Virtual Reality In BFSI Market Research, 2031

The global virtual reality in bfsi market was valued at $418.7 million in 2021, and is projected to reach $3.7 billion by 2031, growing at a CAGR of 24.8% from 2022 to 2031.

Virtual reality is a simulated 3D environment that enables users to explore and interact with a virtual surrounding in a way that approximates reality, as it is perceived through the users' senses. The environment is created with computer hardware and software, although users might also need to wear devices such as helmets or goggles to interact with the environment. Virtual reality in BFSI is a digital platform and use of technology which has the power to re-invent and ensure continuity across industries, and when it comes to the adopting it, the Banking, Financial Services and Insurance (BFSI) has always been the frontrunner. Recently, making a breakthrough move, leading Public Sector lender Union Bank of India announced the launch of their Metaverse Virtual Lounge and Open Banking Sandbox environment.

In addition, VR are now used in a variety of inventive and engaging ways, from data visualization to strengthening security. Whether working from the office or at home, this technology helps finance professionals integrate with fintech like never before. As a result, a new world where data insights can be experienced, where customers can visualize banking products, and where financial institutions can improve their services is being built.

Virtual Reality in BFSI helps to enhance data visualization using virtual reality (VR). Also, most important aspect of utilizing VR technologies in the financial sector is the visualization of data. Moreover, advanced VR-backed stock trading and investing has created a way for participants to track and visualize the financial market with greater depth in a three-dimensional and interactive environment. In addition, there is a rising adoption of virtual reality in BFSI among the end user, because of the easy access to solutions and the opportunity to carry out whatever activities they want easily from anywhere across globe.

Therefore, these are some of the factors that propel the growth of virtual reality in BFSI market. However, the cost of adopting virtual reality in BFSI is high, which led difficulties for the small lenders to adopt the technology. Additionally, small and medium enterprises are unable to adopt these technology because of its high cost. On the contrary, there is growing usage of Artificial Intelligence in virtual reality in BFSI industry, which helps to boost the market in the coming years.

The report focuses on growth prospects, restraints, and trends of the virtual reality in BFSI market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the virtual reality in BFSI market size.

Segment Review

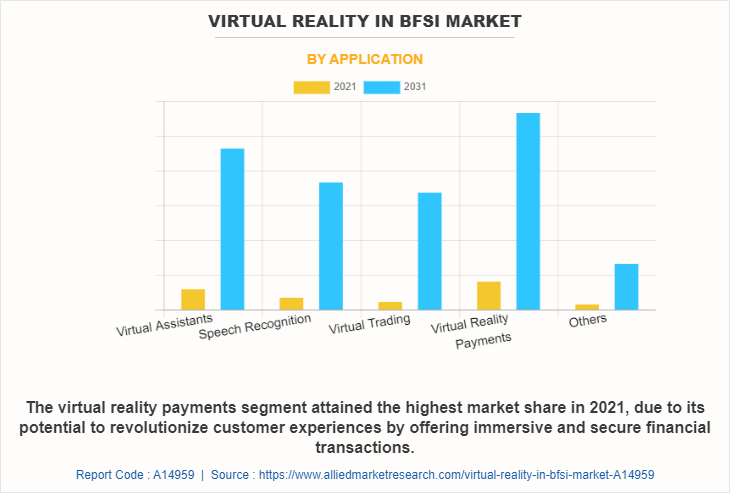

The virtual reality in BFSI market outlook is segmented on the basis of component, deployment mode, application, end user, and region. By component, it is segmented into hardware, software and services. By deployment mode, it is bifurcated into on-premise and cloud. On the basis of application, the virtual reality in BFSI market is segmented into virtual assistants, speech recognition, virtual trading, virtual reality payments, and others. By end user, the virtual reality in BFSI market is bifurcated into banks, credit unions, insurance companies, and NBFCs. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the virtual reality payments segment attained the highest growth in 2021. This is attributed to the fact that as the internet has matured and technology has made more and more advancements, the customer experience of buying online has outstripped the experience of payment. With the help of virtual reality the payments for any shopping are now becoming quicker, easier and less stressful. The advent of a new and improved shopping “experience” powered by virtual reality reflects the changes in the payments industry. Therefore, this is a major factor for the virtual reality in BFSI market share.

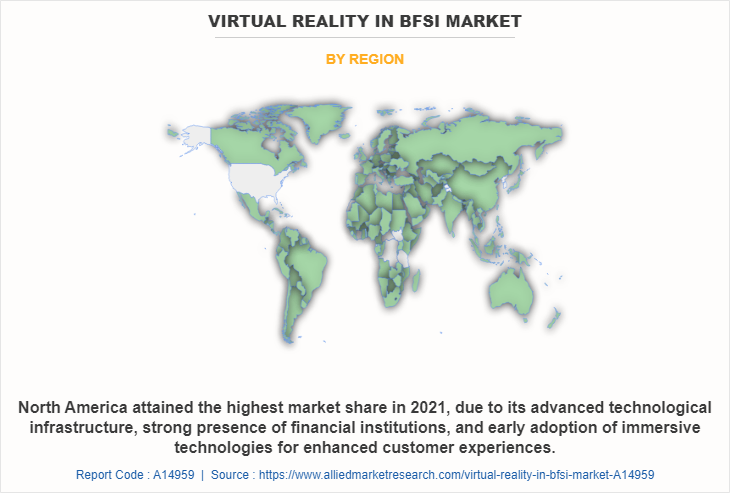

By region, North America attained the highest growth in 2021. This is attributed to the fact that this region has always remained at the forefront of technology adoption. Moreover, rapid advancement in financial industry, due to modern technologies such as machine learning, blockchain, big data, cloud services and artificial intelligence contributes toward the growth of the virtual reality in BFSI market in this region. In addition, increase in use of technology among the bank and financial institutions and surge in partnership of FinTech companies with regulatory bodies are the major factors that boost the virtual reality in BFSI market growth in this region.

The report analyzes the profiles of key players operating in the Virtual Reality in BFSI market such as Acadecraft.com, AeoLogic, Allerin Tech Pvt Ltd., Blue Label Labs, Designity Inc., Mazer, Nsocial Enriched Experimental Agency, Qodequay Technologies Pvt. Ltd., ServReality.com, Strivr Labs, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the virtual reality in BFSI market.

Market Landscape and Trends

Digitalized workplaces and simplified operations along with accelerated performance are expected to drive the growth of the global Virtual Reality in BFSI market over the forecasted period. Demand for enhanced process, and operational expenses, convergence, and centralization are anticipated to favour its growth. Moreover, one of the main driving forces behind the expansion of the global Virtual Reality in BFSI market is the high need for enhanced and efficient process of BFSI industry. Such services streamline the banking process, improve client satisfaction, helps for virtual payments and trading and make it simple for the operator to comprehend and monitor the data. In addition, companies are continuously attempting to reduce their capital expenditures and operational costs. Because of the current competitive environment and global economic crisis, the adoption of cost-effective strategies for restructuring existing business models has increased. Therefore, these are the major market trends for Virtual Reality in BFSI market.

Top Impacting Factors

Enhanced Data Visualization using Virtual Reality (VR)

The most important aspect of utilizing VR technologies in the financial sector is the visualization of data. Accordingly, advanced VR-backed stock trading and investing has created a way for participants to track and visualize the financial market with greater depth in a three-dimensional and interactive environment.

Moreover, the virtual reality has helped to transform the way financial companies assess their reporting insights. Furthermore, now financial information, charts, graphs, and predictions can all take place in a 3D, virtual space. This makes it much easier to draw compelling connections and engage with models to predict better outcomes. Additionally, the power of virtual reality in banking, financial professionals can explore every data point with more focus than has ever been possible. For instance, the Fidelity Labs’ StockCity. Accessible through Oculus Rift, StockCity simulates the stock market as a 3D city, where users can put on a headset and explore the financial world.

Surge in Demand for Virtual Reality Technology

There is a rising adoption of virtual reality in BFSI among the end user due to the easy access to solutions and the opportunity to carry out whatever activities they want easily from anywhere across globe. Furthermore, as consumer preferences shift, lenders have begun to focus on improving customer service through technology. Additionally, Virtual Reality in BFSI reduces risk of human error through proper verification with data measurements, enhancing overall services to customers. Therefore, all such factors encouraged financial institutions and banks to adopt virtual reality technology.

Increased Adoption of Virtual Reality (VR) in BFSI Sector

Banking and financial institutions have begun to incorporate augmented reality and virtual reality in BFS market into their operations in order to smoothen banking industry & provide a personalized customer experience. Additionally, with virtual assistance, VR is creating a virtual digital bank branch where customers can be engaged and given more information & personalized attention. Moreover, the adoption of VR in BFSI provides customers with a 360-degree view of their current situation, various request statuses, new offerings, and much more. Furthermore, customers nowadays make online payments using digital methods such as accounts, debit/credit cards, and digital wallets.

But in a few years, purchases will soon be possible with a flick of the wrist, a blink of the eye, or even the sound of the voice, due to the mobile applications and innovation of new technology. Therefore, such factors helps to boost the virtual reality in BFSI market.

Privacy Concerns of the Users Data

Virtual reality is the use of technology and innovation in BFSI to provide financial services through internet-based platforms. Organization in this market provide end-to-end financial services and solutions to automate banking or financial processes. Additionally, it is used by end-user organizations on the back end to automate the process and management. Moreover, with the usage of cloud technology in financial services there rise the concern of privacy.

Additionally, consumer data is restraining the growth of the Virtual Reality in BFSI market. Many organizations also collect data on a customer’s online spending behavior and social media patterns, to trace their digital footprint. This collected data collected is used for analysis in decision-making like generating credit score and also to determine a customer’s risk profile. Additionally, a large amount of personal and sensitive data is potentially vulnerable to breaches and can be accessed by malicious entities. Thus, such factors is restraining the growth of the Virtual Reality in BFSI market.

The Installation of Virtual Reality in BFSI is Expensive

The cost of adopting Virtual Reality in BFSI is high, which led difficulties for the small lenders to adopt the technology. Furthermore, most of the virtual reality solutions require high initial investments by end-users in the form of supporting infrastructure and licensing requirements, which can drive up adoption costs, especially in smaller businesses and organizations. In addition, the initial subscription and installation costs of virtual reality technology can be high and are typically tougher to bear for small and medium-sized organizations. Moreover, such advance technology required to bear additional infrastructural and technological investments to support a relatively smaller network of devices. Which can drive up the adoption costs and return on investments of virtual reality solution for SMEs. Therefore, such factors are limiting the growth of the market.

Growing Usage of Artificial Intelligence in Virtual Reality in BFSI Market

Artificial Intelligence enables banks to manage record-level high-speed data to receive valuable insights. Moreover, features such as digital payments, AI bots, and biometric fraud detection systems further lead to high-quality services for a broader customer base. Moreover, Artificial Intelligence comprises a broad set of technologies, including, but are not limited to, machine learning, natural language processing, expert systems, vision, speech, planning, and robotics. In addition, the AI in virtual reality banking and financial firms fundamentally reshapes the customer experience. The main premise of virtual reality is to provide banking services around the clock, as well as to help customer support staff focus on more complex tasks. Therefore, such factors provides major lucrative opportunities in the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Virtual Reality in BFSI market analysis from 2022 to 2031 to identify the prevailing Virtual Reality in BFSI market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Virtual Reality in BFSI market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Virtual Reality in BFSI market trends, key players, market segments, application areas, and market growth strategies.

Virtual Reality in BFSI Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.7 billion |

| Growth Rate | CAGR of 24.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 378 |

| By Application |

|

| By Component |

|

| By End User |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | AeoLogic, Mazer, Designity Inc., Strivr Labs, Inc., ServReality.com, Qodequay Technologies Pvt. Ltd., Allerin Tech Pvt. Ltd., Acadecraft.com, Blue Label Labs, Nsocial Enriched Experimental Agency |

Analyst Review

A virtual reality (VR) in BFSI helps in to create a virtual digital bank branch where customers can be engaged and provided many insights, and a more personalized attention with virtual assistance. Moreover, it enables customers with a 360-degree view of their current position, various statuses of their requests, new offerings and many more. Some of the key functions where VR will be forming an impact is the documentation (filling of forms), and others. In addition, with the help of VR customers will have a personalized chat with any of the bank personnel for any services. Also, now-a-days many businesses have started using VR in banking and financial services to create immersive experiences for clients and customers. Furthermore, VR technology can help to showcase abstract financial data in the simplest way possible. In the ever-changing world of finance, VR is a game changer for consolidating and presenting complex data in an immersive, aesthetically pleasing manner. VR-based applications and services can be especially useful for customers who are new to handling personal and commercial finance.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, PNB MetLife had launched conVRse, a VR-based customer service platform that offers a 3D simulated environment to users. In this environment, customers can interact with a virtual avatar called Khushi. Khushi is a customer service expert who answers customers’ questions and assists in fulfilling life insurance policy servicing requirements. Therefore, this strategy helps to grow the market demand for virtual reality in BFSI. Moreover, some of the key players profiled in the report include Acadecraft.com, AeoLogic, Allerin Tech Pvt Ltd., Blue Label Labs, Designity Inc., Mazer, Nsocial Enriched Experimental Agency, Qodequay Technologies Pvt. Ltd., ServReality.com, and Strivr Labs, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Virtual Reality in BFSI helps to enhance data visualization using virtual reality (VR). Also, most important aspect of utilizing VR technologies in the financial sector is the visualization of data. Moreover, advanced VR-backed stock trading and investing has created a way for participants to track and visualize the financial market with greater depth in a three-dimensional and interactive environment.

North America is the largest regional market for Virtual Reality in BFSI

The global virtual reality in BFSI market was valued at $418.68 million in 2021, and is projected to reach $3,724.56 million by 2031, growing at a CAGR of 24.8% from 2022 to 2031.

Acadecraft.com, AeoLogic, Allerin Tech Pvt Ltd., Blue Label Labs, Designity Inc., Mazer, Nsocial Enriched Experimental Agency, Qodequay Technologies Pvt. Ltd., ServReality.com, Strivr Labs, Inc.

Loading Table Of Content...

Loading Research Methodology...