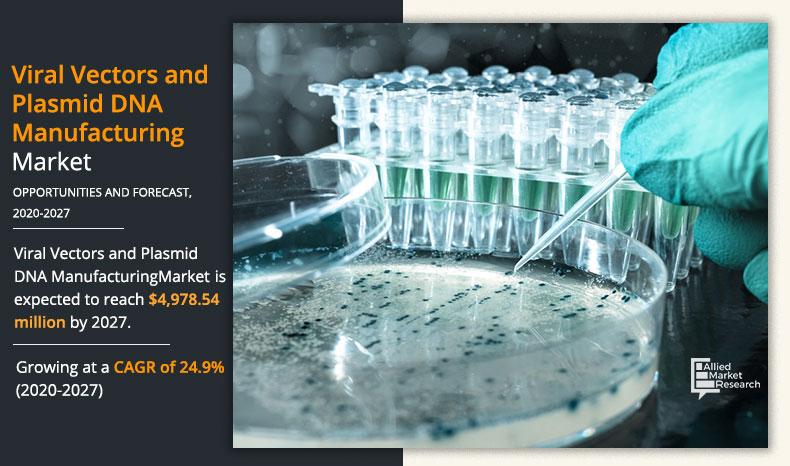

The global viral vectors and plasmid DNA manufacturing market size was valued at $918.37 million in 2019, and is estimated to reach at $4,978.54 million by 2027, registering a CAGR of 24.9% from 2020 to 2027.

Gene therapy involves repairing, repressing, or replacing dysfunctional genes that cause disease with the aim of re-establishing normal function. This therapy serves as a promising treatment option for genetic diseases such as muscular dystrophy and cystic fibrosis as well as certain inherited disorders, cancers, and viral infections. Viral vectors and plasmid DNA manufacturing commonly includes use of system biology and panomics to determine the cause of a patient's illness at the molecular level, followed by use of concentrated medications to address individual patient's illness. Moreover, viral vectors and plasmid DNA can reduce cost of treatment and help decrease repeated administration of medications.

Increase in preference of viral vectors in various treatments has led to advancements in these vectors and plasmids. Advantages of using viral vectors include low risk of chromosomal integration; limited infection to broad spectrum of cells; robustness, owing to process validations; and easy culture production; which fuel their adoption and boost growth of the market.

The COVID-19 outbreak that started from Wuhan city of China has now wide spread globally. Almost every nation is dealing with the outbreak. Most of the markets are dropping down as COVID-19 outbreak has negatively affected various healthcare related markets. This pandemic is expected to present growth opportunities for the viral vector and plasmid DNA manufacturing market in the future as several viral vectors, recombinant protein, live attenuated virus, and nucleic acid-based vaccines are in (pre)clinical development for treatment of the diseases. Viral vector vaccines consist of a recombinant virus (which is the viral vector), frequently attenuated to reduce its pathogenicity, in which genes encoding viral antigen(s) are cloned using recombinant DNA methods. Vector vaccines can either be replicating or non-replicating. The major advantage of these vector-based vaccines is that a single dose can be sufficient for protection. In addition, companies in the viral vector manufacturing market are increasing their production facilities.

Growth of the global viral vector and plasmid DNA manufacturing market is driven by rise in funding for R&D activities pertaining to gene therapy, rise in prevalence of cancer, viral infection, & genetic disorders, and increase in awareness regarding gene therapy. However, high cost associated with gene therapies and risk of mutagenesis & other impediments in gene therapy restrain the viral vectors and plasmid DNA manufacturing market growth. The impact of driving factors is expected to surpass that of the restraints. Moreover, increase in demand for synthetic genes and untapped potential for emerging markets are expected to provide new opportunities for viral vectors and plasmid DNA manufacturing market players in the future.

The global viral vectors and plasmid DNA manufacturing market is segmented on the basis of product, application, and region. On the basis of product, it is divided into plasmid DNA, viral vectors, and non-viral vectors. By application, it is categorized into cancer, inherited disorders, viral infections, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Product segment review

By product, the viral vector topical segment accounted for the largest viral vectors and plasmid DNA manufacturing market share in 2019, and is expected to maintain its dominance during the forecast period, owing to the necessity and applicability of these products in different research interventions. However, the plasmid DNA segment is projected to grow with the highest CAGR from 2020 to 2027, owing to its higher replication rate and ability to stay independent as it does not combine with genetic material of host cells. In addition, it plays a vital role in gene therapy, owing to its ability to easily manipulate & replicate and effectively target defective cells in the body.

By Product

Viral Vectors segment holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Application segment review

On the basis of application, the cancer segment was the largest revenue generating segment in the market in 2019, owing to requirements for quality drugs and versatile therapies for treatment. However, the inherited disorders segment is anticipated to be the highest growing segment with the highest CAGR from 2020 to 2027, owing to rise in incidences of inherited disorders, which has led to increase in R&D activities for development of therapies and, in turn, has led to emergence of novel therapies that involve use of viral vectors and plasmid DNA.

By Application

Cancer Segment is projected as one of the most lucrative segment.

North America held the highest market share in 2019, owing to high prevalence rate of cancer and modern healthcare facilities. Adoption of experimental medicines and growth in awareness regarding gene therapy are expected to boost the North America market. Asia-Pacific is expected to grow at the highest CAGR during the forecast period, owing to rapid industrialization in the area, increase in disposable income, and surge in government initiatives to modernize healthcare infrastructure.

By Region

Asia Pacific region would exhibit the highest CAGR of 30.6% during 2020-2027.

Some of the key players operating in the viral vectors and plasmid DNA manufacturing market include Cognate BioServices, Inc., Catalent Pharma Solutions, Fujifilm Holdings Corporation, Johnson & Johnson, Sanofi Corporation, F. Hoffmann-LA Roche Ltd, 4D Molecular Therapeutics, Sirion Biotech GmbH, Voyager therapeutics, and Thermo Fisher Scientific, Inc. Other players in the value chain analysis include, Cell and Gene Therapy Catapult, UniQure and MassBiologics, Renova Therapeutics, and Shenzhen SiBiono GeneTech Co., Ltd.

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current viral vectors and plasmid DNA manufacturing market trends and future estimations from 2020 to 2027, which assists in identifying prevailing viral vectors and plasmid DNA manufacturing market opportunities.

- An in-depth analysis of various regions is likely to provide a detailed understanding of the current trends to the stakeholders to formulate region-specific plans.

- Comprehensive analysis of factors that drive and restrain growth of the viral vectors and plasmid DNA manufacturing market are provided.

- Key regulatory guidelines for the viral vectors and plasmid DNA manufacturing market are critically dealt according to region.

- A deep dive analysis of various regions provides insights that would allow companies to strategically plan their business moves.

Key Market Segments

By Product

- Plasmid DNA

- Viral Vectors

- Non-viral Vectors

By Application

- Cancers

- Inherited Disorders

- Viral Infections

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Australia

- Japan

- India

- China

- South Korea

- Taiwan

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Viral Vectors and Plasmid DNA Manufacturing Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | COGNATE BIOSERVICES, INC, JOHNSON & JOHNSON, CATALENT PHARMA SOLUTIONS, SIRION BIOTECH GmbH, .F. HOFFMANN-LA ROCHE LTD., SANOFI CORPORATION, VOYAGER THERAPEUTICS INC.., THERMO FISHER SCIENTIFIC, INC., 4D MOLECULAR THERAPEUTICS, FUJIFILM HOLDINGS CORPORATION |

Analyst Review

This section provides opinions of top-level CXOs in the biotech & pharmaceutical industry. According to them, gene therapy is an innovative therapeutic approach that involves delivery of nucleic acid polymers into cells of patients for treating a disease. This procedure has various advantages, which include reduced number of drug administrations and concentrated therapeutic action.

CXOs further stated that technological advancements in genetic research have led to increase in use of gene therapies to efficiently treat cancer and various diseases. Enhanced progression of gene therapies can be attributed to the growth and integration of cognitive computing and data analytics with healthcare. Moreover, increase in funding for R&D activities pertaining to gene therapy; rise in prevalence of cancer, viral infection, & genetic disorders; and increase in awareness regarding gene therapy are the major factors that boost the market growth.

According to CXOs, gene therapies are prominently used for cancer treatment, however in the future, they would be preferred for treatment of rare illnesses and conditions or disorders linked to aging.

The total market value of Viral Vectors and Plasmid DNA Manufacturing Market is $4,978.54 million in 2019.

The forcast period for Viral Vectors and Plasmid DNA Manufacturing Market is 2020 to 2027

The market value of Viral Vectors and Plasmid DNA Manufacturing Market in 2020 is $1,049.69 million.

The base year is 2019 in Viral Vectors and Plasmid DNA Manufacturing Market

Top companies such as, Cognate BioServices, Inc., Catalent Pharma Solutions, Fujifilm Holdings Corporation, Johnson & Johnson, Sanofi Corporation, F. Hoffmann-LA Roche Ltd, 4D Molecular Therapeutics, Sirion Biotech GmbH, Voyager therapeutics, and Thermo Fisher Scientific,.

Cancer segment is the most influencing segment owing to rise in requirement for quality drugs and versatile therapies for treatment are expected to boost growth of this segment

The major factor that fuels the growth of the Viral Vectors and Plasmid DNA Manufacturing Market includes Surge in global incidences of cancer and increase in ageing population susceptible to diseases are expected to boost the demand for viral vectors and plasmid DNA manufacturing.

No, there is no value chain analysis provided in the Viral Vectors and Plasmid DNA Manufacturing Market report

Viral vectors are tools commonly used by molecular biologists to deliver genetic material into cells. This process can be performed inside a living organism (in vivo) or in cell culture (in vitro).

Yes, Viral Vectors and Plasmid DNA Manufacturing companies are profiled in the report.

Loading Table Of Content...