Volume Insights Strategic Overview

Allied Market Research announces the release of its comprehensive analysis of the global automotive radar sector. Designed to enhance vehicle safety, performance, and automation, automotive radar systems play a critical role in enabling advanced driver-assistance systems (ADAS) and autonomous driving capabilities. These radar systems are essential in both passenger and commercial vehicles, ensuring greater road safety, situational awareness, and driver comfort. As the demand for intelligent, sensor-driven, and regulation-compliant automotive solutions rises, automotive radar is becoming a fundamental component of the evolving global automotive ecosystem.

The report highlights the surge in demand for automotive radar, particularly in urban and semi-urban regions witnessing increased adoption of high-end safety features and rising sales of electric and autonomous vehicles. The market has experienced rapid growth, fueled by technological advancements in millimeter-wave radar, government mandates for safety features, and the proliferation of connected vehicle platforms.

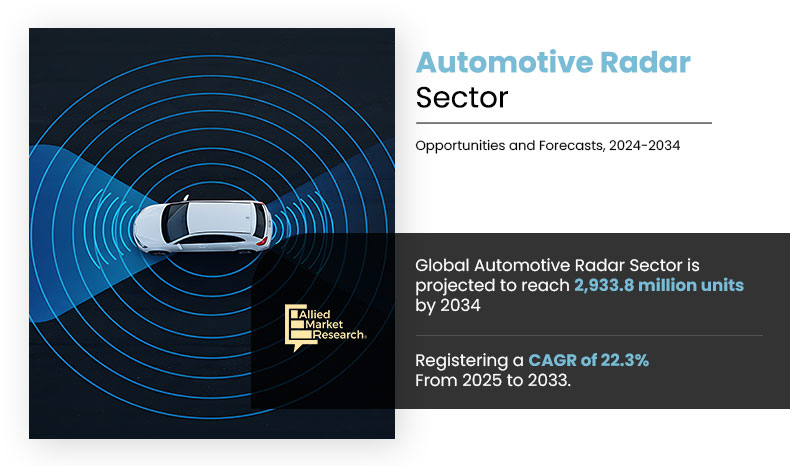

The steady rise in the number of automotive radar units is attributed to the growing implementation of adaptive cruise control, blind-spot detection, collision avoidance systems, and lane-keeping assist. In addition, supportive policies such as the European Union’s General Safety Regulation and the U.S. NCAP initiatives are further accelerating deployment. The global automotive radar market volume was valued at 430.6 million units in 2024 and is projected to reach 2,933.8 million units by 2034, registering a CAGR of 22.3% during the forecast period. This robust growth is driven by continuous innovation in radar architecture, such as high-resolution 4D radar, integration with AI for object classification, and scalable modular systems tailored for next-generation vehicles.

Regional Automotive Radar Sector Volume Growth

Asia-Pacific dominated the automotive radar sector volume share with 49.3% share in 2024, and is expected to grow at 22.7% CAGR, while North America, Europe, and LAMEA exhibit strong growth at 22%, 21.6%, and 22.4% CAGR, respectively, driven by regional urban mobility trends and sustainability efforts

The regional analysis highlights significant variations in adoption trends and sector volume growth potential across the globe. Asia-Pacific dominated the automotive radar sector volume share, accounting for 49.3% of total installations in 2024, and is expected to grow at a CAGR of 22.7%, driven by increasing vehicle electrification, rising integration of ADAS features, and robust automotive production hubs in countries like China, India, and Japan. North America, supported by early adoption of autonomous driving technologies and strong regulatory backing for vehicle safety standards, is anticipated to grow at a CAGR of 22.0%. Europe, fueled by innovation in radar-based driver assistance systems and stringent emissions and safety regulations, is expected to grow at a CAGR of 21.6%, with key contributions from markets like Germany, France, and the UK. LAMEA is projected to register a CAGR of 22.4%, with increasing focus on urban mobility, road safety initiatives, and rising investments in intelligent transportation systems across regions such as the UAE, Brazil, and South Africa contributing to market growth.

Automotive Radar Sector Volume Growth, By Region, 2024-2034 (Million Units)

Region | 2024 | 2029 | 2034 | CAGR (2025–2034) |

North America | 79.02 | 156.61 | 527.82 | 22.0% |

Europe | 115.06 | 224.19 | 742.42 | 21.6% |

Asia-Pacific | 212.34 | 432.52 | 1497.64 | 22.7% |

LAMEA | 24.19 | 48.61 | 165.98 | 22.4% |

Total | 430.61 | 861.93 | 2933.86 | 22.3% |

Source: AMR Analysis

Automotive Radar Country Sector Sales

China and the U.S. continue to lead the automotive radar sector in volume growth, projected to reach 883.9 million and 348.2 million units respectively by 2034, growing at a CAGR of 23.1% and 23.0%. Meanwhile, Japan (24.2% CAGR) and India (21.3% CAGR) are emerging as high-growth markets, driven by rising vehicle ownership, increasing consumer interest in safety and personalization features, and robust demand for radar-enabled ADAS technologies.

The report identifies China and the U.S. as the largest contributors to the automotive radar sector in terms of volume growth.

China, driven by its expansive automotive manufacturing base, rapid electrification, and widespread deployment of ADAS features, is expected to reach 883.9 million units by 2034, growing at a CAGR of 23.1%. The U.S., supported by a strong aftermarket ecosystem and accelerating adoption of autonomous and connected vehicle technologies, is projected to reach 348.2 million units, registering a CAGR of 23.0%.

Germany, backed by its legacy in automotive engineering and innovation, is set to grow to 336.3 million units by 2034 at a CAGR of 21.8%, leading growth within the European region. Other parts of Europe, including countries such as France and the UK (grouped as Rest of Europe), are collectively expected to reach 127.4 million units, growing at a CAGR of 20.1%, supported by regulatory mandates and increasing penetration of radar-based driver assistance systems.

In North America, Mexico is emerging as a high-potential market, projected to grow to 111.9 million units by 2034 at a CAGR of 19.7%, owing to increasing vehicle production, nearshoring trends, and mobility tech investments. Japan, known for its high adoption rate of in-vehicle safety technologies and innovation in sensor miniaturization, is expected to reach 323.7 million units, growing at a CAGR of 24.2%, the highest among developed nations.

Meanwhile, India is gaining momentum as an emerging market, forecasted to reach 114.6 million units by 2034, with a CAGR of 21.3%, fueled by rising urbanization, government safety mandates, and increasing demand for mid-range vehicles equipped with ADAS functionalities.

Automotive Radar Sector Volume Share, By Country, 2023-2033 (Million Units)

Country | 2024 | 2029 | 2034 | CAGR (2025-2034) |

China | 121.6 | 210.0 | 883.9 | 23.10% |

Germany | 51.4 | 85.2 | 336.3 | 21.80% |

U.S. | 48.3 | 83.2 | 348.2 | 23.00% |

Japan | 40.5 | 72.8 | 323.7 | 24.20% |

Rest of Europe | 22.5 | 35.2 | 127.4 | 20.10% |

Mexico | 20.4 | 31.6 | 111.9 | 19.70% |

Source: AMR Analysis

Key Highlights by Stakeholders

Highlighting the significance of this report, Ashwani Ajwani, Vice-President of Allied Market Research, stated, “Surge in demand for personalised, safety-centric, and tech-enabled driving experiences has made automotive radar a pivotal element of next-generation vehicles. Our latest report captures the evolving dynamics of this sector, offering strategic insights for stakeholders aiming to harness the vast potential of this rapidly expanding market.”

He further added, “Asia-Pacific, with its dominance in production volume and ongoing advancements in radar technology integration, leads the global market with a 49.3% share and robust growth trajectory. North America, driven by the strong adoption of autonomous features and a mature aftermarket ecosystem, continues to be a highly promising region. Simultaneously, Europe’s focus on automotive innovation and strict safety mandates, along with LAMEA’s rising investments in smart mobility infrastructure, are collectively fueling global momentum. With this comprehensive analysis, we aim to empower our clients with data-backed clarity to make informed, forward-looking decisions in this highly competitive and transformative industry.”

Automotive Radar Sector Volume Trends

The report further highlights the growing role of sustainable and energy-efficient automotive radar systems in supporting global efforts toward greener and safer mobility solutions.

With mounting regulatory pressure to reduce vehicle emissions and improve road safety, the industry is witnessing a shift toward eco-friendly radar technologies—including low-power radar chips, recyclable housing materials, and compact designs that minimize energy consumption without compromising performance. This transition aligns with broader automotive sustainability goals, reinforcing radar's role in the future of environmentally responsible vehicle development.

In addition, technological advancements, such as integration with IoT platforms, AI-powered object detection and classification, and vehicle-to-everything (V2X) communication capabilities, are reshaping the automotive radar ecosystem. These innovations are not only enhancing detection accuracy and real-time decision-making but also improving overall vehicle efficiency and digital integration. As a result, the demand for smart, multifunctional radar systems—capable of supporting features like adaptive cruise control, blind-spot monitoring, and collision avoidance—is expected to grow substantially.

Furthermore, the study discusses the impact of rising vehicle ownership, increasing disposable incomes, and evolving urban mobility trends on the adoption of automotive radar. Consumers are increasingly prioritizing safety, automation, and driving comfort, making radar systems indispensable components of modern vehicles. Their ability to enable seamless driver assistance, enhance performance, and support autonomous driving technologies positions automotive radar as a critical growth driver in both OEM and aftermarket segments.

Automotive radar stakeholders, including manufacturers, OEMs, and solution providers—are encouraged to leverage the insights in this report to identify emerging opportunities, align with regulatory and technological shifts, and craft resilient strategies in a market that is advancing rapidly toward intelligent and sustainable mobility.

About Allied Market Research

Allied Market Research is a full-service market research and business consulting firm, which provides actionable insights and strategic recommendations to help clients make informed decisions and achieve sustainable growth. For more inquiries, please visit alliedmarketresearch.com