VSAT Maritime Satellite Communication Market Statistics, 2030

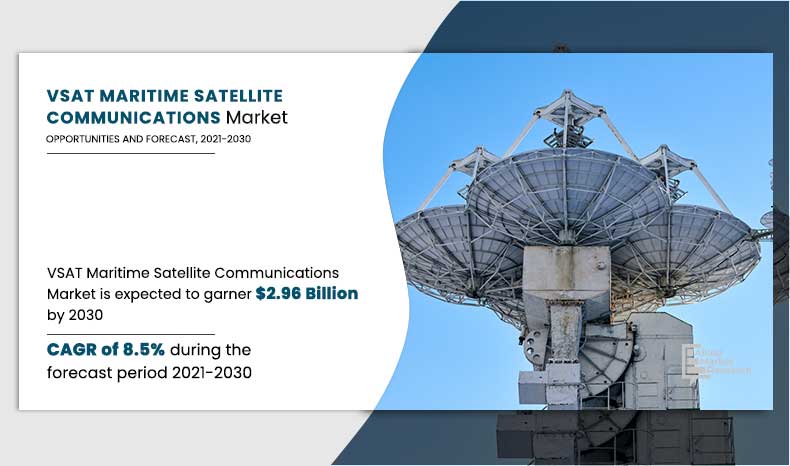

The global VSAT maritime satellite communication market size was valued at $1,347.72 million in 2020, and is projected to reach $2,962.65 million by 2030, registering a CAGR of 8.5% from 2021 to 2030.

A VSAT maritime satellite communication is wireless internet beamed down from satellites orbiting the Earth. In addition, it is much faster from some common service providers and is different from land-based internet services such as cable or DSL, which transmit data through wires. In addition, satellite internet works by using radio waves to communicate with satellites orbiting the Earth. Furthermore, it is the only internet service that is available nationwide and is often the only way to get online for remote islands and ships sailing on seas.

Increase in import and export operations through the marine industry and increased technological advancements in the VSAT maritime satellite communications market drive growth of the market. In addition, increasing VSAT satellite applications in civil and military maritime sectors fuels growth of the market. However, lack of reliability in satellite services and lack of awareness among consumers to use VSAT maritime satellites is expected to impede the market growth. Furthermore, increasing demand for VSAT connectivity among shipowners is expected to provide lucrative opportunities for the VSAT maritime satellite communication market growth.

By Component

Solution segment accounted for the highest market share in 2020.

By services, the video segment dominated the VSAT maritime satellite communication market in 2020, and is expected to continue its dominance in the coming years as it allows customers and crew members to stream high quality videos on their smartphones for entertainment purposes. However, the tracking and monitoring services segment is expected to witness significant growth rate during the forecast period as it allows for rapid information transmission between head office, dispatch consoles, and ships.

Region wise, the VSAT maritime satellite communication market was dominated by Asia-Pacific in 2020, and is expected to witness growth at the highest rate, owing to higher government investment on maritime products and services, expanded security risks, and increased sea transportation and other tracking.

By Region

Asia-Pacific would exhibit the highest CAGR of 11.1% during 2021-2030

The report focuses on growth prospects, restraints, and trends of the VSAT maritime satellite communication market analysis. The study provides Porter’s five forces analysis to understand impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the VSAT maritime satellite communication market share.

By End User

Merchant Shipping segment accounted for the highest market share in 2020.

Top Impacting Factors

Increase in Imports and Exports Operations Through Marine Industry

Increase in imports and exports in various countries, owing to growing trade environment benefits growth of the market. Increase in exports through marine operations, owing to cheaper costs is leading to sales of more subscriptions for VSAT satellite communication services. In addition, increased imports and exports across several countries has made satellites busy in controlling traffic of communication signals.

Moreover, maritime VSAT has a wide range of uses, with VSAT communication being critical for onboard crew safety and operations. In addition, VSAT can easily perform a variety of services, including point of sales, internet access, file distribution, database access, and environmental monitoring, which explains its high utilization rate and fast-growing market. Hence, it helps the crew to stay connected during the journey. Thus, increasing import and export operations through the marine industry propels growth of the VSAT maritime satellite communication market.

Increase in Technological Advancements

When crews are locked on board and have limited mobility options, having quick, dependable, and secure communication between ships and land is always necessary and critical. In terms of analytics and educated insight into performance patterns, the internet of things (IoT) and cloud technologies provide real-time data telemetry and much more. All of this necessitates the most up-to-date marine communication equipment as well as satellite connectivity.

In addition, investments in 5G mobile phone networks is quickly increasing, with major operators, such as Vodafone, building out expanded coverage in cities and ports to provide lightning-fast connection that can be extended throughout coastal areas and beyond for maritime applications. Moreover, companies such as SpaceX intends to begin commercial VSAT services from low earth orbit (LEO) satellites providing connectivity in V, Ku, and Ka bands for ship VSAT with better access and speed than existing VSAT from geostationary satellites or LEO L-band. Thus, increased technological advancements in VSAT maritime satellite communication industry propels growth of the VSAT maritime satellite communication market.

Segment Review

The global VSAT maritime satellite communication market is segmented based on component, band type, services, end user, and region. By component, it is divided into solution and service. By band type, it is fragmented into, ku-band, ka-band, and c-band. In terms of services, it is segregated into voice, tracking and monitoring services, video, and data. In terms of end user, the market is classified into merchant shipping, passenger ships, leisure vessel, offshore, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the VSAT maritime satellite communication market analysis include Marlink, Inmarsat Global Limited, Iridium Communication Inc., Thuraya Telecommunications Company, Hughes Network System, LLC, KVH Industries, Inc., Speedcast, NSSLGLOBAL, ORBCOMM, and GTMARITIME. These players have adopted various strategies to increase their market penetration and strengthen their position in the VSAT maritime satellite communication industry.

COVID-19 impact analysis

The pandemic halted many imports, exports and international operations owing to lockdowns implemented by government authorities which disrupted the global supply chain. Many nations' restrictive policies made it difficult to install new satellite communication terminals, and lower activity also caused some end-users like cargo suppliers and others to put their connectivity subscriptions on hold, resulting in an increase in the number of inactive terminals.

Additionally, due of its high reliance on travel and human connection, the current pandemic scenario had a negative impact on international trade and shipping. In addition, crews used terrestrial cellular networks to communicate instead of vessel systems when the ships were anchored in port. Aside from the COVID crisis, the offshore oil & gas industry had its own set of problems as a result of a price war for oil and production constraints. This resulted in decrease of movements of the ships for the trade during the pandemic.

Key Benefits for Stakeholders

- The study provides in-depth analysis of the global VSAT maritime satellite communication market share along with current & future trends to illustrate the imminent investment pockets.

- Information about key drivers, restrains, & opportunities and their impact analysis on the global VSAT maritime satellite communication market size provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the VSAT maritime satellite communication market.

- An extensive analysis of the key segments of the industry helps to understand the global VSAT maritime satellite communication market trends.

- The quantitative analysis of the global VSAT maritime satellite communication market forecast from 2021 to 2030 is provided to determine the market potential.

VSAT Maritime Satellite Communication Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Band Type |

|

| By Services |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Speedcast, Hughes Network Systems, LLC, Marlink, Iridium Communications Inc., KVH Industries, Inc., NSSLGLOBAL, GTMARITIME, ORBCOMM, Thuraya Telecommunications Company, Inmarsat Global Limited |

Analyst Review

Adoption of VSAT maritime satellite communication has increased over the years as it provides internet connection to all parts of the world from remote places to busy cities as is a type of connection that uses a satellite to get an internet signal from your internet service provider (ISP) to you. In addition, AI is driving advancements in VSAT maritime satellite communication automation and researchers are building autonomous satellites that prevents collisions with space debris, setting up and maintaining communication networks, monitoring condition of satellites, and their operating routines, which is expected to boost the market growth.

Key providers of the VSAT maritime satellite communication market such as KVH Industries, Inc., Marlink, and Inmarsat Global Limited account for a significant share in the market. Various companies are partnering to increase VSAT maritime satellite communication capabilities with the larger requirement from the automation. For instance, October 2021, Hiber, an IoT-as-a-service scaleup, partnered with Inmarsat, the world leader in global, mobile satellite communications to provide satellite connectivity to build Hiberband, its revolutionary low-cost, low-power network for Internet of Things (IoT) products. The agreement pairs Inmarsat’s recently-unveiled ELERA network, the global satellite network for IoT, with Hiber’s IoT-as-a-service ecosystem to provide easy-to-use, low power, and cost-effective IoT solutions and services to transport, logistics, agriculture, mining, and other industries worldwide.

In addition, with increase in demand for VSAT maritime satellite communication services various companies are expanding their current services to continue with rise in demand. For instance, in June 2021, Thuraya, the Mobile Satellite Services (MSS) subsidiary of the UAE-based Al Yah Satellite Communications Company (Yahsat), has launched its web-based SatTrack maritime tracking and monitoring service in partnership with FrontM, a leading international developer of software applications. Developed for vessels and fleets serviced by the Thuraya MarineStar Solution (supporting voice, tracking, and monitoring), SatTrack facilitates sustainable fishing practices, improved crew welfare and safety, better fleet visibility and management, and onboard real time condition monitoring.

Moreover, many market players are expanding their partnership and collaborations to expand their maritime communications. For instance, in September 2020, Marlink, the world’s leading provider of end-to-end managed smart network solutions has extended its partnership with software and service provider Quadrille to provide a dedicated news and information channel to Marlink maritime customers. Marlink and Quadrille are thus expanding their existing partnership, which was established more than four years ago with the aim of providing seafarers with a range of video and news content. Under the Marlink brand name XChange Media, the companies already offer comprehensive and highly trusted, high-quality news to the crew on board.

Loading Table Of Content...