Walking Assist Devices Market Research, 2032

The global walking assist devices market size was valued at $3.6 billion in 2022 and is estimated to reach $6.6 billion by 2032, exhibiting a CAGR of 6.3% from 2022 to 2032. The growth of the walking assist devices market is driven by surge in geriatric population globally. According to a 2022 report by WHO, it was estimated that between 2015 and 2050, the proportion of the global population over 60 years is anticipated to nearly double from 12% to 22%.

Key Takeaways

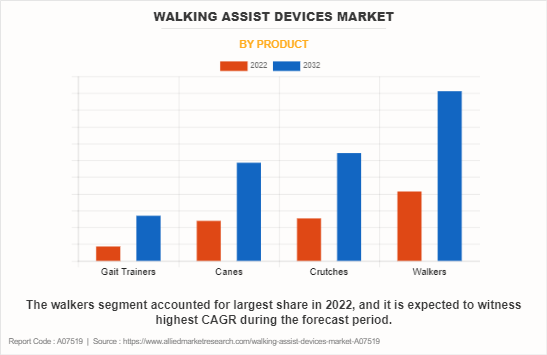

- On the basis of product, the walker segment was the highest contributor to the market in 2022.

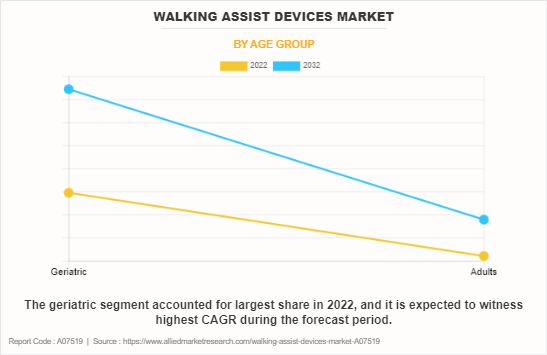

- On the basis of age group, the geriatric segment dominated the market in 2022 and is expected to continue this trend during the forecast period.

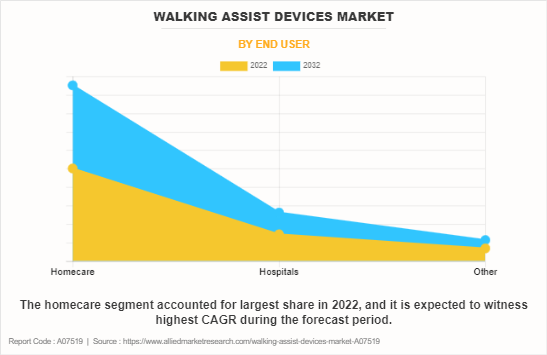

- On the basis of end user, the homecare segment dominated the market share in 2022 and is expected to continue this trend during the forecast period.

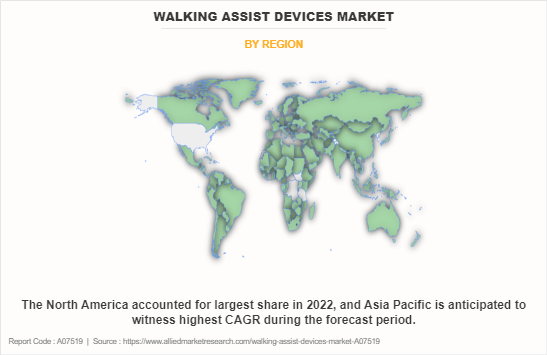

- On the basis of region, North America garnered the largest revenue share in 2022.

- Asia-Pacific is expected to grow at the fastest rate during the forecast period

Walking assist devices are innovative tools designed to provide support and assistance to individuals with mobility challenges, enhancing their ability to walk and maintain balance. Walking assist devices come in various forms, catering to different levels of mobility impairment. One common type is the walking cane, a simple yet effective aid that provides stability and helps distribute weight while walking. Another widely used device is the walker, featuring a frame with four legs that offers substantial support and often includes wheels for added maneuverability. Walkers are particularly useful for individuals with more significant balance issues or those who need additional support when standing. In addition, crutches are commonly used to assist with walking by transferring weight from the lower limbs to the upper body. Some innovative walking assist devices incorporate advanced technologies, such as smart canes equipped with sensors to detect obstacles and provide alerts. Overall, these devices play a crucial role in promoting independence and improving the quality of life for individuals with mobility limitations, offering a range of options to suit different needs and preferences.

Market Dynamics

The walking assist devices market size in expected to grow significantly, owing to surge in global geriatric population, increase in mobility impairment due to traumatic injuries, high adoption of walking assist devices after major surgeries especially in lower body and spine surgeries.

The escalating global geriatric population has emerged as a pivotal driver for the burgeoning walking assist devices market share. For instance, according to 2022 report by National Library of Medicine, it was estimated that the global share of elderly persons (60 years and above) is expected to rise from 13.4% in 2020 to 21.3% by 2050. There is an increase in the prevalence of age-related conditions and mobility challenges, such as osteoarthritis and frailty as the elderly population continues to expand. This demographic shift has prompted a growth in demand for innovative solutions to enhance mobility and ensure independence and quality of life for seniors. Walking assist devices, including canes and walkers, have become indispensable aids in addressing mobility issues among the elderly population. Walking assist devices provide crucial support, stability, and confidence, enabling seniors to maintain an active lifestyle and navigate their surroundings with greater ease.

The walking assist devices market forecast indicates that rise in the geriatric population not only propels the need for walking assist devices but also stimulates advancements in technology and design, fostering a dynamic market that continuously evolves to cater to the unique needs of an aging demographic. Consequently, manufacturers and healthcare providers have invested in research and development to introduce innovative walking assist devices, thereby contributing to the overall growth and expansion of the market in response to the increase in demand driven by the rise in the geriatric population. Thus, the rise in geriatric population globally is expected to provide significant for growth opportunity for the walking assist devices market.

Furthermore, the surge in mobility impairment resulting from traumatic injuries has become a significant driving force behind the remarkable growth observed in the walking assist devices market share. Traumatic injuries, often arising from incidents such as accidents, falls, or sports-related mishaps, can inflict severe damage to the musculoskeletal system, resulting in a substantial reduction in capacity of an individual to ambulate independently.

For instance, according to 2022 report by the National Library of Medicine, it was reported that Injuries caused through trauma, including traumatic brain injuries (TBI) and spinal cord injuries (SCI) are a leading cause of disability internationally. This growth in population of individuals facing mobility challenges has fueled an escalating demand for innovative walking assist devices that cater to diverse needs and degrees of impairment. Walking aids such as crutches, canes, and walkers have long served as essential tools for those recovering from injuries, providing stability and support during the rehabilitation process.

The rise in awareness of the pivotal role these walking assist devices play in enhancing not only mobility, but also overall well-being has contributed to their increased adoption. These devices go beyond mere physical support, offering a sense of independence and empowerment to those navigating the challenges of mobility impairment. Moreover, the integration of smart technologies, such as sensors and AI, has further personalized and optimized the user experience, making these devices more intuitive and user-friendly. For instance, CAN Mobilities offers CAN GO a smart cane with artificial intelligence integrated in it. The CAN Go is a smart cane with web and mobile interfaces that combines advanced sensors, communication technology, and data-driven insights to help people with mobility challenges stay mobile, safe and independent. Thus, the rise in mobility impairment due to traumatic injuries is expected to drive the growth of the walking assist devices industry.

In addition, the high adoption of walking assist devices for the rehabilitation after major spine surgeries and knee surgeries is expected to drive the growth of the walking assist devices industry. Patients undergoing surgeries in these critical areas often face challenges in resuming their normal walking activities post-operation due to pain, muscle weakness, and the need for gradual rehabilitation. Walking assist devices play a pivotal role in aiding individuals during the recovery process. Walking assist devices provide crucial support, ensuring stability and balance while reducing the weight-bearing load on the affected limbs. The post-surgery rehabilitation phase is crucial for restoring mobility, and walking assist devices offer a practical solution by promoting early ambulation and preventing complications associated with prolonged immobility. Thus, the rise in the adoption of walking assisted devices for rehabilitation after major surgeries is expected to present significant walking assist devices market opportunity for growth.

However, the high cost of walking assist devices serves as a significant restraint for the walking assist devices market growth, particularly impacting the major consumer segment comprised of the geriatric population with low monthly income. The substantial price tags associated with these devices pose a formidable barrier to accessibility for seniors who are already grappling with financial constraints. Elderly individuals often rely on fixed and limited incomes, making it challenging for them to allocate funds for expensive walking assist devices.

The 2023 global recession poses challenges for the walking assist devices market. The rise in inflation impacting the raw material cost, coupled with the surge in oil prices resulting in higher supply chain cost has negatively impacted the walking assist devices market

Segmental Overview

The walking assist devices market is segmented on the basis of product, age group, end user, and region. Based on the product, the market is classified into gaits trainers, canes, crutches, and walkers. On the basis age group, the market is bifurcated into geriatric and adults. On the basis of, the market is segmented into homecare, hospital and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

On the basis of product, the walking assist devices market is categorized into gait trainers, canes, crutches, and walkers. The walker segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to the high adoption of walkers by the geriatric population.

By Age Group

On the basis of age group, the market is categorized into geriatric and adults. The geriatric segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period due to high prevalence of mobility issues due to chronic diseases such as osteoarthritis.

By End User

On the basis of end user, the market is categorized into homecare, hospital and others. The homecare segment dominated the market in 2022, owing to the fact that the major consumer segment which is geriatric population uses the walking assist devices from the comfort of their homes and growing trend toward home-based healthcare solutions.

By Region

On the basis of region, the walking assist devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America had the highest market share in 2022, owing to high number of knee replacement surgeries and hip replacement surgeries and strong presence of major key players. However, Asia-Pacific is expected to exhibit fastest growth during the forecast period, owing to rise in geriatric population.

Competitive Analysis

Competitive analysis and profiles of the major players in the walking assist devices market, such as Compass Health Brands, Drive DeVilbiss Healthcare, Eurovema Mobility AB, GF Health Products, Inc., Human Care HC AB, Invacare Corporation, Rifton Equipment, Classic Canes Limited, CAN Mobilities Inc, and Ossenberg GmbH. Major players have adopted product launch and product upgrade as key developmental strategies to improve the product portfolio and gain strong foothold in the walking assist devices market.

Recent Developments in the Walking Assist Devices Industry

Recent Product Launch in the Walking Assist Devices Market

- In May 2022, CAN Mobilities Inc. announced the launch of its flagship product, CAN Go the smartest cane across the globe. The CAN Go is a smart cane with web and mobile interfaces that combines advanced sensors, communication technology, and data-driven insights to help people with mobility challenges stay mobile, safe and independent.

Recent Product Upgrade in the Walking Assist Devices Market

- In September 2023, CAN Mobilities Inc. announced an addition to its CAN Go smart cane the data driven fall detection. This cutting-edge AI-driven technology, designed to enhance the safety and independence of users, allows the CAN Go smart cane to detect falls in real-time and automatically contact a caregiver or loved one for assistance.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the walking assist devices market analysis from 2022 to 2032 to identify the prevailing walking assist devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the walking assist devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global walking assist devices market trends, key players, market segments, application areas, and market growth strategies.

Walking Assist Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.6 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Invacare corporation, Rifton Equipment, Classic Canes Limited, Compass Health Brands, LLC, Ossenberg GmbH, Human Care HC AB, Eurovema Mobility AB, CAN Mobilities Inc., Drive DeVilbiss Healthcare., GF Health Products, Inc. |

Analyst Review

The global walking assist devices market was valued at $3.6 billion in 2022 and is estimated to reach $6.6 billion by 2032, exhibiting a CAGR of 6.3% from 2022 to 2032. The growth of the walking assist devices market is driven by surge in geriatric population globally. According to 2022 report by World Health Organization, it was estimated that between 2015 and 2050, the proportion of the world's population over 60 years will nearly double from 12% to 22%.

Key Takeaways:

- By product, the walker segment was the highest contributor to the market in 2022.

- By age group, the geriatric segment dominated the market in 2022, and is expected to continue this trend during the forecast period.

- Based on end user, the homecare segment dominated the market share in 2022, and is expected to continue this trend during the forecast period.

- By region, North America garnered the largest revenue share in 2022. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period

The total market value of walking assist devices market is $3.6 billion in 2022.

The leading application of walking assist devices is the rehabilitation after traumatic injury and surgeries and to provide support for walking especially in elderly individuals with mobility challenge.

The market value of walking assist devices market in 2032 is expected to be $6.6 billion.

The forecast period for walking assist devices market is 2023 to 2032.

The base year is 2022 in walking assist devices market report.

Loading Table Of Content...

Loading Research Methodology...