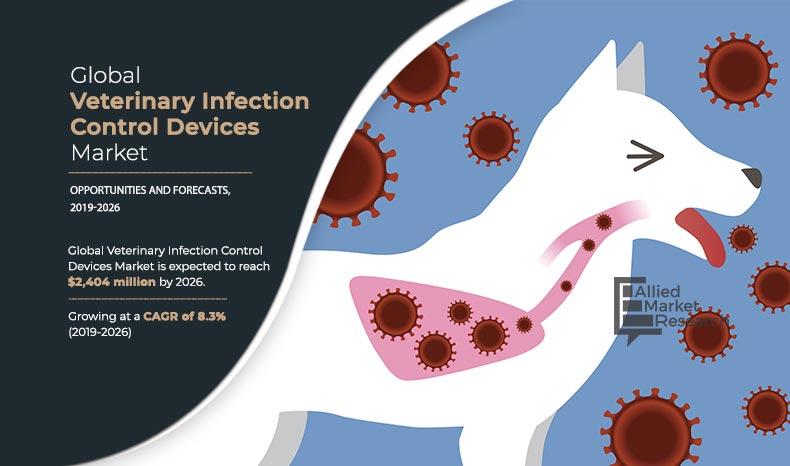

The global veterinary infectious disease diagnostics market size was valued at $1,271 million in 2018, and is expected to reach $2,404 million by 2026, registering a CAGR of 8.3% from 2019 to 2026. Infectious diseases in animals can lead to fatalities if left untreated for long period. Therefore, early diagnosis plays a major role in treatment of animals suffering from these diseases. Furthermore, procedures and tests which are performed to detect the presence of infectious disease is called veterinary diagnosis. In addition, products used in these tests and procedures are called as veterinary infectious disease diagnostics. These diagnostics aid in detection of various infectious disease in animals such as infections caused by viruses, bacteria, and parasites. Moreover, diagnostics can be used in detection of infectious diseases in animals such as cats and dogs.

Market Dynamics

Rise in ownership of companion animals and surge in animal health expenditure are the major factors that boost the growth of the global veterinary infectious disease diagnostics market. For instance, diagnosis of animal ailments require a considerable amount of funds. Number of consumers who are willing to spend more and are seeking for such services has increased. In addition, increase in prevalence of various infectious diseases among companion animals significantly drives the growth of the veterinary infectious disease diagnostics market. However, lack of awareness related to the use of veterinary infectious disease diagnostics in underdeveloped countries restricts the veterinary infectious disease diagnostics market growth. On the contrary, surge in awareness related to animal healthcare across the globe is expected to offer remunerative opportunities for market expansion during the forecast period.

Segments Overview

The global veterinary infectious disease diagnostics market size is studied on the basis of product type, application, and region. On the basis of product type, it is segmented into immunodiagnostics, molecular diagnostics, and others. By application, it is classified into dogs, cats, and others. By region, it is analyzed across North America (the U.S, Canada, and Mexico) and Europe (Germany, France, Italy, the UK and rest of Europe), Asia-Pacific (Japan, China, India, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product Type

By product type, the immunodiagnostics segment acquired the largest share of the veterinary infectious diseases market in 2018. Furthermore, the segment is expected to grow at the fastest rate during the forecast period due to factors such as surge in the prevalence of infectious diseases in animals. Furthermore, other factor that contribute to the growth of the market include rise in animal healthcare expenditure. In addition, benefits associated with the use of these tests is another factor that fuels the growth of the veterinary infectious disease diagnostics market. For instance, lateral flow assays provide rapid results and sensitive & accurate diagnosis, which makes them a preferred choice. In addition, other benefits include low sample volume, low cost, and user-friendly operation. Therefore, aforementioned factors contribute to the growth of veterinary infectious disease diagnostics market.

By Product

Immunodiagnostics segment is projected as one of the most lucrative segment.

By Application

By application, the dogs segment acquired the major share of the global veterinary infectious disease diagnostics market and is expected to exhibit the fastest growth rate during the forecast period, owing to surge in ownership of dogs as companion animals worldwide. Furthermore, surge in awareness related to dog health among their owners is another major factor that augments the growth of this segment.

By Application

Dog segment holds a dominant position in 2018 and would continue to maintain the lead over the forecast period.

By Region

On the basis of region, North America acquired a major share, owing to easy availability of veterinary infectious disease diagnostic products in the region, surge in pet ownership, and increase in animal healthcare expenditure. The other major factor that contributes toward the growth of this market include rise in incidences of various diseases related to animals. However, Europe is expected to grow at the highest rate during the forecast period, due to surge in awareness related to animal health among owners. In addition, presence of majority of key players in Europe boosts the growth of the market in this region. Some of the key players operating in the Europe veterinary infectious disease diagnostics market include Virbac., Randox Laboratories Ltd, ID.Vet, and Biomérieux SA. Therefore, this leads to easy availability of veterinary infectious disease diagnostics in the region, which fuels the growth of the market

By Geography

Asia-Pacific region would exhibit the highest CAGR of 10.3% during 2019-2026.

Competitive Analysis

The global veterinary infectious disease diagnostics market is highly competitive and the prominent players in the market have adopted various strategies for garnering maximum veterinary infectious disease diagnostics market share. These include collaboration, product type launch, partnership, and acquisition. Major players operating in the market include Biomérieux SA, HESKA Corporation, IDEXX Laboratories, Inc., ID.Vet, Neogen Corporation, Qiagen N.V., Randox Laboratories Ltd, Thermo Fisher Scientific Inc, Virbac, and Zoetis.

Key Benefits for Stakeholders

- This report entails a detailed quantitative analysis along with the current global veterinary infectious disease diagnostics market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The veterinary infectious disease diagnostics market forecast is studied from 2019 to 2026.

- The market size and estimations are based on a comprehensive analysis of key developments in the veterinary infectious disease diagnostics industry.

- A qualitative analysis based on innovative product types facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

Veterinary Infectious Disease Diagnostics Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | QIAGEN N.V., THERMO FISHER SCIENTIFIC INC, Randox Laboratories Ltd, Neogen Corporation, Virbac., IDEXX Laboratories, Inc., ID.Vet, bioMérieux SA, Heska Corporation, Zoetis |

Analyst Review

Veterinary infectious disease diagnostics are products which are used to identify and detect the presence of viral, bacterial, parasitic, and other type of infections in animals. Furthermore, there are different types of veterinary infectious disease diagnostics available in the market such as immunodiagnostics, molecular diagnostics, and others, which are used in detection of infectious diseases in animals such as cats, dogs, guinea pigs, and rabbits.

Moreover, factors such as rise in adoption of companion animals and surge in animal healthcare expenditure contribute to the growth of the veterinary infectious disease diagnostics market. In addition, factors such as rise in awareness related to animal health among their owners is another factor that fuels the growth of the market.

Furthermore, the market in North America is on the rise, owing to factors such as easy availability of veterinary infectious disease diagnostics and presence of key players. In addition, Europe is anticipated to register highest growth during the forecast period, owing to factors such as rise in research related to new veterinary infectious disease diagnostics and surge in awareness related to the use of these diagnostics.

The total market value of veterinary infectious disease diagnostics market is $1,270.50 million in 2018.

The forcast period for veterinary infectious disease diagnostics market is 2019 to 2026

The market value of veterinary infectious disease diagnostics market in 2019 is $1,376.00 million.

The base year is 2018 in veterinary infectious disease diagnostics market

Top companies such as, QIAGEN N.V., Thermo Fisher Scientific Inc, Randox Laboratories Ltd, Virbac., and Zoetis held a high market position in 2018. These key players held a high market postion owing to the strong geographical foothold in different regions.

Immunodiagnostics segment is the most influencing segment owing to surge in the prevalence of infectious diseases in animals. Furthermore, other factors that contribute to the growth of the market include rise in animal healthcare expenditure

The major factor that fuels the growth of the global veterinary infectious disease diagnostics market includes surge in pet ownership across the world which led to surge in awareness towards animal healthc among pet owners.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 11.7%. This is due to increased pet ownership and surge in awareness associated with early diagnosing and treatment of diseases prevalent among companion animals.

Veterinary infectious disease diagnosticss are products used in procedures conducted to test the presence of infectious diseases in animals. There are different types of veterinary infectious diseases diagnostics present in the market such as immunodiagnostics, molecular diagnostics and others.

Veterinary infectious disease diagnostics are employed to detect the presence of viruses and bacteria in animal such as giardiasis and coccidiosis in dogs and others.

Loading Table Of Content...