Volume Insights Strategic Overview

Allied Market Research announces the release of its comprehensive analysis of the global Adaptive Cruise Control (ACC) market. As a pivotal component of modern advanced driver-assistance systems (ADAS), adaptive cruise control systems are revolutionizing the way vehicles perceive and respond to their environment. Designed to maintain safe distances, regulate vehicle speed, and reduce driver fatigue, ACC systems are rapidly becoming a standard safety feature across mid- to high-end vehicle segments worldwide. Their integration is not only enhancing passenger safety and driving convenience but also supporting the broader transition to semi-autonomous and autonomous mobility.

The report underscores a sharp uptick in demand for adaptive cruise control systems, particularly in regions with evolving traffic norms, dense urban mobility patterns, and growing emphasis on vehicular automation. The proliferation of electric vehicles (EVs), government safety mandates, and rising consumer expectations for intelligent driving experiences are propelling the ACC market forward. Technological strides in sensor fusion, machine learning, and real-time data processing are further enhancing system reliability and responsiveness.

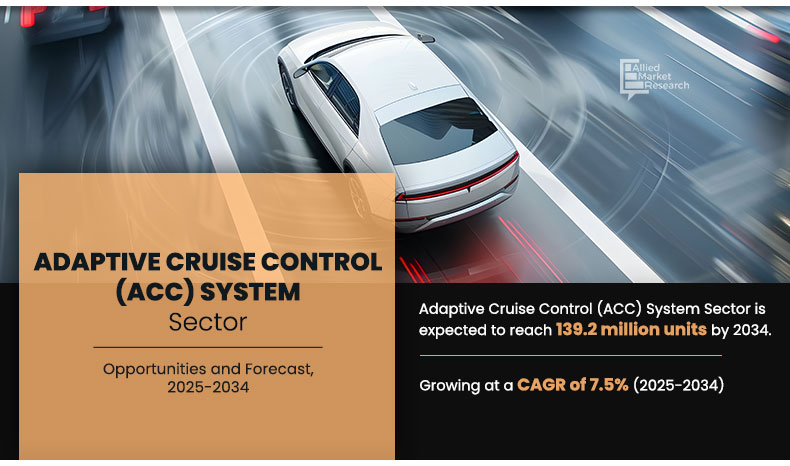

The market’s exponential rise is also attributed to increasing adoption in both passenger and commercial vehicles, with OEMs investing in integrated radar and camera-based solutions. Regulatory frameworks like the Euro NCAP and U.S. NHTSA guidelines have created a favorable environment for widespread ACC deployment. According to the report, the global Adaptive Cruise Control (ACC) market volume stood at 73.5 million units in 2024 and is anticipated to surge to 3,145.2 million units by 2034, growing at a CAGR of 7.9% over the forecast period. This upward trajectory is fueled by the development of multi-mode adaptive systems, AI-powered decision engines, and plug-and-play modules suited for next-generation, software-defined vehicles.

Regional Adaptive cruise control (acc) system Sector Volume Growth

Asia-Pacific dominated the adaptive cruise control (acc) system sector volume share with 49.3% share in 2024, and is expected to grow at 7.8% CAGR, while North America, Europe, and LAMEA exhibit strong growth at 7.2%, 6.9%, and 7.5% CAGR, respectively, driven by regional urban mobility trends and sustainability efforts.

The regional analysis highlights significant variations in adoption trends and sector volume growth potential across the globe.

Asia-Pacific dominated the adaptive cruise control (ACC) system sector volume share, accounting for 49.3% of total installations in 2024, and is expected to grow at a CAGR of 7.8%, driven by increasing urban mobility demand, rapid vehicle electrification, and robust manufacturing ecosystems in countries such as China, India, Japan, and South Korea. The region’s expanding middle-class population, rising demand for safety-enhanced vehicles, and government initiatives promoting smart transportation continue to fuel widespread adoption of ACC systems. North America is anticipated to register a CAGR of 7.2%, supported by early integration of autonomous driving technologies, strong automotive R&D activity, and proactive regulatory frameworks such as the U.S. NCAP that mandate advanced safety systems in vehicles. Key automotive markets in the U.S. and Canada are focusing on enhancing driver convenience and accident prevention through widespread deployment of radar- and camera-based ACC platforms.

Europe, driven by innovation in radar-based driver-assistance technologies and stringent emission and safety standards, is forecast to grow at a CAGR of 6.9%. Countries like Germany, France, Sweden, and the UK are leading the charge in integrating ACC systems as part of broader ADAS suites, supported by OEMs’ focus on sustainability, electrification, and connected mobility. LAMEA (Latin America, Middle East, and Africa) is projected to witness a CAGR of 7.5%, with increasing focus on urban traffic management, growing vehicle imports featuring advanced safety features, and government-led road safety initiatives. Emerging markets such as Brazil, UAE, and South Africa are investing in infrastructure and intelligent mobility solutions that are fostering the growth of adaptive cruise control adoption across the region.

Adaptive cruise control (acc) system Sector Volume Growth, By Region, 2024-2034 (Million Units)

Region | 2024 | 2029 | 2034 | CAGR (2025–2034) |

North America | 12.9 | 15.9 | 24.9 | 7.2% |

Europe | 18.9 | 22.9 | 35.2 | 6.9% |

Asia-Pacific | 34.9 | 44.2 | 71.0 | 7.8% |

LAMEA | 4.1 | 5.1 | 8.2 | 7.5% |

Total | 70.7 | 88.1 | 139.2 | 7.5% |

Source: AMR Analysis

Adaptive cruise control (acc) system Country Sector Sales

China and the U.S. continue to lead the adaptive cruise control (acc) system sector in volume growth, projected to reach 20.0 million units and 7.9 million units respectively by 2034, growing at a CAGR of 8.0% and 8.1%. Meanwhile, Japan (8.1% CAGR) and India (9.8% CAGR) are emerging as high-growth markets, driven by domestic OEM innovations in compact ADAS integration (Japan) and increasing installation of ACC in mid-range vehicles supported by safety regulations and urban mobility shifts (India). Growth in these markets is underpinned by a rising focus on traffic safety, early adoption of radar-based cruise systems, and the push for localized manufacturing of ADAS components.

The report identifies China and the U.S. as the largest contributors to the adaptive cruise control (acc) system sector in terms of volume growth.

China, driven by its expansive automotive manufacturing base, rapid electrification, and growing integration of ADAS technologies in both domestic and export vehicle models, is projected to reach 20.0 million units by 2034, growing at a CAGR of 8.0%. The nation's strong policy support for intelligent transport systems and robust radar technology supply chains continues to strengthen its leadership position in the global ACC landscape.

The U.S., supported by a well-established aftermarket ecosystem, regulatory mandates such as FMVSS and NCAP programs, and increasing consumer demand for autonomous and connected vehicle features, is anticipated to reach 7.9 million units by 2034, registering a CAGR of 8.1%. The rising inclusion of Level 2 and Level 3 autonomy features in premium vehicles is further driving adoption.

Japan, known for its cutting-edge sensor technologies and early implementation of ADAS components in compact vehicles, is forecasted to reach significant ACC system deployment by 2034, growing at a CAGR of 8.1%. Its automotive giants’ focus on system miniaturization and affordability ensures steady growth across domestic and export segments.

India is rapidly emerging as a key growth market, projected to witness the highest CAGR among major Asian economies. With a forecasted CAGR of 9.8%, the ACC system market in India is being driven by increasing vehicle electrification, urban safety initiatives, and the growing demand for mid-range vehicles integrated with basic driver-assistance functionalities. Supportive government policies under Bharat NCAP and Make-in-India initiatives further amplify market momentum.

Adaptive cruise control (acc) system Sector Volume Share, By Country, 2023-2033 (Million Units)

Country | 2024 | 2029 | 2034 | CAGR (2025-2034) |

China | 19.957 | 27.432 | 41.298 | 8.00% |

U.S. | 7.878 | 10.877 | 16.41 | 8.1% |

Germany | 654.3 | 904.5 | 1364.4 | 8.1% |

Japan | 568.5 | 789.1 | 1192.8 | 8.1% |

India | 271 | 413.7 | 665.6 | 9.8% |

Source: AMR Analysis

Key Highlights by Stakeholders

Highlighting the significance of the report, Ashwani Ajwani, Vice-President at Allied Market Research, stated,

“The surge in demand for safety-first, tech-integrated, and personalized driving experiences has positioned adaptive cruise control (ACC) systems as a cornerstone of the global shift toward semi-autonomous and autonomous mobility. This report offers stakeholders strategic intelligence into the evolving competitive landscape, enabling data-driven decisions in a high-growth market.”

He added, “Asia-Pacific, anchored by China, India, and Japan, continues to lead with a 49.3% market share, underpinned by large-scale vehicle production, increasing mid-range vehicle sales, and fast-paced radar technology localization. China benefits from its robust supply chain and ADAS mandates, India is accelerating due to urban safety initiatives and rising ADAS penetration, while Japan maintains leadership in compact, sensor-rich vehicles tailored for dense urban traffic.

In North America, particularly the U.S., the ACC market is fueled by early adoption of Level 2+ autonomy, premium segment integration, and a mature aftermarket ecosystem. Meanwhile, Europe is driven by strict safety regulations like Euro NCAP and strong OEM investments in integrated radar-camera modules.

LAMEA, though nascent, is seeing strong momentum—led by infrastructure upgrades in the Middle East and increasing automotive assembly activities in Latin America, making it a region to watch.”

The report emphasizes the growing influence of sustainable and energy-efficient radar-based adaptive cruise control (ACC) systems in shaping the future of global mobility. As regulatory frameworks across key automotive markets tighten around emissions control and safety compliance, industry players are accelerating the shift toward eco-conscious radar technologies that meet performance benchmarks while supporting environmental targets.

This market evolution is evident in the increasing deployment of low-power radar chipsets, recyclable module housings, and compact form factors—particularly in Europe, Japan, and North America, where green vehicle initiatives and emissions targets are driving OEM innovation. These sustainable advancements are aligned with global automakers' commitments to climate-neutral vehicle platforms, reinforcing radar’s integral role in the architecture of next-generation ADAS systems.

In parallel, the integration of AI-powered object detection, edge-based decision-making, and vehicle-to-everything (V2X) connectivity is transforming traditional ACC systems into smart, multi-functional radar platforms. This transformation is especially evident in China and the U.S., where connected vehicle programs and 5G infrastructure are enabling advanced capabilities like real-time traffic response, predictive braking, and adaptive lane centering.

The report also explores how growing vehicle ownership in emerging economies like India and Southeast Asia, along with rising disposable incomes and a demand for urban safety, is catalyzing ACC adoption in mid-range and entry-level vehicles. In these regions, cost-effective radar modules with embedded driver-assist functionalities are gaining traction as manufacturers localize production and scale deployments.

Radar-enabled features such as adaptive cruise control, blind-spot monitoring, and collision avoidance are no longer exclusive to premium segments—they are increasingly becoming baseline expectations across the global automotive market. As a result, both OEM and aftermarket players are investing in platform-agnostic radar solutions that support modular integration and over-the-air updates.

About Allied Market Research

Allied Market Research is a full-service market research and business consulting firm, which provides actionable insights and strategic recommendations to help clients make informed decisions and achieve sustainable growth. For more inquiries, please visit alliedmarketresearch.com