Video Analytics In Banking Market Research, 2032

The global video analytics in banking market was valued at $1.4 billion in 2022, and is projected to reach $12.1 billion by 2032, growing at a CAGR of 24.7% from 2023 to 2032.

The back-end software that is used for the processing of day-to-day transactions performed by the bank and broadcast updates to accounts along with several other financial records is known as video analytics in banking. Intense competition is occurring in the banking industry due to the lowering of switching barriers and the arrival of several next-generation banks. Quick services are provided by the key players of the market at a very low price to attract new customers. In addition, video analytics in banking enables an individual to exchange banking services online in real-time.

These solutions allow users to access their accounts and carry out primary transactions from any branch office. Video analytics in banking systems are rapidly becoming the backbone of modern banks as they look over various tasks such as journal entries, creation & management of accounts, balances, transactions, and others. Such software uses an agile architecture that allows the bank to make quick fixes and changes in the software without interrupting the customer’s digital experience.

Increase in adoption of high-resolution cameras and the rise in demand for real-time event detection is boosting the growth of global video analytics in banking market. In addition, increase in the use of digital transformation technology positively impacts growth of the video analytics in banking market. However, government regulations related to CCTV surveillance & high cost, and increasing security concerns are hampering the video analytics in banking market growth. On the contrary, rising Innovations in the banking industry are expected to offer remunerative opportunities for expansion of the video analytics in banking market during the forecast period.

Segment Review

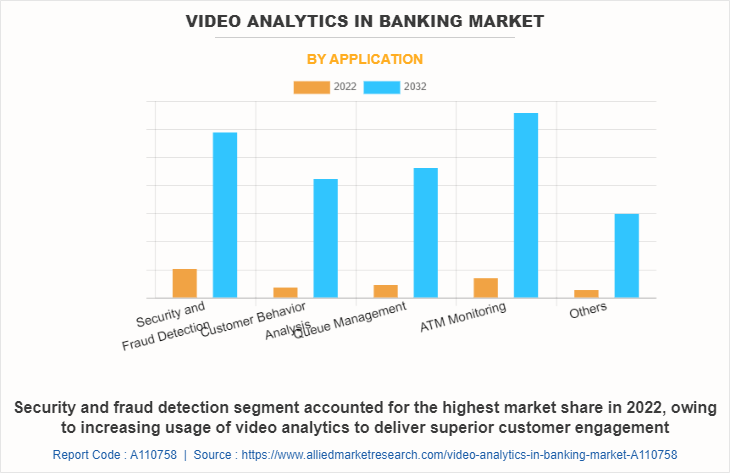

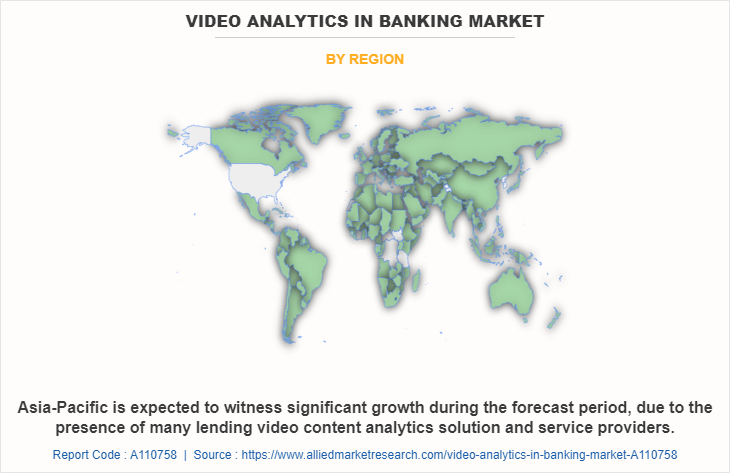

The video analytics in banking market is segmented on the basis of by component, deployment mode, application, and region. On the basis of component, the market is categorized into solution and service. On the basis of deployment mode, the market is fragmented into on-premise, and cloud. By application, it is classified into security and fraud detection, customer behavior analysis, queue management, ATM monitoring, and others. By region, the video analytics in banking market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of application, the security and fraud detection segment holds the highest video analytics in banking market share, owing to growing acceptance in programs like motion detection, intrusion detection, number plate recognition. However, the customer behavior analytics in banking segment is expected to grow at the highest rate during the forecast period, owing to rising need to retain customers through improved customer satisfaction.

Region wise, the video analytics in banking market size was dominated by North America in 2022, and is expected to retain its position during the forecast period, owing to rapid technological development in the country is supported by strong economic growth. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to Increasing the implementation of industry solutions, mainly in China, Japan, and India, coupled with increasing adoption of cloud-based technologies.

The key players that operate in the video analytics in banking industry are Axis Communications AB, AllGoVision Technologies Pvt. Ltd, bosch sicherheitssysteme gmbh, Wipro Limited, Eagle Eye Networks, Inc., IBM Corporation, Zhejiang Dahua Technology Co., Ltd, Grekkom Technologies, Senstar Corporation Inc., and Avigilon Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities

Video analytics in banking is a technology that processes a digital video signal using a special algorithm to perform a security-related function. In addition, there are three distinct types of video analytics fixed algorithm analytics, Artificial Intelligence learning algorithms, and Facial Recognition. Each of these processes digital video signals with the help of an algorithm to perform a security-related function. Fixed algorithm analytics and Artificial Intelligence learning algorithms both detect suspicious behavior caught by a video camera and alert the security personnel monitoring those cameras. Furthermore, Fixed algorithm analytics works by performing a dedicated task and looking for a specific behavior. Moreover, AI algorithms learn ‘on the job’ by being connected to a camera for several weeks. During this period the camera learns what is ‘normal’ and issues alerts when something happens outside of that experience.

Top Impacting Factors

Increase in the Adoption of High-resolution Cameras

The increase in the adoption of high-resolution cameras such as 4k or 8k enables organizations to get accurate and more sophisticated video analyses. In addition, the high-resolution videos help to identify and analyze people in the crowd, trigger alarms when certain conditions are met, filter & search videos, and draw insights from video metadata more accurately. In addition, with the surge in demand for high-resolution video analytics in banking, several banks have upgraded their current security infrastructure to continue with the rising demand in the market. For instance, in April 2021, Wilson Bank & Trust upgraded the security infrastructure at 40 of its locations with Hanwha cameras, by switching to industry standard Powered over Ethernet (PoE), Internet Protocol (IP)-based cameras, the bank has realized significant savings with regards to installation and maintenance costs.

The Bank has also installed cameras to record parking entrances and exits. This strategy has helped the security team to identify a vehicle associated with a fraud case by using an image of a license plate captured as it was leaving the facility. Furthermore, apart from high resolution, enhanced vision angle, sustainability, and technological compatibility are increasing the adoption of high-definition (HD) cameras across the security industry. Besides, increased camera pixels offer superior digital zoom capabilities to enhance long-distance vision. Such demands are driving the growth of video analytics in banking market.

Rise in Demand for Real-time Event Detection

Increase in demand for real-time event detection may assist in analyzing live or recorded video streams to detect, classify and track behavior patterns and predefined objects, which may become key market driving factors. In addition, with the growth in demand for video analytics in banking solutions, various companies have established strategic alliances to increase their video analytics software solutions offerings in real-time event detection solutions. For instance, in September 2021, DataCenter Inc. (DCI) partnered with DataVisor to empower community banks with real-time AI-powered fraud solutions and prevention capabilities and may capture more fraud, earlier, while enabling a secure and frictionless customer experience.

Moreover, real-time analytics with high-performance capabilities may transform standard surveillance networks used in intelligent detection and alert systems for vehicles, static objects, and people. Furthermore, each organization such as private, public, and government organization deploys network links with varying bandwidths between cloud and IP cameras to compute large-scale videos for improved analytics. Real-time event detection has aided in reducing crimes, thefts, and other criminal activities while improving the overall social settings and international trade climate. Therefore, these are the factors driving the growth of video analytics in banking market.

Restraints

Government Regulations related to CCTV Surveillance and High Cost

Many banks and other organizations are incorporating video analytics into their video surveillance systems because of the wide range of possibilities for this technology. These tools capture and analyze video in real time. In addition, video analytics solutions are used for many different things, such as automatic number-plate recognition (ANPR), population estimation, and facial recognition. Despite the benefits offered by video analytics, there are many privacy concerns that have regularly been raised by people. As a result, nations like the U.S. and the UK are mandating the use of video analytics in banking to prevent anti-social behavior only in restricted regions and with limited capability. For instance, in October 2021, the European Parliament adopted a non-binding resolution that forbids the creation of personal facial recognition databases and the application of facial recognition technology by police enforcement in public areas.

Furthermore, facial recognition technology and other remote biometric surveillance equipment are expected to be subject to similar restrictions in Oakland and Somerville. ‐¯Guidelines for the information obtained by CCTV cameras have also been set by the General Data Protection Regulation (GDPR). Companies and organizations are not permitted to install CCTV without a valid cause, under the GDPR requirements. As a result, it is anticipated that severe rules will restrict the growth of the global market for video analytics in banking.

The optimal performance of the video analytics system in the banking industry requires a solid IT foundation and reliable connections, both of which come at a major financial and maintenance cost. The infrastructure necessary for constant surveillance is lacking in underdeveloped nations and in SMEs. As a result, regular maintenance is required to make the system more dependable. It is projected that suppliers engaged in global video analytics in the banking market would find it difficult to compete given the high cost of maintenance and other responsibilities. Additionally, video analytics systems demand significant investments. Thus, it is anticipated that throughout the course of the projection period, the high costs and the necessary expenditures are hampering the growth of the video analytics in banking market.

Opportunities

Rising Innovation in the Banking Industry

BFSI companies are increasing investment in machine learning and AI solutions to transform financial institutes’ management for providing enhanced services to the end users and to automate the necessary solutions. In addition, with rising complexity and competition in the BFSI market, the demand for industry-specific solutions increased to meet the goals of the companies and AI-powered video analytics tools are helping banks and other industries to enhance their security and upsurge their revenue opportunity, which is driving the growth of the market.

Furthermore, AI and business intelligence can assist financial institutes at various stages of risk management process ranging from identifying risk exposure, measuring, estimating, to assessing its effects. Moreover, increasing investments in AI and other technologies offer the potential to analyze video content in real-time, extract metadata, send out alerts, and provide actionable intelligence to security personnel or other systems, offering a far more streamlined and personalized customer experience, which is enhancing the growth of the market. In addition, major financial institutes such as Bank of America, JPMorgan, and Morgan Stanley, are investing heavily in HD security cameras, data mining, machine learning (ML), statistics, and AI technologies to develop video analytics solutions to detect flags such as money laundering techniques and for other fraud cases, which in turn is expected to provide lucrative opportunity for the growth of the video analytics in banking market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the video analytics in banking market analysis from 2023 to 2032 to identify the prevailing video analytics in banking market opportunities.

- Video analytics in banking market outlook research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the video analytics in banking market segmentation assists to determine the prevailing video analytics in banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global video analytics in banking market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global video analytics in banking market trends, key players, market segments, application areas, and market growth strategies.

Video Analytics in Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.1 billion |

| Growth Rate | CAGR of 24.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 231 |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | Axis Communications AB, Grekkom Technologies, Avigilon Corporation, Zhejiang Dahua Technology Co., Ltd, Senstar Corporation Inc., IBM Corporation, Eagle Eye Networks, Inc., AllGoVision Technologies Pvt. Ltd, Wipro Limited, Bosch Sicherheitssysteme GmbH |

Analyst Review

Video analytics in banking is the continuous processing and analysis of fast-moving live data from a variety of sources, including Internet of Things (IoT) devices, to trigger alerts and automate actions. Video analytics reduces the need for long-term data storage as the data is analyzed in real-time. It is essential for enterprises that want to extract immediate insights from fast and ever-growing volumes of data.

The global video analytics in banking market is expected to register high growth growing adoption of streaming analytics platforms to provide faster insights and actions, advanced technologies such as big data, IoT, and AI, and rising industrial automation are driving the growth of the video analytics in banking market. Thus, increase in adoption of video analytics in banking, owing to its high reliability and low latency networks is one of the most significant factors driving the growth of the market. With surge in demand for video analytics in banking, various companies have established alliances to increase their capabilities. For instance, in December 2022, Wipro Limited partnered with Finastra, a global provider of financial software applications and marketplaces, to drive digital transformation for corporate banks in the Middle East.

In addition, with further growth in investment across the world and the rise in demand for video analytics in banking, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in September 2021, BriefCam launched Video Analytics Enabled on Deep Learning Cameras from Axis Communications. The new hybrid deployment option for the BriefCam platform; edge video processing on Axis deep learning cameras, reduces the total cost of ownership of a real-time video analytics deployment, enables operation in low-bandwidth environments, and makes for faster real-time alerting.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, March 2023, Irisity AB a provider of advanced video analytics collaborated with Axis communication to launch an advance surveillance camera equipped with AI capabilities. This collaboration combines Irisity’s expertise in AI-powered video analytics with Axis Communication surveillance camera technology, providing enhanced security and intelligence capabilities.

The Video analytics in banking market is estimated to grow at a CAGR of 24.7% from 2023 to 2032.

The Video analytics in banking market is projected to reach $12,140.72 million million by 2032.

Increase in adoption of high-resolution cameras and the rise in demand for real-time event detection is boosting the growth of global video analytics in banking market. In addition, increase in the use of digital transformation technology positively impacts growth of the video analytics in banking market. However, government regulations related to CCTV surveillance & high cost, and increasing security concerns are hampering the video analytics in banking market growth. On the contrary, rising Innovations in the banking industry are expected to offer remunerative opportunities for expansion of the video analytics in banking market during the forecast period.

The key players profiled in the report include Axis Communications AB, AllGoVision Technologies Pvt. Ltd, bosch sicherheitssysteme gmbh, Wipro Limited, Eagle Eye Networks, Inc., IBM Corporation, Zhejiang Dahua Technology Co., Ltd, Grekkom Technologies, Senstar Corporation Inc., and Avigilon Corporation.

The key growth strategies of Video analytics in banking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...