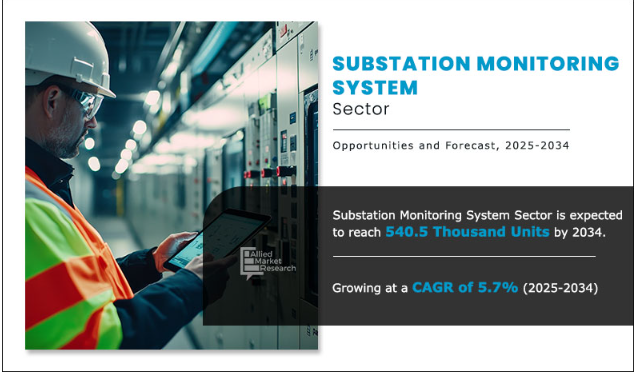

Volume Insights on Substation Monitoring System Sector

The global substation monitoring system sector volume projection was valued at 314.5 Thousand units in 2024 and is projected to reach 540.5 Thousand units by 2034, registering a CAGR of 5.7% from 2025 to 2034.

Volume Insights Strategic Overview

Allied Market Research announces the release of its comprehensive analysis of the global Substation Monitoring System sector volume. Substation monitoring systems are critical for enhancing the operational efficiency, reliability, and safety of electrical power infrastructure. These systems enable real-time monitoring and analysis of various parameters such as voltage, current, temperature, humidity, circuit breaker status, and transformer health. With the growing demand for uninterrupted power supply and the increasing complexity of power grids, utilities and grid operators are adopting intelligent monitoring solutions to reduce downtime, improve fault detection, and optimize asset management.

The report highlights a rising demand for advanced monitoring systems equipped with predictive maintenance capabilities, IoT integration, and cloud-based analytics. Substation monitoring system sector sales are gaining traction across transmission and distribution networks, especially in regions undergoing grid modernization and smart grid development. This trend is further accelerated by increasing investments in renewable energy integration, electrification of infrastructure, and aging utility assets in need of efficient lifecycle management.

Sector growth is also fueled by regulatory mandates focused on improving grid stability, cybersecurity, and energy efficiency. The deployment of wireless sensor networks, AI-based analytics platforms, and remote diagnostics tools are enabling real-time insights, automated alerts, and faster response times during critical events.

The steady adoption of substation monitoring systems is supported by a combination of factors including grid reliability concerns, a growing emphasis on digital transformation within utilities, and government initiatives aimed at building resilient and intelligent energy systems. These dynamics are expected to sustain the sector's expansion across both developed and emerging power sectors over the coming years.

Segmental Substation Monitoring System Sector Volume Growth

The wired segment dominates the substation monitoring system sector volume share, accounting for a 64.5% share in 2024, and is projected to grow at a CAGR of 5.5%. In contrast, the wireless segment is showing stronger growth, with a CAGR of 6.0%, fueled by increasing demand for remote monitoring, reduced infrastructure costs, easier installation, and greater scalability across smart grid applications.

The global volume of the substation monitoring system sector volume by particle sensor is expected to grow from 203.1 thousand units in 2024 to 342.9 thousand units by 2034, registering a CAGR of 5.7% over the forecast period. This expansion is supported by the growing need for real-time monitoring and diagnostics of substation equipment to ensure grid reliability and prevent equipment failures. Particle sensors play a vital role in detecting contamination levels in insulating oils and gases within transformers and other high-voltage equipment. Their ability to detect early signs of wear, arcing, or internal faults helps utilities reduce unplanned outages and extend equipment life. Further, the substation monitoring system sector volume application includes utility, mining, steel, oil and gas, and transportation. The utility segment acquired a lucrative substation monitoring system market share in 2024, owing to a rise in demand for energy and the modernization of aging infrastructure.

The increasing integration of renewable energy sources and the corresponding need for efficient grid balancing are also driving the adoption of advanced monitoring solutions. Additionally, aging grid infrastructure in developed regions, combined with rapid urbanization and industrial expansion in emerging economies, is prompting utilities to invest in proactive asset management technologies. Technological advancements in sensor miniaturization, sensitivity, and data transmission capabilities are further supporting their widespread deployment. Government regulations mandating grid modernization and reliability enhancements, along with a rising focus on predictive maintenance strategies, are expected to further boost demand. These factors collectively contribute to the strong growth trajectory of particle sensors in the substation monitoring system sectors volume.

Substation Monitoring System Sector Volume Growth, By Region, 2024-2034 (Million Units)

Communication Technology | 2024 | 2034 | CAGR (2025-34) |

Wired Substation Monitoring System | 203.1 | 343.0 | 5.54% |

Wireless Substation Monitoring System | 111.4 | 197.6 | 6.06% |

Total | 314.5 | 540.5 | 5.73% |

Source: AMR Analysis

Regional Analysis Substation Monitoring System Sector Stakeholders

Asia-Pacific remains the largest contributor to the global Substation Monitoring System sector, accounting for the highest volume share in 2024. This dominance is driven by rapid industrialization, expansion of power infrastructure, and increasing demand for reliable electricity across major economies such as China, India, Japan, and South Korea. The region's aggressive investments in smart grid initiatives, transmission and distribution (T&D) upgrades, and electrification of transportation and industry are significantly accelerating the deployment of advanced substation monitoring systems.

Government policies aimed at improving grid stability, reducing transmission losses, and integrating renewable energy sources are further supporting regional growth. Countries like China and India are heavily investing in substation automation technologies to address aging infrastructure and growing energy demands, while Japan and South Korea are leading in digital utility transformation and smart substation deployments.

Moreover, the presence of key sector players, growing domestic manufacturing capabilities, and strong support from government-backed utility programs contribute to Asia-Pacific’s continued leadership in the sector. Following Asia-Pacific, North America ranks as the second-largest region, bolstered by aging grid infrastructure, rising cybersecurity concerns, and increasing investments in utility modernization. Europe follows with steady growth driven by environmental targets, smart grid rollouts, and widespread renewable energy integration across the region.

Substation Monitoring System Sector Volume Trends

The report highlights the increasing importance of sustainable and intelligent substation monitoring system technologies in supporting global efforts toward more resilient energy infrastructure and smarter grid management. As regulatory pressures grow to enhance grid reliability—particularly in rapidly urbanizing regions and industrial centers—there is a strong push for compact, energy-efficient, and highly accurate monitoring solutions that can be seamlessly integrated into critical substation equipment such as transformers, circuit breakers, and switchgear.

Driven by the urgency to minimize power outages, extend asset life, and support renewable energy integration, governments and utilities around the world are actively implementing smart grid frameworks and investing in the large-scale deployment of substation automation technologies. This has accelerated demand for modular and scalable monitoring systems capable of providing real-time diagnostics, fault detection, and predictive maintenance. Innovations in sensor technology, including fiber optics and MEMS (micro-electro-mechanical systems), are further improving measurement precision, enhancing durability, and enabling system miniaturization.

Moreover, technological advancements in artificial intelligence (AI), edge computing, and secure wireless communication are transforming the substation monitoring system landscape. AI-powered platforms can now process equipment performance data locally, facilitating faster anomaly detection, automated decision-making, and seamless integration with SCADA (Supervisory Control and Data Acquisition) systems. These smart capabilities not only improve operational efficiency but also reduce lifecycle maintenance costs by minimizing manual inspections and unplanned downtime.

The study also examines how rapid urbanization, growing electrification, and shifting energy consumption patterns are influencing the widespread adoption of smart monitoring solutions across both mature and emerging markets. Key areas of application include power generation, transmission and distribution (T&D), industrial automation, and electric transportation. Additionally, the increasing integration of substation monitoring systems within renewable energy infrastructures, smart cities, and microgrids is opening new growth avenues.

Backed by strong digital transformation trends and modernization programs, the substation monitoring system sector volume forecast indicates steady growth, driven by rising demand for predictive analytics, IoT-enabled monitoring, and the need for reliable power infrastructure. As utilities continue prioritizing system resilience and sustainability, stakeholders are encouraged to capitalize on these trends by aligning their strategies with evolving grid modernization goals.

About Allied Market Research

Allied Market Research is a full-service research and business consulting firm, that provides actionable insights and strategic recommendations to help clients make informed decisions and achieve sustainable growth. For more inquiries, please visit alliedmarketresearch.com.

About Allied Market Research

Allied Market Research is a full-service market research and business consulting firm, which provides actionable insights and strategic recommendations to help clients make informed decisions and achieve sustainable growth. For more inquiries, please visit alliedmarketresearch.com