Video Wall Market Research, 2032

The global video wall market size was valued at $6.8 billion in 2022, and is projected to reach $17.5 billion by 2032, growing at a CAGR of 10.1% from 2023 to 2032.

A video wall is a display technology that consists of multiple individual display screens, such as LCD or LED panels, arranged in a grid-like pattern to create a larger and more visually impactful display. These screens are typically tiled together seamlessly, both physically and in terms of content, to form a single, cohesive image or video presentation.

When many screens are connected to display a single bigger image or multiple windows of images, the result is a multi-screen wall known as a video wall. A video wall does not need to be complicated; it may just be one source picture shown on several displays. Alternately, it may be used to simultaneously show different visuals on different screens coming from different places, such as live video streams. These video walls can be permanently put on a wall or deployed on portable mounting devices. Advertising has shifted from traditional to digital media, and the expansion of digital outdoor advertising has fueled the need for video walls. Additionally, one of the major factors influencing the need for video walls internationally is the growth in tourism.

Additionally, because of this, there has been a shift in consumer behavior about interaction with all forms of transportation, allowing them to strategically base their brands on consumer mindsets. During the forecast period, this is anticipated to enhance the video wall industry. Suppliers are developing new goods or collaborating to form alliances for competitive benefits when businesses recognize an opportunity. Airports such as Orlando International Airport, for example, have installed a 700-screen video wall that displays cinematic video content and automatically updated flight information at check-in, on the curb, in the spacious application performance monitoring (APM) automatic transfer room, and at orientation points of the APM and the north terminal. This assisted in providing passengers with pertinent visual content. As a result, these elements are anticipated to propel the worldwide video wall market in the transportation sector during the forecast period.

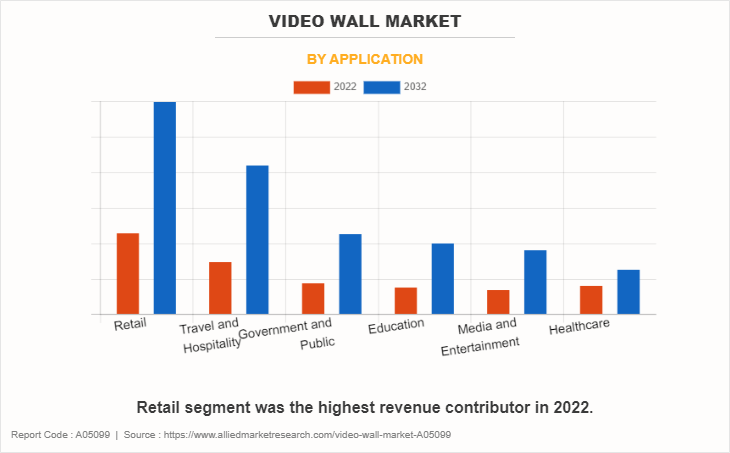

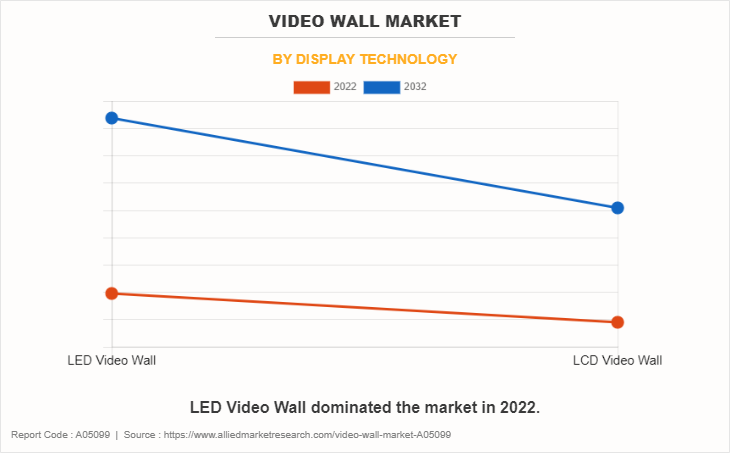

The video wall market outlook is segmented into Application and Display Technology.

As per application, it is fragmented into government and public, retail, travel and hospitality, education, healthcare, and media and entertainment. Retail segment accounted for the largest share in 2022 during Video Wall Market Forecast from 2022-2032.

On the basis of display technology, it is categorized into LED video wall and LCD video wall.LED video wall generated the largest revenue in 2022.

Region wise, the video wall market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).Asia-Pacific was the highest revenue contributor in 2022.

Top Impacting Factors

The video wall market is anticipated to expand significantly during the forecast period owing to a rise in development of interactive digital signage systems supported by augmented reality to increase demand for LED video walls and increasing consumer preference toward digital signage. However, the high production cost of video walls may hinder market growth. On the contrary, higher adoption rate of video walls in transportation sector provides lucrative opportunities to the Video Wall Market Growth.

Competitive Analysis

The key video wall market leaders profiled in the report include Sony Corporation, Toshiba Corporation, Panasonic Corporation, LG Electronics Inc., Barco NV, Planar Systems, Inc., Acer Inc., ViewSonic Corporation, Samsung Electronics Co Ltd., and Koninklijke Philips N.V. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration, and business expansion to increase the video wall market share during the forecast period.

Historical Data & Information

The video wall market is highly competitive, owing to the strong presence of existing vendors. Vendors in the Video Wall Market Opportunity with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to Video Wall Market Demand. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Sony Corporation, Toshiba Corporation, Panasonic Corporation, LG Electronics Inc., Barco NV, Planar Systems, Inc., Acer Inc., ViewSonic Corporation, Samsung Electronics Co Ltd., and Koninklijke Philips N.V. are the top companies holding a prime share in the global video wall market. Top market players have adopted various strategies, such as expansion and investment to expand their foothold in the video wall market.

- In October 2023, LG Electronics and Alphonso announced a significant investment by LG in Alphonso to bring together the two TV industry leaders' technologies and innovations to LG's smart TV lineup.

- In June 2023, Samsung Electronics launched The Wall for Virtual Production at InfoComm 2023. The Wall for Virtual features pixel pitch options of P1.68 and P2.1, dedicated studio frame rates (23.976, 29.97 and 59.94Hz) and genlocking, which can synchronize the screen with a camera's video signal. The display also boasts a refresh rate of up to 12,288Hz, a max brightness of 1,500nits, a 35,000:1 fixed contrast ratio (for P2.1) and up to 170-degree wide viewing angles. All these features combine to enable an unprecedented level of picture quality for virtual content.

- In October 2022, Samsung Electronics launched the Micro LED technology at Integrated Systems Europe (ISE) 2022 in Barcelona, with three models of its state-of-the-art display technology. Micro LED technology defines display innovation. From the luxury industry to hospitality and travel, the potential of Micro LED is endless in enabling businesses to achieve more.

- In September 2022, ViewSonic showcased its wide range of integrated visual display solutions at audio-visual event at InfoComm India. It is an event for leading technology companies to showcase their latest technologies and solutions. It helps users work and communicate using age innovative solutions for a hybrid environment.

- In June 2021, Sony Electronics launched the modular Crystal LED C-series (ZRD-C12A/C15A) with high contrast and B-series (ZRD-B12A/B15A) with high brightness. Both displays are available in two-pixel pitch sizes (P1.26mm and P1.58mm) to suit different installation needs and expand the line-up of Sony's Crystal LED for various applications including corporate showrooms, lobbies, and productions.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the video wall market analysis from 2022 to 2032 to identify the prevailing video wall market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the video wall market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global video wall market trends, key players, market segments, application areas, and market growth strategies.

Video wall Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.5 billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 360 |

| By Application |

|

| By Display Technology |

|

| By Region |

|

| Key Market Players | Koninklijke Philips N.V., Toshiba Corporation, Sony Corporation, Samsung Electronics Co Ltd., Barco NV, LG Electronics Inc., Panasonic Corporation, ViewSonic Corporation, Acer Inc., Planar Systems, Inc. |

Analyst Review

The video wall market is expected to leverage high potential for the LED video wall during the forecast period. The current business scenario is witnessing an increase in demand for video walls, particularly in developing regions such as China, India, and UK, owing to increase in advancements in video wall products. Companies in this industry are adopting various innovative techniques such as mergers and acquisition activities to strengthen their business position in the competitive matrix.?

The major factor that drives the growth of the video wall market across Asia-Pacific is the immense digital needs of emerging economies with high populations in countries such as China, India, and Indonesia. In addition, market players are looking to launch new products to strengthen their market position. For instance, in October 2021, Barco India expanded its innovative LED video wall portfolio by launching the new IEX series. With each tile having a 16:9 aspect ratio, the new series can be used to create native Full HD or UHD screens, which would allow customers to display videos in the most common formats in full, without distortion or unused canvas. This is a key development for market growth.?

Video wall products such as LED video wall and LCD video wall are gaining positive attention as growing use of video wall displays are creating numerous market opportunities. Beneficial characteristics of video walls such as attention-grabbing, high-resolution display, flexibility in content, and brand impact are fueling global video wall market. Furthermore, the growth of end-user industries is also escalating significant demand for video walls. Key video wall market leaders profiled in the report include Sony Corporation, Toshiba Corporation, Panasonic Corporation, LG Electronics Inc., Barco NV, Planar Systems, Inc., Acer Inc., ViewSonic Corporation, Samsung Electronics Co Ltd., and Koninklijke Philips N.V.

Retail is the leading application of video wall market.

The upcoming trends of video wall market include rise in development of interactive digital signage systems supported by augmented reality to increase demand for LED video walls.

Asia-Pacific is the largest regional market for video wall.

The global video wall market was valued at $6,836.0 million in 2022.

Samsung Electronics, Sony Corporation, Toshiba Corporation, Panasonic Corporation are th top companies to hold the market share in video wall market.

Loading Table Of Content...

Loading Research Methodology...